Is the Russian ban on enriched uranium to the US the catalyst ASX uranium stocks need?

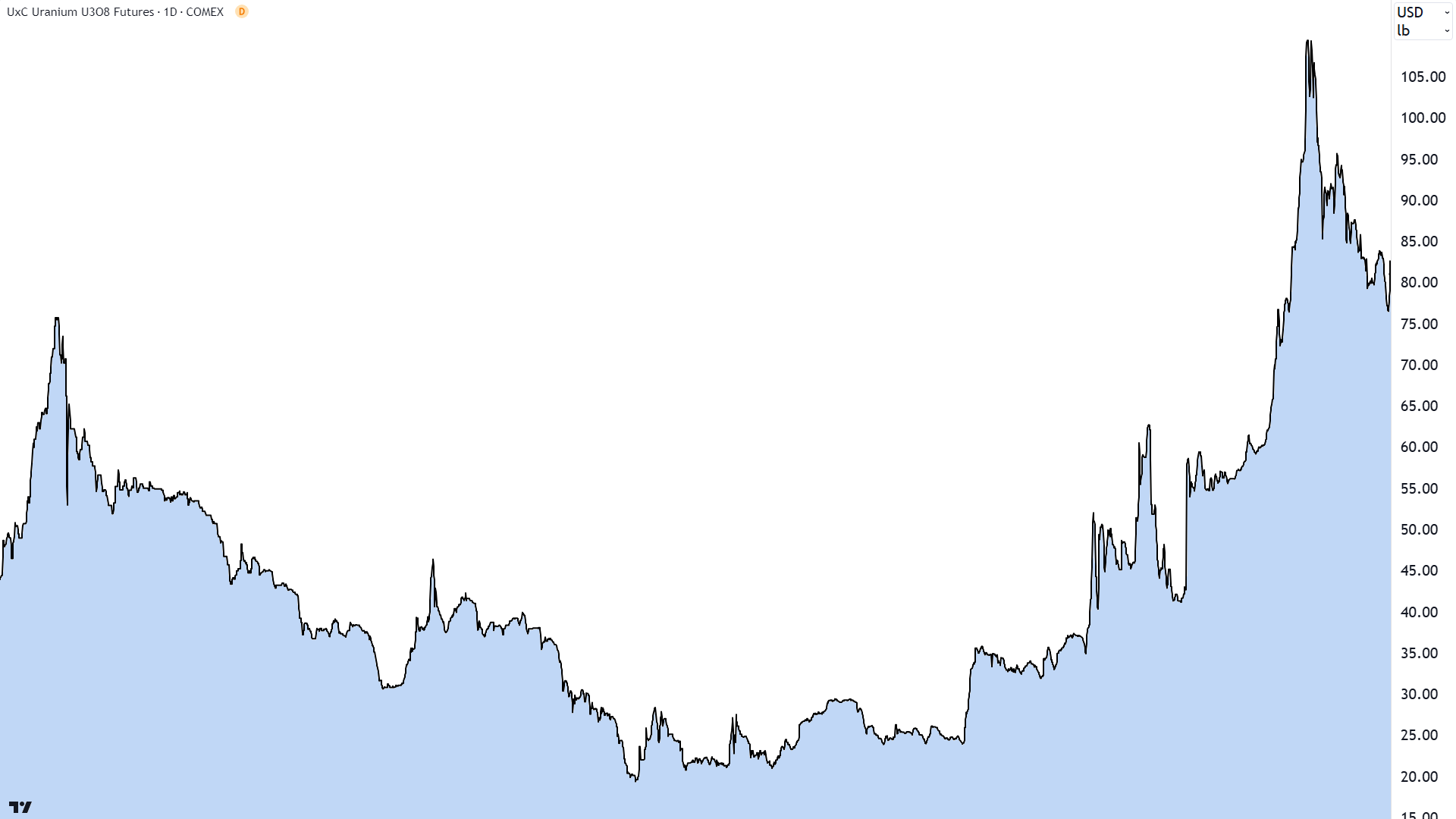

The recent price performance of uranium has been lacklustre at best in 2024. After a strong rally from around US$50/lb in late 2022 to a peak of US$110/lb set in January this year, it’s been a steady decline with front-month uranium futures tipping US$76.50 earlier this month.

This is typical of a commodity price cycle that was initially driven by a growing supply deficit after several preceding years of doldrum prices leading to the shuttering of several marginal projects. It also contributed to significant underinvestment in new supply across the industry.

But, as is also typical of a commodity price cycle, as the uranium price subsequently recovered, it incentivised the resumption of supply and increased investment in exploring for and developing new projects.

%20long%20term%20price%20chart%20(Source-%20TradingView).png)

Consider that just this year, Boss Energy has restarted production at its Honeymoon mine in South Australia, Paladin Energy has restarted production at its Langer Heinrich mine in Namibia, and Uranium Energy Corporation has restarted operations at its Christensen Ranch project. Cameco has also been ramping up production at its MacArthur River and Key Lake mines in Canada.

On the demand-side, a rush of restocking activity by nuclear utilities did not materialise in 2024 to the degree that many uranium bulls were expecting (possibly baulking at the higher prices). As a result, this year has largely been a case of supply growing moderately to meet demand – and the uranium price has dutifully softened.

One-two bull punch?

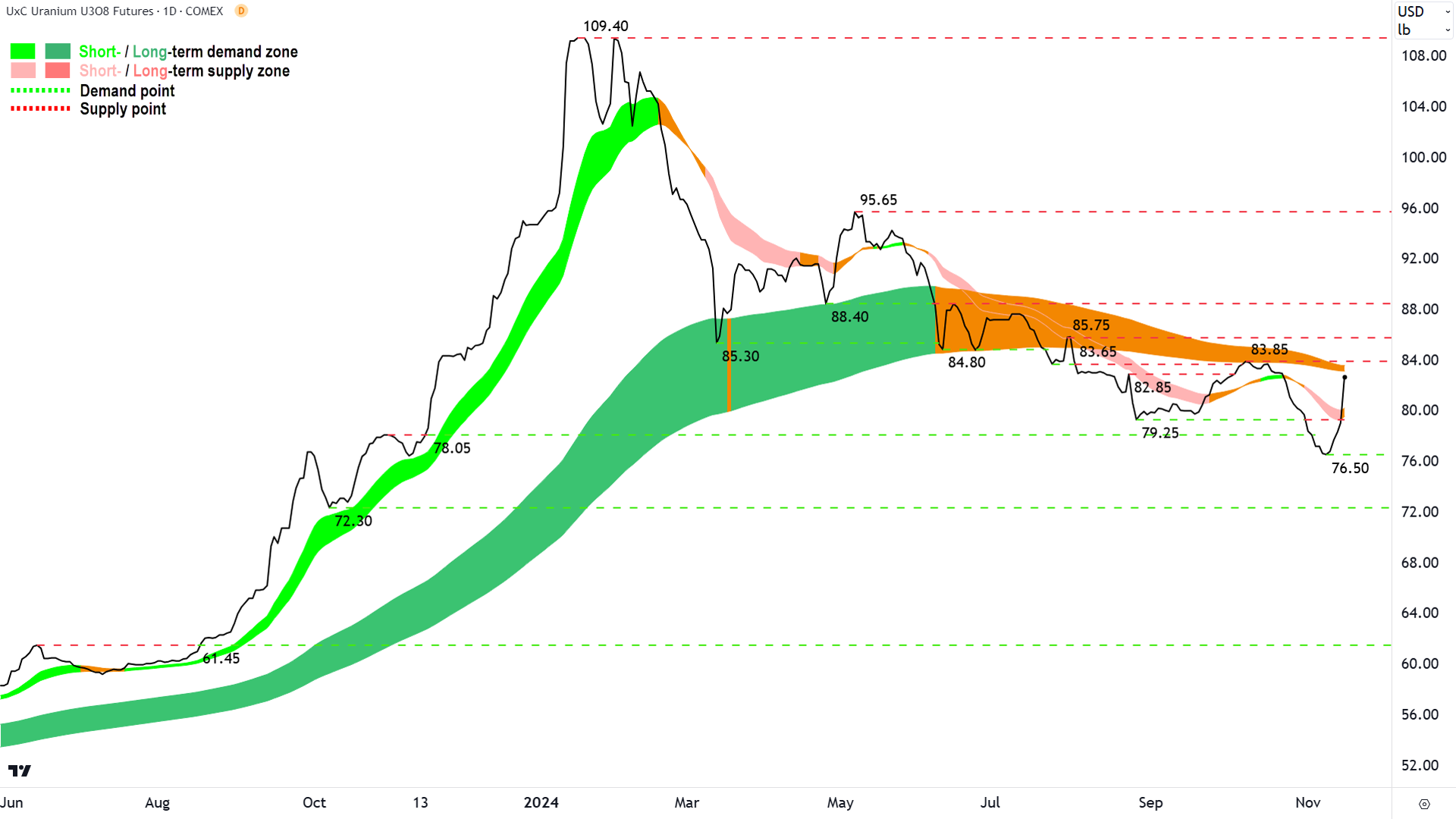

There have been two key developments in the last two weeks that have helped reverse the prevailing decline in the uranium price, and which may prove to turn the broader tide back to one of steady appreciation like the market that occurred in 2023.

The first item may help bolster the demand-side of the uranium market but is likely to be a longer-term factor. The sweeping success of President-elect Trump in the US election earlier in the month increases the probability of increased investment in nuclear power production in the USA.

Whilst President-elect Trump’s energy policy appears to emphasise fossil fuel dominance (“drill baby drill”), it also advocates for increased nuclear power production. In speeches and interviews given since his victory, Mr Trump has intimated that nuclear power, particularly from small modular reactors (“SMR”), will play a major role in the USA’s long term clean energy production aspirations.

The second key development for the uranium market is likely to hit the supply-side of the equation. On Friday, Russia announced restrictions on exports of enriched uranium to the USA. The ban mirrors the US’s ban on imports of Russian uranium products in May.

%20COMEX%20Chart%2015%20November%202024.png)

In combination, these two developments have helped drive a 10% rally in the uranium price back towards a key resistance level around the October high of US$83.85. You can check my detailed technical analysis on the uranium price in the ChartWatch section of the Evening Wrap I publish here, but in short, if the uranium price can breach that level, it likely reverses the prevailing medium-term downtrend.

Risk-reward is “improving”

This latest development has triggered one major broker to opine that the “risk-reward appears to be improving” for the uranium price. In a research note published this morning titled “Uranium: Improving Risk-Reward?”, Morgan Stanley notes that the Russia news “may add further tightness” to the uranium market that along with other factors, could tip the balance back towards an imminent price recovery.

On uranium supply, the broker points out that supply has been “disappointing” due to Niger’s Orano mine being placed on care and maintenance in October due to transport issues. Also, several junior miners have announced production cuts due to slower than expected ramp-ups, lower ore grades and delays by local community opposition. It’s possible that some of these miners may even need to access spot markets to fulfil offtake agreements

Exhibit 2: Uranium supply cuts: We count 2,563 tU of lost or delayed supply for 2024/2025. Source: Company Reports, Morgan Stanley Research estimates. From ("Uranium: Improving Risk-Reward?", Morgan Stanley Research, 18 November 2024)

On uranium demand, Morgan Stanley notes that utility contracting volumes are down 63% from 2023 and this is one of the major reasons for recent price weakness. This could improve, however, given the Russian ban now in place and with what was a major perceived risk event by the nuclear industry in the US election out of the way.

Morgan Stanley notes the above factors would likely reinforce a “tighter balance for 2025” in the uranium market. It concludes: “This may limit further downside to spot prices from here and even drive some recovery”.

Is this the catalyst for an ASX uranium stocks resurgence?

Perhaps not surprisingly given the uranium price performance, Australian uranium stocks have generally had a terrible 2024 after a promising start to the year. In a follow up article I’ll publish tomorrow, I’ll investigate the key fundamental and technical factors presently impacting ASX-listed uranium stocks to try to ascertain whether recent developments could be the catalyst for their revival.

This article first appeared on Market Index on Tuesday 19 November 2024.

5 topics

7 stocks mentioned