Just 4 of the last 22 corrections became bear markets

Mason Stevens

Equity markets are inherently volatile. The flip side of a higher long-term return is higher risk. Circa 10% corrections are not uncommon for equity markets. When they happen they are invariably accompanied by calls of a bear market coming ahead of an impending recession. Occasionally, those calls are right, but more often than not they are premature and the market returns to its longer-term trend.

During the current correction, the S&P 500 Index has declined by about 9% from its closing peak, the NASDAQ Composite Index by about 12%, and the ASX 200 Index by about 11%.

The chart below from the Schwab Centre for Financial Research shows the number and magnitude of corrections and bear markets for the S&P 500 Index since 1974. Each period shown represents the beginning month and year of the market correction or bear market. The general definition of a market correction is a market decline that is more than 10% but less than 20% peak-to-trough. A bear market is defined as a decline of 20% or more.

There have been 22 market corrections since November 1974, and only four of them became bear markets (which began in 1980, 1987, 2000 and 2007).

And from the start of the current bull market in 2009 through February 2018, there have been six corrections in the S&P 500 that didn't turn into bear markets.

Source: Schwab Centre for Financial Research, Morningstar data for S&P 500

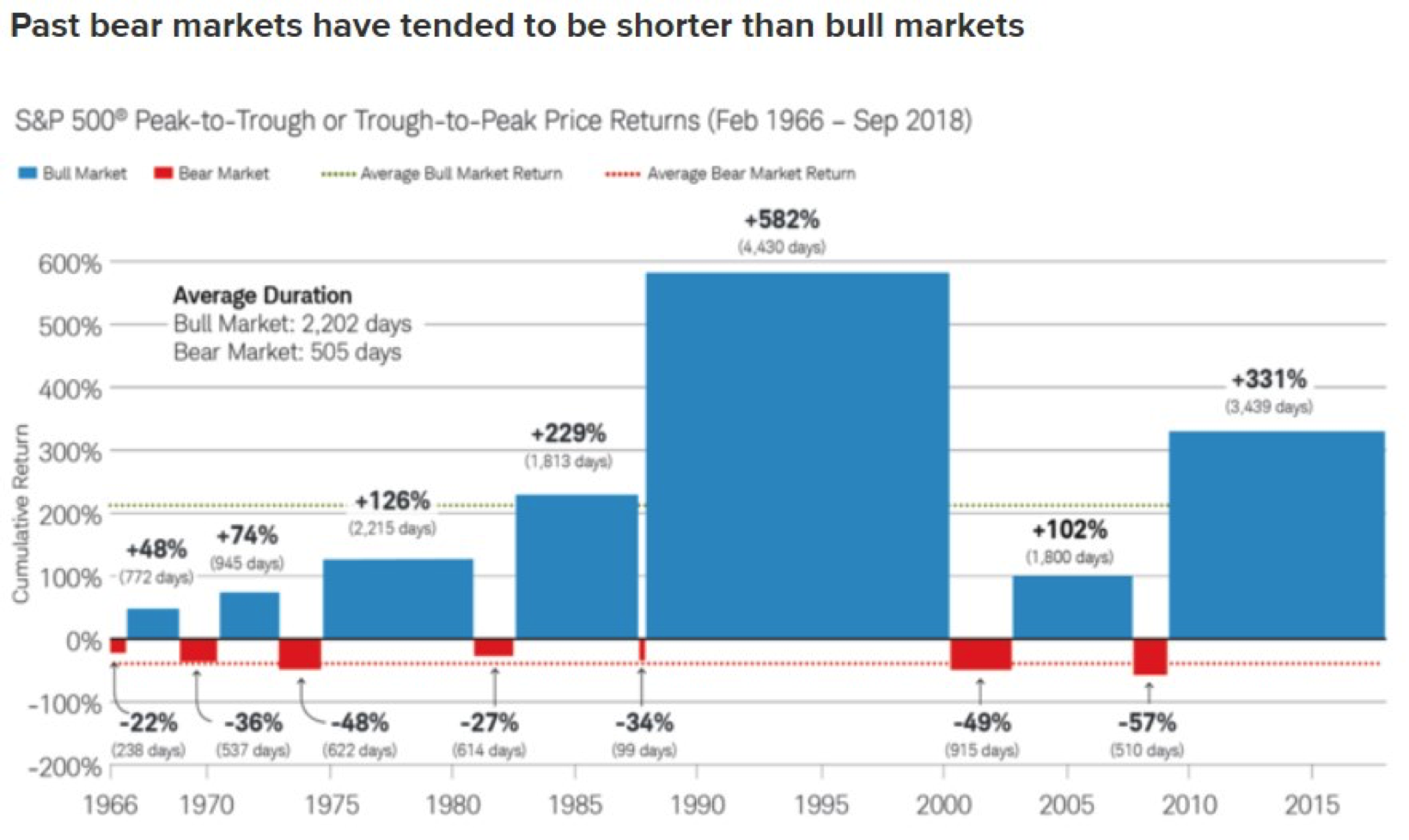

There will be another bear market eventually and, when it comes, it's important to keep a few things in perspective. Since 1966 the average bear market has lasted just under 17 months, far shorter than the average bull market (see chart below).

Bear markets often end as abruptly as they begin, with a quick rebound that is difficult to predict. A common mistake is people taking their money out of the equity market near the bottom and missing the rebound.

A good discipline in good times and bad is to rebalance regularly at the asset class level. Rebalancing means reducing positions that have become overweight and topping up positions that have become underweight relative to your benchmark weights. Such an approach (sometimes referred to as passive rebalancing) has generally been shown to be more successful than traditional big-picture tactical asset allocation calls.

Source: Schwab Centre for Financial Research, Bloomberg

How should the latest market moves be interpreted? Earnings growth is still supportive, although companies haven't been getting much credit for it. Based on the latest figures from FactSet, with nearly half of S&P 500 companies having already reported their September quarter earnings, 77% have reported a positive EPS surprise and 59% have reported a positive sales surprise. The year-on-year growth rate of S&P 500 EPS in Q3 is running at 22.5%, which is stronger than what the market was expecting at the start of reporting season.

Even two of the more controversial results, from Amazon and Alphabet, beat the consensus profit forecasts, with the disappointment centred around revenue growth and guidance (still good, just not as much as analysts had hoped).

Bear markets are usually associated with economic recessions, and at present there have been few signs that a recession is imminent.

US real GDP growth in the September quarter (released on Friday) was stronger than expected, coming in at an annualized rate of 3.5%, above the consensus forecast of 3.3%. Consumer spending was particularly strong at 4.0%, although housing activity contracted and net exports subtracted from growth. The inflation data was good, with the core PCE deflator dropping from 2.1% to 1.6% annualized in Q3.

US GDP growth will slow next year as the fiscal stimulus ends and the lagged effects of higher interest rates take hold. However, a recession is not being indicated, with the Conference Board's leading economic index for the US still posting consecutive monthly increases.

With the US equity risk premium back to 3.5% (i.e. 100 / 15.2x forward PER - 3.08% 10-yr yield), that makes the latest equity market sell-off more likely to be a normal correction, as the market adjusts to the slower growth environment expected for next year, rather than the start of a major bear market and recession.

"The stock market has forecast nine of the last five recessions." - Paul Samuelson

--

This article is prepared by Mason Stevens Limited (Mason Stevens) ABN 91 141 447 207 AFSL 351578 and is general advice only and does not take into consideration yours or your client’s personal objectives, financial circumstances or needs and should not be relied upon as personal advice. You should consider this information, along with all of your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Securities, by nature, rise and fall and as a result investing in securities including derivatives involves risk. Past performance is not a reliable indicator of future performance and may not be achieved in the future. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.

Mason Stevens ensures that the information provided is accurate and complete but does not warrant its accuracy or reliability. Opinions and or information may change without notice and Mason Stevens is not obliged to update you if the information changes. Mason Stevens and its associated companies, authorised representatives, agents and employees exclude to the full extent by law, liability of whatever kind, including negligence, contract, fiduciary duties or otherwise, to investors or anyone else in respect of any loss or damage, including indirect or consequential loss or damage, foreseeable or not, arising from or in connection with this information.

1 topic

Responsible for identifying domestic and international equity investment opportunities. 25 years of financial markets experience as an equity strategist, economist, analyst, portfolio manager and consultant.

Expertise

Responsible for identifying domestic and international equity investment opportunities. 25 years of financial markets experience as an equity strategist, economist, analyst, portfolio manager and consultant.