Livewire Christmas Cracker #10: A small company with all the attributes of stellar growth

In our new 'Christmas Cracker' series, each morning through to Christmas we will bring you a top insight for 2018 from one of our contributors. Today’s insight is by Graeme Carson, Cyan Investment Management.

A small company with all the attributes of stellar growth

As 2017 comes to a close it’s always topical to cast an eye across your portfolio and tip what’s likely to be the best performer in 2018. Our eyes are firmly focused on Axsesstoday (AXL).

AXL is an equipment financier (comparable to Silver Chef SIV:ASX) that is on track to deliver a FY18 NPAT of at least $6.5m with a market cap of only $85m.

Listed 12 months ago, AXL hasn’t put a foot wrong and delivered share price growth of 55% and paid out 2.2c in dividends. In context of the performance of the underlying business, we believe this is actually quite modest, and likely just the beginning of a strong and sustained run in the share price.

The company beat its prospectus guidance in FY2017 and has subsequently upgraded its 2018 earnings forecast (twice!). AXL has expanded its distribution network and product offering, invested heavily in IT systems to support a rapidly growing business and has the access to capital to execute its growth plans.

As mentioned, the most comparable listed peer is Silver Chef (SIV). It is valuable to cast your mind back to 2009 when Silver Chef was itself an emerging company trading around $1 per share. Over the next seven years its price rose by more than 10 times as it proved itself as a market leader in providing finance for equipment in the hospitality industry. AXL now appears to be taking a significant chunk of the market share in that industry, complemented by a growing presence in the provision of finance to SME’s for commercial transport. In layman’s terms AXL provides equipment finance to restaurants, cafes and franchises (think coffee machines, cooking, refrigeration, dishwashing) as well as finance for commercial vehicles.

So, why do we think that AXL will be a stellar performer in 2018 and beyond? The company is still in the early stages of its growth lifecycle phase and has been managing the pace at which it’s been growing. The demand for its underlying product offering was incredibly strong, but it chose to temper growth to ensure its systems, funding structure and risk management protocols were all properly in place. It appears that next year will be the period when some of those managed constraints will be removed. The key indicators are:

Growing market share

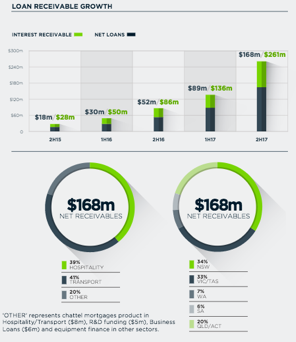

The two key sectors for AXL are hospitality and transport. Both are roughly equal in size and importance to the business, and both are growing strongly. The net receivables book is an easy metric to measure growth and the group total rose 219% to $168m at the end of FY17, 65% higher than the IPO forecast. This can be largely attributed to an uplift in accredited retail merchants and introducers form 77 to 249 in that 12 month period (the product distribution pipeline).

Funding capability

Finance companies require capital to grow. The loan book needs to grow if the demand for product is to be satisfied. AXL is in an enviable position for a relatively small company given it can access capital through equity raising (AXL recently raised $12m), company generated cashflow, bank debt (the facility was recently increased to $175m) and very importantly, a proposed securitization program. The latter will provide a significant growth catalyst for the business at both the top line and the margin. Getting this funding mix right can really drive profitability and rate of growth.

The numbers

So we are very satisfied with strong product demand and have comfort around access to growth capital, but what do the actual financial metrics of the business look like? The stock is currently trading on less than 14x earnings on a PE basis in FY18 with compound EPS growth forecast to exceed 20% in both FY19 and FY20 and NPAT to again double over the course of the next 2 years.

The catalysts

We see the short-term share price drivers as the implementation of the proposed securitzation program and a strong 1HFY18 result. Over the medium-term there is a real opportunity for a price re-rating as the embedded growth is released and the company enjoys the benefits of operating leverage.

Obviously, the risks and potential for growing pains cannot be ignored. But what we have been particularly impressed with over the past 12 months is the focus of the management team on risk and discipline. Even though the business has more than doubled, the credit quality statistics have not deteriorated and the company doesn’t look at revenue as its key metric.

If you are looking for a well-priced growth company with a proven business model that can actually be easily understood, then AXL will sit nicely in your portfolio.

The full box of Crackers

For the full box of Livewire Christmas Crackers, please click here.

1 topic

1 stock mentioned

1 contributor mentioned