It's time to dissect ESG as smart money floods the sector

Over the last few decades, a growing number of investors have been willing to do something which it seems Scott Morrison is unwilling to do in Rome: put their money where their mouth is around positive change in the world.

Investors of all levels have begun to embrace a non-financial lens to their choice of securities or products, particularly as the younger generation begin to make active choices around their own portfolios or superannuation allocations.

This preference towards positive investments has taken on the acronym of ESG, or environmental, social and governance. But what is ESG, really?

What one person may see as a positive, another may see as a negative or as irrelevant. Whatever their view, there is likely to be an ESG-focused investment out there applicable to their investment philosophy.

However, without scrutiny and an understanding of the ESG characteristics of our investments, investors leave themselves open to simply the same old investments in an eco-friendly wrapper, also known as “greenwashing”.

Today we will look to establish a better understanding of what types of ESG investments and classifications there are and how investments may be interpreted under these different frameworks.

The growth of ESG

According to Bloomberg, assets under management in ESG products may exceed US$53 trillion by 2025, a figure which will be more than 30% of global assets under professional management.

A recent report by Morningstar on global ESG flows supports this figure, if you are interested in the sector, I recommend giving it a read to get a sense of the scale it has achieved recently.

In the last six months, Morningstar data shows global sustainable fund assets nearly doubled to a value of circa US$3.9 trillion to close out third quarter 2021.

Europe made up 81% of these inflows, followed by the US with a distant second at 12%. Within the sustainable fund universe, there are now over 6,000 managed funds globally.

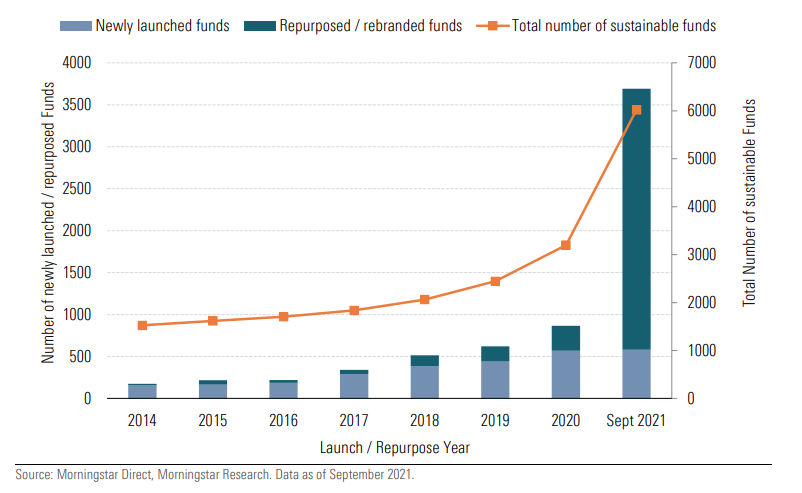

Interestingly, there has been a massive increase in rebranded funds, as investment managers recognise the volume of flows and the changing tide of investor preference.

Newly launched and repurposed sustainable funds

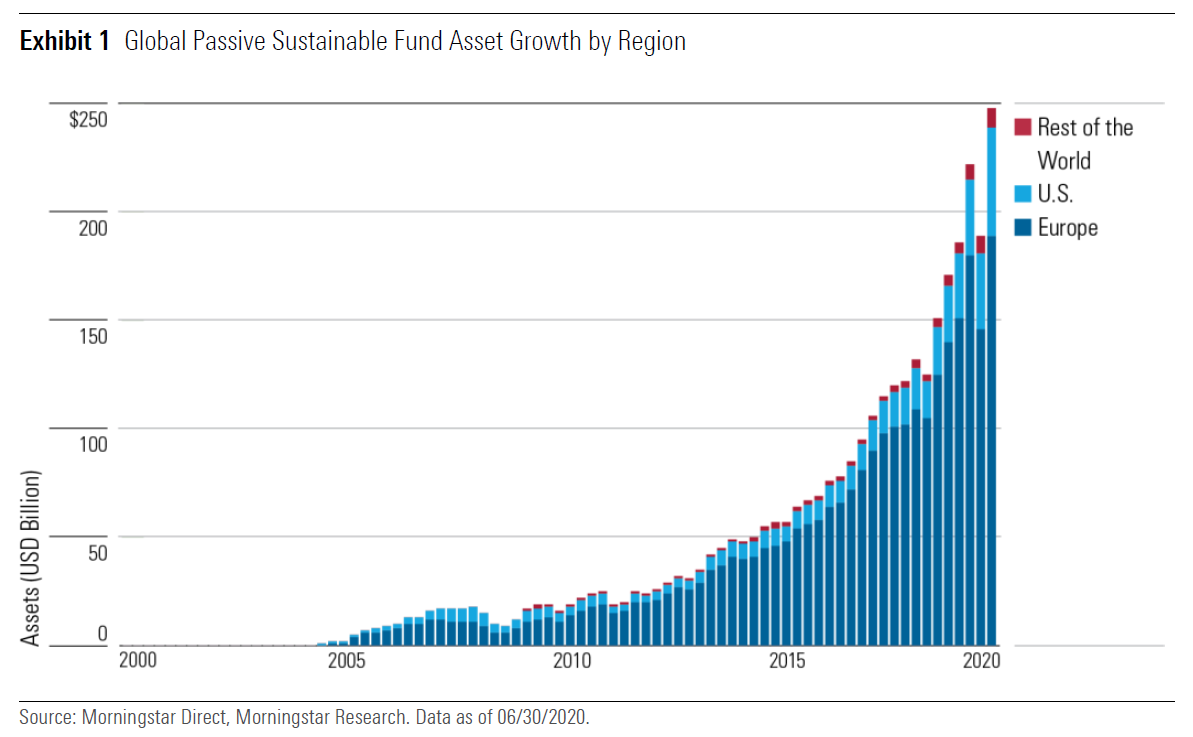

In passive index funds, the growth has also been exponential, the chart below from Morningstar shows not only the rapid growth of assets since the early 2000’s but also the majority share which is driven by European investment.

Global passive sustainable fund asset growth by region

Types of ESG

As mentioned previously, ESG means different things to different people.

Based on the data above, there are clearly many people who want some “brand” of ESG. There are currently three primary forms of ESG strategies in the market, each of which will have a varying amount of appeal depending on an investor’s personal view or investment purpose.

ESG overlay

This is the lightest form of ESG investing, essentially integrating an ESG overlay over an existing investment strategy as another form of risk analysis.

For example, a manager may look at a domestic miner such as BHP (ASX: BHP) and consider its environmental impact alongside its sales and export volumes.

If the environmental impacts are negative, but not so negative to offset strong business fundamentals, the manager will still make the investment into BHP.

We would argue that all managers should at least have this overlay, as each of the three ESG letters are significant risk factors to any company.

Exclusion/inclusion

This is the most ‘standard’ form of ESG strategy, in which a fund may choose one (or both) of; excluding certain undesirable sectors from their investment universe (e.g. gambling, tobacco, weapons), or only including the most desirable companies based on their ESG ranking – a topic we’ll come back to shortly.

This is a step up from the overlay method since it might restrict flows entirely from an environmentally/socially damaging sector, or only direct flows towards companies doing environmental/social good within their field.

Depending on the investor and manager, this might also include various geographies or geopolitical regimes, though more often this will fall to the individual investor’s asset allocation framework.

Impact

Impact investing is, at least in my view, the ideal methodology if an investor truly cares about doing good with their money.

In an impact fund, the manager will select only those companies who are either listed and actively seeking measurable environmental or social improvements (equities) or are issuing debt to fund a project which will have positive social or environmental consequences (fixed income).

Examples of this might be social housing bonds, sustainability linked bonds or renewable energy producers.

How ESG is measured

The multi-trillion-dollar question is: “How do we quantify ESG?”

One of the most commonly employed overlays or filters are the UN Sustainable Development Goals, 17 key items which the United Nations identified in 2015 as “a blueprint to achieve a better and more sustainable future for all”.

Source: United Nations

There are also index providers which look to have a uniform ratings system, to quantify how companies fit into the broad ESG landscape.

One of the most commonly used is Morningstar’s Sustainalytics, which uses a risk rating matrix to measure how a company is exposed to certain industry-specific ESG risks and how well they are managing that exposure. This can then form a weighted-average rating for a managed fund based on their holdings.

Another rating system is Evergreen’s ERIG Index, which focuses more directly on the fund-level metrics and investment process. This index looks to build a rating system based on how the investment manager adopts certain approaches to ESG, including; ESG overlay, negative screening, active ownership, positive screening and impact investing.

And of course, there is the individual investor’s “gut feeling”, also known as the “pub test”.

Case Study: iShares ESG Aware MSCI USA ETF

The iShares ESG Aware MSCI USA ETF (ESGU:NASDAQ) is one of the largest ESG-focussed ETFs in the world, with over $23.6 billion USD under management – for that reason, it gets to be the guinea pig for this thought experiment.

The index for this ETF seeks to “maximize exposure to positive environmental, social and governance (ESG) factors while exhibiting risk and return characteristics similar to those of the MSCI USA Index”, and excludes sectors such as coal, oil and civilian firearms.

I want to single out one holding simply as an example of how different ESG measurement techniques might view the exact same company – to be clear, we’re not going to comment on the overall investment merit of this ETF or the company, only potential ESG risks and how they’re regarded.

One of ESGU’s holdings is Activision Blizzard (NASDAQ: ATVI), a video game publisher responsible for some of the largest titles in the world; Call of Duty, Overwatch and World of Warcraft to name but a few.

As a consumer of games and someone who keeps an eye on gaming management news, this one is within my circle of competence to point out some ESG risks.

The company has been consumed by an ongoing scandal over workplace culture, with California state suing the company and accusing management of “withholding and suppressing evidence” of sexual abuse at all levels of the corporate ladder.

Furthermore – and this is a problem with most major publishers – the company has a year’s long track record of predatory behaviour to both its userbase (see my very first Mason Stevens morning note around selling gambling mechanics to children) and its employees, through a process known as “crunch time”, leading to seasonal periods of “mental breakdowns and resignations”.

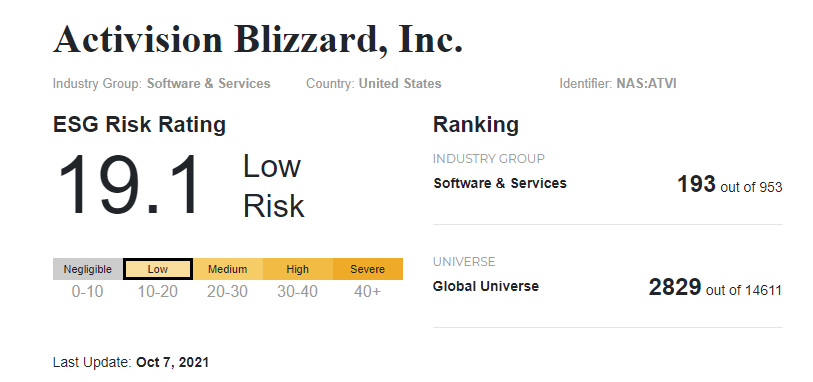

However, if you plug ATVI into Sustainalytics, you’ll find a comfortable 19.1 “low risk” rating to the business, where the company’s exposure to ESG issues is low and their management of issues is “average” – again, this is the management currently engaged in a federal lawsuit.

ATVI Sustainalytics

Source: Sustainalytics

Does this mean Sustainalytics are wrong? Not at all, in fact, it may very well be the case that the social and governance issues I just pointed out will have no material effect on their bottom line.

If I sat next to you over a drink and told you that the company was being taken to task by a federal court for allowing members of staff to be abused, selling casinos to children and enabling a culture of mental breakdowns, would you still tell me that it was an “ESG aware company”?

Neither side is necessarily wrong. In fact, ATVI sits cleanly within the “ESG overlay” sector, given its strong financial growth (growing sales at 11.6% CAGR over five years).

But this only goes to highlight the importance of investors having a clear idea of what they are buying, and what their personal view for ESG should be – is it a risk management technique, a filter or a tool for positive change?

Good money doing good

The trend of investing towards companies making positive impacts on the world is, in itself, positive.

Where we often find our public sector to move slowly and laboriously around issues such as environment, or social change, our private sector tends to be nimbler and act with conviction when it comes to making change.

Similarly, an entire group of investors can quickly create momentum by placing their capital in managers and sectors that they believe will make a more sustainable future.

What is crucial is that those investors understand their own personal view of ESG and what they want to achieve out of it; do you want a more risk-managed portfolio, to restrict flows to undesirable sectors or to invest in companies spearheading a bold vision for the world?

Always make sure you look at what you own beyond the label of “ESG” or “sustainable”, consider if it does meet those views and aims you have for the category.

No one approach is wrong, because there is no uniform approach to ethics or morality, but the approach should at least be consistent with your own views and how you want your money working towards the future.

3 topics

1 stock mentioned