Is Splitit the next Afterpay?

Splitit (ASX:SPT) has had an incredible debut on the ASX since its listing on the 29th January 2019, with the stock galloping from its 20c IPO price to an intraday day high of 74c before settling at 55c on the 31st January; an extraordinary 175% two-day gain.

It’s been a profitable pathway for these interest-free consumer payment splitting companies, with Afterpay (ASX:APT) shareholders having enjoyed a 15-fold gain in only 2.5 years. So, is the early excitement about this new player justified? I'll discuss some similarities and differences between the two.

Arguably, the major factor differentiating the offerings is that Splitit customers must have a valid credit card (Mastercard or Visa) with an appropriate limit, to make a purchase using the Splitit system.

Critically Splitit does not assume any of the credit risk; this resides with the credit card companies. Depending on the merchant’s requirements, the Splitit payments are then charged to the credit card over the following 2 to 36 months.

Also, depending on the merchant agreement, each payment will be made to the merchant only at each monthly payment event. As such, Splitit is targeting higher-end, higher-value purchases; think jewellery, travel, homewares, sporting goods and high-fashion with an average value of around $1000.

In contrast, Afterpay made its market entry by targeting lower-end apparel sales. Even after moving up the value chain, the average sale is still only around $140. Afterpay allows customers with both bank accounts and credit cards to use their system.

It pays the merchant the total value of the goods upfront, thereby taking on the credit risk, but enforces a much shorter payment term of just 6 weeks. Partly because of the credit risk, Afterpay is able to charge a greater merchant fee of around 4%, versus the 1.5% fee Splitit charges.

For investors, the real concern/opportunity is the markedly different life-cycle stage of the two businesses. Afterpay in now an established, proven, profitable global business. Splitit has but 12 months of modest revenue generation. But, for that, investors are paying a fraction of the price of its successful competitor.

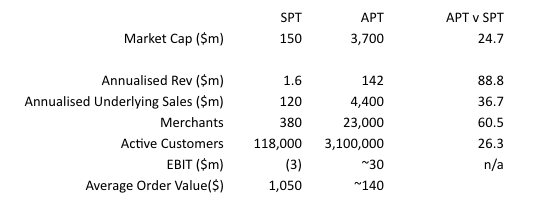

The table below details the broad financial comparisons that show, despite the huge market debut for SPT, the current valuation not wildly overdone.

However, the law of small numbers is important to remember. Even small market share gains by Splitit would make the business look significantly more attractive on a relative basis.

But until it becomes cash-flow positive (we estimate growth of about 6x their current annualized sales), there is certainly more risk to its business model.

2 stocks mentioned