J.P. Morgan Asset Management's quality portfolio for today's market

Markets are at a fascinating crossroads. The cloud of caution which dominated investor sentiment at the beginning of the year has cleared up dramatically as fundamentals appear to be more resilient than first thought. Corporate earnings have continued to broadly beat expectations and markets have rallied beyond the October 2022 lows despite all the headwinds that remain unresolved.

Perhaps most importantly of all, equity markets (minus mega-cap tech) remain reasonably valued. And that, in J.P. Morgan Asset Management's view, is why you need to be able to play offence and defence in portfolios today.

In this wire, I'll share the highlights from the latest J.P. Morgan Asset Management markets presentation entitled "Waiting and Watching". That is, waiting for central banks to stop hiking and watching markets rally higher in the face of it. I'll also share their thoughts on what a quality portfolio looks like in today's climate.

Equities looking past higher rates... but to what?

With the Federal Reserve handing down a 25 basis point hike this morning (and the Reserve Bank likely to go one more here at home next week), the big question for markets is whether central banks are one and done.

Craig said the house view has changed over the last few months reflecting the greater likelihood of a US soft landing.

"The chance of a soft landing versus a recession in the US is much more finely balanced," Craig said but added that they're not rushing to buy.

"We are not going to be very aggressive. We are not thinking about adding risk to our portfolios... We are thinking much more around that balance in terms of what was an underweight towards equities is becoming more neutral."

The house view is that this morning's Fed hike will be the last of the cycle and that the RBA's August hike (if it comes) will also be the last of its cycle. Both central banks will, in their view, keep rates higher for longer.

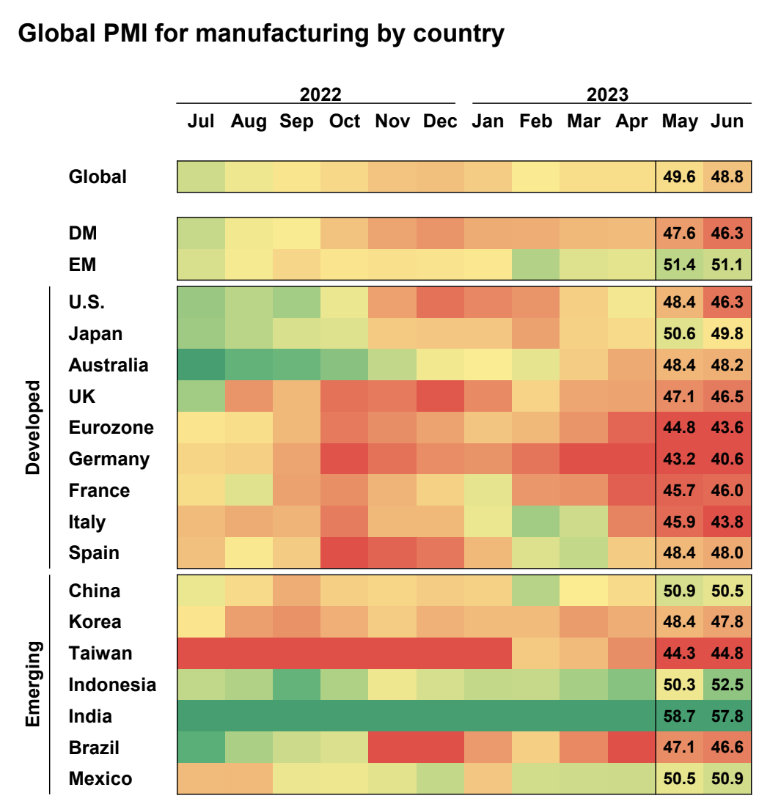

The key risks and headwinds moving forward stem from the corporate landscape. PMIs - or purchasing manufacturing indices - have been trending down across most parts of the world. The weakness comes from a rotation away from manufacturing goods into producing services as well as a lack of inventory coming back into storage. That, in their view, is a key source of downside risk because it serves as a drag on growth.

The impact of Chinese stimulus on Australian investors

Following the quarterly Politburo meeting, Chinese officials pledged to step up policy support for the economy. Although light on details, the announcements were enough to send materials and China-linked shares soaring earlier this week. And while JPMAM always had a view that Beijing would end up providing some kind of stimulus, they remain wary of how much that will really change the economy's fortunes.

"What we do see is better growth in the second half of this year from China because of the stimulus measures that have been announced, [but] we're not thinking about them being massive or an increase of such that they are going to actually drive a huge amount of growth," Craig noted. However, he did add that Beijing's 5% growth target is still achievable.

"I don't think they're going to want to miss that for two years in a row," he said.

What JPMAM is expecting for earnings

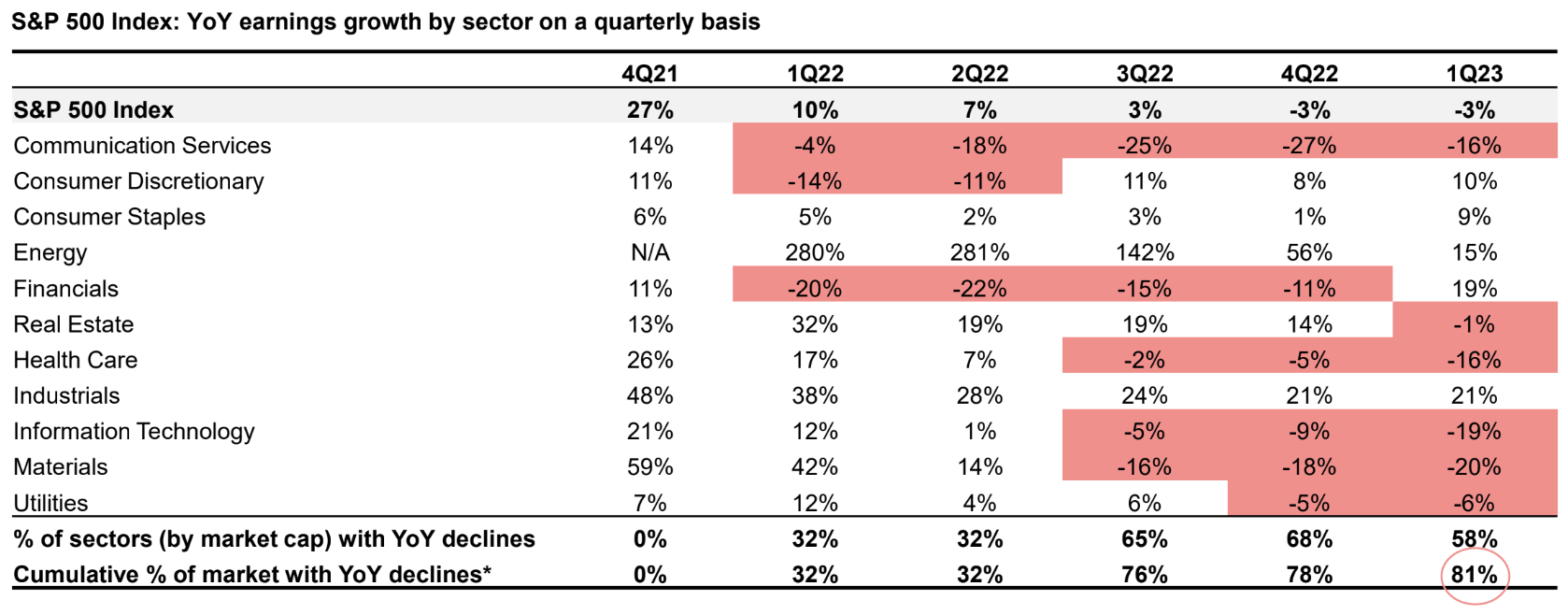

While the US stands out on its own, the earnings profile for other countries is much more mixed. The good news is that the worst of the earnings recession may be behind investors in the US market - although that is highly dependent based on the sector.

"You can see that about 80% of the S&P has already experienced negative year-on-year earnings growth. Even if we do get a slowdown or an economic recession, we wouldn't expect the earnings to materially collapse," Mariani said.

In Mariani's view, valuations are fair on the S&P 500 ex-mega cap tech. But even strong earnings have not been rewarded so far this season.

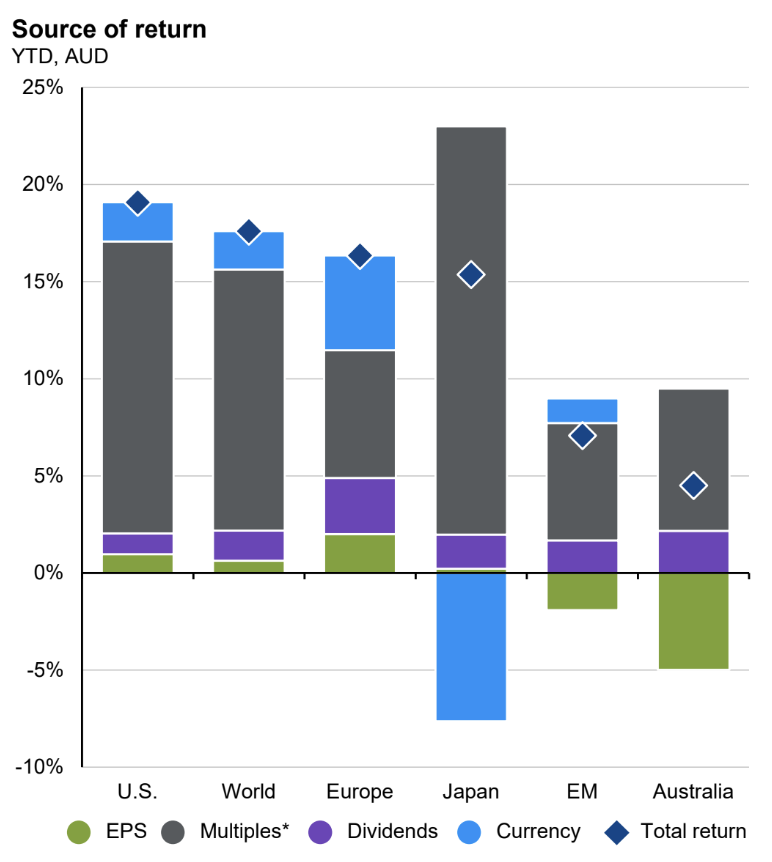

The bad news is that Australian earnings per share continue to lag behind our global peers. And for those arguing that our dividend and income opportunities are a reason to continue investing at home, this chart comparing our dividend and earnings yields to the rest of the world may challenge that view.

"I think Australia's earnings outlook still faces challenges," Craig said.

"The earnings revision ratios are still more negative than many other markets around the world. In Europe, they've moved higher. In Japan, they moved higher. And in the US, they are flat.

"I think there are still some challenges to the earning season that come through here."

As for spots of potential strength and weakness, Craig argues consumer-exposed names are still going to be impacted due to spending and sentiment. He prefers the banks and defensive-oriented sectors like healthcare and utilities outperforming over the next four weeks.

The model portfolio

Quality and income are the two guiding stars of JPMAM's model portfolios. Between stocks and bonds, the allocation is much more even than it would have been at the beginning of the year. That said, there is a small underweight towards Australian stocks.

"We'd see the growth prospects and the upside probably being a little bit better elsewhere in the world than simply in Australia," Craig said.

Those better areas include Japan - where the Nikkei 225 has rallied by nearly 27% in the past year. European and US large-cap stocks are NEUTRAL-rated while the major UNDERWEIGHT is in US small caps. But above all, security selection will be key.

"Get exposure to something other than just those [mega-cap tech] names because if the rally does broaden out, the rest of them will rally," Mariani said.

"A focus on income, whether it's coming from dividends or whether it's coming from things like options premiums should help," he added.

In the fixed income space, there is still a general preference for government bonds and investment-grade credit. Having said that, the increased likelihood of a soft landing has increased the opportunity set in high yield and other riskier areas of credit.

Finally, Craig argues there is still a place for alternatives.

"Our view is that alternative assets have a strong role to play in the portfolio, particularly as we look at the way inflation may perform in the future," he said.

Note: The model portfolio tends to start with a 60/40 allocation to equities and bonds respectively. Underweights and overweights generally don't deviate much more than 5% either way. That is, an underweight equities call could represent a 55/45 style of allocation rather than anything drastic.

3 topics

1 contributor mentioned