Is the dream run of Australia’s Big 4 coming to an end?

The continued success and profitability of Australian banks over the last few decades, as well as recent large capital raisings, means that Australia’s big 4 banks are now valued at over $400 billion by market capitalisation and they account for over 26% of the S&P/ASX 300 index. As a result, Australian bank stocks are widely held by many Australians either directly, or through their super funds.

Do Australian Banks warrant such a high weighting in investors' portfolios going forward?

Investors Mutual has, over the past few years, been relatively cautious about investing in the big 4 banks. This article seeks to explain to investors the thinking behind our view.

The foundation for extraordinary growth

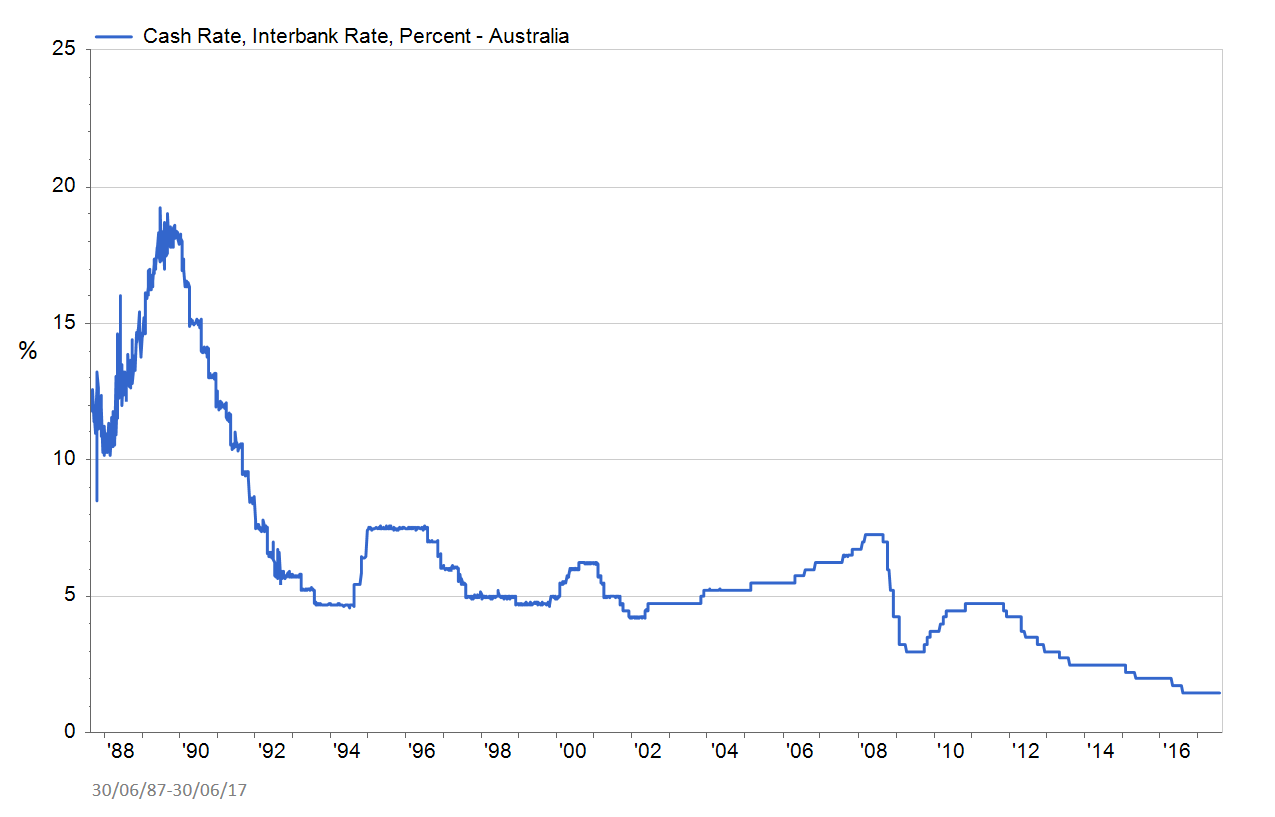

The foundations for this extraordinary run began as far back as the mid-1980’s, a time when median house prices were two times disposable income, while household debt to disposable income sat at around 50%. This relatively low level of consumer indebtedness provided a low base from which the banks could grow.

Bank deregulation really kick-started this growth in 1987 (see Chart 1), with the removal of interest rate controls and the reduction of mortgage capital requirements. This deregulation allowed Australian banks to compete more aggressively for home loans and deposits, while at the same time they were required to hold far less capital on their balance sheet to support underperforming loans, relative to other classes of lending like business loans.

This resulted in commercial lending being crowded-out ever since the 1980’s by more-profitable residential lending, with double-digit growth in this sector, helped along by the rise of third-party mortgage brokers like Aussie Home Loans (1992) and RAMS (1995). These and other mortgage brokers provided the big four with an expanded, and far more incentivised distribution capability, which also provided more flexible customer service and document processing – resulting in a far better conversion rate than the banks were achieving through their branch network.

Chart 1: Household debt increases, as property prices climb

Source: FactSet as at 31 March 2017

The Golden Era

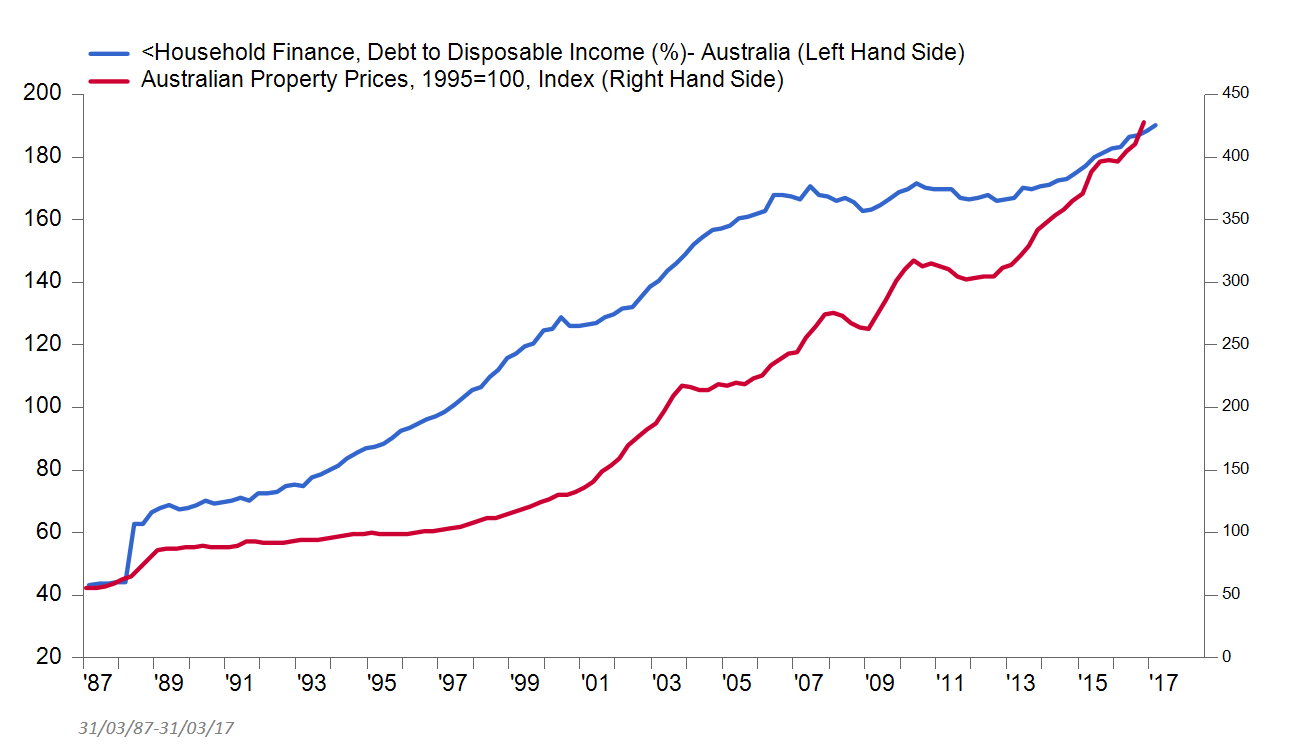

The period from the early 1990’s until now has been a dream run for Australia’s banks, with uninterrupted economic growth and falling interest rates driving unprecedented demand for residential mortgages. The prolonged fall in interest rates (see Chart 2) allowed consumers to borrow larger amounts, with the resulting boost in residential house prices also generating a huge surge in investors seeking interest-only mortgages.

Chart 2: Interest falling to historical lows

Source: FactSet July 2017

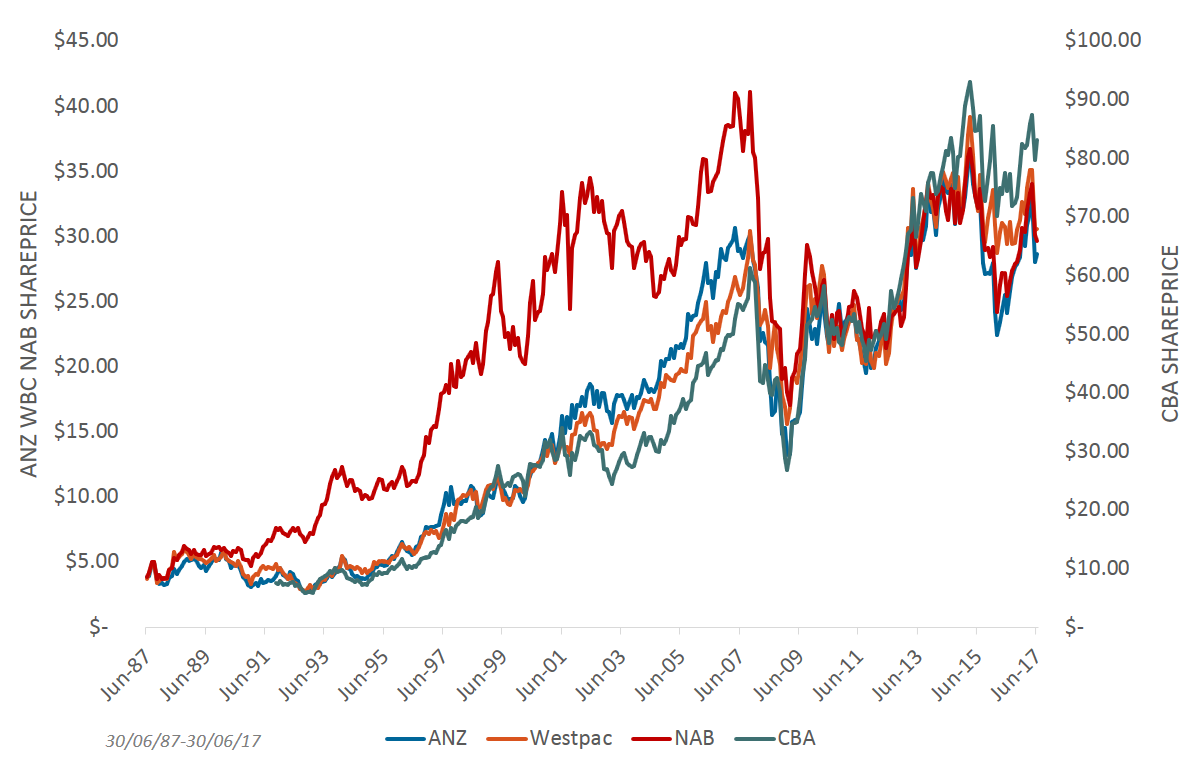

On the back of this credit boom, Australian banks have been able to generate record profits and increasing dividends, providing investors with strong share price capital growth and significant, tax-effective income in the form of franked dividends.

This sustained performance over the last 30 years now sees all four banks in the top five largest Australian companies by market capitalisation with the Financials sector weighting of Australia’s ASX 300 now more than double the weighting of global banks in the MSCI World Index.

Chart 3: An extraordinary period of growth

Source: Morningstar as at 31 May 2017

This concentrated exposure also extends to direct retail investors, with bank stocks widely held by many due to the familiarity that they offer, their historic track record of strong share price performance, and their reliable, tax-effective dividends. The lack of perceived alternatives has also supported demand from retail investors, especially among those in retirement seeking a consistent income stream.

As an example, direct retail investors make up over 50% of the Commonwealth Bank’s share register. Given the index concentration of Financials, most Australian investors exposure to Australian banks may be even greater, when you factor in these investors holdings in funds with shareholdings in Australia’s Top 20 companies.

Historical drivers are today’s risks

Residential mortgages now represent $1.5 trillion of the assets on the balance sheets of the big four who now account for more than 80 percent of all residential mortgages in Australia. We believe that the big four banks’ ability to continue growing this level will be restricted by three key factors:

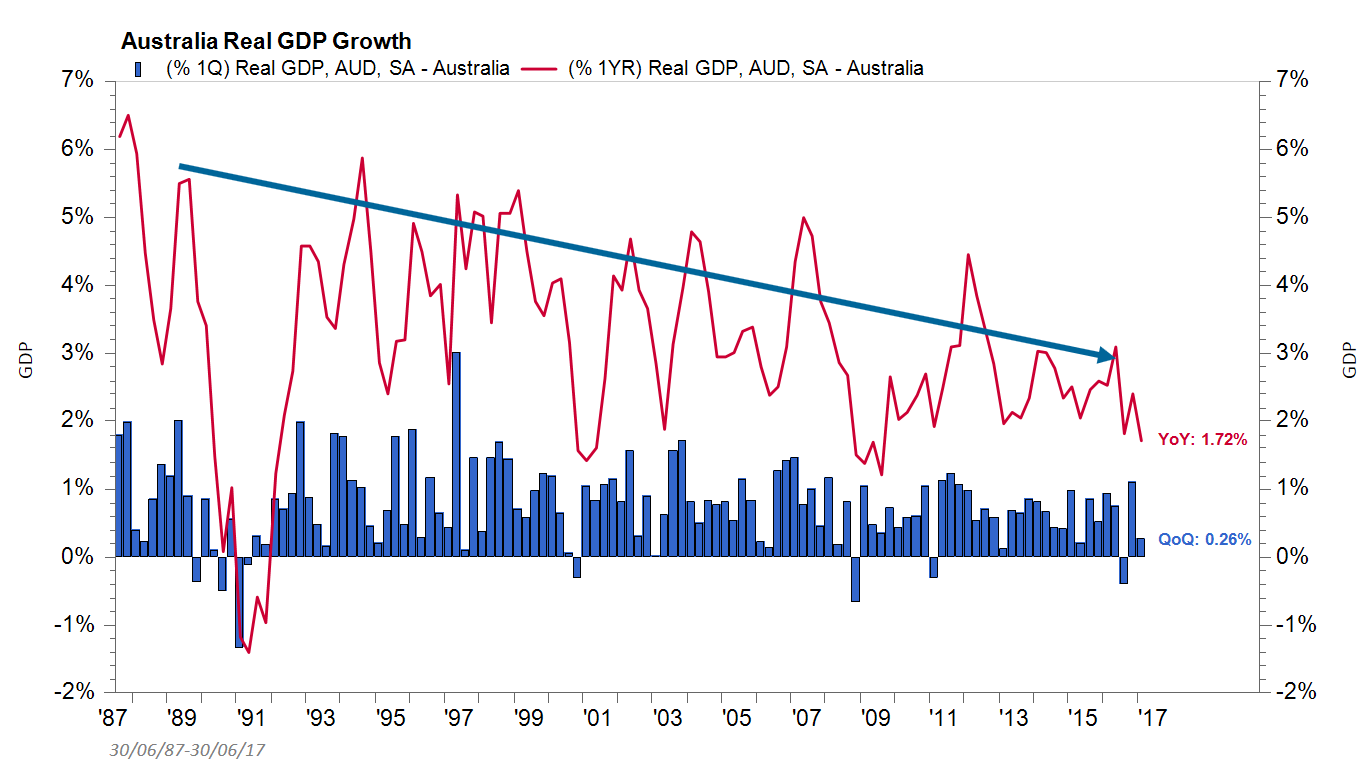

1. A slowing economy

Increases in pricing and volume are needed for the earnings growth trend of the big four banks to continue. However, we expect that interest rates (price) will continue to remain low, especially given that household sector debt is already high, relative to international standards. This, combined with low wage growth, also means that there is limited scope for a material increase in household debt from these levels, especially with GDP growth continuing to trend downwards (see Chart 4).

Chart 4: Australian GDP growth is trending lower

Source: FactSet as at 31 March 2017

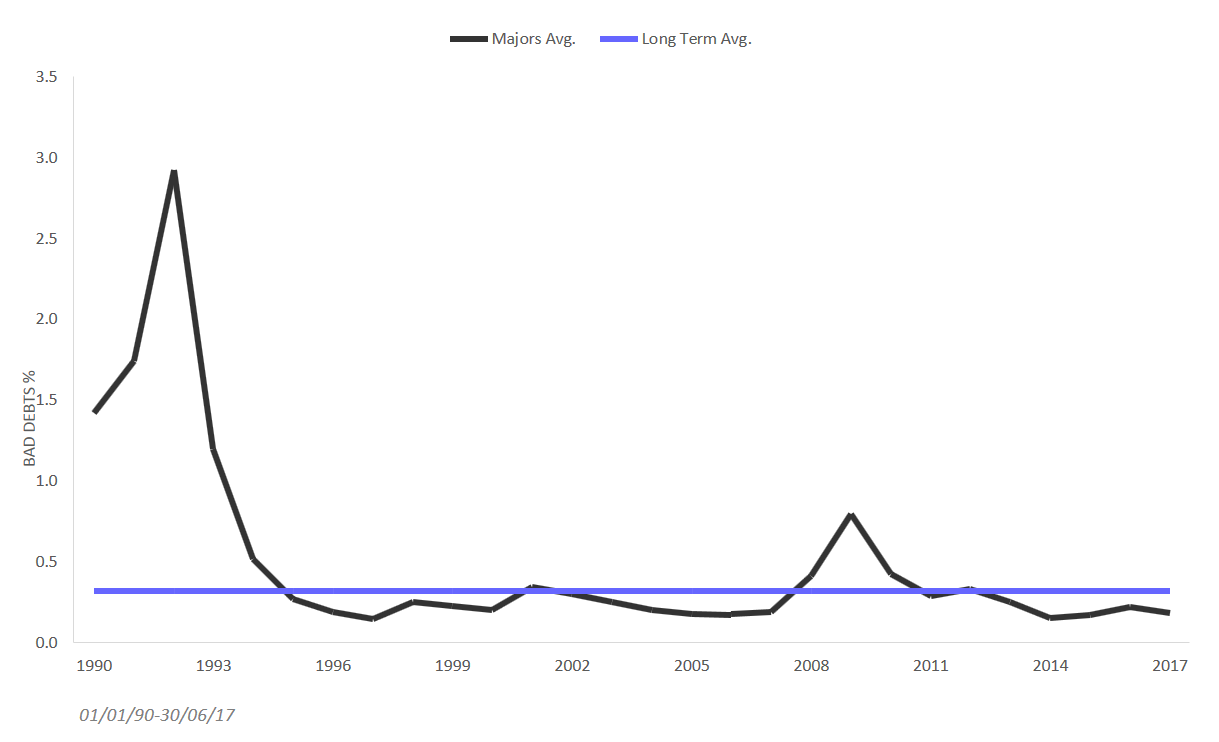

Chart 5 shows the history of bad debt charges as a proportion of total loans for the major banks since Australia’s last recession. In 1992, major bank bad debt charges peaked at 3% of average non-housing loans with Westpac recording a $1.6bn loss and narrowly avoiding insolvency. The loss on commercial lending was even higher during the GFC, but this was masked by the strong performance of the banks housing portfolios which now represent almost 2/3 of the major bank portfolios and are yet to experience a bad debt cycle.

Chart 5: Historical Bad Debt as a percentage of gross loans

Source: Deutsche Bank as at 30 June 2017

Since the GFC, conditions have been benign, with banks profiting from writing back problem loans as well as new bad debt charges being very low. Although economic conditions remain relatively stable, these conditions can’t persist forever and bank shareholders must accept the risk of bad debts spiking in any future economic downturn.

So, with the major banks’ limited capacity to drive increases in volumes and prices, perhaps this is as good as it gets?

2. Tighter regulations

In recent years, APRA, the Australian banking regulator, has increased its focus on mortgage lending, as a way to protect the banking system against any sharp downturn in the housing market. Measures already in place include a tightening of lending rules and increasing the capital base that it requires Australian banks to hold in support of their residential mortgage book. This increased requirement has led to Australia’s major banks raising $30 billion in capital over the last four years alone.

To counter the huge surge in borrowing by property investors, APRA is also taking a more prudent approach, with increased monitoring and new limits on interest-only loans.

In the wake of recent financial advice scandals, the rigging of the bank bill swap rate (BBSW), delaying of insurance payments and failure of important Anti-money Laundering & Counter-Terrorism Financing (AML/CTF) programs, the Government has also directed the ACCC to monitor the banks’ conduct more closely, especially around responsible lending (which has been notoriously lax on loans written through mortgage brokers), the setting of mortgage interest rates and of fees and charges, which remain high relative to overseas banks.

APRA has also very recently announced that it will undertake an independent review into the recent operational risk and governance issues at the Commonwealth Bank, the largest of the big four, following the recent breaches of AML/CTF regulations raised by AUSTRAC.

As the impact of these conduct issues start to come through, it is difficult to see the overall regulatory environment being as friendly for the banks as it has been in the last 30 years.

3. A new political environment

The widespread criticism of the banks’ conduct has resulted in the Federal Government being far more willing to act against the banks, with the recently-introduced bank levy taking many by surprise. This 0.06% annual levy applies to the banks’ higher risk liabilities and is aimed at reducing the use of ‘riskier’ funding (like corporate bonds and hybrid instruments) to fund residential lending. We expect this levy will impact profit of the big four by around $250 million each, next year.

With revenue growth now more constrained, the banks’ earnings growth will have to be achieved through reducing costs, either through the more efficient use of technology and/or reductions in employees and branches. The big four banks are major employers in Australia, with each having around 40,000-50,000 employees. While reducing costs in this way could be used to grow earnings, given the current political environment, it may not be a simple task.

In conclusion, while it has been 26 years since the last recession in Australia, history shows that banks also have sharp earnings cycles, with bad debt spikes usually occurring once every 10 years. Given the limited opportunities for growth and tighter capital base, we believe that it is very difficult to see the conditions that enabled the banks’ Golden Era to be repeated going forward. In the event that Australia’s economic environment did become more difficult, Australian banks could also be disproportionately hit given the high leverage on their balance sheets.

Where else should investors be looking?

Investors have enjoyed sustained capital growth and reliable income from Australia’s banks, but they are not without risk. Investors must be cautious not to underestimate the risks of a bad debt cycle, growing regulatory uncertainty and continuing imposts from a Federal Government in need of repairing its Budget deficit.

As we are underweight the major banks in our portfolios we have sought to look for other good quality companies which we believe can deliver reasonable capital growth and growing income streams in the next few years, examples include:

Shopping Centres Australia Property Group (SCP) is a REIT that owns a portfolio of shopping centres and freestanding retail assets across Australia and New Zealand. SCP offers recurring earnings, as the majority of its rental income is derived from food-based or non-discretionary tenants like Woolworths. SCP also has a long-weighted average lease expiry of 10 years, with rental income growth secured by fixed annual increases and turnover rents that cannot be revised downwards. A sound balance sheet, the defensive nature of its underlying assets, and strong cashflow, with very little capital expenditure requirements, allows SCP to offer an attractive dividend yield of near six percent. Some growth in rental received and distributions paid to its shareholders is assured in years to come thanks to its existing lease agreements with anchor tenants.

Spark Infrastructure Group (SKI) is an infrastructure investment company with an equity stake in the electricity distribution assets of Victoria and South Australia’s power networks, as well as an interest in New South Wales transmission operator Transgrid. SKI’s predictable cashflows, through its defensive regulated assets, will help to provide steady earnings over the long-term. SKI also has a favourable operating environment, with recent regulatory resets offering certainty until at least 2020. This means SKI’s cashflow and earnings growth outlook has been largely de-risked, which will allow SKI to maintain a yield of at least 6 percent quite comfortably.

Concluding remarks

In our view, Australia’s 4 major banks’ are very unlikely to repeat their performance of the last few decades and their ‘dream run’ now looks to be over. While the banks remain strong entities, we believe investors should be cautious about using the banks’ past success and their large weightings in the Australian sharemarket as a guide towards portfolio positioning.

In any portfolio, stock selection remains the key and at IML we continue to invest in attractively-valued quality companies that have a strong competitive advantage, recurring earnings and that are run by capable management. It is these companies, in our experience, that will provide the best investment outcomes in future years.

While Australian banks are worth considering for any quality equity portfolio as they do possess the criteria we look for, the environment today is significantly different to the circumstances that saw the extraordinary growth of the banks being achieved from a low base three decades ago.

NAB and Westpac remain our preferred major bank holdings, due to the strength of their franchises, governance, and management. CBA has also recently started to look attractive; given that its share price has de-rated by 10% since the announcement of AUSTRAC’s investigation.

Clydesdale Bank (CYB) remains a high conviction holding of IML since it was spun out of NAB 18 months ago. In stark contrast to Australian banks, CYB operates like a building society with 90% of loans funded by customer deposits. In our opinion, CYB has great potential to win market share and to cut its cost base by 15% which should result in a much more profitable bank and the potential to release 75 cents per share of excess capital to shareholders in FY19.

We remain of the very firm view that over the long-term, good quality industrials and a selective holding in certain banks, are better placed to produce consistent, tax-effective income with reasonable capital growth that many investors are seeking.

1 topic

7 stocks mentioned