James Hardie (JHX) – Built to Last

When Jim Collins wrote "Built to Last" in 1994, little did he know how influential his work would be in inspiring visionary leaders to create great companies.

The visionary companies identified in Collins' study had outperformed the stock market by 15x and had a history of multiple product lifecycles and generations of leadership.

As competitors flip-flopped around strategy, visionary companies prospered due to strong and progressive ideologies, fostering of audacious goals (BHAGs), experimentation of new ideas, and a relentless effort to continually improve their products, business, and organisation.

Visionary companies didn't just claim to adhere to idealistic values but created mechanisms to ensure constant improvement and invested more in cultivating talent and research and development than comparison companies.

We often wondered if Collins was to apply his research project across the ASX, how many companies would make the visionary list?

One company that firmly fits into this list is James Hardie Industries (JHX).

James Hardie has grown to become one of the most profitable building materials companies in the world and is the world leader in manufacturing fibre cement siding products used for housing exteriors.

James Hardie boasts visionary characteristics, such as a strong innovation pipeline, a brand of choice, and a culture of delivering the best exterior and interior housing products.

More importantly, James Hardie has gone through various management succession cycles, demonstrating the management depth of its thriving organisation instead of relying on a single charismatic leader.

Like the visionary companies in Collin's study, James Hardie has remained committed to its mission of being a:

"High-performance global company that delivers organic growth above the market with strong returns, consistently, quarter on quarter, and year on year."

Not only has it grown to own the fibre cement siding market with over 90% market share, but James Hardie has also grown the category to now represent over 24% of siding material in the USA through a focus on consumer and supplier advocacy.

Why is Fibre Cement Growing?

Unlike the Australian market, which is dominated by brick exteriors, the USA market is split across several exteriors, such as wood, vinyl, stucco, and fibre cement.

Fibre cement is the fastest-growing category, having grown from 9% share to 24% from 2005-2022.

While fibre cement is 2-3x more costly than some alternatives, superior aesthetic properties, which lead to better curb appeal, higher durability, and low maintenance, are fundamental winning tenets.

Fibre cement’s national penetration is 24%, but markets such as the Northeast and Midwest are under-represented with less than 10% and 19%, respectively. This compares to the Northwest market, where fibre cement share is over 34%.

In under-represented markets, James Hardie is addressing this through contractor development, installer training, and increasing awareness of differentiating factors such as the ColorPlus range and fire-resistant properties.

Market share growth is likely to come from vinyl in these regions, as there is a substantial prevalence across a range of homes, even in upper-priced homes of up to US$3m. This is despite Vinyl's inferior aesthetics and a fragmented supplier base, which has led to varying product qualities.

Tailwinds Building for James Hardie's Products

In 2023, James Hardie demonstrated an ability to grow underlying earnings in the face of declining housing starts and a challenging renovation and restoration market.

As we look out over the medium term, the outlook for new home construction and renovation demand should continue to improve.

Underpinning this outlook is an aging stock of homes requiring residing, as 35% of housing stock built pre-1969 and 14% pre-1979 built mostly with wood and stucco.

As interest rates decline, demand for single-family housing units should recover, as demand is being underpinned by families spending more time at home since the pandemic.

Unlike pre-GFC, where single-family homes were in oversupply, new home supply has been constrained with an under build of dwellings. Between 2008 and 2020, single housing starts averaged 0.7m, with the recent peak of 1.3m in 2021 still well below the pre-GFC high of 1.8m in 2008.

James Hardie – A Growing Consumer Brand

Like the visionary companies, James Hardie has continued innovating its go-to-market strategy to ensure demand creation for its products.

One notable shift is a growing emphasis on winning the homeowner's mind, in addition to being the supplier of choice with contractors.

In 2021, Hardie's debuted its global marketing campaign "It's Possible" to connect to the homeowner and has since introduced new product ranges such as the Magnolia Home collection, the Hardie Artisan collection, and the ongoing expansion of colours through the ColorPlus.

While it's easy to be skeptical about the benefits of marketing, the brand goodwill created is shifting the dialogue between homeowners and contractors from a price conversation to the long-run benefits of James Hardie's fibre cement products over alternatives.

This is analogous to Dulux's successful strategy in Australia, which for years resulted in a dominant market share position, compared to competitors offering lower-priced products such as Wattyl/Valspar.

James Hardie is morphing into one of the most trusted brands in building materials, which is of great significance given residing of homes is a costly endeavor and a more discretionary choice, unlike replacing a leaking roof.

At the same time, the brand momentum is driving demand for James Hardie's lesser-known products, such as higher-priced full-wrap solutions, including Trim and ColorPlus solutions.

These products are growing by 10% and 14% CAGR, steadily increasing James Hardie's share of wallet in exterior materials and underpinning growth in group average selling prices.

The James Hardie Advantage

While fibre cement is a commodity, often we wonder what it will take to disrupt James Hardie, given the industry-leading profit margin and high return on funds employed.

Over the years, various competitors have introduced fibre cement products. Lower-priced new products, such as reformulated engineered wood, have also entered the market.

To date, these competitors have made few inroads given the fly-wheel effect of James Hardie's contractor support program, manufacturing scale, and trusted brand status.

For example, James Hardie has grown its Contractor Alliance Program members from 4,000 a year ago to over 6,000. Members receive lead generation, support, marketing tools, and training to help grow their businesses.

Contractors are trained to sell more products, install more efficiently, and upsell premium products, benefiting James Hardie and their bottom line.

With respect to the top customers, data sharing is prevalent across 70% of these customers, up from 30% a year ago. In addition, James Hardie has broadened its focus from the top 25 builders to the top 200, further entrenching its dominance.

Matching James Hardie's scale and cost advantage is a significant challenge, as its plant network is strategically located near customers and raw material suppliers.

The scale allows James Hardie to service customers of all sizes, with flexible manufacturing lines enabling a scalable production and supply chain network, ensuring demand is met as needed.

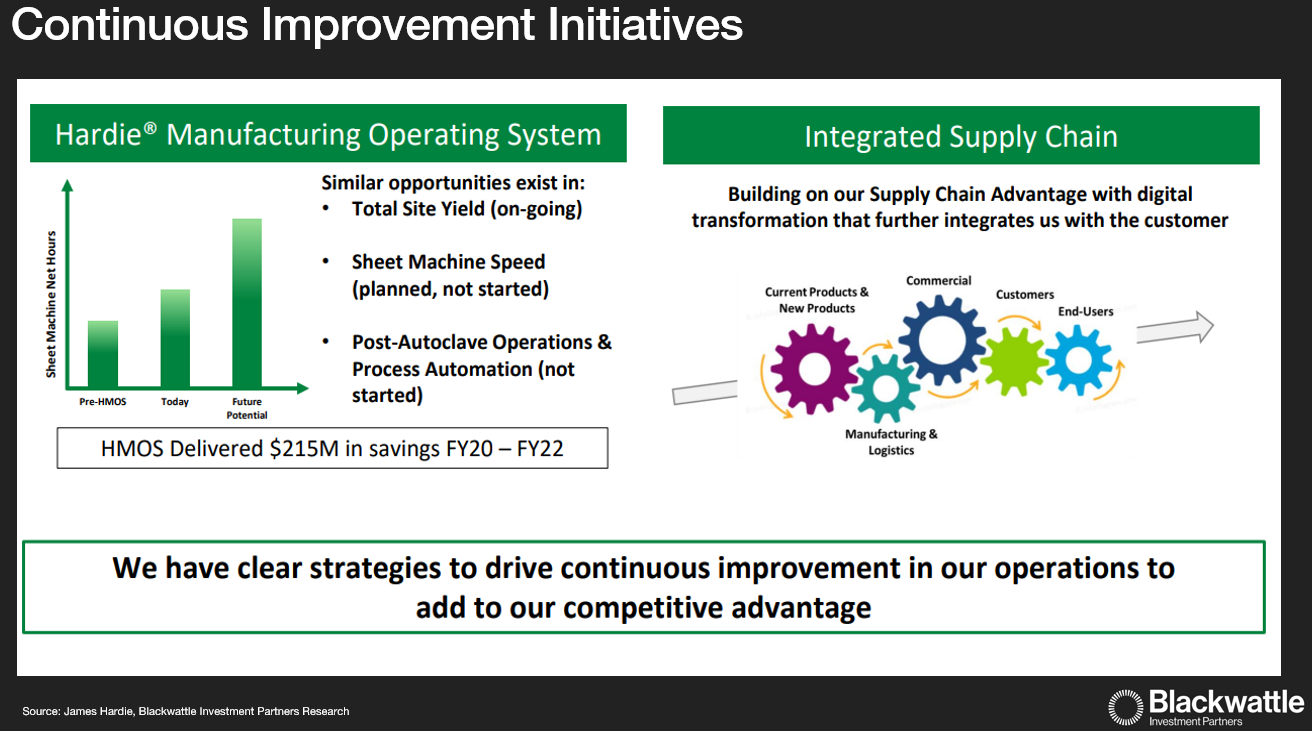

In addition to the plant configuration, significant industry know-how developed through years of manufacturing enhancements has resulted in declining unit costs.

Over time, each new production line has added more incremental capacity than older lines at little incremental cost due to advances in plant design and production technology.

Newer products, such as reformulated engineered wood, will take time to build awareness, as adoption can be slow in the building materials industry.

A World-Class Growth Company at a Reasonable Price

Finding great companies is difficult.

Finding great companies at a reasonable price is even harder.

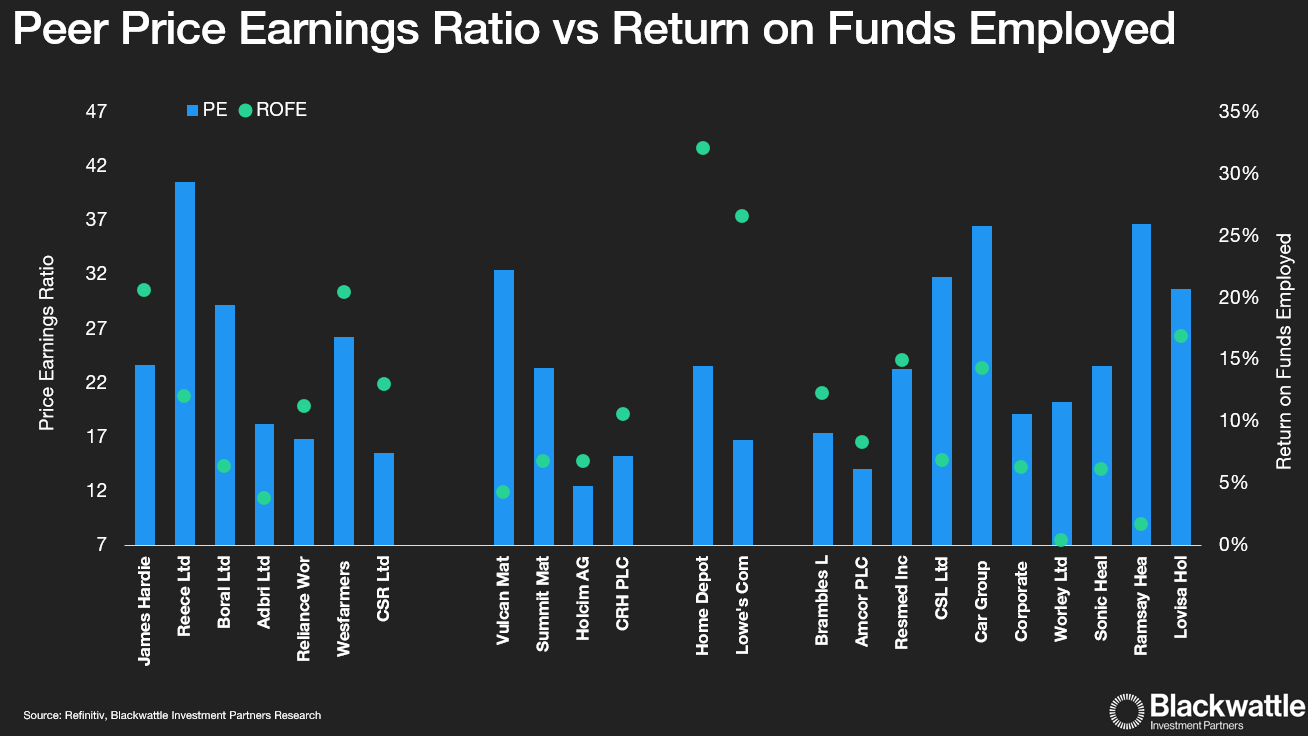

As the chart below shows, James Hardie generates top-quartile returns globally and offers an attractive growth profile at a reasonable valuation compared to its industry peers.

The valuation looks even more compelling if we contrast James Hardie to other ASX-listed companies with global operations and market leadership.

As Collin's wrote in "Built to Last", if there is one secret to an enduring great company, it's the ability to manage continuity and change, a discipline that must be consciously practiced.

James Hardie offers those enduring qualities, proven in the face of numerous setbacks, including asbestos liability damages, deep housing cycles, and management restructuring.

Yet it's a much stronger business today thanks to its organizational culture of aspiring to be the best building materials company while offering endless exterior design possibilities to homeowners.

As a Long-Short investor, Blackwattle Investment Partners seeks out companies with these qualities to invest in.

If history is a guide, good business tends to throw up one good decision after another, while poor businesses with weak stewardship tend to face one painful decision time after time.

James Hardie indeed sits in the former group, warranting visionary status.

3 topics

6 stocks mentioned