Is China's economy turning around?

There has been no shortage of commentary highlighting the economic challenges that China has been facing. A property sector in crisis. A disappointing recovery after its zero-covid policy. Growing trade tensions with the US.

Yet recent economic indicators seem to be telling a different story. China’s annual GDP growth slowed from an annual rate of 6.3% in Q2 to 4.9% in Q3. But growth in the quarter accelerated from 0.5% in Q2 to 1.3% in Q3. Indeed, a wide range of indicators would suggest some stabilising or even a pickup in economic activity of late.

Take for example, PMI indicators. Both the official and private sector surveys are pointing to an improvement in manufacturing and both sit just above 50 signaling expansion.

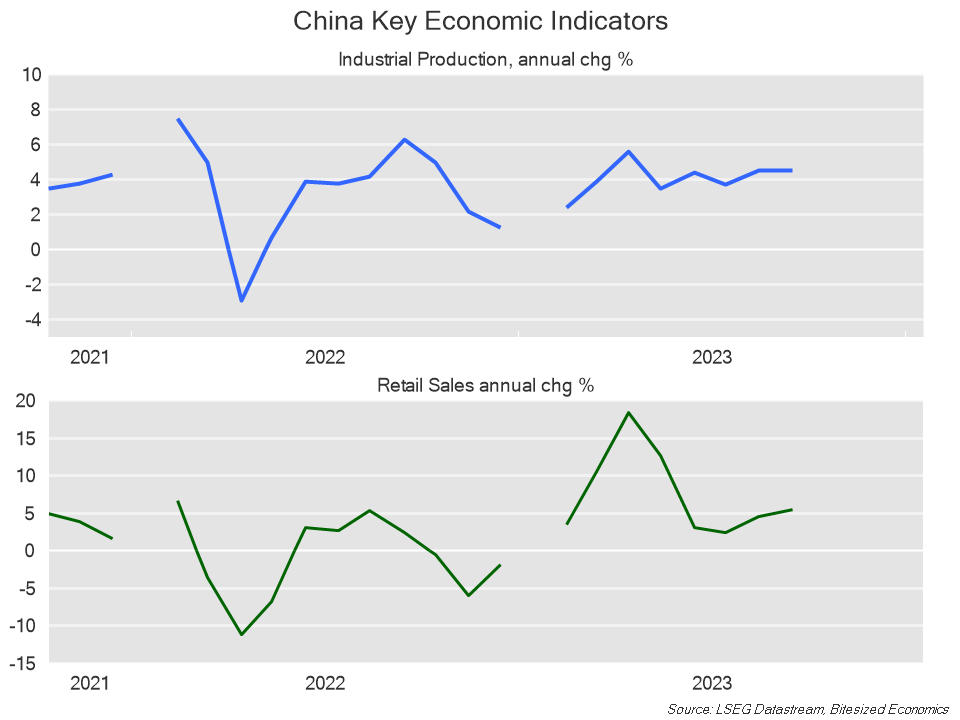

Moreover, actual activity indicators also improved or remained stable through to September. Retail sales picked up from 4.6% to 5.5% in September, while industrial production was steady at 4.5% growth.

So, what should we make of this improvement?

Given the structural economic challenges that China is facing, it makes sense to have doubts about this better-than-expected run of data. The country’s statistics bureau did after all, stop publishing the youth unemployment rate, which was last at a record high.

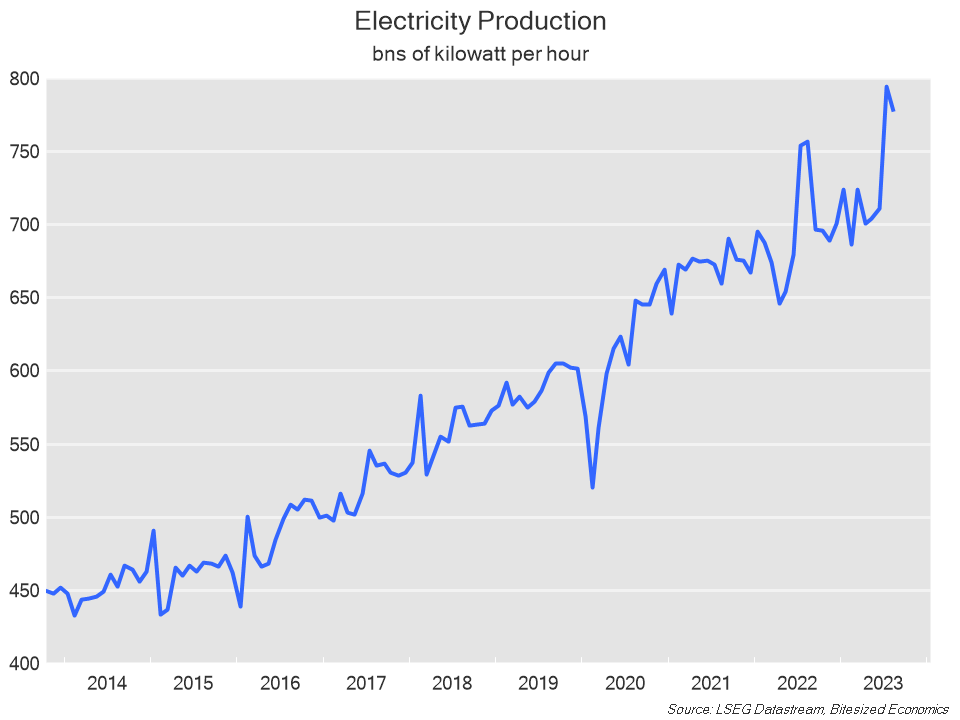

But the range of pickup across a variety of indicators suggest that indeed, there has been at least an improvement or stabilisation in economic activity. It hasn’t just been activity data and PMI surveys- exports, imports and electricity consumption have also improved of late.

However, while there does seem to be some stabilisation, whether a recovery is broad-based and sustainable is another matter altogether. Here are three reasons to doubt whether we’re seeing the beginnings of a long-lasting recovery:

1. The availability of the data. PMI surveys are more sentiment-driven rather than being a gauge of actual activity. And as far as the activity data is concerned, most economic data that China provides only provides a comparison on a year ago. Economists are left to estimate what might have happened month-to-month. China was still in the midst of its zero-covid policy a year ago when travel and consumer spending was severely restricted. So, a 5.5% increase on a year ago in retail spending only highlights an improvement in activity from when the economy was in the middle of covid lockdowns.

2. There may have been a burst of spending ahead of China’s golden week holiday from October 1, after pandemic restrictions last year, which may prove to be temporary.

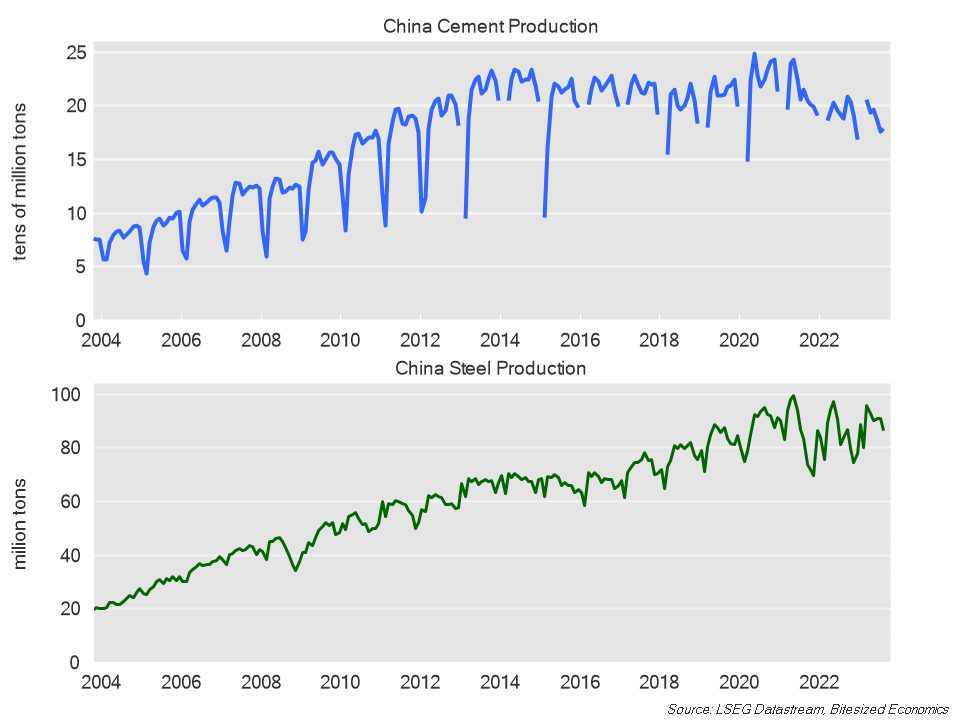

3. The recovery does not seem broad-based, especially with those areas closely linked to housing construction. ie. cement and steel production are down.

Attention is also firmly on the challenges in the property sector and the potential fallout from troubled developers. Country Garden, once one of China’s largest developers, has more than likely just defaulted on its offshore debt.

There are however, two areas which could be some bright spots for China’s economy.

The first relates to spillover effects from a resilient US economy. While geopolitical tensions may have limited trade flows between China and the US in recent times, a strong global economy would support China’s export demand.

The second is fiscal stimulus.

The government has implemented a wide range of stimulus measures to support consumption, to boost the share market, eased mortgage requirements and gradual reductions to interest rates. There has been a concerted effort saying “we’re worried about the economy and we’re going to do what we can to support it”.

State-run media have reported accelerated construction of new projects into the fourth quarter. And earlier, Bloomberg had reported that Beijing was considering increasing its budget deficit to allow greater issuance of debt for local governments.

There is one glaring problem, which would be obvious to regular readers of this newsletter - these measures still stop short of providing a sizeable boost to household incomes. If the government were to provide large-scale stimulus to households, it would go a long way having a tangible impact in boosting demand and at the same time, reduce the reliance on infrastructure investment and the property market as a driver for growth.

For now, it appears as though Chinese authorities are continuing to turn to public infrastructure spending as a source of growth as well as piecemeal stimulus measures across the economy.

Of course, further spending on infrastructure ignores the financial issues with local governments, notably through the large amount of debt through LGFV (local government financing vehicles). However, based on details on LGFV debt issuance and media reports, it appears that State-owned banks have taken on the responsibility for lending to LGFVs and rolling existing debt over. This idea was raised as a possibility in another piece I wrote earlier this year.

That doesn’t change the fact that some of these loans are backed by loss-making investments. Or the fact that it would likely prevent banks from lending more to productive parts of the economy. But it does kick the problem of potential bad debts down the road or transitioning the economy to more productive forms of growth.

In the meantime, the elusive 5% GDP growth target for this year set by the CCP may be within reach after all. But the lingering drag from the troubled property sector, the undetermined amount of zombie debt held on banks balance sheets and the reliance on increasingly unproductive infrastructure investment for growth suggests that China’s structural economic issues have not gone away. This recent pickup in activity is probably not a sign of a healthier economy. And it might just mean that we still need to brace for weaker economic growth next year and beyond.

5 topics