Joyce's 3 biggest blunders at Qantas

Qantas (ASX: QAN) CEO Alan Joyce has brought forward his retirement two months earlier than previously flagged – perhaps the first time during his tenure that the airline has actually been ahead of schedule.

His early retirement will see CEO Designate Vanessa Hudson assume the role of Managing Director and Group CEO effective 6 September.

The damage Joyce has dealt to the Qantas brand will take a long time to repair. We'll be highlighting some of his critical blunders below.

#1 Shareholder return over capex investments

Joyce has served as CEO since 2008. Back then, the average age of Qantas' fleet (both passenger and cargo) was approximately 8.5 years, according to the Qantas Data Book 2008-09.

Fast forward to 2022, the average age of its passenger fleet is now 14.7 years, according to the Qantas 2022 Sustainability Report.

Tracking website Planespotters estimates that the average age of Qantas fleet is 13.7 years, well above the average age of peers such as Cathay Pacific (10.5 years), Emirates (8.9%) and Singapore Airlines (6.9 years).

#2 Using the buyback as exit liquidity

During February reporting season, Qantas initiated an on-market buyback of up to $500 million shares. This follows a $400 million buy-back completed in December 2022 at an average price of $5.78.

On 1 June 2023, Joyce sold approximately 92% of his personal on-market holdings or 2.5 million shares at $6.75 per share. The trade was worth almost $17 million. On the very same day, Qantas brought back 1.85 million shares as part of its ongoing on-market buyback.

In essence, Joyce leveraged the company's buyback as liquidity to exit his personal stake in the company. The buyback would have absorbed approximately 75% of Joyce's sale.

The stock is now down around 15% since his exit.

#3 A timely sale

Selling your stock when it's high is one thing. But selling right ahead of the company's FY23 results, which flagged Group capital expenditure commitments of $14.7 billion and an ACCC investigation about ticket sales ... Maybe he's just really good at timing the market.

Back in February, Qantas said it is "at the start of the biggest fleet renewal program in its history, with up to 299 aircraft spread over 10-plus years."

Last week, the Australian Competition and Consumer Commission (ACCC) said the airline broke consumer law by advertising tickets for more than 8,000 flights between May and July 2022 that had already been cancelled.

"One consumer was provided with a replacement flight a day before their original departure date, which was communicated only by the Qantas app. As a result, the consumer had to change connecting flights and had a 15-hour layover in Los Angeles, which had a significant impact on the consumer and left them $600 out of pocket," notes the court filing.

Qantas vs. Jets ETF

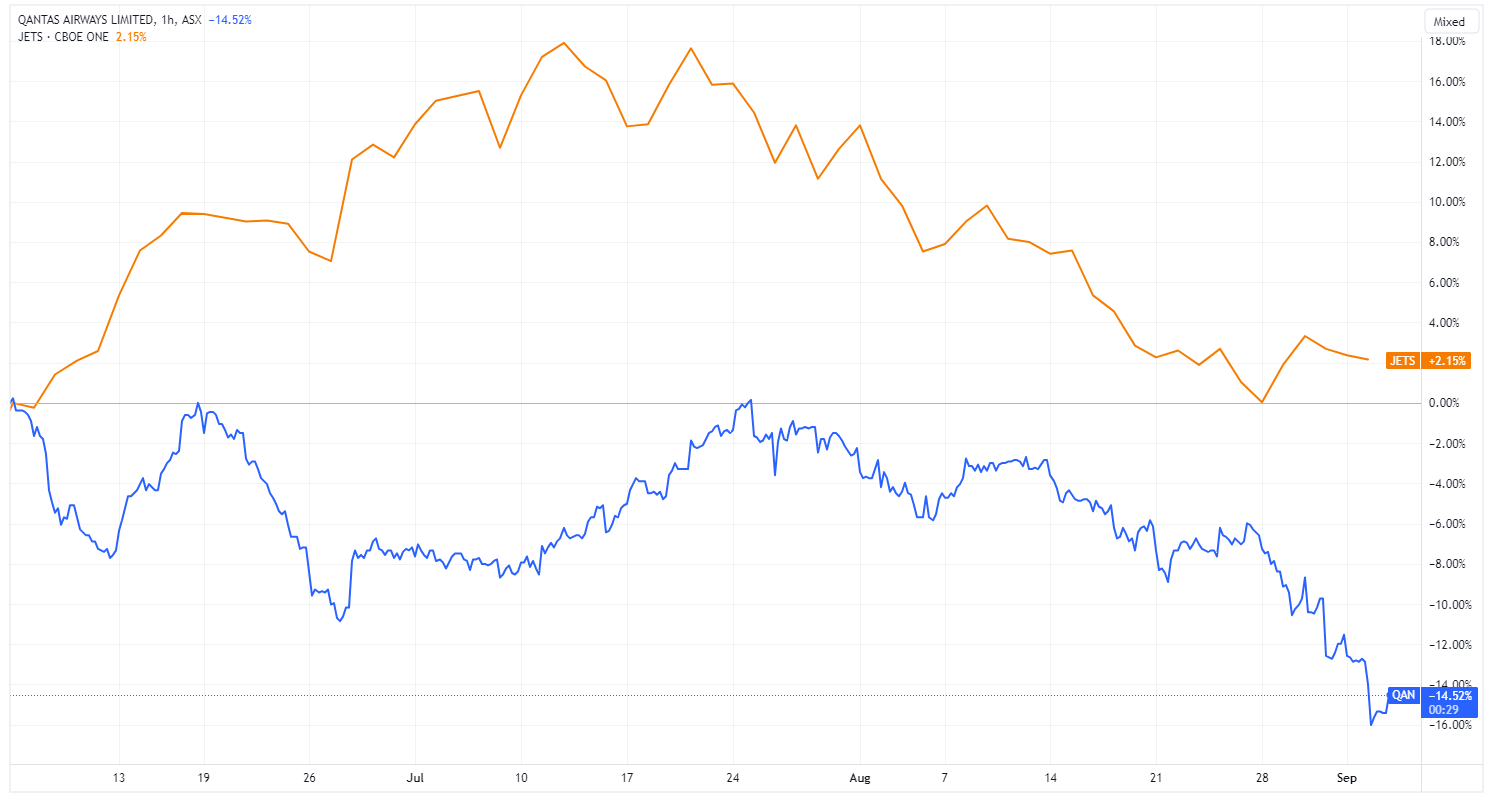

Qantas shares have managed to recover much faster than an industry benchmark such as the US Global Jets ETF.

This ETF provides investors access to the global airline industry, including airline operators and manufacturers. It's top holdings include major US airlines such as Delta , Southwest and United Airlines as well as a 0.90% allocation in Qantas.

Global Jets ETF (Orange) vs. Qantas (Blue) Source: TradingView

However, the recent reputational damage has taken some heat out of Qantas' outperformance.

This wire was first published on Market Index.

2 topics

1 stock mentioned