Is a higher takeover offer on the way for Origin Energy, and how high can it go?

The Australian Competition and Consumer Commission approved the Brookfield consortium’s bid for Origin Energy (ASX: ORG ) earlier this week. The two parties must now decide on a price but the playing field has completely changed since Origin signed the Binding Scheme of Implementation Deed back in March 2023.

Two months ago, Vertium Asset Management CIO Jason Teh said the Origin Energy trade offered investors an effective ~5% return over a three month period based on:

- The offer was a consideration mix of $5.78 per share and US$2.19 per share (less any dividends paid out prior to the takeover)

- At an exchange rate of 70 cents, the bid values Origin at $8.90 per share

- At the current exchange rate of 64 cents, the price is $9.20 per share

- A 4.5 cents per month ticking fee will accrue on a daily basis if the scheme is delayed beyond 30 November 2023

If you bought back then, the trade would’ve offered “a decent ~5% return for a 3 month wait with close to zero downside risk. Importantly, there is a free option on higher returns on the increased chance that the Consortium raises their takeover offer.”

And that’s where we are right now. The possibility of a higher takeover offer.

An outdated bid amid a new era for utilities

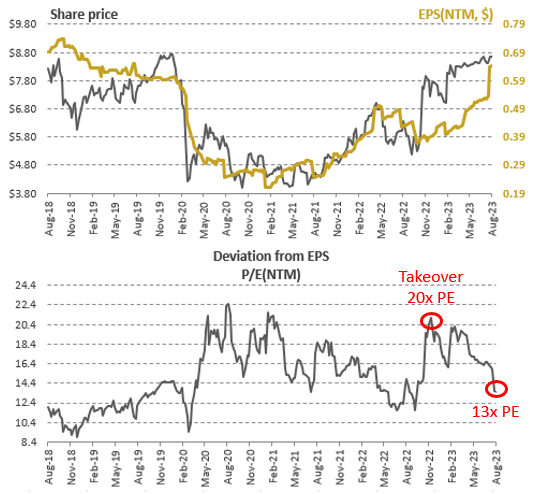

“Brookfield offered to pay about a 20x PE multiple in late 2022, a good price to pay for control. But because of the takeover offer, its share price was unable to reflect its outstanding FY23 result back in August,” explains Teh.

“Hence Origin’s PE multiple shrunk to 13x as its earnings estimates surged.”

To recap the FY23 result:

- Underlying EBITDA +47% to $3.1 billion vs $2.92 billion estimate

- Underlying profit +83.5% to $747 million vs $663 million estimate

- Adjusted free cash flow -9% to $965 million, reflecting an increased dividend and higher working capital

- Final dividend +21.2% to 20 cents per share

And FY24 outlook:

- Energy Markets Underlying EBITDA in FY24 of $1.3–1.7 billion (FY23: $1.03 billion)

- Electricity gross profit is expected to improve reflecting higher tariffs and an increased contribution from Eraring and the peaking fleet

- Octopus Energy is in a rapid growth phase and continues to invest in international growth

At today’s prices – Brookfield would be getting an absolute steal. So where to from here?

“It’s unlikely that Brookfield consortium will offer 20x PE multiple again on the higher earnings base. But shareholders will block the takeover on the current 13x PE multiple,” he says.

“A compromise could be reached if the PE multiple was within the range of 15-17x. A reasonable takeover price range could be $9.90 to $11.22.”

Based on Thursday’s close of $9.27, a potential compromise price would suggest an upside of 6.8% to 21.0%.

The factors at play

The Energy Markets division: FY23 earnings jumped 159% to $1.03 billion as higher wholesale prices and customer tariffs flowed into the bottom line.

“Origin’s Energy Markets division is the most significant profit driver for the business, which is influenced by electricity prices. Higher long-term electricity prices are currently not priced into the deal,” says Teh, adding that “the deal does not reflect the new world where higher electricity prices are expected when Australia transitions away from coal to renewable energy.”

The UK-based Octopus Energy (20% stake): Octopus has grown from a few thousand customers back in 2015 to now the second largest UK energy retailer with 9.7 million customers. The business generated $240m in earnings for Origin in FY23.

NSW wants to extend Eraring: Origin announced in February 22 that it would close Australia’s largest coal-fired power station, Eraring, by August 2025. However, the NSW government now admits that it needs coal-fired power for longer and advancing talks to keep Eraring open past 2025.

“Extending Eraring allows Origin to capture higher eletricity prices for longer. If this occurs, it is definitely not captured in the takeover price,” Teh said.

Origin’s major shareholders AustralianSuper and Perpetual: “I think at current prices, most shareholders including Australian Super, would be happy holders of the stock if the takeover fails. They would certainly try to negotiate a higher takeover price and it’s obvious a control premium has to be paid for the company,” he says.

Scenario analysis

Back in August, Teh noted four possible scenarios that could’ve played out. To recap:

- #1 Brookfield walks away: It’s possible but extremely unlikely that they walk away given they were willing to pay a 20x PE multiple for the business and now its trading around 13x.

- #2 Takeover completed on current terms: Origin gets taken out at the original $18.2 billion price. Investors earn a ~5% return, which is divided into a 2.3% fully franked dividend yield and 2.6% capital upside.

- #3 Another takeover bid: Another possible but extremely unlikely scenario given the size of the deal and how it would have flushed out any other potential buyers when it was first offered.

- #4 Consortium offers better terms: The takeover requires a minimum 75% of shareholders to approve the deal. Shareholders may not be happy about selling the business at an out-dated valuation.

So what are the possible scenarios now?

- #1 Shareholders reject the current takeover offer (40% probability)

- #2 Shareholders accept the current takeover offer (0% probability)

- #3 Brookfield consortium revises the takeover offer higher (60% probability)

Origin Energy is currently trading at $9.27, which implies the market is expecting a higher bid to follow through.

At what price will shareholders be happy to approve of the takeover? And at what price does Brookfield say ‘this is too much’? Let’s see how this plays out.

4 topics

1 stock mentioned

1 contributor mentioned