Livewire readers' Aussie stock picks are a tale of two cities

Global markets have had a rough time of it in the first quarter of 2022. It's no surprise, really - inflation is taking off, central banks are tightening or about to, and war has broken out on Europe's eastern flank.

And the markets have responded in kind.

The MSCI World index returned -9.60% over the three months. The Australian market fared much better at 0.58% - nothing to write home about, but at least it's in the black.

On that dreary note, why don't we see how our readers' large-cap Aussie stock picks are going.

In the large cap space, it's a tale of two cities - those exposed to the commodities bull market, and the rest. With every rule there are exceptions, but it holds up pretty well nonetheless.

It's also a tale of two cities in the small cap space, but more so for the spread of returns. The small caps have behaved, well, very small cap. Which is to say, higher potential for both gains and losses. The top performer, Lake Resources, had a total return of 97.52%. Compare that to Life360 at -39.24%.

Read on for a match report on small-cap and big cap reader picks through the first three months of the year.

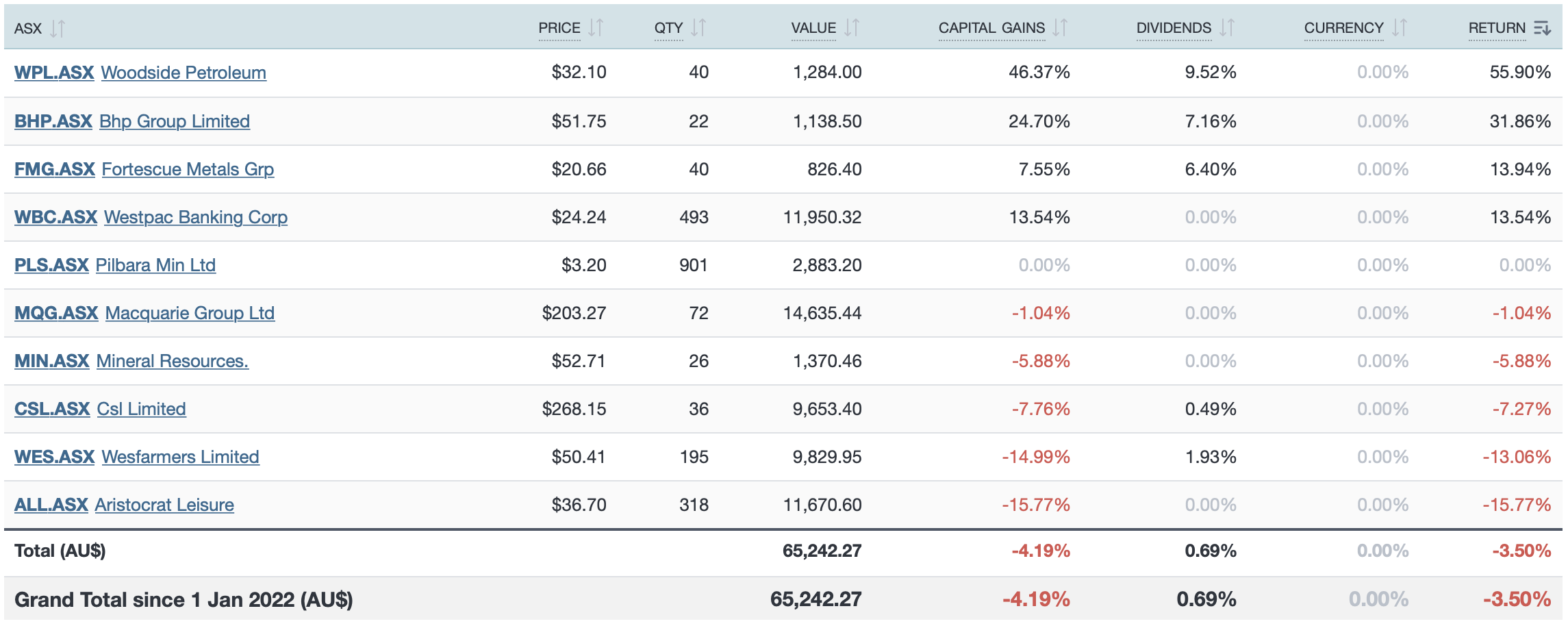

Large Caps

Key takeaways:

- The basket of stocks returned -3.5%.

- Woodside Petroleum had a blinder, topping the table with a 55.9% return. It also boasted the highest dividend yield of 9.52%;

- Aristocrat Leisure was the worst performing stock, returning -15.77%;

- Non-energy minerals, the most tipped sector making up four of the top ten picks, returned 5.19%;

- It wasn't a quarter for income investors, with average dividend yield of just 0.69%.

First-quarter update, from best to worst

- Woodside Petroleum (ASX: WPL)

Share of tips: 1.4%

Q1 total return: 55.90%

Woodside investors have gorged on good news lately, despite some of it being tied to the tragedy in Ukraine.

The oil price skyrocketed 33.3% in the quarter, while spot gas prices hit record highs.

What's more, BHP announced in November that it would spin off its petroleum assets to Woodside.

Then, earlier this month, Woodside published an explanatory memorandum and an independent report recommending that shareholders green light the merger at a meeting May 19.

Looks like the sky is the limit for this energy stock.

2. BHP Group (ASX: BHP)

Share of tips: 2.5%

Q1 total return: 31.86%

The deal between BHP and Woodside has been good news for both parties, it seems.

And income investors will be laughing all the way to the bank.

"We estimate, using share prices on the 12 April 2022, that the “dividend” amount (in the form of the WPL shares), would be approximately equal to US$4.60 (12% of BHP’s current share price) which would carry US$1.97 of franking credits per BHP share," said Peter Gardner from Plato Investment Management.

"This is equal to a further 5.1% of the current BHP share price of $51.72."

3. Fortescue Metals Group (ASX: FMG)

Share of tips: 2.2%

Q1 total return: 13.94%

Fortescue's share price has had a good start to the year off the back of the commodity bull market, leading it to post a 13.94% total return in the first calendar quarter.

Indeed, it rose by 20% in the back half of March alone.

The share was also helped along when Fortescue Future Industries (FFI) inked an MOU with E. ON to supply up to five million tonnes per annum of green, renewable hydrogen to Europe by 2030.

4 . Westpac Banking Corp (ASX: WBC)

Share of tips: 1%

Q1 total return: 13.54%

Investors seemed to be buoyed by Westpac's FY22 Q1 earnings update, released in early February. The bank reported a $1.82 billion statutory net profit in the three months to 31 December 2021.

Our fundies weren't so jubilant about the results, however.

"Net interest margin declines particularly for the larger mortgage banks of CBA (ASX:CBA) and Westpac (ASX:WBC) are quite large and this has been driven by lending competition, particularly around the stark repricing of their fixed rate mortgages," Brad Potter from Tyndall AM noted at the time.

"Both CBA and Westpac participated in their self-defeating battle, which substantially repriced both their front book and also their back book via low priced fixed rate mortgages."

5. Pilbara Mineral Resources (ASX: PLS)

Share of tips: 2.6%

Q1 total return: 0%

The price of lithium has gone on a tear, clearly to the betterment of Pilbara Mineral Resources - the stock has soared 127% in the past year.

It's come off the boil at the beginning of 2022 - finishing the three months perfectly flat.

The stock is also in good favour with shareholders due to its joint venture with South Korea's Posco, with the two due to construct a downstream lithium chemicals conversion facility based in Korea.

“With commissioning expected late 2023, this joint venture places both Pilbara Minerals and POSCO in a very strong position to participate as one of the few near-term lithium fine chemicals producers with underwritten raw materials supply that will emerge in the coming two years," said Pilbara Minerals’ Managing Director and CEO, Ken Brinsden.

"It’s exciting for both the team at Pilbara and our shareholders to be able to extend our reach in the industry beyond spodumene and merchant markets.”

6. Macquarie Group (ASX: MQG)

Share of tips: 4.3%

Q1 total return: -1.04%

Macquarie Group, the second most picked Aussie large cap, lost 1.04% in the quarter. But don't extrapolate its performance in the first three months of 2022 to its performance writ large. The stock skyrocketed to about $215 in 2021. It dropped to $175 in early march but is now back up trading at $205 at time of writing. Over the past year, it's up 30%.

MQG is a fan favourite among Livewire readers, featuring in the top five on this list for four years running now.

Macquarie is sitting on a lot of capital waiting to be put to work. Last year it did a capital raise of $1.5 billion. It already had an enormous $8.4 billion of surplus capital at the time. So don't be surprised if it makes some big announcements soon.

7. Mineral Resources (ASX: MIN)

Share of tips: 2.54%

Q1 total return: -5.88%

Mineral Resources does it all - it mines, and it produces iron ore and lithium. So obviously it's benefited greatly from the bull run in commodities.

And the going has been good the past 6 or so years, with the share price soaring roughly 4x to where it is today at $61.

Can it go higher? Goldman Sachs certainly think so. They recently upgraded it to a BUY with a target price of $70.80.

"MIN has a 20yr track record of delivering high return growth and value creation across mining services, iron ore and lithium in Western Australia. MIN’s strategy has always been to increase earnings from their high margin annuity style long life mining services business which generates c. 30% EBITDA margins."

8. CSL (ASX: CSL)

Share of tips: 5%

Q1 total return: -7.27%

Has the long-time market darling of the ASX lost its revered status? Our readers still back it - it was the most tipped stock this year round.

It's not resting on its laurels. The company is opening up its wallet and expanding beyond its core plasma business. In December it announced it would buy Swiss-based Renal and Iron Deficiency company Vifor Pharma for US$11.7 billion.

"Vifor will make up <20% of CSL’s revenue focusing on therapies that serve the Iron deficiency market, Chronic Kidney Disease (CKD) and Dialysis. It is a market likely to see structural growth driven by increasing incidence of obesity and diabetes," says Sam Byrnes from ECP Asset Management.

"Vifor also adds ~30% to CSL’s product pipeline with three product launches in the next two years. CSL can add value to these by expanding distribution into its wider global network, adding to growth and replacing revenue that is at risk from generics."

9. Wesfarmers (ASX: WES)

Share of tips: 0.9%

Q1 total return: -13.06%

Wesfarmers had a rough start to the year, as did most retailers.

But it's a highly diversified business, which should help see it through. The company is essentially made up of five businesses: Bunnings (50%), Kmart (29%), Officeworks (9%), chemicals, energy and fertiliser (6%), and industrials and safety (6%).

According to Wesfarmers managing director Rob ScottThe first half of financial year 2022 was the “most disrupted period for our businesses since the onset of COVID-19."

It showed in the results. Revenue fell 0.1% to $17.76 billion, while earnings before interest and tax (EBIT) dropped 12.3% to $1.9 billion. Meanwhile NPAT dropped 14.2% to $1.2 billion.

Is the worst behind it? If so, these hard times may represent a buying opportunity for investors.

10. Aristocrat Leisure (ASX: ALL)

Share of tips: 0.7%

Q1 total return: -15.77%

Gaming provider Aristocrat Leisure has really copped a pummelling, losing over 15% in the first quarter of calendar year 2022.

"Aristocrat Leisure’s share price has been under pressure following the abandonment of the Playtech takeover, then the Russian invasion of Ukraine and increasing concerns about the impact of accelerating inflation on discretionary spending in venues such as casinos," says Stuart Jackson from Montgomery Investment Management.

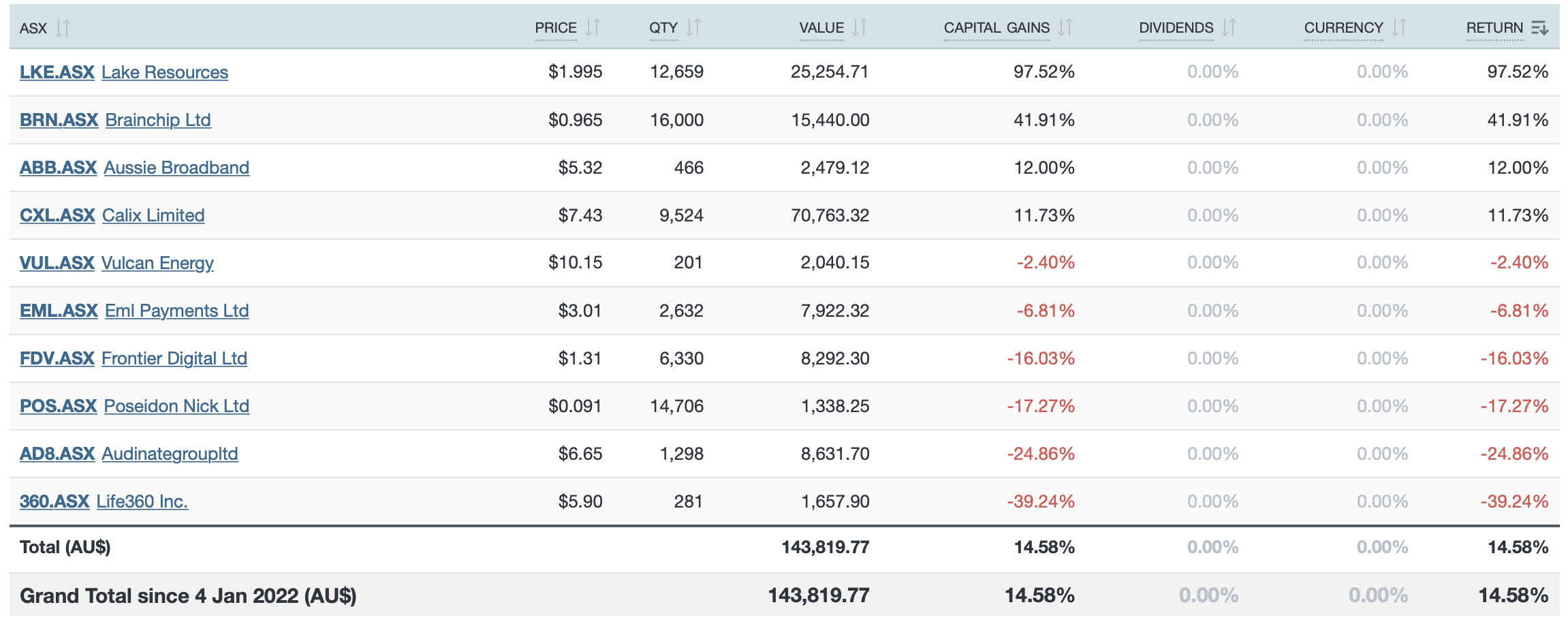

Small Caps

Key takeaways:

- The basket of stocks delivered a total return of 14.58% between January 1 and March 31.

- Lake Resources blew the lights out, taking top gong with 97.52%;

- Audinate was the worst performer, returning -24.86%.

- No dividends distributed.

1. Lake Resources (ASX: LKE)

Share of tips: 0.99%

Q1 total return: 97.52%

This lithium play shot the lights out at the start of 2022, returning 97.52%. But this kind of performance often brings with it questions around overvaluation.

In a recent Buy Hold Sell, John Deniz from Paragon Funds Management labelled it a "massive sell," and even a ripe short.

"If you could get the borrow, you'd want to short it. You do not want to be left holding the bag as they go into the truth-telling phase," he said.

"They've got a challenging direct lithium extraction brine asset, poor management, a really lightweight board and their joint venture partner, I'd almost call a joke. They paid nothing for their 25% interest, which is a big red flag and it says a lot about the asset. But more importantly, the resource - it's got a substandard brine and the only way they'll make it work is by throwing lots of acids at it. And good luck with that."

2. Brainchip (ASX: BRN)

Share of tips: 0.61%

Q1 total return: 41.91%

Brainchip came onto most investor's radars when its stock soared 1,500% in five months, back in 2020.

There's a school of thought that you should only invest in products you understand. Brainchip plays in an exceptionally esoteric space. I mean, who of us really understand neural computing technology.

Still, artificial technology represents the future, and that's where growth will take place.

"I think over time, the Australian market, especially the institutional investors (instos) – initially the small-cap instos, and then as the company grows, larger cap instos - will need to get their heads around this technology. That's really the interesting part, and I think that's where the opportunity is for BrainChip," says Marc Kennis from Pitt Street Research, who's bullish on the stock.

"The really interesting thing about BrainChip in the long term is the royalty revenues that will start to kick in once its technology goes into commercial production. That's what we're looking for and that's still a year out, at least. We want to see that tick up over time."

3. Aussie Broadband (ASX: ABB)

Share of picks: 0.64%

Q1 total return: 12%

The Aussie telco continues to grow market share, and has seemed to avoid the sell-off much of the list suffered in the opening months of 2022.

" was roughly 5% in 2019, improving in 2020, but then up to towards 10% in 2021, and all indications are that market share continues to grow beyond that point - so, very pleasing to see," says Liam Donohue from Lennox Capital.

"In 2019, EBITDA as a earnings metric was broadly zero, but with a relatively fixed cost base, and again, that growth in subscribers, you can see how that earnings leverage has flowed through the business. In FY 24, we're expecting a bit over $60 million of EBITDA. And depending on certain M&A opportunities in the market at the moment, it may be well north of that number."

4. Calix Limited (ASX: CXL)

Share of tips: 0.86%

Q1 total return: 11.73%

Material processing technology company Calix returned a very respectable 11.73% in the first quarter. Granted it doesn't look set to repeat the 546% it put on last year, but it's nonetheless in a decent position.

While it posted a loss of $9.1 million for FY21. it also recorded strong revenue growth of 22% year on year, to $29.9 million.

"I think this company has got star potential," says Thorney Technologies's Alex Waislitz.

"It could have many applications and each one has got big market shares. It could lead to spinoffs of the technology or licensing, but I think it's a company that we certainly believe in."

5. Vulcan Energy Resources (ASX: VUL)

Share of tips: 0.86%

Q1 total return: -2.40%

Stock in lithium explorer Vulcan Energy has been on a rollercoaster this year lifting 18% through March alone, but most of that has since been wiped, with the stock sitting at $9.16.

There's clearly a lot of buzz around what the company might do next.

The March rally came after the company announced its intention to help Europe decouple from Russian energy by producing geothermal energy in Germany’s Upper Rhine Valley.

Vulcan and MVV Energie AG, Germany's largest municipal energy supplier, announced earlier this month a 20-year binding purchase agreement for at least 240 gigawatt hours per year of renewable heat.

“Vulcan is committed to playing a leading role in Germany’s “Wärmewende”, or heat transition as the country looks to reduce its reliance on Russian energy," said managing director Dr Francis Wedin.

"This agreement represents a real and immediate step taken by a German energy utility to achieve energy security whilst not compromising on climate goals."

6. EML Payments (ASX: EML)

Share of tips: 0.86%

Q1 total return: -6.81%

EML Payments, the only stock to make a return from your 2021 top-tipped list, fell roughly 39% through 2021. And 2022 hasn't started well either, with the stock losing 6.81%.

This kind of devaluation has plowed fertile grounds for a possible takeover, with the AFR reporting that Bain Capital has been in talks with the payments provider, but has walked away from the table. For now.

In response to the news, EML payments released this statement:

"EML confirms that earlier in the year it was in discussions with Bain Capital regarding a potential change of control proposal. Those discussions have now ceased. The Board of EML will always consider proposals presented to the company and is fully committed to acting in the best interests of, and maximising value for, EML shareholders. EML appointed Goldman Sachs as its financial adviser and Herbert Smith Freehills as its legal adviser."

The depressed price could represent a buying opportunity. Macquarie think so, having recently upgraded the stock to a BUY with a price target of $3.95.

7. Frontier Digital Ventures (ASX: FDV)

Share of tips: 0.61%

Q1 total return: -16.03%

In November, the online classifieds business announced that revenues had skyrocketed 160% to $21.6 million in FY21, against losses of $4.3 million.

That didn't stop investors selling off the stock, though. It bottomed out at about $1.10 before recovering to $1.31 by the end of March.

Karen Towle, the portfolio manager of the Tribeca Special Opportunities Fund likes the stock.

"Frontier Digital is a business that we've owned for a number of years now and continue to see fantastic opportunities ahead for them," she says.

A lot of Towle's faith in the company is ground in its managing director, Shaun Di Gregorio.

"He has real experience in understanding fledgling online businesses, and he's taken that experience and he's put it into emerging markets, as I said, in South America and the Middle East and Asia. So there are tonnes of opportunities there. He only takes a number one or number two business, and then he just adds his expertise. And he's seeing extremely fast rates of growth in the businesses as they benefit from that expertise."

8. Poseidon Nickel (ASX: POS)

Share of tips: 1.31%

Q1 total return: -17.27%

The nickel sulphide explorer and developer fell 17.27% in the first quarter, despite good news in November that it had found a significant mineralised section at its Silver Swan project.

In a recent Buy Hold Sell, John Deniz from Paragon Funds Management gave it a HOLD.

"Only because of nickel's strong fundamentals and likelihood for much higher nickel prices this year, where the punters are likely to be able to throw darts at any stock and do well. However, we don't rate Poseidon's tied assets at all, and we don't rate their Silver Swan and Golden Swan resource discoveries. They're tiny. They lack any scale potential. And they're also getting very deep, which means they'll be fairly expensive to exploit."

Josh Clark of QVG Capital, on the other hand, was a SELL.

"I've got a bit less conviction around the nickel price. So my understanding of the asset is that that ground has been picked over for over a decade now and no one's been able to get it to work successfully in the past. So that speaks to some of the challenges that they'll have to get it up and running, or at least in a commercial sense."

9. Audinate (ASX: AD8)

Share of tips: 0.49%

Q1 total return: -24.86%

Audinate's total return might have fallen over 24% in the first quarter of 2022, a function of the tech sell-off, but it may have turned the corner more recently with the stock rising 8% in the past five days alone.

"We would definitely be a buyer of this stock," Market Matters' James Gerrish said in February.

"(Audinate has) a clear competitive advantage in what they do. It's well-run, it's founder-led. It's got the ability now to leverage its position into other areas like video. It's growing its top line strongly. And it's handled a pretty challenging period over the past 12 to 18 months."

10. Life360 (ASX: 360)

Share of tips: 1.11%

Q1 total return: -39.24%

The list has to be bookended by something, and so far it's Life360. And by a margin.

While the shares peaked at around $13.64 in late November 2022, they now sit at about $5.51.

In February, the company announced a $US31.4 million statutory EBITDA loss reported by ASX:360, roughly double its US$16 million loss the previous year.

However, Jun Bei Liu from Tribeca Investment Partners said in February that the sell-off was an overreaction.

"The result had very strong top-line growth with annualised monthly revenue up 50% during the year," she noted.

"This growth is driven by improvements essentially across all metrics. Over 30% growth in monthly active users, improved conversion rate, and a 40% increase in paying members."

Her conviction in the company in light of the sell-off led Jun Bei to give it a BUY.

"However, I will put a caveat on the side. Is that for the past three months we have seen significant selloffs across unprofitable tech companies, and we think Life360 is one of the best out of that whole bracket. There are a lot of unprofitable tech companies with business models that won't exist with rising costs of capital. However, this company has an incredible business model, and it's the largest player in a fast-growing segment."

Never miss an update

Hit the 'follow' button below to be notified every time I post a wire or hit the 'like' button to let us know you enjoyed it.

Don't forget to follow my colleagues Hans Lee and Ally Selby for their coverage of readers' global and #1 stock picks in the first quarter of 2022.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

20 stocks mentioned

11 contributors mentioned