Is coronavirus driving a recession, depression or an economic hit like no other? What does it mean for the bear market in shares?

Global and Australian shares have fallen well beyond the 20%

decline commonly used to delineate a bear market. From their

highs to their recent lows major share markets have had

roughly 35% falls as investors have moved to factor in a big hit

to growth from coronavirus shutdowns. Recession now looks

inevitable and they tend to be associated with deep and long

bear markets, but now there is even talk of depression

suggesting an even deeper bear market. In reality, there are big

differences now compared to past recessions and the Great

Depression, so it really looks like an economic hit like no other

with very different implications for the bear market in shares.

But let’s first look at past bear markets as they provide some

lessons for investors regardless of the cause.

The two bears - gummy & grizzly

There are 2 types of bear markets in shares:

- “gummy” bear markets with falls around 20% meeting the technical definition many apply for a bear market but where a year after falling 20% the market is up (like in 1998 in the US, 2011 and 2015-16 for Australian & global shares); and

- “grizzly” bear markets where falls are a lot deeper and usually longer lived (like in 1973-74, US and global shares through the tech wreck or the GFC).

I can’t claim the terms “gummy bear” and “grizzly bear” as I first

saw them applied by stockbroker Credit Suisse a few years

ago. But they are a good way to conceptualise bear markets.

Grizzly bears maul investors but gummy bears eventually leave

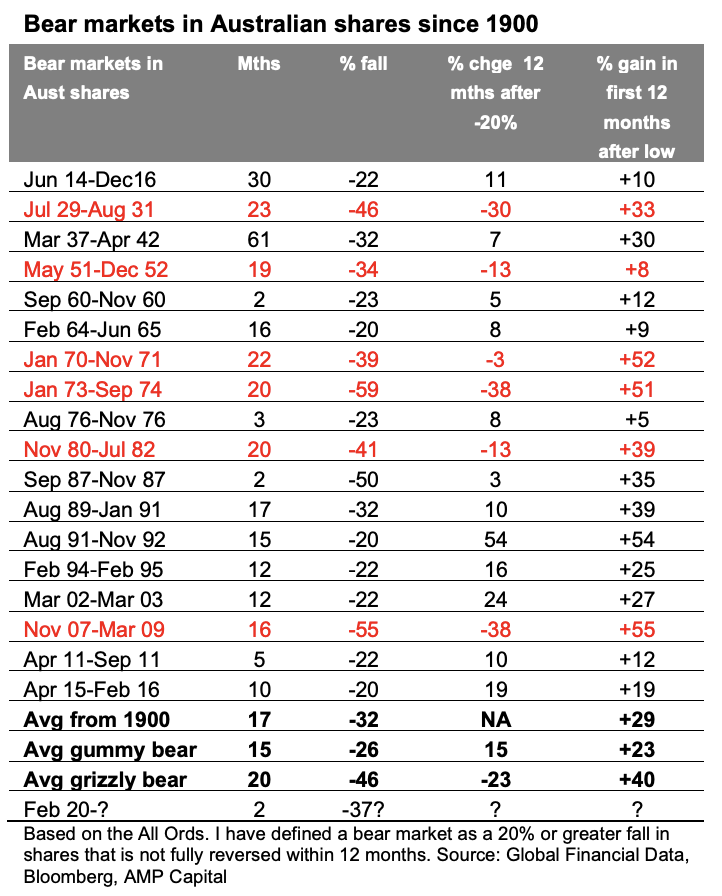

a nicer taste (like the lollies!). The next table takes a closer look

at bear markets. It shows conventionally defined bear markets

in Australian shares since 1900 – where a bear market is a 20%

decline that is not fully reversed within 12 months. The first

column shows bear markets, the second shows the duration of

their falls and the third shows the size of the falls. The fourth

shows the percentage change in share prices 12 months after

the initial 20% decline. The final column shows the size of the

rebound over the first 12 months from the low.

Since 1900 there have been 12 gummy bear markets (in black)

and six grizzly bears (in red). Several points stand out.

- First, gummy bear markets tend to be shorter & see smaller declines around 26% compared to 46% for the grizzly bears.

- Second, the average rally over 12 months after the initial 20% fall is 15% for the gummy bear markets but it’s a 23% decline for the grizzly bear markets.

- Third, the deeper grizzly bear markets are invariably associated with recession, whereas the milder gummy bear markets including the 1987 share market crash tend not to be. All the six grizzly bear markets, excepting that of 1951- 52, saw either a US or Australian recession or both whereas less than half of the gummy bear markets saw recession. It’s also the case for the US share market. • Finally, once the bear market ends the rebound is strong with an average gain of 29%. Trying to time this is hard with many who get out on the way down finding they don’t get back in until the market has risen above where they sold!

Recession versus depression or something else?

So, one of the key messages from history is that if we have a

recession then the bear market will likely be grizzly and severe

with markets even lower than they are today in 12 months’ time.

It’s not necessarily that simple though as the shock this time is

very different to those seen in the past. But first the bad news.

Recession now looks inevitable. There is now even talk of

“depression”. While there is a huge unknown around how long it

will take to control the virus and hence how long the shutdowns

will last it is looking clear that the short term hit to GDP will be

deeper than anything seen in the post WW2 period hence the

increasing references to the pre-war depression:

- Chinese business conditions PMIs for February fell an unprecedented 24 points due to shutdowns starting 23rd January. Consistent with this Chinese economic activity indicators are down 20% from levels a year ago. Chinese March quarter GDP could well be down 10% or so.

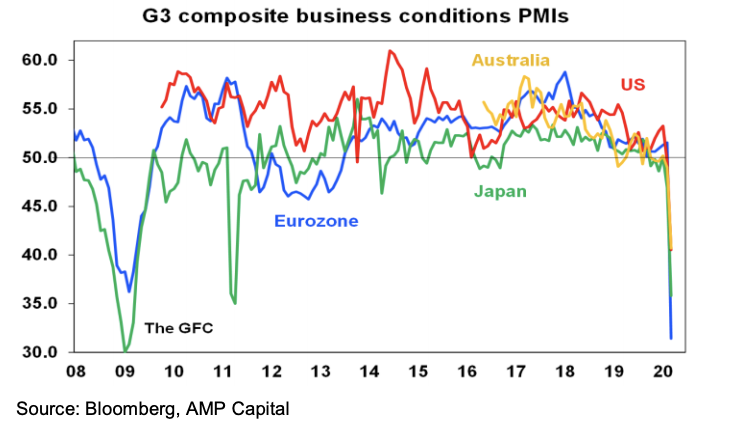

- Business conditions PMIs for the US, Eurozone, Japan and Australia all plunged in March as lockdowns ramped up. The average decline for these countries composite business conditions PMIs was an unprecedented 12 pts. This takes them below levels seen in the GFC. And the shutdowns have only just started so further falls are likely in April. So like China, developed countries could conceivably see 10% or so falls in GDP centred around the June quarter.

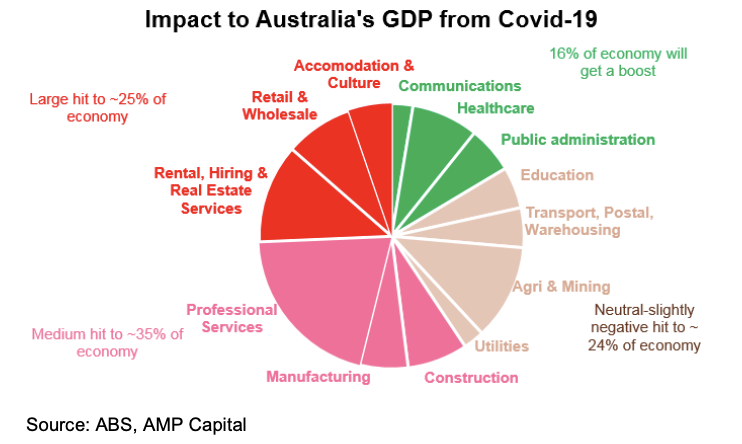

- By way of example the next chart shows the industry makeup of the Australian economy. The shutdowns will see a large hit to roughly 25% of the Australian economy, particularly accommodation & culture, retailing & real estate.

Big differences v past recessions and depressions

But while the slump in economic activity may be deeper than

anything seen in the post war period, depression may not be

the best description. Most definitions of depression focus on it

being over several years and seeing a very deep fall in GDP

compared to a recession which is shorter and shallower. The

current hit to economic activity may be very deep but it won’t necessarily be longer than past recessions. And there is good

reason to believe that if the virus comes under control in the

next 2-6 months and we minimize the collateral damage from

the shutdowns that the hit to activity may be shorter. There are

big differences between the current situation and that of past

recessions and Great Depression of the 1930s:

- First, recessions and The Great Depression (which saw GDP contract by 36% over 4 years and unemployment rise to 25% in the US and GDP fall by 9.4% in Australia with a rise in unemployment to 20%) were preceded by a period of excess in terms of investment, consumer discretionary spending, private debt growth and inflation that had to be unwound. This time around there has been no generalised period of excess and there has been no large-scale monetary tightening to bring on a downturn.

- Second, monetary policy was tightened in the lead up to past recessions and in the early phase of the Great Depression whereas global monetary policy was eased last year and that easing has accelerated this month with rate cuts, a renewed ramp up of quantitative easing (QE) and central banks around the world establishing various ways to ensure credit flows to the economy. In the 1930s banks were simply allowed to fail. Now they are being supported by ultra-cheap funding. Much of this owes to the GFC experience which has made it easier for central banks to now ramp up QE and introduce support mechanisms.

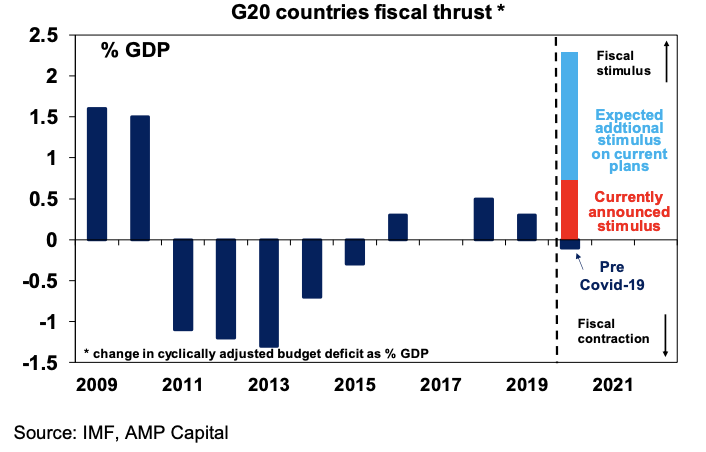

- Third, going into the Great Depression fiscal policy was tightened to balance budgets whereas in the last month we have seen massive and still growing global fiscal policy stimulus swamping that of the GFC. The latest US fiscal stimulus package alone is around 9% of US GDP.

- Fourth, there has been no trade war such as the SmootHawley 20% tariffs on US imports that were met by global retaliation and saw global trade collapse in the 1930s.

The bottom line is that while we may see the biggest hit to

global and Australian GDP since the 1930s thanks to the

shutdowns, there are big differences compared to the

Depression suggesting that a long drawn out global downturn is

not inevitable. Basically, it’s a disruption to normal activity

caused by the need to stay at home. In fact, growth could

rebound quickly once the virus is under control and policy

stimulus impacts. Which in turn should benefit share markets

and could see this latest bear market turn into a gummy bear

market rather than a grizzly bear market. Of course, at this point

we are still waiting for convincing evidence that markets have

bottomed. And the key is that the number of new cases of

coronavirus starts to slow and that collateral damage from the

shutdowns are kept to a minimum.

4 topics