J.P. Morgan is bullish on the next 10-15 years. Here’s where it sees the best opportunities

This time last year, the world was bemoaning stagnant inflation and high interest rates. It was also tipping a recession. With a series of rate cuts on the horizon and consumer spending finally dipping, perhaps those predictions will finally come to bear. Or equally, they might not.

As long-term investors, you should be investing across cycles – not just for the shorter term, and there’s positive news for investors. J.P. Morgan is remarkably bullish on the growth prospects and opportunities available to investors in its 10–15-year growth outlook. Even 2025 is looking bright.

That’s noting its expectations of a slight dip in the performance of a standard US 60% equities:40% bond portfolio – if you don’t take any action to improve it. (As a side note, it found that a standard Australian 60:40 portfolio remains resilient due to anticipated currency depreciation.)

“This year’s findings underscore the value of active management and alternative asset classes in generating alpha and diversification. Investors are encouraged to incorporate assets that can navigate inflation shocks and fiscal risks, with bonds remaining essential for diversification,” said Leon Goldfield, Portfolio Manager – Asset Management Solutions.

J.P. Morgan sees much to like on the horizon, and in this wire, I’ll summarise some of the highlights of its report.

Brighter skies ahead

J.P. Morgan believes we’re seeing a healthier investment environment, and market enthusiasm is back.

“The global economy is entering a new era marked by higher fiscal spending increased capital investment, and stronger economic growth,” says Kerry Craig, Global Market Strategist.

While interest rate cuts may be part of the coming year, it’s expected to be a normalisation rather than a return to the extreme lows of the past. Inflation has fallen too – while still above pre-Covid levels, it is a lower starting point than the start of 2024 and the combination of this, with normalised interest rates, is a benefit for fixed income investors.

J.P. Morgan has estimated returns of 4.5% in 10year Australian government bonds, and 5% in Australian credit, compared to 4.2% in US 10-yr bonds and 6.1% in US high yield. Markets have rallied and J.P. Morgan estimates that returns will be slightly lower – but still view them as offering attractive returns. It is seeing more attractive entry points outside the US that can benefit from currency appreciation. That said, it points to high quality and the powerful US tech sector as supporting higher valuations in US equities.

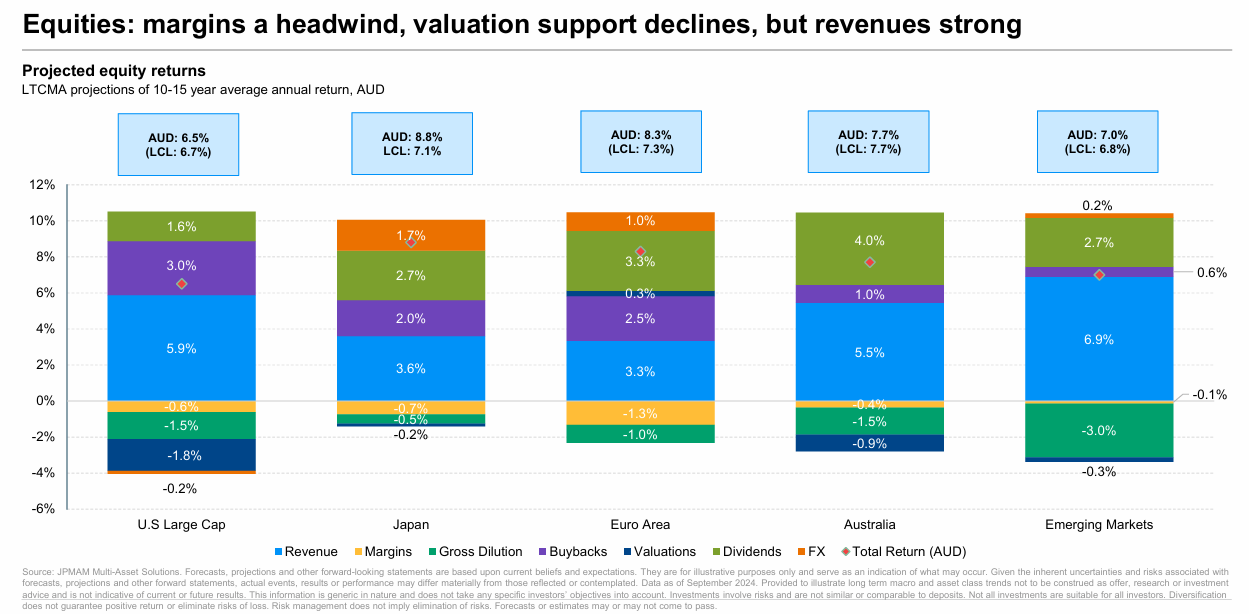

It forecasts returns of 6.50% (AUD) for US large cap equities in 2025, compared to 8.30% for the Euro area, 8.8% for Japan and 7.6% for China.

From an Australian perspective, equities have had higher valuations, and this has meant a lower return expectation compared to global equities. J.P. Morgan estimate returns of 7.70% for 2025 (last year, it estimated 8.80%).

Key trends to watch

- Strong private capex trends: the process of deleveraging in the private sector has started to shift. There has been a lift in private sector credit in the last four years and this is expected to continue.

- Fiscal activism: Governments have taken a more interventionist approach to managing growth in recent years and will continue to do so. US government spending should benefit US bond markets, while the Chinese stimulus package should see benefits for trading partners.

- Economic nationalism: President-elect Trump announced proposed tariffs on China, Mexico and Canada. This is a theme that may carry across countries and affect returns in equity markets.

- Technology adoption: there are expected to be productivity and economic gains from the growth in AI. There also continues to be significant capital investment in technology. Technology accounts for around 40% of private credit and equity markets.

Opportunities for investors

Infrastructure and real estate are viewed as big opportunities for the coming years.

There is significant spend tipped for global infrastructure to manage AI and tech requirements, before we even factor the needs of the green transition. If you look at the US alone, it has also needed to factor substantial government support to upgrade aging infrastructure, particular after the collapse of the bridge in Baltimore.

J.P. Morgan believes there is a generational opportunity in real estate as well – from a private market perspective. It expects better returns in core real estate, supported by higher 10yr Treasury yields.

“With significant opportunities emerging in infrastructure and other real assets, investors can leverage these sectors for stable income and to hedge against inflation,” says Andrew Creber, CEO of J.P. Morgan Asset Management Australia and New Zealand.

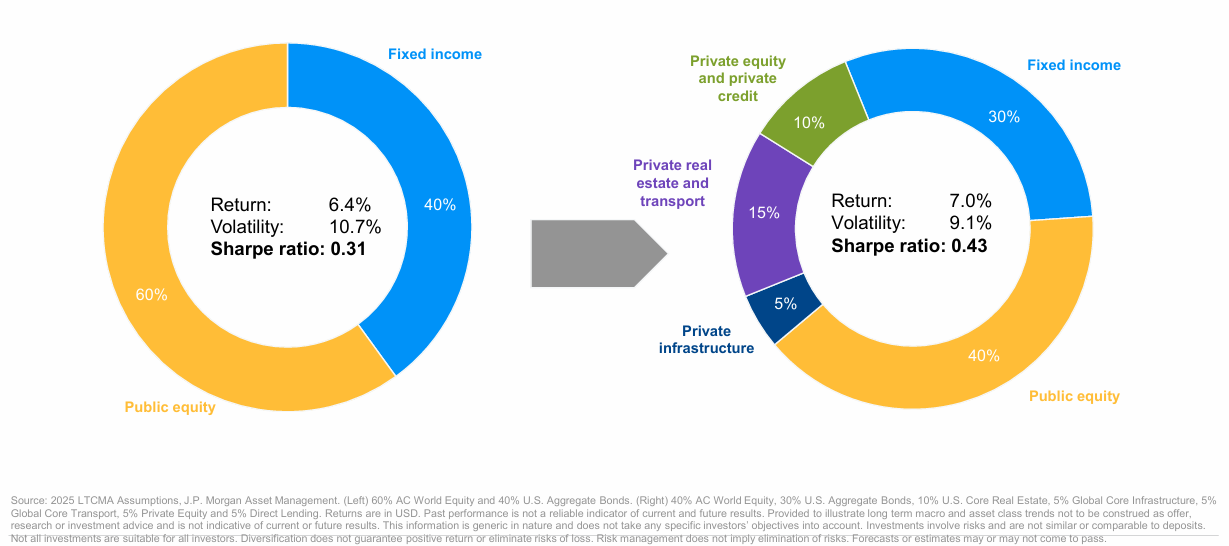

The J.P. Morgan outlook reiterates the importance of using alternatives as part of a well-diversified portfolio and to enhance risk-adjusted returns, showing a comparison in the chart below.

It highlights investors will be rewarded by a ‘renewed focus on alpha, inflation resilience, diversification’ to take advantage of the opportunities ahead.

1 topic