Is the US high yield credit market a ‘canary’ we should listen to?

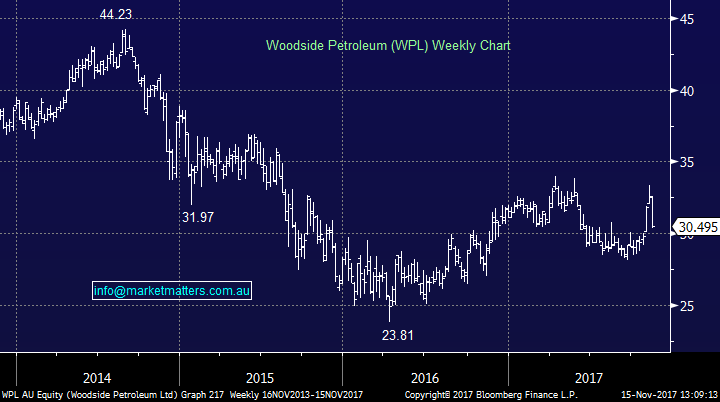

As we enter the seasonally weak middle part of November, the market – right on cue, rolled over on Tuesday and was down again yesterday ~35pts. As we’ve previously suggested, the catalyst seemed to be the big line of Woodside stock that was placed to institutions on Monday night, however given high cash levels across the investment world, we think the prevailing weakness will ultimately be a ‘dip to buy’ scenario. To that end, we added a small (3%) holding in Woodside yesterday, a day early by the look of trade today however we will add to the position if weakness persists, and WPL can tick up to a 5% yield plus franking – (currently 4.61% projected).

US High Yield Debt

Some very interesting moves played out in the US Junk Bond market during the week and its worth taking note of the trends. As means of background, the Junk Bond market refers to all corporate bonds that are noninvestment-grade as determined by the relevant rating agencies – in the case of S&P, that’s a rating of BB or lower, and there were some clear wobbles happening in some parts of that market. It’s worth discussing given:

- The Australian market is considered a ‘high yield’ market and moves in other ‘high yield’ areas will ultimately have an impact

- We’re negative the ‘yield trade’ collectively thinking that interest rates are about to break their 30-year down trend.

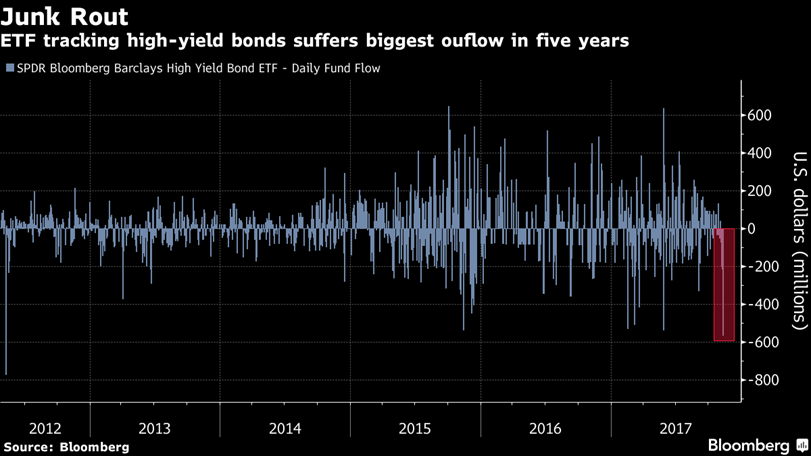

- The moves / selling of junk bonds in some cases was pretty aggressive and it highlights that when money wants to get off a particular theme, the moves can be big and are clearly being amplified by the amount of ‘trend following’ money that sits in passive ETFs.

A good chart from Bloomberg showing this trend of outflows…

The actual move has not been that significant in price terms when looking at some of the ETFS such as the Barclays High Yield ETF (below) because the pain was only really directed towards notes rated B or lower, which saw their risk premiums widen around 40 basis points, however spreads on the largest group of bonds in the just-below-investment grade BB category, which accounts for 50% of the Bloomberg Global High Yield Corporate Bond Index, widened by around 14bp. To give an example here that would be relevant for our portfolio, if a Hybrid was issued at a spread of 4%, and suddenly we saw a move in the market to 4.40%, or in other words, at one point the market is happy to accept 4% for the risk, but that changes, and they only have interest at 4.40%, the capital price of that security would have dropped to around $91.

Barclays High Yield Bond ETF Weekly Chart

Thinking more broadly, the Fed QE program was all about keeping interest rates low to force investment. If a saver can only achieve 2% by holding cash, but can get ~6% yield by following the MM Income Portfolio, then the relative appeal of the Income portfolio is obvious, however, if that same low risk term deposit offers 4%, to maintain the original 4% spread, the Income Portfolio would need to yield 8%, which is achievable if the companies within the portfolio are growing earnings but if they aren’t, and that yield remains stagnant, then the share prices would need to fall to offer the market an acceptable yield. Interest rates are clearly very important.

Turning back to the high yield market in the US, the below chart looks at credit spreads for differing credit qualities. The interesting aspect here is that although we saw a widening of spreads in higher risk credits, the higher quality investment grade credit actually saw tightening, or buying in other words, so, money simply moved from higher risk to lower risk, and it seems for now that it was simply a function of miss-pricing in the risker end rather than something more sinister.

That said, it’s clearly a shot across the bow of high yield investors and simply, another warning sign that investors should be very cautious of defensive style yield investments.

Woodside (WPL) – $30.47 PE of 19.56x Yield of 4.61% fully franked

Clearly this is a play on coordinated global growth underpinning strength in the Oil price and we’ve positioned in the highest quality operator with the best balance sheet and a strong yield. Some might question the rationale around higher Oil prices given its stunning decline of the past four years from above US$100 per barrel to below US$30, and subsequent move back to near US$55 today, however it’s that large move which has curtailed a lot of new developments, reducing future supply. This is not a long term buy and hold scenario, however it is a company that should benefit from the ‘reflation trade’ as that starts to take hold.

Today’s price action confirms we were a day early with our buy however buying into the energy sector into weakness, starting with a small allocation was always the plan.

Woodside (WPL) Weekly Chart

Conclusion

The changing dynamics in some parts of the market are becoming clear, with rising interest rates the likely catalyst for some major changes

We are comfortable with our small 3% weighting to Woodside at this stage, and will look to add more should weakness persist.

1 topic

1 stock mentioned