Is Teck Resources copper pivot a gamechanger?

This predominantly met coal company has been diversifying into copper and is approaching an impactful inflection point where Copper will take over coal EBITDA

Teck Resources (TECK) is best known as the second largest seaborne exporter of steel making coal, but the company is approaching a key inflection point that will see its copper segment overtake its coal business in overall EBITDA. This comes at a time when demand for copper is strong and expected to continue, thanks to the red metal used in electric vehicles (EVs) and renewables, as well as entering a reflationary environment.

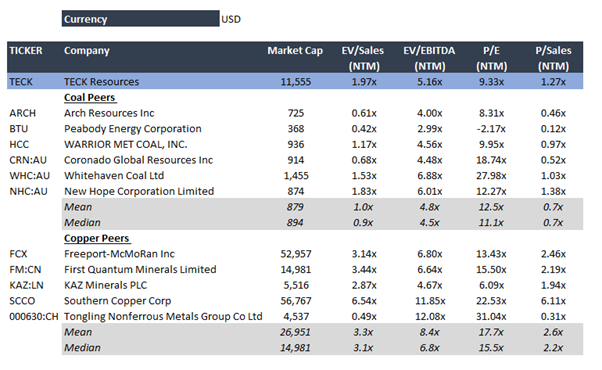

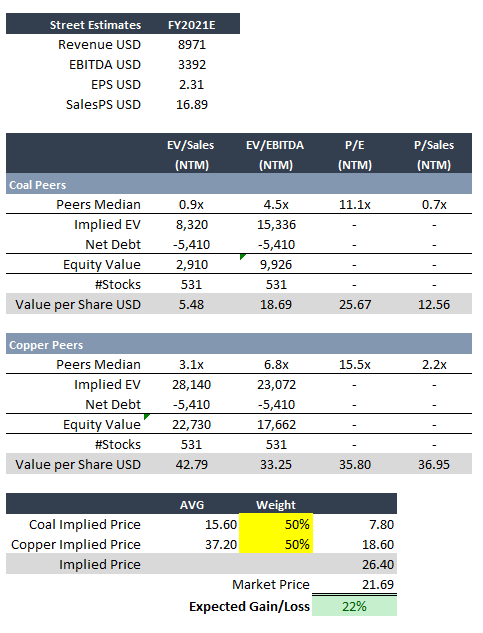

Once their new mine (QB2) is producing, TECK will see significant FCF generation and has committed to returning capital to shareholders. Teck is currently valued by the market as a coal company. The coal business is strong, and TECK has lowered costs significantly in this segment. But once TECK begins production at QB2 we expect a re-rating higher, to be more in line with copper peers.

What is TECK resources?

TECK is a Canadian based exploration & mining company focused on met coal (for steel production), copper and zinc. TECK’s met coal asset located in the Elk Valley of British Columbia is the primary contributor of EBITDA to the company currently. Its copper assets are in Canada, Chile and Peru and zinc/lead assets in Alaska and Canada. In 2018 it invested CAD$1.2 billion to obtain an indirect stake in Quebrada Blanca Phase 2 (QB2) project, a large copper resource that the company predicts will supply decades of copper output and growth for the company.

Strong copper exposure with a future green metals play

TECK is on-track to making a key transition from coal to copper in terms of EBITDA contribution of >50%. TECK is the majority owner of QB2, a major copper project in Northern Chile which is on track to begin production in 2H22. QB2 has potential to become a top five global copper producer and will boost TECK’s copper production by +60% and the EBITBA contribution from QB2 will be greater than 50%, overtaking the contribution from coal. By 2023, Teck will have doubled their consolidated copper production. QB2 provides Teck with very capital efficient copper unit growth over the next decade with low Opex/Sustain costs of ~1.38/lb in the first 10 years. As QB2 comes online, the market will focus on significant FCF metrics with an estimate of 58% of market cap over five years. The board has also approved a minimum of 30% to be returned to shareholders through dividends or buybacks, but it could be 100% of the surplus if that is what the Board decided. Ultimately, a base metals-pure play would likely attract a higher multiple as overall investor interest in copper continues to grow while coal continues to decline. Management recently said that by growing copper production, they will rebalance the portfolio to become a major green metals producer.

TECK provides investors with strong copper growth exposure at a time when copper demand is set to expand significantly. The copper price is expected to remain robust given its leverage to industrial / construction markets and the anchor of a long term deficit as EV and renewable demand starts to reach critical mass, given the higher copper intensity of those technologies relative to conventional methods. According to Jefferies, copper intensive renewable energy is coming and the shift from coal & gas power to wind and solar are five times more copper intensive. EVs require 83kg of copper, or four times more than combustion engine vehicles, and EV charging points contain ~10kg of copper each. Demand for copper for EVs will increase 10x by 2023 from 170kts to 1.7mt. This positive demand outlook coincides with low inventory levels as a starting point.

Trade tensions and other risks

TECK's coal operations are well-positioned, with incremental sales to China, where pricing is more favourable due to the tensions between Australia and China, and sees no end in sight. Steelmaking coal prices have increased significantly since the start of the year in response to improving demand in markets outside China and the trade flows rebalancing. FOB Australia pricing levels increased significantly over a 3-week period and are currently approximately USD 40 per tonne higher than they were at the start of 2021, and CFR China prices have increased to above USD 220 per tonne. Inventories at China ports are currently very low, sitting at around 2.4 million tonnes. The record low was around 1.2 million. The record high was 13.8 million tonnes. So, when you look at this with port inventory and around half these tonnes being Australian coal that have not cleared customs due to the ban, the port stocks are indeed very low, and the China CFR price is continuing to be high. TECK targets 7.5mt or ~30% of 2021 coal sales to China to capture significant premiums over Australia FOB prices. Total coal operating cost is estimated to decline by C$6/t to C$99/t, helped by completion of Neptune project (2Q21).

.png)

.png)

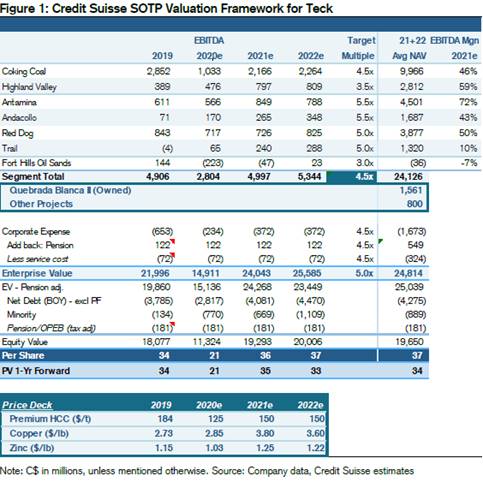

SOTP valuation according to Credit Suisse is C$34 (~$27):

.jpeg)

Other Risks

- Over budget complications on QB2 expansion.

- Any delays to the QB2 production launch.

- Commodity price risk (coking coal, copper, and zinc)

- Mining and operating risk at the operations.

Technical

Teck has been in an uptrend since March 2020, which follows a two-year decline from $30 to $5. We see first major resistance at ~$26, and then $30.

.jpeg)

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics