It's a good time to go shopping

For real estate investment trusts (REITs) at home and abroad, last financial year was tough. With inflation charging and interest rates in hot pursuit, for the first time in decades, fears of a wage-price spiral took root. For REIT investors, these were the opposite of ideal conditions.

However things didn’t turn out as bad as expected. A few months before the end of the financial year, the pace of rate rises either slowed or abated altogether. With signs that the rate cycle had peaked, many investors reflected on their over-reaction.

The returns from REITs over the last financial year suggest as much, with AREITs returning a solid 7.5%, much improved on FY22’s -11.2% return. This performance did not match that of equities, the S&P/ASX 300 rose 14.4% during the financial year, but since their lows in September 2022, AREITs have returned 15.4%. This was a solid result for at least part of the year, which was also 1.5% ahead of equities through to June 2023.

Over the same period, the RBA cash rate increased by 1.75%, increasing pressure on consumers and the broader economy, exactly as it was designed to do.

The recovery in AREITs highlights the severity of the 2022 sell-off across interest rate sensitive asset classes, and the partial decoupling of AREIT returns as inflation begins to fall and rates stabilise.

Key reporting season trends

Given media headlines, investors won’t be surprised to learn that Net Tangible Asset (NTA) values fell 3.4% over the year, led by office and long-lease assets, which declined between 6% and 13%. AREIT capitalisation rates increased by 23 basis points (bps)2 and, while most asset types experienced rising cap rates (which in isolation leads to a fall in capital values), this impact was partially offset by rental growth due to indexation clauses in rental contracts, known as CPI linked leases.

Rental growth in the industrial sector was especially notable. As widely anticipated, rental growth is currently at or near record highs in most locations; making it a great time to own industrial sheds.

While headline AREIT earnings growth was up 4.7%2 in FY23, it was skewed significantly by the sector’s largest stock (see below). Goodman Group (GMG) delivered an impressive 16% growth in earnings per share (EPS), without it, sector EPS growth was a much weaker -0.6%2.

This figure shows the drag on earnings growth from rapidly increasing debt servicing costs and expenses, including insurance, taxes and labour, all of which went up significantly. For most AREITs, finance and expenses growth far exceeded their embedded annual rental growth in FY23.

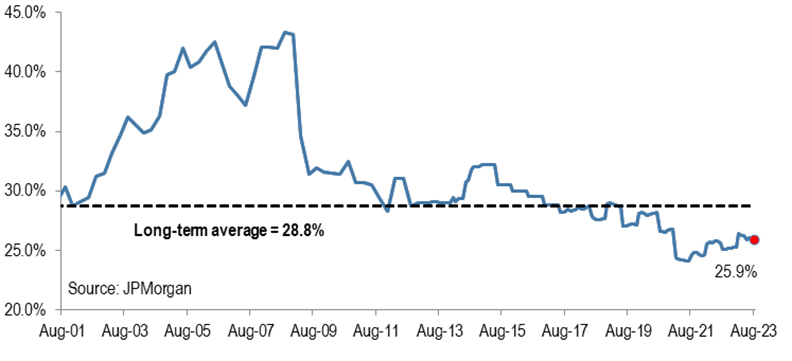

AREIT gearing remained well managed in FY23. Over the previous financial year, the weighted average gearing across the sector rose by 1.5%2 to 25.9% (refer chart one), primarily due to declines in asset values. While gearing ranged from a low of 16%3 to a high of 48%3, it remains below the long-term sector average of 28.8%2 across the sector.

Most AREITs reside towards the bottom, or even below their target gearing range (typically 30-40%3). The same applies to debt covenants, which are typically 50-55%3. AREITs with gearing around 30% remain well placed while those above this mark continue to be penalised by the market. In a higher rate environment this is to be expected. It also explains our portfolio preference for well managed AREITs with lower debt levels.

Rising debt costs were the main contributor to the significant slowing in sector earnings growth. The current financial year is likely to be similar. We expect further earnings headwinds as average debt costs rise, although this will be less significant than it was last year. Debt books are being reset and the benefits of higher levels of hedging should improve cash flow security.

This reporting season showed AREIT balance sheets are in good shape and well positioned to absorb further asset value declines in FY24. Thereafter, a stabilisation in debt funding costs and asset values is likely.

Chart 1: AREIT sector weighted average look-through gearing.

Sector trends

The industrial sector was the star performer. While cap rates rose by 40bps2 on average, more than other core sectors, this was more than offset by industrial income growth which saw rental growth of up to 20%3 in some portfolios.

The sector is enjoying extremely high re-leasing spreads of 15-30%3 across most portfolios and record high occupancy rates. As a result, most portfolios are significantly under-rented. With longer lead times for new supply, the outlook remains very favourable.

The same cannot be said of the office sector, where cyclical headwinds and the implications of hybrid work continue to cloud the sector’s outlook. Understandably, investors are fixated on how this will impact cashflows.

In Australia, the flight to quality argument rings true. Higher quality office assets with capable management are faring far better than less attractive spaces. This is apparent in occupancy rates. On average AREIT portfolios are 93.9% occupied while the average CBDs occupancy according to JLL is 85.1%. The current spread of 8.8%2 (refer chart two) between the two is the widest it has been in years, showing demand for quality well managed office space is not dead.

Overall office occupancy rates were generally flat, a good result that surprised many pundits, while lease expiry over the next two years looks manageable for most REITs. The main headwind in the office sector will be asset values, which declined on average around 6%, with cap rates increasing 28bps to 5.37%2.

While office leasing spreads were positive and incentives showed a marginal decline (average 28% versus market 35-40%2 for Sydney/Melbourne), they remain stubbornly high. So does the capital expenditure required to attract new tenants, thus further devaluation pressures are a key negative for the sector.

Chart 2: AREIT office occupancy vs. CBD market occupancy

With industrial properties flying and office struggling, the retail sector sits somewhere in the middle. Despite a slowing economy, this reporting season revealed a sector continuing to recover from the turmoil of the pandemic.

Impressive sales growth underpinned retail centre operating metrics, especially large centres, which saw their net property income bounce back to pre-COVID levels. Re-leasing spreads across the sector, meanwhile, turned positive for the first time since 2018. The shopping centre is back.

Retail occupancy rates continued to recover and are now almost 99%3. While retail sales remained resilient throughout last financial year, there are signs of a slowdown that may become more evident as FY24 unfolds.

This is cyclical rather than structural. Retail tenants, having enjoyed sales growth far ahead of rents, which saw a material reduction during COVID, are soundly positioned. Indeed, speciality occupancy costs (rents as a percentage of sales) are at their lowest level since 2010.

Despite the prospect of slowing retail sales, rents are at sustainable levels. While retail asset values also declined (cap rates increased around 20bps over FY23) most assets in the sector saw significant write-downs during the pandemic, so the threat of implied market value declines appears remote.

The GMG effect

We should also note the incredible performance of Goodman Group (ASX: GMG) over the last five years, and its effect on the AREIT sector at large. This is a REIT in name only, and one that towers above every other appropriately classified AREIT.

In 2018, GMG accounted for 14.2% of the AREIT 300 index, second only to Scentre Group (ASX: SCG) at 18.2%. As of 30 June, this year GMG had grown to 26.1% of the index. By the end of the FY23 reporting season, that figure was 30.5%, significantly larger than the second largest SCG now at 10.9%. No single stock has dominated the AREIT index to this extent in 30+ years.

As a leading owner, manager and developer of industrial and logistics real estate, GMG has never been in a sweeter spot, delivering operating EPS growth of 16%3 in FY23. Whilst this was ahead of market expectations, it flagged a conservative 9%3 EPS growth for FY24. Since announcing it was expanding its data centre operations, now comprising around 30%3 of its developments, investors have jumped aboard a bandwagon that was already traveling at a cracking pace.

The result is a stock that offers a measly distribution yield of 1.3%3, with distributions per unit not increasing over the last five years. This financial year, the payout ratio is likely to be less than 30%3. With less than 25%3 of its earnings from traditional rent collection, the remainder from development and funds management, and the fact that 60% of GMG’s earnings come from offshore, Goodman is an AREIT in name only.

Generalist equity investors now dominate the stock’s ownership register as its seen as a growth stock. Its influence over the AREIT index is likely to grow but comes with the consequences of further equity-like returns and a detrimental impact on the AREIT sector, plus a stock concentration risk is currently at its highest ever. The returns have been wonderful, but long time AREIT investors have been warned.

Are we there yet?

It has been more than three months since the Reserve Bank last raised the cash rate. While the threat of higher rates remains, there are clear signs that inflation has peaked and is now in decline. Recently released research from Citi showed AREITs outperformed in two of the past three RBA interest rate cutting cycles. That outperformance began at the plateau before interest rate starts to fall.

This is where the sector now finds itself. After being punished in an era of rising rates and their impacts on earnings growth, a change is in the air.

Currently, office AREITs trade at over a 40%3 discount to their revised NTA, accompanied by an 8%3 distribution yield. Retail AREITs change hands at an average discount of over 25%3 and offer a 6%3 yield while diversified AREITs also offer a 6%3+ yield. As the interest cycle peaks and begins to wind down, there is real value on offer for investors taking a longer-term view. Asset values may decline further but AREIT prices already account for that and more.

As a portfolio manager of actively managed REIT funds, it’s a good time to go shopping.

Footnotes

1. S&P/ASX 300 AREIT Index

2. Source: JPMorgan

3. Source: Dexus /Company reports

4. Citi Research (Sept 2023): REITs through the interest rate rearview mirror

1 topic

2 stocks mentioned