Is the US budget deficit sustainable? – Part 2/2

I recently penned the first part of this wire where I posit that in spite of what is bordering on fiscal recklessness, it’s unlikely to bite the US Dollar in the short-to-medium term, and maybe even longer.

It’s here: (VIEW LINK)

Reason 1 is that after the GFC, and even during COVID, the world seems hopelessly short of US Dollars. There are more than three additional reasons why but here are the ones I think might be the most relevant, for now at least.

Reason 2: The US Dollar is the global reserve currency

Kind of related to Reason 1, there is no alternative today to the US Dollar. The Yen is a relatively small global pool inside a somewhat insulated country that has non-traditional fiscal and monetary policy. The Pound Sterling is a little the same but regardless, that ship has sailed. The Yuan will never work given the opaque nature of the Chinese financial market. Now, if only we could gather the brightest minds to stress-test all kinds of outcomes over a decade, and to design the perfect multi-geography currency that would weather all kinds of storms. And we’d give them the leeway to spend 3 years fine-tuning the project, to make sure they got it just right.

Well, I just described the Euro currency and it’s almost collapsed twice since its inception.

There is no (current at least) alternative to the US Dollar.

Reason 3: The resilience of the US economy

The US consumer is a monster, they just will not let up. Retail sales are up 2.3% over the 12 months to September in the face of higher interest rates, as well as a slowing global economy. Plus, we already know the US is the global innovation hub for tech, for AI, for health care, for pharma, for finance, for entertainment, and more. The things that the US probably doesn’t lead in are EVs, renewable energy, and semi-conductors. And guess what? They’ve passed US$2 trillion of Government spending aiming to become leaders in, you guessed it, EVs, renewable energy, and semi-conductors. You can bet the US consumer will be on the end of those ideas, spending - it's what they do.

Reason 4: Simple maths

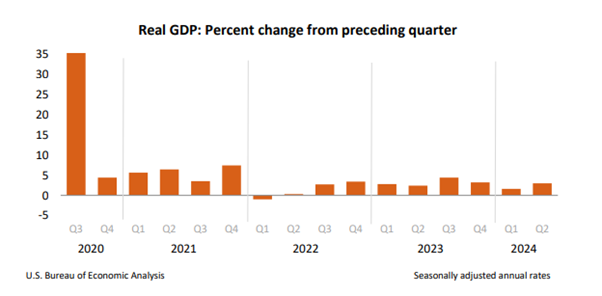

Good economies tend to turn into good stock markets because economic activity tends to turn into corporate profits. Profits drive valuations, simple as that. So given your Economics 101 lesson of C+I+G+(X-M) = GDP, the C in the US is doing just fine (see Reason 3), the I is good not great, and (X-M) is fine. However, and it’s kind of the whole point of this piece, the G is massive. The US has added over US$4 trillion of GDP since the pandemic, GDP has grown at 3.2% since right after WW2, and it is currently growing at 3%, in real terms.

None of this is to say that US markets will never again go into correction (because they will), or that we’ll never see another US bear market (because we will), or even that the US Dollar will continue to hold up so strongly forever (because it probably won’t). But it is to say this - in a world of trade-offs, because there are no right or wrong answers, you need to make educated assessments and then make decisions based on those assessments.

I am asserting that based on the observations noted above, the US will most likely remain the world’s pre-eminent capital market for investors in spite of the current-day poor fiscal discipline. The role that the US plays in global capital markets has made it almost too big to fail. Which is unfortunate, frankly. But it presents an opportunity for investors looking for growth to buy anyone else’s anxiety when markets correct. Again, they will correct.

For at least the short-to-medium term, stay long the US if you’re looking for growth. If you’re looking for income, it may be that Australia has the best market on the planet for that, but if you have an SMSF or you’re looking for growth for any other reason, the US likely remains the best market for achieving that goal.

Good luck out there.

5 topics