Is the Fed running late to the Goldilocks party?

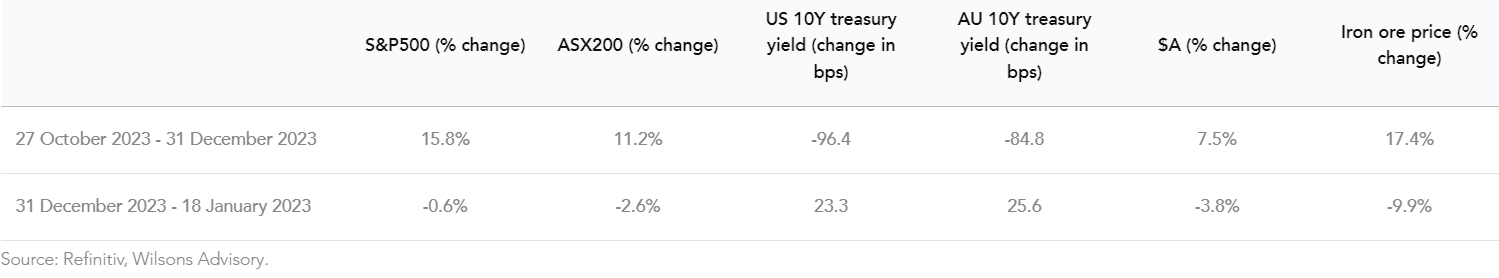

Equities have eased back this year after a very strong surge late in 2023. This still leaves the US stock-market up 15% (9% for Australia) from the late October lows.

The goldilocks narrative of easing inflation paving the way for central bank rate cuts in concert with slowing but still positive economic growth proved a powerful impetus for both equities and fixed interest markets in the latter stages of 2023.

The magnitude of the rally left both equities and bonds vulnerable to a short- term retracement, although our expectation continues to be that equities and fixed interest should post positive returns in 2024 as inflation extends its decline, central banks ease policy and growth slows, before accelerating again in late 2024 and into 2025.

The market aggressively brought forward the expected timing and magnitude of central bank rate cuts toward the end of 2023 with the Fed’s mid-December dovish guidance providing a significant impetus to this re-pricing.

Figure 1: Equities and bonds are backing off after the big year-end rally

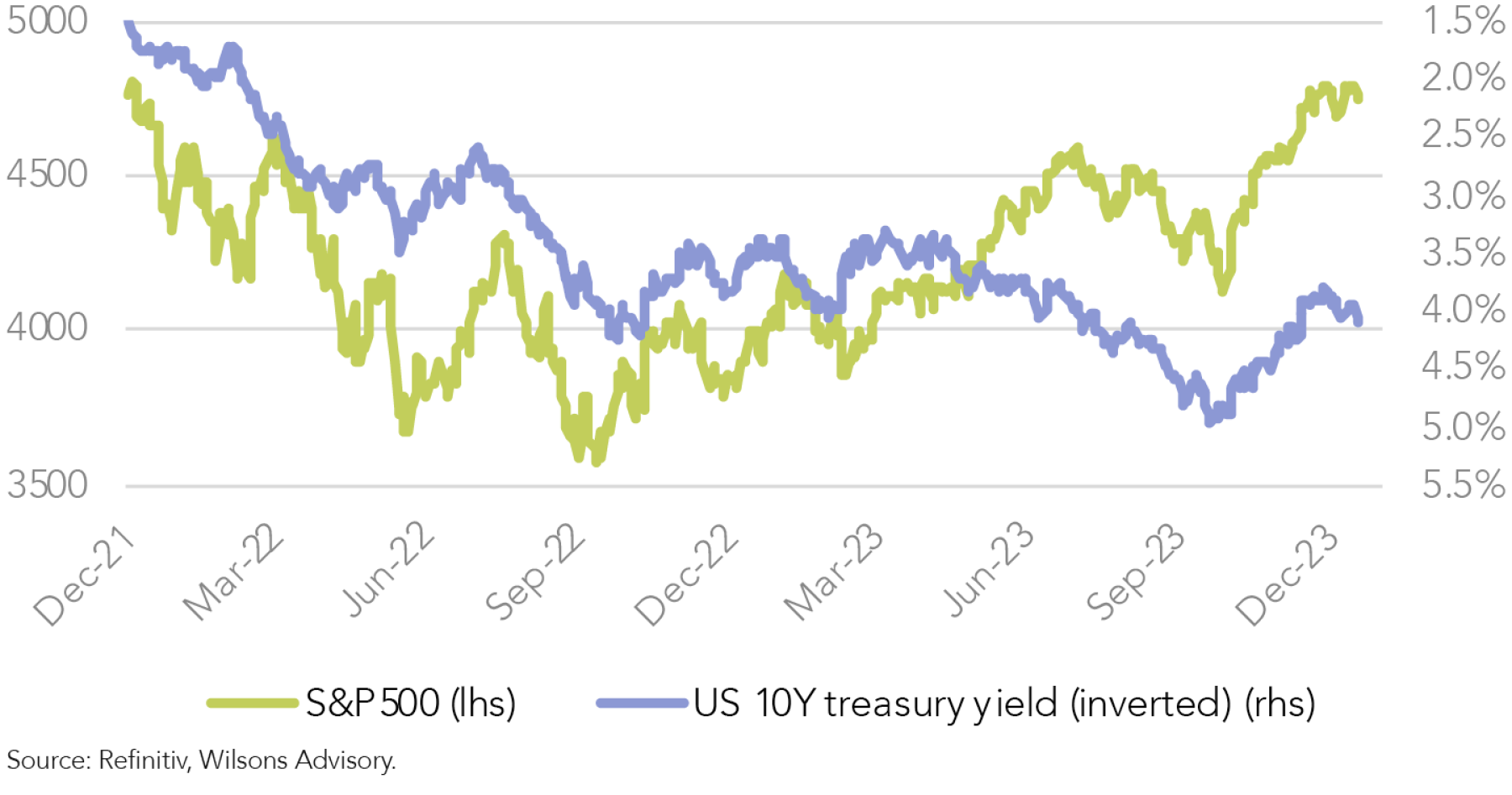

Figure 2: The bond market's direction continues to be important for the equity market

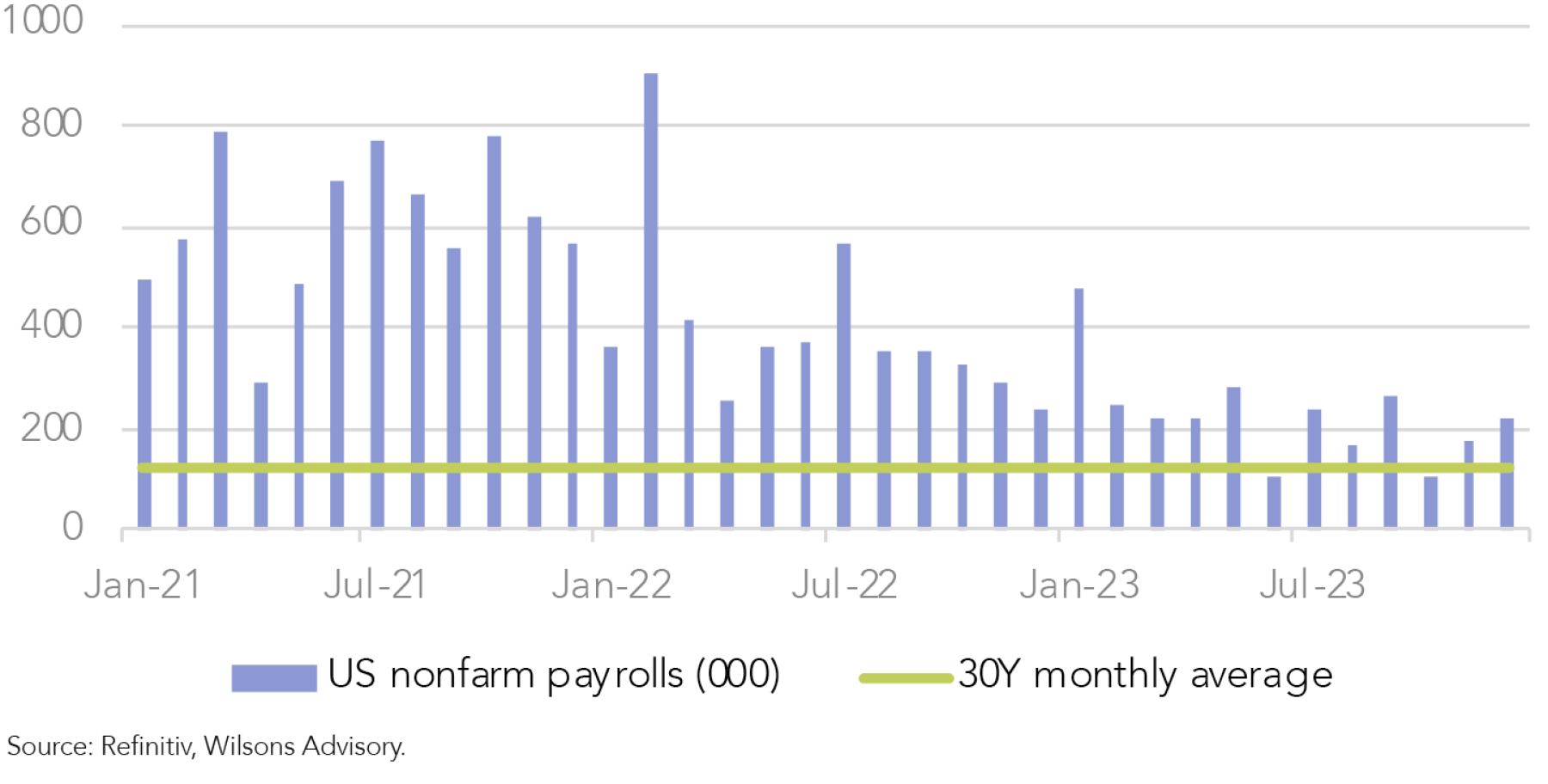

US Activity Data Stays Resilient

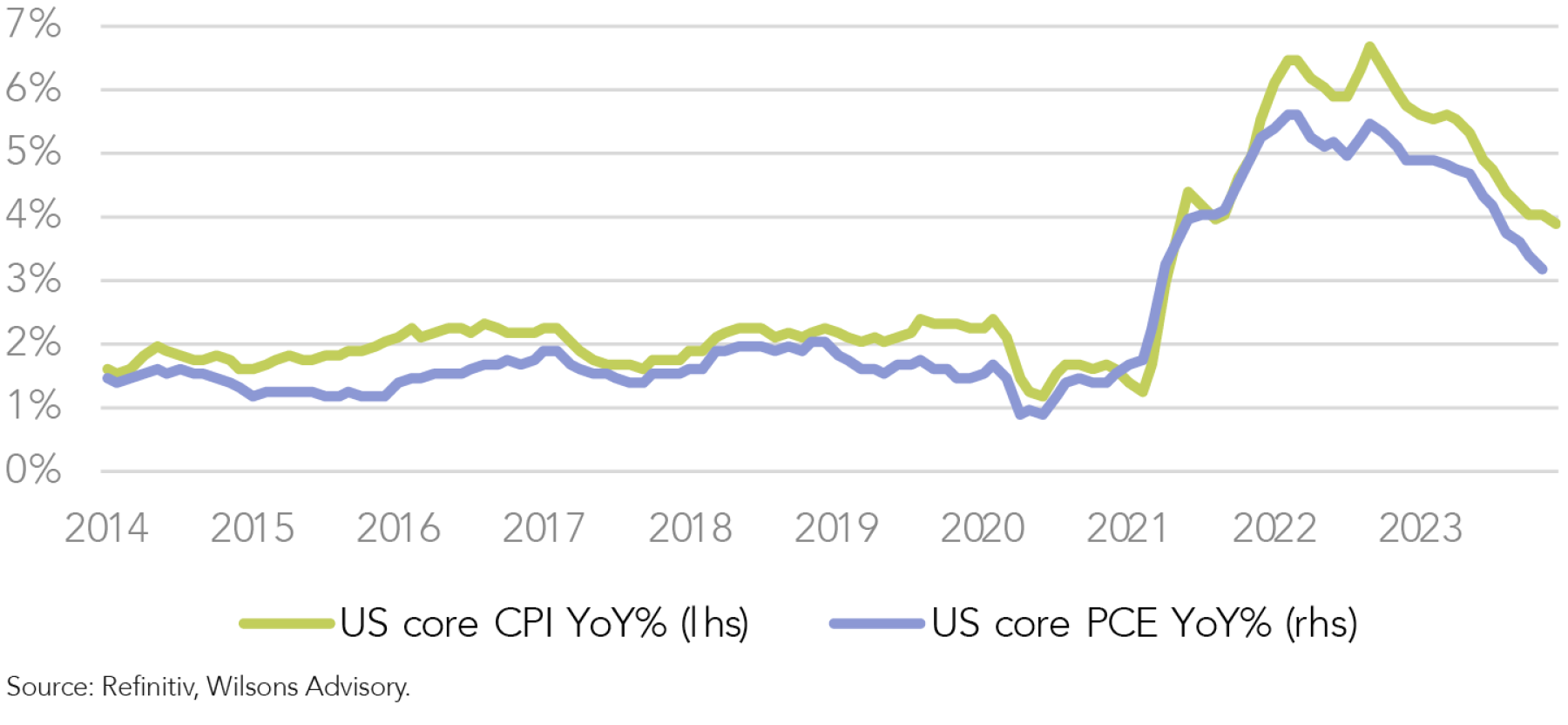

So far this year US activity data has continued to be on the strong side of consensus, while CPI and wages data has also surprised marginally to the upside. This has seen the market begin to par back aggressive rate cut expectations, with bonds yields rising and equities easing back in response. While the prospect of a March rate cut from the Fed has been pared back from over 90% at the beginning of 2024 to just under 60%, we still see this as optimistic, with a May or June commencement more likely, in our view.

We remain constructive on the US inflation trend in 2024 and the ability of the US economy to keep growing, but the aggressive interest rate repricing and consequent equity surge looks to have gotten ahead of itself. A period of consolidation in shares (and bonds) is likely in our view, with a recalibration of rate cut timing likely to cool recent exuberance. However, the overarching narrative of cooling inflation, decent growth and multiple US rate cuts later in the year should remain intact.

Figure 3: US inflation is easing though different measures are giving different signals on the pace of the deceleration

Figure 4: US job gains continue to track at an above trend pace, making a hard landing still look unlikely

Australian equities and bonds have also sold-off in sympathy with this US interest rate re-calibration. Indeed, the Australian sell-off in equities this year has been larger than the US sell-off (as at 18 January). We would attribute some of the additional weakness in Australian equities since the early January peak to a retracement in commodity prices (after a strong run-up) in response to a somewhat underwhelming run of China data to start the year.

The size of the bond market sell-off has been very similar to the US, which is perhaps surprising given the Australian data has been relatively bond-friendly relative to the US trend. Seasonally thin market liquidity may be a factor.

Australia’s economy is still sluggish

Australian economic data released at the start of the year has been mixed but is on balance consistent with below trend growth, easing inflation and the RBA almost certainly having hit the peak on rates.

Australian retail sales did rise a stronger-than-expected 2% in November (2.2% year-on-year), however this was boosted by very strong Black Friday sales. This suggests that spending has been brought forward from December. We expect to see a pullback in December retail sales based on the experience of the last few years.

Employment was softer than expected, albeit this followed a very strong November print. Employment in December retraced very sharply by -65k month on month, which was a material miss (consensus: +15k); however, this follows a similarly large upside surprise in November, which surged +73k (revised up from 61k). The Australian employment report is notoriously volatile, so a smoothed or trend analysis is more instructive. The average in recent months has slowed, but is still trending at ~15k to 20k. Year on year employment growth remains relatively solid at 2.8%, albeit a notable step down from 3.2% in November.

Hours worked were weak again for the month at -0.5% (after - 0.2%), and the year-on-year moderated further to 1.2% (after 1.5%). This marked the slowest pace since March 22. Meanwhile, the unemployment rate held at 3.9%. The unemployment rate is just above the range since mid-22 of ~3.5% to 3.75%, but is likely still below the NAIRU/full employment level estimated by the RBA at ~4.25% to 4.75%. The participation rate fell back sharply to 66.8% (from a record high 67.3%). Job vacancies also fell for the sixth quarter in a row in November. They are still high relative to unemployment indicating the jobs market remains tight, but it is now cooling which should take some pressure off wage growth.

Overall the labour market still appears reasonably tight but is cooling at the margin as the overall economy cools. This provides more impetus to the view that the RBA has done enough and should be able to ease later in the year; but contingent on inflation being reasonably well behaved.

Figure 5: Recent Australian employment trends have been volatile, but the labour market is cooling in trend terms

Longer runway for rate cuts

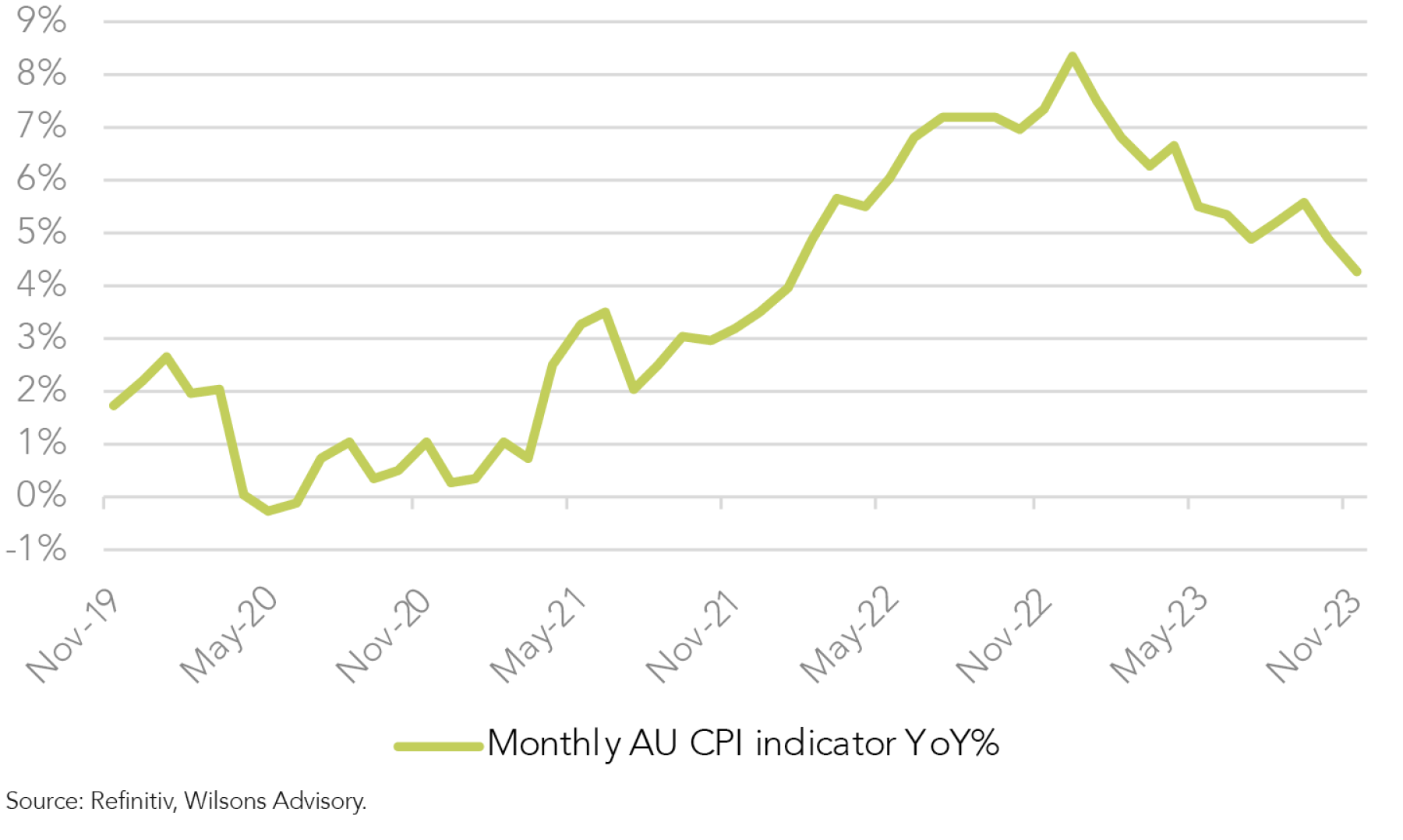

Inflation data for November surprised to the downside. The monthly CPI for November was lower than market expectations, up 0.3% month-on-month and 4.3% year-on-year (down from 4.9%). Core inflation was also lower, up 0.25% month-on-month and 4.8% year-on-year (down from 5.1%). Housing was the main contributor to inflation for the month, along with rents and new dwellings. December data should see another step down as the base effects fall out, fuel prices lower, and Western Australian power subsidies kick in. The full December quarter inflation release is the next key piece of domestic data (due 31 January) as the RBA heads toward its first meeting of 2024 under its new 6-weekly framework. We expect the quarter-on-quarter pace to step down from September’s worryingly high 1.2% to a still high but encouraging 0.8%. This would level core CPI at a still high year-on-year pace (4.4%). Therefore, an RBA rate cut is still a story for the second half of 2024 in our view.

Figure 6: Australia's recent November CPI print was encouraging, but the upcoming December quarter print will be key

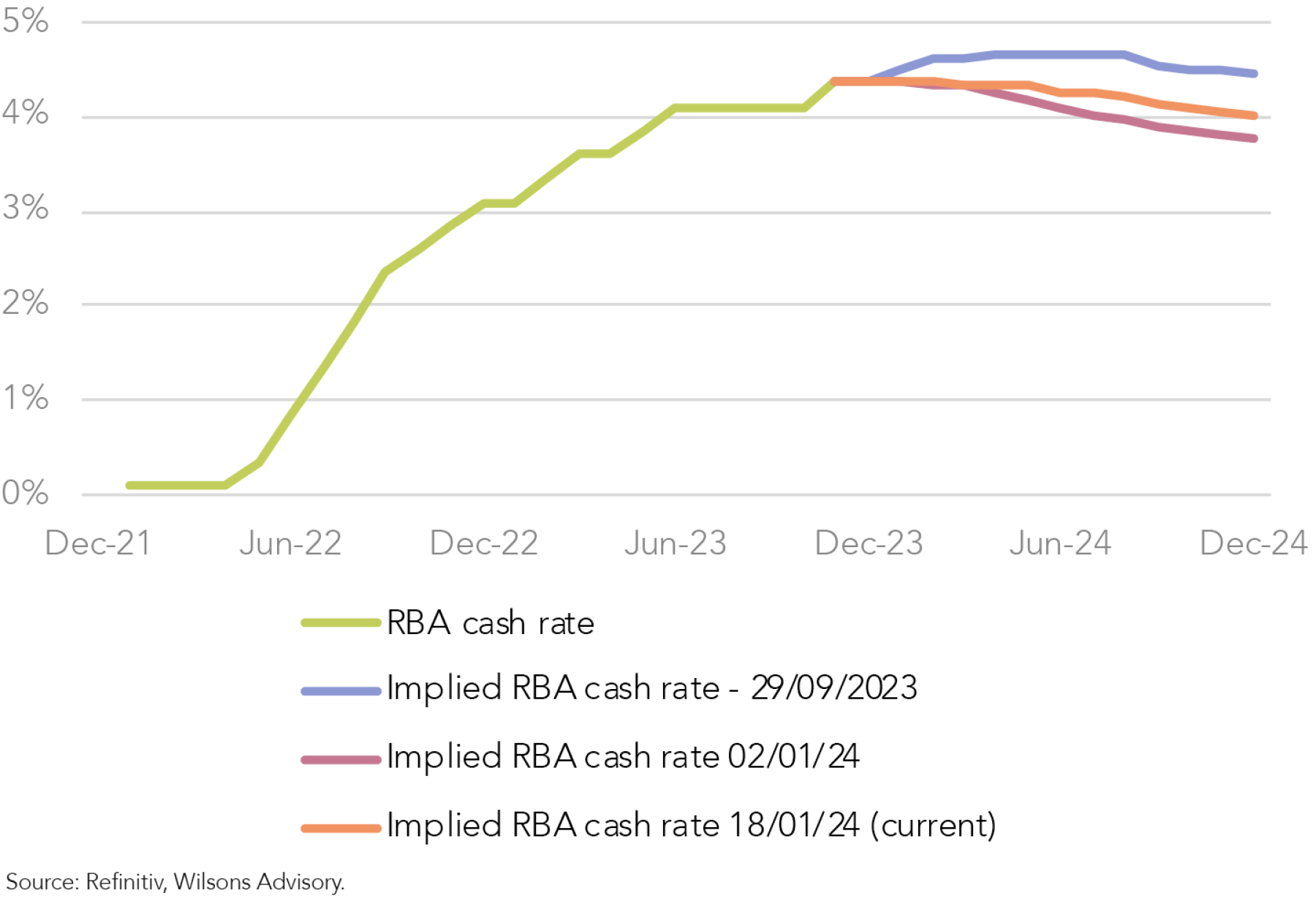

The market is currently priced for just over one rate cut in 2024, beginning in either September or November. This compares to the beginning of January when markets were pricing a June cut and just over two cuts for the year.

Figure 7: RBA rate cut expectations have been shifting, in part due to sentiment shifts toward Fed easing prospects

Investment summary view: Holding pattern before gains

Easing inflation pressures, central banks ultimately moving to cut rates and prospects for stronger growth in 2025 should set the scene for decent returns for both equities and fixed interest in 2024.

However, with global investors positioned significantly more bullishly than 12 months ago, it’s likely to be a choppier equity advance than in 2023, particularly for the global equity market.

The first few months of 2024 could be characterised by range trading as excessive optimism is worked off as central banks hold the line on

interest rates.

However, equities should ultimately benefit from rate cuts later in the year, lower bond yields and the anticipation of stronger growth late in the year and in 2025.

Learn more

Wilsons Advisory think differently and delves deeper to uncover a broad range of interesting investment opportunities for their clients. To read more of our latest research, visit our Research and Insights.

5 topics