Latest lithium views from 3 major brokers: Price forecasts & ASX lithium stock picks

With lithium prices sliding back towards their December low over the last few days, it is no surprise three major brokers just chose to release sector updates. Of particular interest across the three reports is what is happening on the ground in China – both in terms of demand for lithium minerals and EV sales – as well as how producers have responded to the latest slump in prices.

In this article, I’ll give you the lowdown on each of the reports, but first, let me note that working at a major investment bank clearly doesn’t mean you don’t have a sense of humour – note the thigh-slapping titles below from Morgan Stanley and Macquarie!

Morgan Stanley: DataDig: Over supp-Li-ed

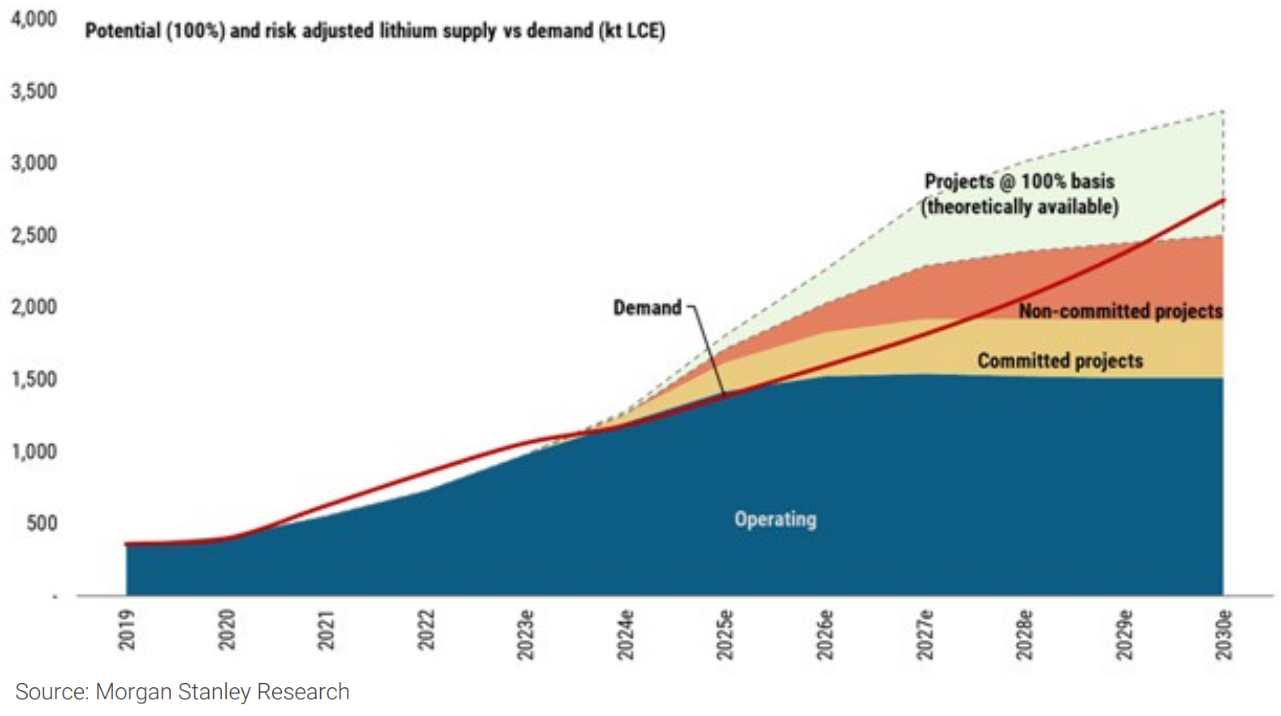

Morgan Stanley notes a significant ramp-up of investment in new supply capacity has been the “driving force” behind the oversupply that has plagued the lithium market since 2022 and pummelled lithium minerals prices.

The problem isn’t likely to go away any time soon, suggests Morgan Stanley, who thinks lithium markets will remain in surplus until “beyond 2030”. The broker lays the blame on significant supply that’s about to be unlocked in Australia (Greenbushes ramping), China, Chile, and Africa (as it comes out of its wet season).

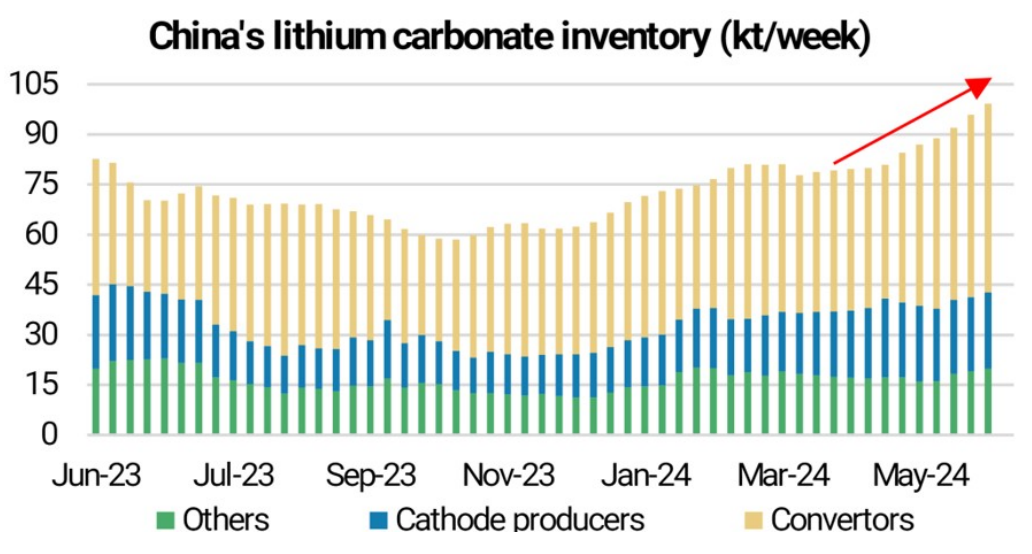

On the demand side, Morgan Stanley predicts further complications for lithium prices due to growing risks of slowing cathode restocking in China. Exacerbating matters, the slowdown is occurring at a time when inventories remain at their “highest levels since June 2023”. Morgan Stanley contends that a major part of the demand slowdown is the growing trend to lower lithium-intensity electric vehicle variants like hybrids.

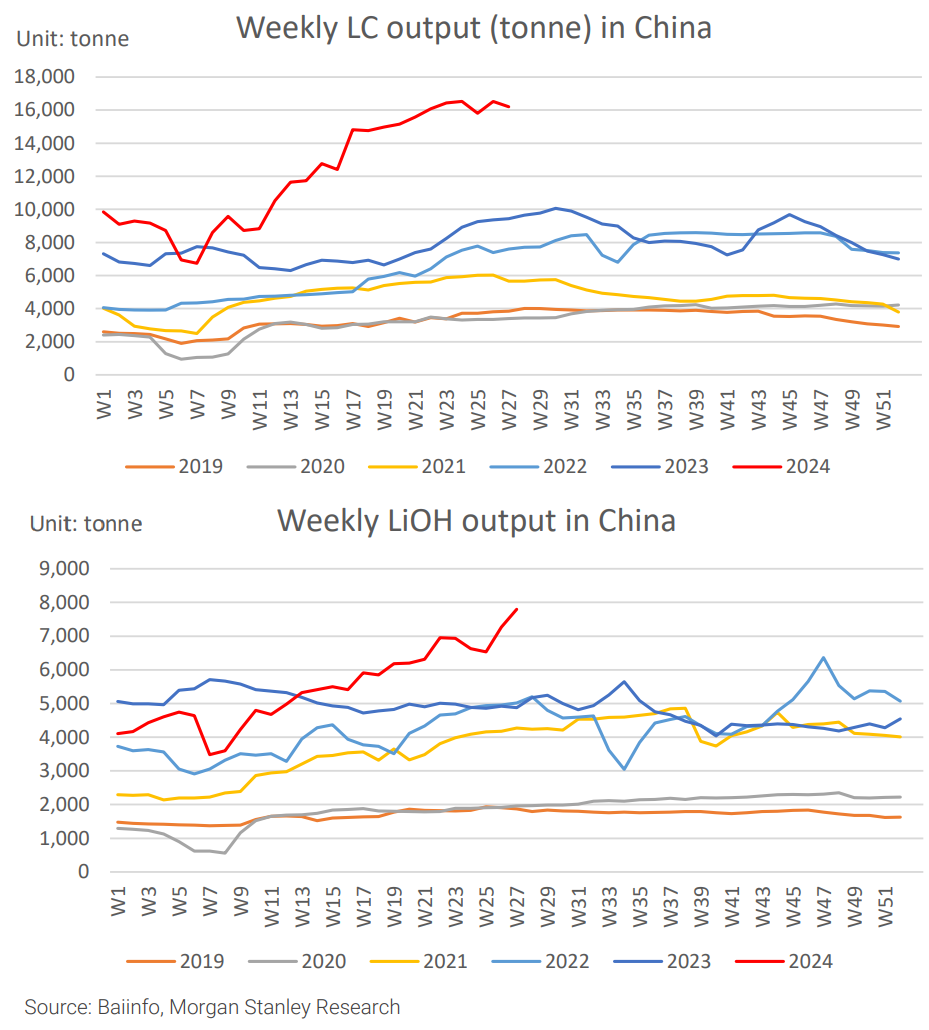

Three charts provided in the research report perhaps best tell the short-term story of what’s happening in the Chinese lithium market:

1. Lithium minerals inventories are rising:

.%20Source%20Morgan%20Stanley%20Research.png)

2 & 3. Chinese lithium chemical producers are churning out product regardless:

Putting the pictures together, it appears Chinese battery manufacturers have plenty of products to choose from at a time when demand is potentially softening.

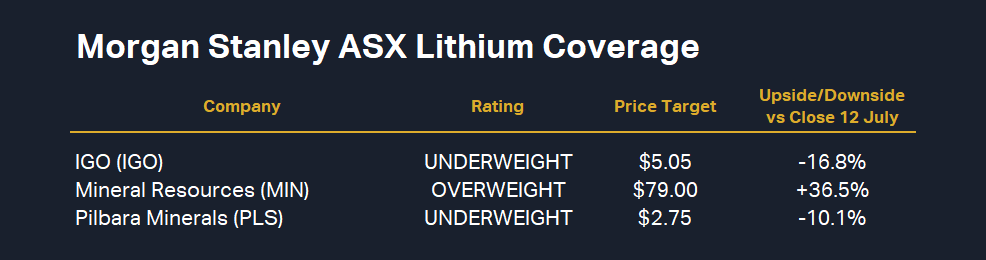

On ASX lithium stocks, Morgan Stanley proposes a “cautious” approach. The broker calculates that Pilbara Minerals (ASX: PLS) and IGO (ASX: IGO) are trading on an “implied spodumene price of US$1,350/t and US$1,370/t, respectively”. The current spodumene price is closer to US$950/t, so this suggests that both ASX lithium producers may be significantly overvalued.

Morgan Stanley’s preferred ASX lithium exposure remains Mineral Resources (ASX: MIN), but ironically, this is mainly due to its “ramping lower cost iron ore exposure from the Onslow Iron project and an improving balance sheet” and not its lithium exposure.

Goldman Sachs: Lithium equities outperforming commodity, with growing dispersion

Goldman Sachs notes there’s a silver lining for investors in Aussie lithium stocks, wait for it: ASX lithium stocks have outperformed both the underlying commodities and their international peers in 2024. If you’re holding any ASX lithium stocks, I bet you feel a whole lot better now!

As for lithium prices, the broker notes new volumes continue to be added to the prevailing market surplus. “We have yet to see meaningful volumes come out of the market or new projects get deferred”, Goldman Sachs notes.

If anything, new projects continue to be proposed or progressed. This is despite the prices of most lithium minerals trading back near the top end of their respective integrated cash cost curves. Translation: lithium prices are approaching marginal costs of production.

On this last point, Goldman Sachs highlights Pilbara Minerals’ recent announcement to push ahead with its P2000 expansion plans. It also believes Direct Lithium Extraction (“DLE”) could exacerbate present supply issues as it is “set to become a commercial reality outside China later this year”.

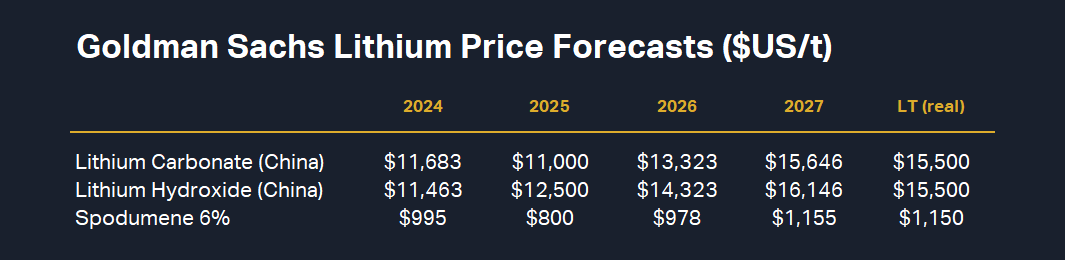

Given its concern about the supply side, Goldman Sachs concludes “we continue to factor in near-term pricing weakness over 2H CY24 and CY25”. See below the broker’s lithium price forecasts out to 2030.

.png)

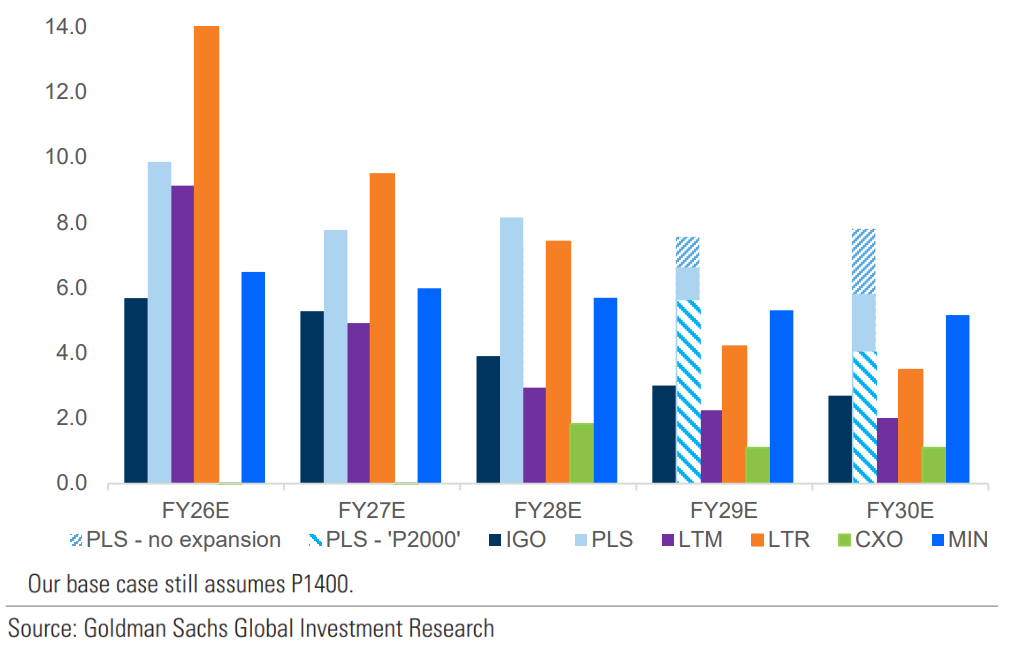

On ASX lithium stocks, Goldman Sachs is BUY rated on IGO only. It’s the only stock in their coverage that is presently trading at an implied spodumene price below the current spot price. See Exhibit 19 below which displays the broker's implied spodumene pricing for several local producers.

Based on the chart above, PLS appears to be the second most expensive ASX lithium stock in Goldman Sachs' coverage. It gets further special attention in the research report, with the broker noting the stock is particularly overvalued compared to its peers on several metrics. In the chart below, Goldman Sachs forecasts PLS is likely to grow increasingly “fundamentally expensive” over time.

Macquarie: Australian Lithium and Rare Earths Miners Quarterly preview: Down, Down (Prices Are Down)

Macquarie’s update centres on quarterly production previews for Australian rare earths miners and their small-cap lithium coverage, but there are some important titbits of info on the lithium market.

They blame the recent slump in lithium prices fairly and squarely on Chinese chemical producers. The broker noted that its analysts had observed “more resilient than expected lithium supply upstream” on their recent Chinese visit. This is certainly consistent with Morgan Stanley’s Exhibits 166 and 167 (i.e. the charts above).

Macquarie predicts elevated upstream supply could continue to “weigh on lithium prices in the near term”.

The broker only has three ASX lithium stocks presently rated at better than neutral: Arcadium Lithium (ASX: LTM), Patriot Battery Metals (ASX: PMT), and Piedmont Lithium (ASX: PLL).

This article first appeared on Market Index on Monday 15 July 2024.

5 topics

9 stocks mentioned