Livewire Christmas Cracker #3: Is this bull market just getting started?

In our new 'Christmas Cracker' series, each morning through to Christmas we will bring you a top insight from one of our contributors. These will be diverse and could be a macro call, sector view, stock idea, or even some useful tech. Today's insight is from Daryl Wilson, CEO, Affluence Funds Management.

Is this bull market just getting started?

As well as relaxing and eating too much, the holiday season can often be a time for reflecting. So, here’s something to think about.

The prevailing wisdom right now is that almost all markets are expensive. The US stock market is regularly quoted as being one of the most overvalued of all. The following scary statistics are often used to explain why a crash is imminent:

- The Shiller PE is now at a level only surpassed twice - in 1929 (pre-great depression) and 1999 (pre-tech crash).

- Massive global debt levels are driving easy money for poor quality borrowers and funding share buy-backs, driving markets higher.

- Central banks continue to deliver liquidity and extended periods of very low interest rates, driving markets higher.

- US stock market indices make regular new highs and the market cap to GDP ratio is also at historic highs.

- Passive index buying is driving large cap valuations ever higher, with little regard for quality and no regard for price.

- Record low volatility and high confidence measures mean investors are complacency and unprepared for market falls.

- Tech darlings trade on stratospheric valuations, driven by expectations that they can grow to astronomic levels.

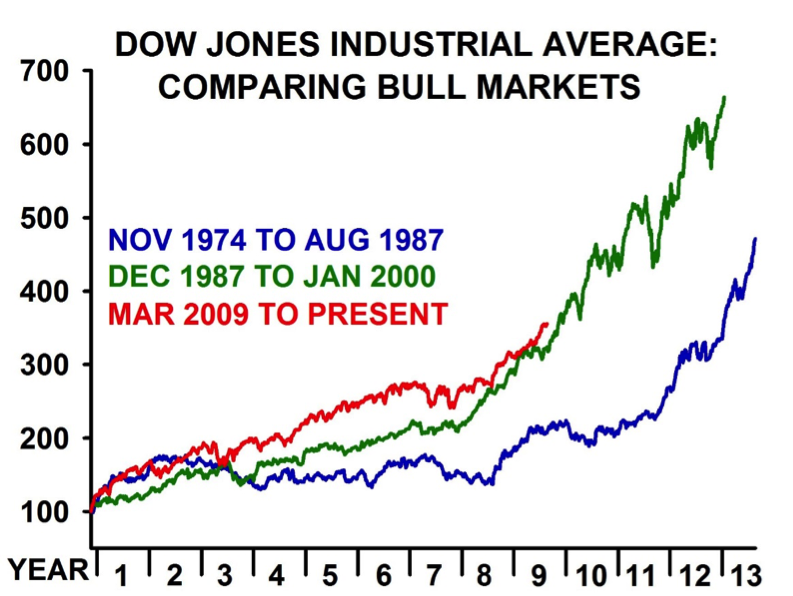

But before you hit the sell button, consider this. Compared to the last two BIG bull markets, both of which similarly started after major corrections, we're just getting started.

The graph below shows it well:

Based on that evidence, you could argue the US market can go another 25% - 80% higher from here.

So, does all that mean you should buy? Or sell? We have no idea. Nobody knows what will happen in the near term. And if you structure your portfolio as a big bet one way or the other, you've got a roughly 50% chance of being wrong. You risk missing out on a lot more upside, or taking a lot of pain on the downside.

So, what can you do about that dilemma? Perhaps accept you don't know what's going to happen next, and plan accordingly. That means spending some time looking at your investment portfolio and thinking about how it might perform in as many different scenarios as you can imagine. For example, what might happen to the value of your investments if:

- The ASX rises by 20%, falls by 20%, or goes sideways?

- Residential property crashes, or goes up another 20%?

- Interest rates rise a lot?

- The Australian dollar rises by 20%, or falls by 20%?

- The US market falls a lot more than the ASX, or continues to rise a lot more?

I'm sure you can think of many possibilities. It doesn't really matter how each might happen, just that you've considered the impact on your own investment portfolio if it did. Of course, you'll be guessing, and you won't get it totally right. But it might help you understand how diversified you really are, which is no bad thing.

In this environment, where markets seem overvalued, but still want to go up, this type of scenario analysis can be a useful tool to help you manage uncertainty. It may lead you to make some timely adjustments to your portfolio. If you are well diversified and can withstand shocks better than most, then you'll probably perform better than most over the long term.

And it’s the long-term that matters for most of us. Because in the short term, probably none of the above scenarios will happen. But over the very long term, all of them will. How prepared are you?

Read next

For more Christmas Crackers please click here: (VIEW LINK)

1 topic

1 contributor mentioned