Little, mid-sized and big: Three healthcare stocks for 2021

Welcome to the third of a three-part deep dive on the one sector that has been on everyone’s mind this year: Healthcare. It's a sector that rewards patient investigation (no pun intended). It spans a multitude of sub-categories and specialisations, from drugs to medical devices, from tissue engineering to aged care, and everything in between, and, as I illustrated in my last wire, Your prescription for finding the best healthcare stocks, it's a volatile space, too. So making sense of it all is not for the faint-hearted. In this wire, I asked a trio of experts to weigh up which parts of the sector they believe hold the most promise for 2021 and beyond, and to reveal their one favourite stock.

"Aggressive culprit" now more rational

Emma Fisher, Airlie Funds Management

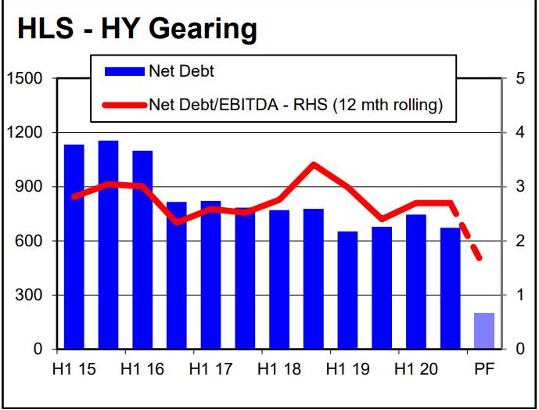

Our preferred healthcare stock for 2021 is Healius (ASX: HLS). We see the business as a turnaround story, with the sale of the medical centres business (as announced in mid-June) removing the “problem child” that soaked up a lot of CAPEX and historically generated very poor returns. As illustrated below, the business has fixed its balance sheet with this sale.

Source: Diogenes Research

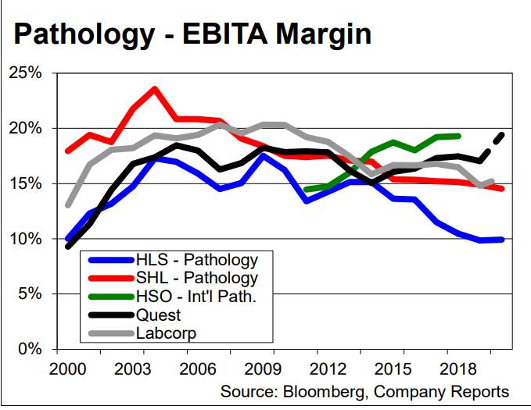

The biggest driver of group earnings from here is pathology, which now comprises around 80% of group EBIT. The pathology industry (in which HLS is the number two player) has enjoyed steady, defensive top-line growth, growing at a 5.8% CAGR since 2003. The issue has been industry margins.

Source: Diogenes Research

Pathology is a very high fixed-cost business, so incremental volumes should drop through at very high margins. The reason they haven’t over the last decade has been an industry land-grab for referrals. With most pathology players opening collection centres like crazy, this has added fixed costs to the business. The most aggressive culprit has been Healius, under the prior management team.

But the company is now closing centres and behaving more rationally, and other players appear to be following suit. At the mid-December investor day, management outlined cost initiatives to drive around 300 basis points of EBIT margin improvement in this division. While execution risks remain, we think the risk/reward looks attractive.

We believe Healius can grow pathology earnings at 7% from here, and this isn’t a heroic assumption given industry revenue has historically grown at 5.8% plus margin improvements. If this occurs, lower corporate and interest costs following the medical centre sale would see group EBIT nearly double over the next four years.

Why CSL can beat expectations

Stuart Welch, Alphinity

COVID created some near-term headwinds for CSL Limited (ASX: CSL) but it’s our preferred healthcare stock.

The key challenge over the last six months has been plasma collection volumes, with CSL collecting most of its source plasma in the US. Immunoglobulin (IG) is fractionated the plasma and purified for the treatment of immune deficiency and various neurological disorders.

Many plasma donors were fearful of contracting COVID and stopped donating plasma. has begun picking up again and plasma collection volumes have been recovering since June, but remain well below prior-year levels. This will impact IG volumes in FY22 given the nine-month manufacturing cycle.

While this is certainly a headwind for CSL, there is increasing evidence IG price increases are providing an offset. CSL disproportionately supplies tender markets outside of the US, where IG prices have historically been 40% lower than the US. But competitors are increasingly short on product and not participating in these tenders, which means tender prices are now rapidly approaching parity with the US.

Given the spectre of US international pricing parity regulation, the industry is unlikely to sacrifice these pricing gains easily. Meanwhile, underlying plasma collection volumes continue to improve sequentially and will be greatly improved by widespread COVID vaccination. The confluence of these factors has the potential to see CSL deliver earnings ahead of market expectations.

Fixing broken hearts

Chris Kallos

I’m quite excited about Anteris Technologies (ASX: AVR), which runs a proprietary tissue engineering business.

Having already sold validated heart-repair tissue to a French company, it is now working on manufacturing a heart valve and is currently running open-heart surgery trials in Belgium.

If successful, Anteris could be worth between US$200 million and US$400 million a year from now, from its current market cap of around $22 million.

Both the heart valve and the tissue are proprietary – and that’s huge. But the big story is that the company aims to enter the transcatheter aortic valve replacement therapy (TAVR) market. Open-heart surgery for elderly people has always been very risky, so surgeons now often introduce catheters via other parts of the body.

Anteris is currently making sure its proprietary valve works in normal patients, and will then put a submission to the US Food and Drug Administration sometime in 2021. The plan is for this treatment to then be acquired by a third-party, or licensed out by Anteris.

Conclusion

Over the course of this three-part series, it's been fascinating to learn just a little about how these experts think about such a complex sector, one that is such an important part of our economy. The companies in this space are much more than drivers of profit; they're uncovering treatments, inventing devices and curing the diseases and are (at least in my book) some of the most exciting and vital businesses around.

Stay up to date

Don't forget to follow my profile to read the other wires in this three-part series, and give this article a like if you enjoyed it. Part one saw our trio discuss how they find quality healthcare stocks, and in part two they revealed where they see the best opportunities.

2 topics

2 stocks mentioned

1 contributor mentioned