Is it small caps' time to shine?

Currently, Australian investors tend to focus on large and medium-cap companies in their portfolios, gaining exposure to Australian small caps either through managed funds or direct stock investments.

However, for international equities, most Australian managers use the MSCI ACWI ex Australia Index, which excludes the bottom 15% of the investable universe. As a result, they miss out on exposure to global small caps.

This lack of exposure means they’re missing out on the potential of small-cap stocks in the global market to deliver potential outsized returns.

These future leaders of tomorrow are in the growth phase of their businesses. Given their size and ambition to expand, they are often more nimble and innovate quickly to adapt to challenges.

The case for investing in small caps is particularly strong today. As inflation cools across the world, central banks are likely to cut rates later in the year. During this recovery stage of the economic cycle, smaller companies have historically performed better compared to their larger peers.

The challenge lies in finding this alpha. The global small-cap universe is vast and complex, with individual volatility and a large amount of data to consider.

For example, the MSCI World Small Cap Index covers 4,130 stocks across 23 developed markets¹. The index covers approximately 14 per cent of the investable market in each country.

The sector holdings are diverse, with the largest holdings being:

- Industrials at 20.5%,

- Financials at 15.0%,

- Consumer Discretionary at 13.1%,

- Information Technology at 11.0%, and

- Health Care at 9.5%.

Geographically, the largest representations are from the United States at 60.3%, Japan at 12.3%, the United Kingdom at 5.3% and Canada at 3.8% ¹.

So how can investors understand and harness the opportunity in global small caps?

Small caps’ time to shine

When it comes to small caps, there may be volatility across individual stocks, but the asset class as a whole can be a good allocation for investors.

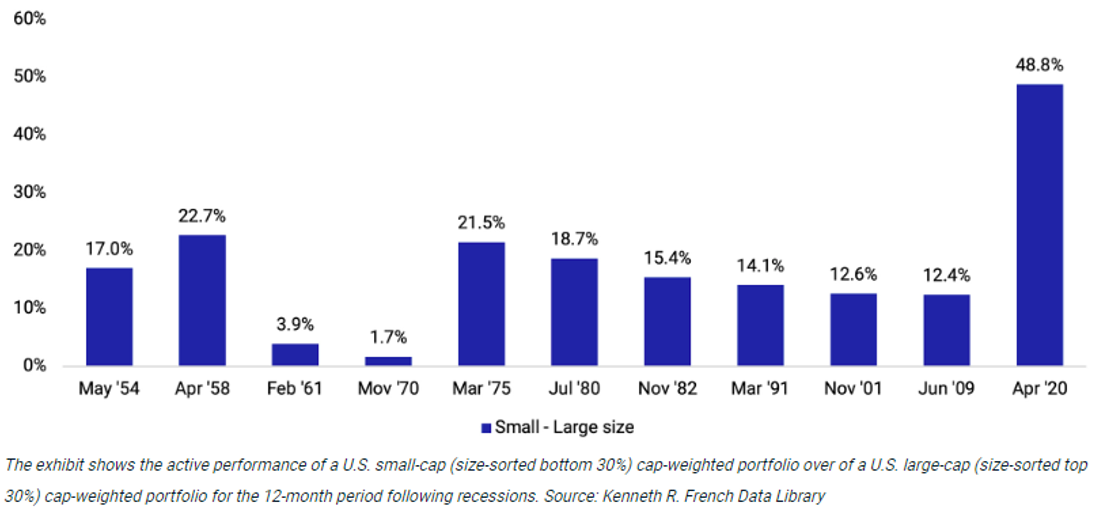

Firstly, as mentioned, small caps have historically performed well compared to large caps during the recovery stages of the economic cycle (refer chart). With inflation cooling in economies across the world and the possibility of rate cuts towards the latter part of the year, we could be entering an environment favourable to small caps.

US small-cap-factor outperformance in the 12 months following recessions

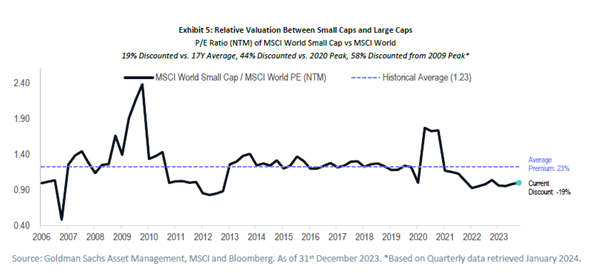

Not only this, but small cap valuations are at historic lows due to rate rises, macroeconomic conditions and economic growth concerns pushing small cap valuations down to their lowest quartile since 2006. As of 31 December 2023, the MSCI World Small Cap Index represented a 19 per cent discount from the historical average and a 44 per cent discount from the peak in 2020 (refer chart).

This not only means potential returns in comparison to valuations are high, but there is a good buffer against any potential downsides.

While debt-to-service ratios are often a concern during high-interest rate periods, the shorter refinancing cycles and higher proportions of floating-rate debt of small caps relative to large caps may act as a tailwind to performance during the converse interest-rate outlook.

All-in-all, it’s an opportune moment for investors to consider allocating to global small caps.

A systematic approach

When investing in small caps, it is important to realise the size and breadth of the universe, which brings a high degree of complexity, and informational inefficiencies within the investing space.

Therefore, a systematic approach to small cap investing is crucial.

For example, the Yarra Global Small Companies Fund, managed by Goldman Sachs Asset Management, employs a quantitative method utilising AI, big data and machine learning, which the team finds very helpful for navigating the more than 7,500 opportunities in our small-cap universe.

Using the MSCI World Small Cap Index as a benchmark, we start with fundamental, bottom-up research to identify high-quality business models, examine the financial positioning, management quality and industry outlook of companies across different sectors to uncover sources of alpha.

Importantly, we also leverage proprietary alternative data sources to identify differentiated themes and trends affecting companies, which other investors may not see.

Our analysis helps us to identify fundamentally undervalued companies, as we believe buying high-quality businesses at a fair price leads to strong long-term performance.

And finally, we also leverage global market insight, recognising that other market participants can provide valuable information to supplement our own analysis.

Given the complexity of the small cap universe and the risk profile of a subset of small cap companies, it is important to select a skilful manager who can adequately analyse and capture the opportunities in this space while properly managing the risks.

Once you do, small caps can be a great way to diversify your portfolio beyond the typical larger players.

For more information on the Yarra Global Small Companies Fund, please click below:

1 fund mentioned