Is now a good time to buy a property?

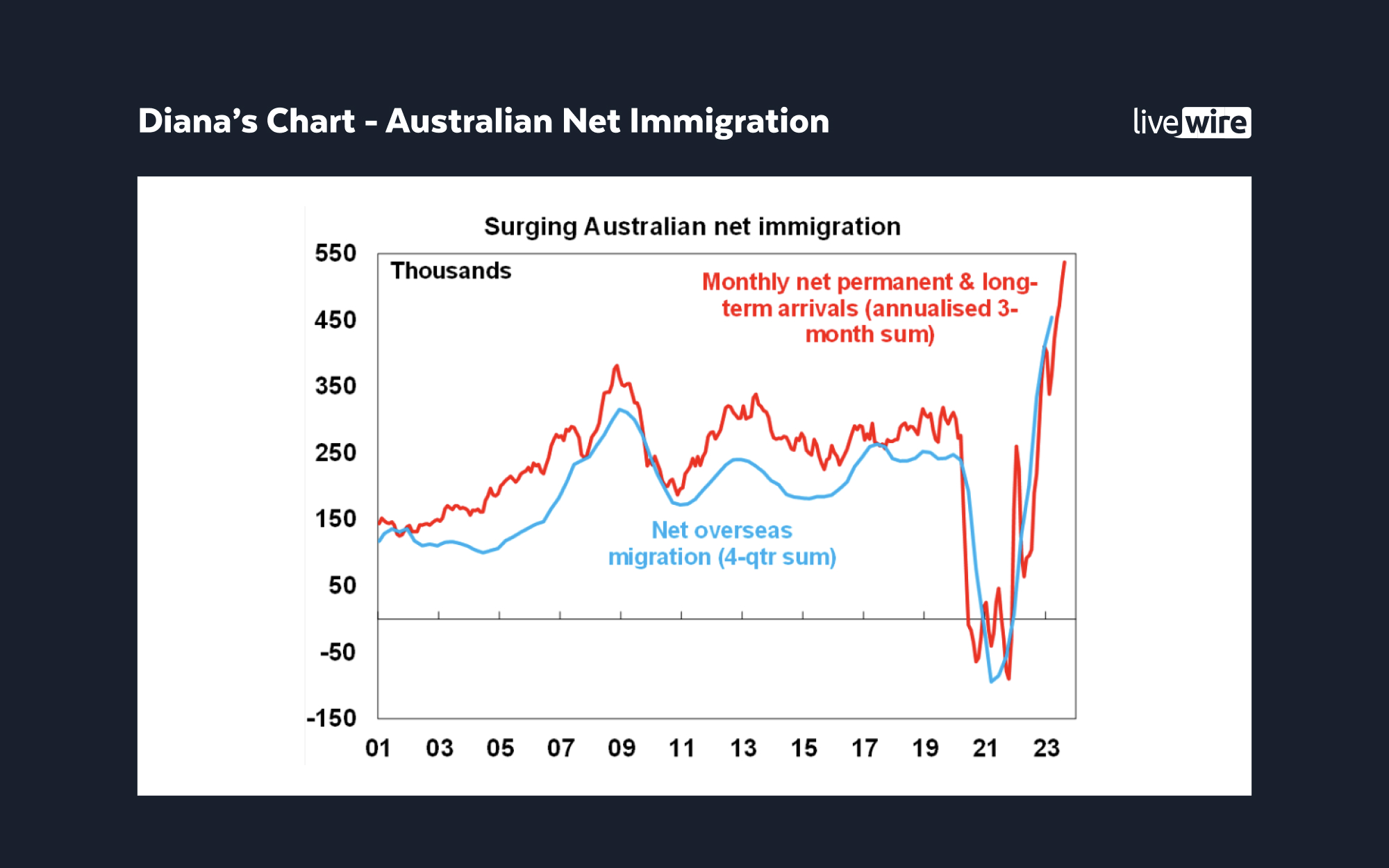

425 basis points in rate hikes from Australia's central bank should - in theory - dampen house prices, reduce loan serviceability, and make obtaining a mortgage harder. But, to quote AMP's Deputy Chief Economist and series regular, Diana Mousina, this has been a "weird cycle".

If you think about it, this entire housing cycle has been counter-intuitive. The Reserve Bank's rate hikes have increased the cost of capital and the cost of borrowing, essentially providing a double-whammy for housing supply. But a huge surge in migration, a crash in building approvals, and the lowest residential vacancy rate on record have all added fuel to an already large fire.

All this is just the Australian residential conversation. All the questions in the commercial property space revolve around office occupancy and builder insolvencies.

So, what does the housing cycle look like ahead of 2024? And will the consensus forecast of 5% national house price growth be smashed again?

To discuss it all, Signal or Noise has assembled the country's top property experts for our annual show focused on the Australian housing story. Joining me and Mousina are:

- Eliza Owen, CoreLogic's Head of Australian Research, and

- Chris Bedingfield, Principal and Portfolio Manager at Quay Global Investors.

Note: This episode was filmed on Wednesday 15 November 2023. You can watch the show, listen to the podcast, or read an edited summary below.

Edited Summary

Opening question: Is Qualitas' Andrew Schwartz right?

Our panel was given this quote from a recent Expert Insights with Qualitas' Andrew Schwartz. Schwartz was answering a question about the property cycle, posed by our own Sara Allen:

Allen: At what point of the residential property market cycle are we?

Schwartz: I don't think it's often in your investing career that you see a market dynamic where you have very low vacancies and exceedingly high demand, supply-side delays in terms of getting new products into the market.

That dynamic is not going to change quickly given the high levels of immigration. For us, that gives rise to an investable asset class that we can have very significant comfort around. We continue to heavily focus on that, as one of the major asset classes.

I think we're at the start of the next cycle.

The panel was then asked whether they think Schwartz is right.

Chris Bedingfield: "I guess it's hard to disagree." Chris goes on to add that the fundamentals are strong but that supply is the big question mark and because of that, he argues it may be better to buy an existing home than one off the plan.

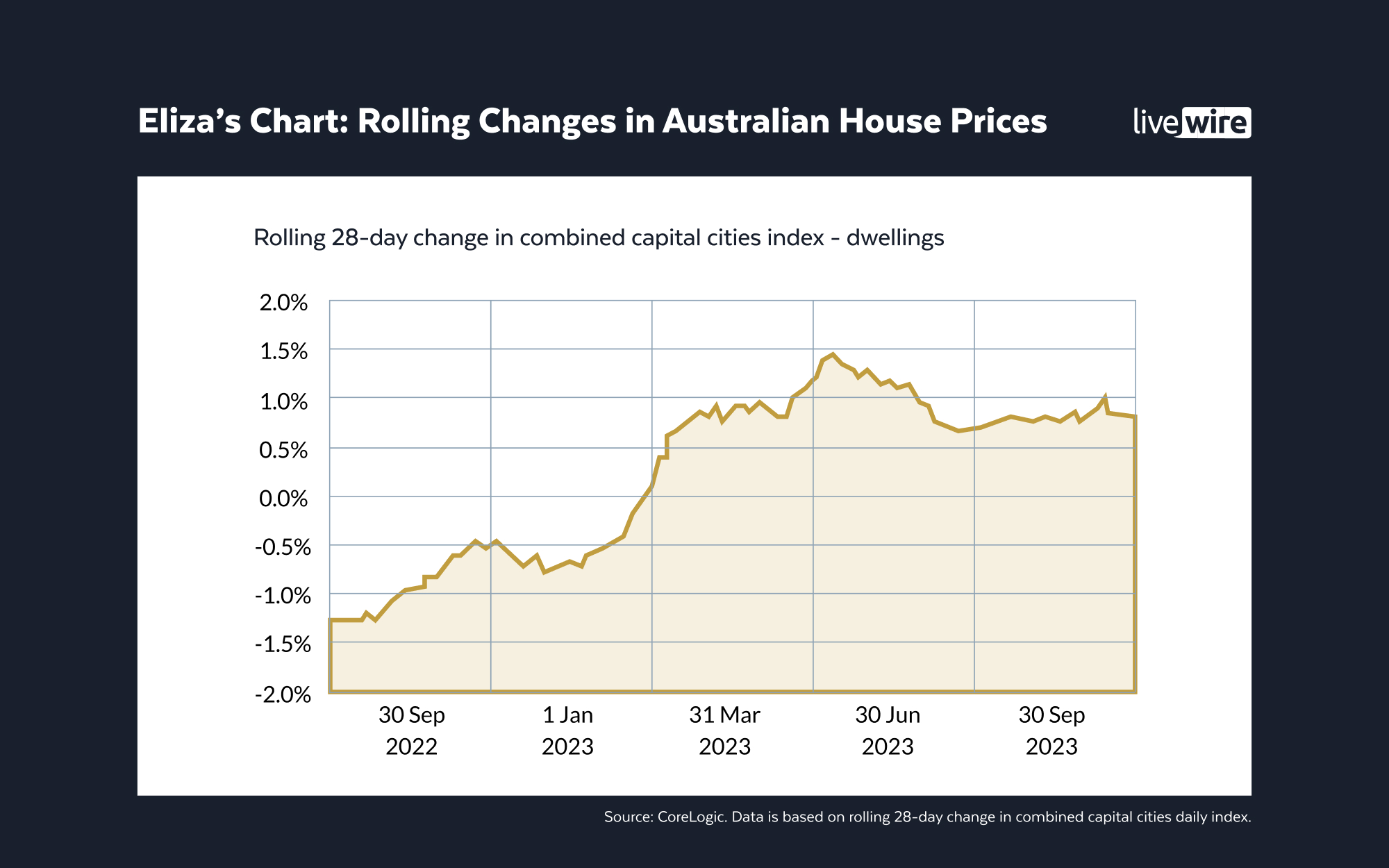

Eliza Owen: Eliza thinks there is more nuance to the question of the "next cycle" as people use different terms and starting points for the beginning and end of property cycles. She thinks that the upswing in prices has been driven primarily by thin trading volume. "There's a difference between rising value and rising transaction volumes."

Diana Mousina: Diana argues the cash rate at its current level cannot support much more property price upside. The AMP team have a consensus view of 5% price growth in 2024 for house prices but she says the risks are tilted to the downside.

Topic 1: 240,000 homes a year?

Our longest and most in-depth discussion of the show centred around the Albanese administration's goal of building 240,000 homes per year for the next five years. We asked the panellists if this goal was unrealistic (SIGNAL) or if we would actually get there despite the headwinds (NOISE).

Chris and Eliza both think it's possible - but for very different reasons.

Eliza - NOISE: Eliza argued that although construction costs are up 25% since the COVID-19 pandemic, the 240,000 homes target is a "good stretch goal to have", especially given how much we need to focus on supply. But in the short term, it may not look feasible at first.

Chris - NOISE: While Chris originally said that it's a little bit of both, he argues that prices will eventually oscillate around replacement cost. That is to say, interest rates can have their short-term impact but at the end of the day, it's how you get the cost of building back to a level that it is feasible to do so.

If we want to build 250,000 homes a year, Chris has a simple solution: "drop rates to zero". Until then, rents will "continue to squeeze" until that replacement cost is breached.

Diana - Short term SIGNAL: The supply goals are unrealistic for now but in the long term, low building approvals are noise. We can eventually reach those targets but it will take time. For now, slowing construction due to the rising cost of capital is here to stay.

For the entire near-10 minute discussion, watch the video.

Topic 2: A looming rebound for REITs?

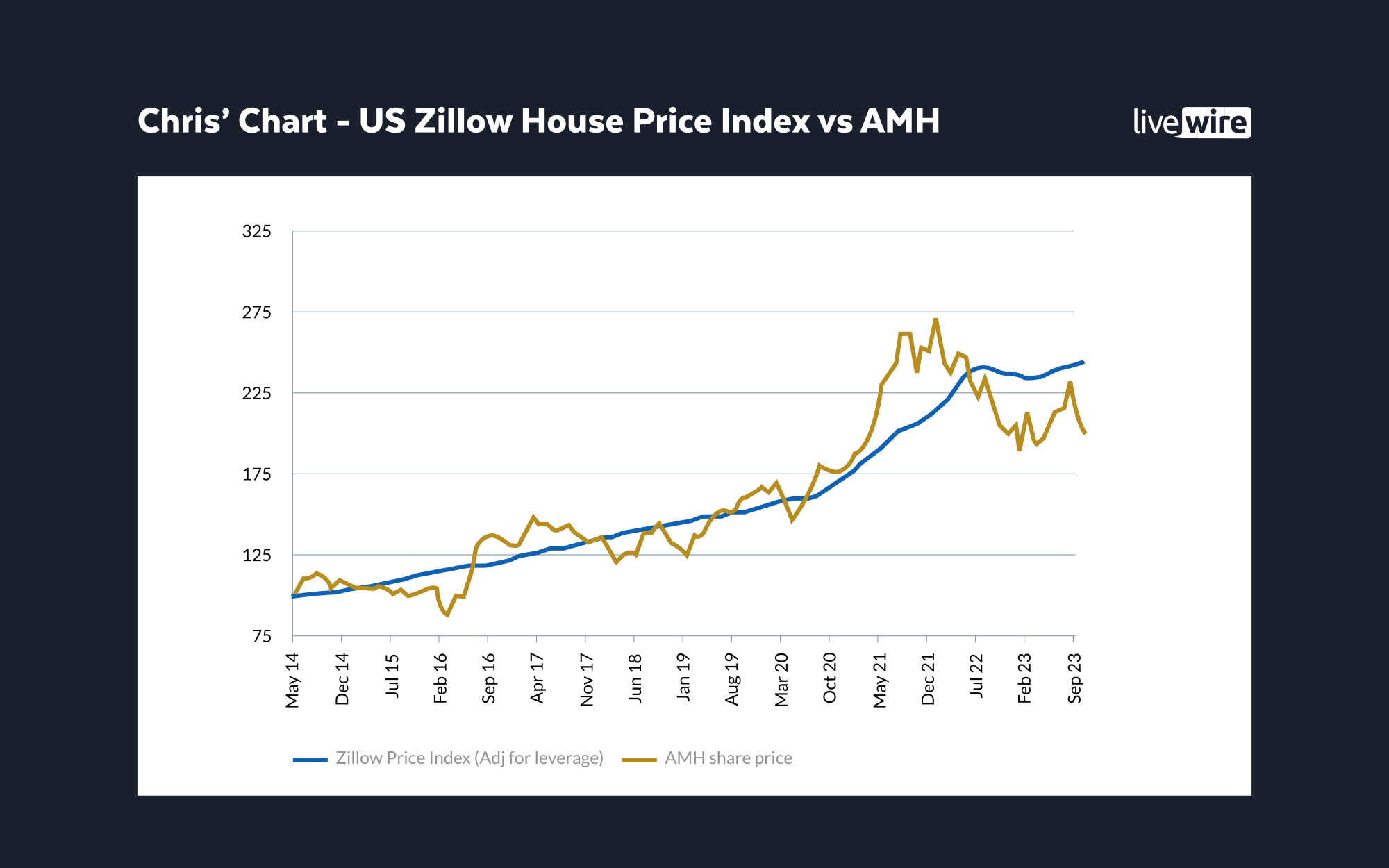

The next topic was posed purely to Chris, as he runs a portfolio of both commercial and residential property stocks. We asked Chris to tell us why he thinks REIT share prices can rebound next year.

In part, here is what he said: "There is an assumption that interest rates are up and you have to sell REITs. Interest rates are up so residential prices will fall. It doesn't always work out that way. In the US, house prices are at all-time highs. In Canada, house prices are rising and they had 400 basis points in rate rises as well. There is a big demand-supply mismatch."

Topic 3: Australia's rental crisis worsens even further

Diana - Short term SIGNAL: The good news is that asking rents are looking like they have topped out. The bad news is that for now, rent increases are likely to continue. Having said that vacancy rates may have bottomed out in most capital cities and a 500,000+ net migration figure cannot last forever. Once both of these factors play out, a slowdown in rents should arrive.

Eliza - Short term SIGNAL: Data tracked by CoreLogic suggests rental growth has persistently slowed since 2021 and in capital cities, since late 2022. But while there is also a lot of nuance within those capital cities (e.g. certain areas have continued to skyrocket while others have not), there is good reason to believe rents will slow (not least if the RBA cuts interest rates next year).

Chris argued that "reverse household formation" will actually be the signal for when rents are sustainably coming down, which in turn will be caused by a rise in unemployment.

Charts to Watch

Now it's over to you - Which of our panellists did you most agree with? And what are your thoughts on where house prices are going? Let us know in the comments below.

Signal or Noise will return with its final episode of the year in mid-December.

3 topics

1 stock mentioned

4 contributors mentioned