Lithium cycle has troughed as Chinese battery makers set to ramp up production –Citi

For regular readers of my lithium updates, you’ll know that major broker Citi has been one of the most vocal and accurate forecasters of the lithium price through 2024. They turned decidedly bearish in April and doubled down on that bet in May.

Having said this, throughout the period Citi was bearish, it retained a substantially bullish longer term outlook. In this recent article I wrote in December about their then-latest views, Citi said it expected the present lithium minerals supply glut to dissipate this year and that prices would improve by as much as 37% from current levels by 2027.

“Short term bearish, long term bullish”, it’s been a consistent theme of Citi’s lithium strategy for 9 months…until now. Ok, I might have pumped that up a little lithium bulls, because Citi haven’t exactly turned short term bullish yet, but their latest research report on the lithium market does suggest that they’re no longer bearish.

EV battery ramp up

The main reason for the change of heart in Citi’s short term view on the lithium market is due to their attendance at a major lithium forum held in Chongqing late last month. According to Citi, the event was attended by over 30 key industry participants including commodity traders, battery manufacturers, and lithium industry experts.

The bad news for lithium bulls is that the consensus view has not changed. 2025 is still going to be a surplus year for lithium minerals.

The good news for lithium bulls is Citi notes “an increasing number of industry participants have turned less bearish compared with three months ago”.

Hey, to anyone reading this article who isn’t a lithium bull, the phrase “less bearish” sounds like I’ve completely wasted your time. For lithium bulls, however, it’s more like this:

Citi cites the following reasons for the industry’s collective shift in bias towards the lithium market:

The “very bullish” indicated orderbook of battery makers in 2025 including a 30-50% forecast increase in production by the world’s largest battery manufacturer Contemporary Amperex Technology Co. Limited (“CATL”), plus a 50-100% forecast increase in “Tier 2 players” like Build Your Dreams (“BYD”).

The strong battery manufacturing orderbook in the last three months of 2024 should flow through to the first three months of this year – noted by Citi as a typical “slack season”.

Following on from the above, major manufacturers appear to be set to maintain full production during the Chinese New Year period (possibly to front run any looming Trump tariffs)

Cathode processing fee hikes are widely anticipated and flowing through the system, this should assist cathode manufacturers who Citi notes have been generally loss-making for two years.

Demand vs Supply = Price

The burgeoning supply side of the lithium minerals pricing equation has been well documented throughout my lithium coverage in 2024. A wall of supply from new projects, as well as historically high inventories, have proven a critical factor in slashing most lithium minerals prices by over 85% over the past two years.

On the demand side, a consistent theme was less than expected demand from Chinese battery manufacturers as various subsidies within China rolled off, and as consumers shifted their preference substantially towards less lithium intensive hybrid EV variants.

Citi’s latest research report does not focus specifically on the supply-side of the equation, but it does peg an upcoming decision by CATL on whether to resume production at its massive Jiangxi lepidolite mine as critical. Rather, this time the broker’s focus is on demand – and it appears the demand outlook heading into 2025 is significantly improved from that which prevailed for most of 2024.

Citi notes their forecast increase in Chinese battery demand in 2025 is currently at 30%, while broader market consensus is approximately a 20-25% increase. The broker suggests the abovementioned forecast increase in production from CATL (30%) is credible, but that forecasts by Tier 2 players is less so.

“Even if we apply a 30% discount to the guidance of the tier-2 players”, Citi notes, “we would still be looking at a 40%-ish [sic] growth target”. Without confirmation of guidance and the materialisation of actual orders, Citi suggests this growth will be considered by many as “too good to be true”.

Still, if the orders do happen to materialise, and we’ll know by around March, the broker expects a “meaningful” uptick in utilisation across the battery supply chain. Citi notes this could potentially result in more sustainable price improvements across the value chain.

How to play along with the next lithium bull market at home

“We maintain our view that the battery price cycle has troughed, and we see modest price hike potentials in 2025” is the conclusion Citi has drawn from their recent investigations.

This doesn’t mean Citi thinks its clients should rush out and scoop up beaten down ASX lithium stocks, however. Instead, Citi recommends CATL as its near-term top pick, citing potential positive catalysts such as dividends and the company's upcoming listing in Hong Kong.

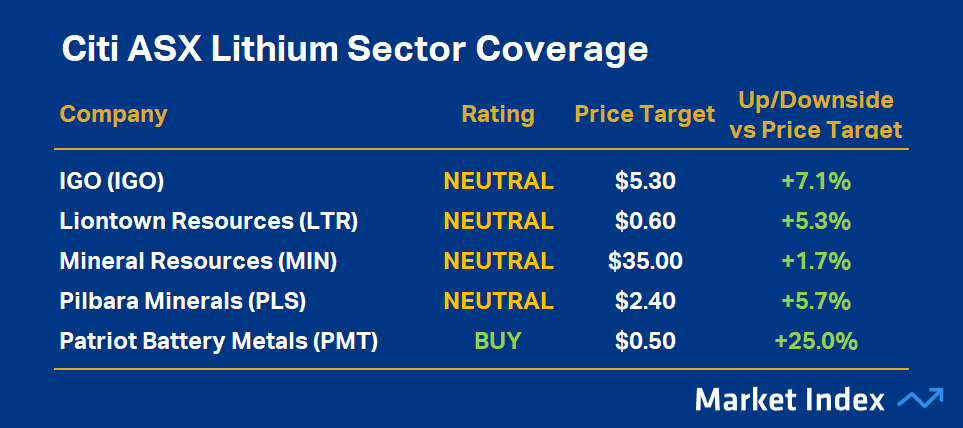

Based on previous research reports, I note that Patriot Battery Metals (ASX: PMT) remains the broker’s only BUY rated ASX listed lithium stock.

This article first appeared on Market Index on Wednesday 8 January 2025.

5 topics

11 stocks mentioned