Macquarie reveals its 16-stock "recession-proof" portfolio

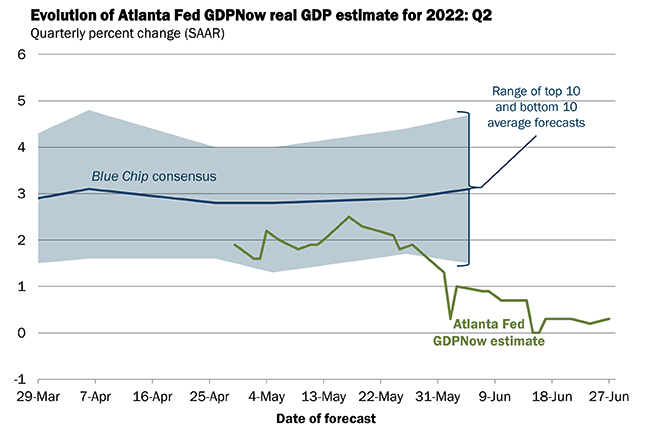

When America sneezes, the world catches a cold. The US is already halfway to a technical recession, with the most recent quarter recording a slight contraction. And while the next read is still a while away, some leading indicators already suggest prospects are not looking bright.

Australia is by no means immune, though our commodities and strong labour market are reasons to suggest the impact of this recession may not be as brutal as in other countries should it eventuate.

For one, Reserve Bank Governor Philip Lowe does not believe that Australians should be concerned about a recession on the horizon. Here is a snippet of what he said at an AmCham event recently:

If the last two years has taught us anything, it's that you can't rule anything out. But our fundamentals are strong, the position of the household sector is strong, and firms are wanting to hire people at record rates... I don't see a recession on the horizon.

Nonetheless, it is the word on everyone's lips. With that in mind, the team at Macquarie has thrown together a best-and-worst portfolio for recessions. This wire will examine that note - including the sectors and stocks that they choose. Plus, we'll examine why they believe we are not at the low point yet for this bear market.

History may not repeat itself - but it pays to look

With the help of the US markets as an example, the team at Macquarie is keen to make this key distinction about recessions:

We split recessions into two parts, as the first part is terrible for stocks, but eventually, stimulus or a trough in the cycle drives a rapid rise in stock prices as growth fears ease.

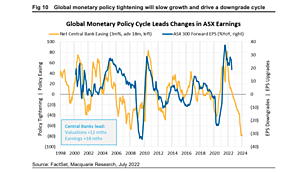

Given where we are in the global central bank rate hiking cycle, the team believes a global recession still won't hit until the first half of calendar 2023. With this as a base case, the team says now is the time to start considering a defensive portfolio.

Here are the fast stats for sectors that work best in an "early contraction" phase (i.e. the one we are about to enter if they are right):

- Staples and utilities outperformed 13 of 15 times;

- Health and Telecom outperformed 12 of 15 times;

- Gold outperformed in 5 of 8 cases and has the second-highest average return.

At the other extreme:

- Industrials have never outperformed;

- Diversified financials and basic materials outperformed in just 2 of 15 cases.

- US real estate tends to underperform (rising rates are generally not great for REITs)

One key caveat to this clause: China

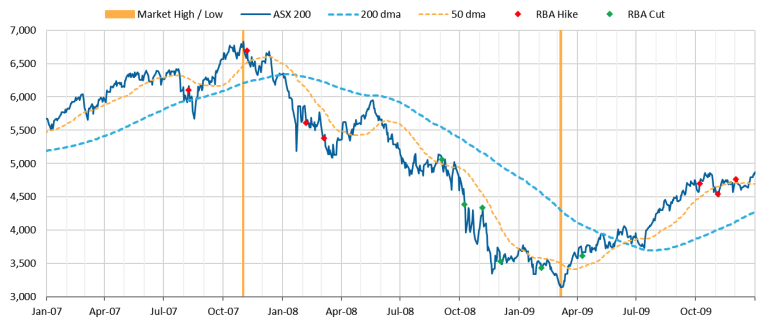

For those with shorter memories, the last prolonged bear market was the Global Financial Crisis of 2008. While some general theories about recessions came to fruition, there was one key caveat that explained why Australian assets were so much more insulated in that period:

China and its insatiable demand for our commodities

Chinese stimulus drove the low in commodities before rebounding and creating a multi-year bull run. In contrast, small caps and most other value names did not outperform until well after the market bottom.

Now for the good news - and the bad news:

The good news? China is pumping stimulus again. At the end of May, Beijing announced a package of 33 measures covering fiscal, financial, investment, and industrial policies. Per reporting from Reuters, the Xi administration "will expand private investment, accelerate infrastructure construction, and stimulate purchases of cars and home appliances to stabilise investments."

The bad news? China is still coming out of its zero-COVID lockdown slumber. The hit to its economy means those years of 8-10% sustained GDP growth are likely not to manifest this time. Further, there are media reports that China may look to centralise its iron ore buying. The move is being seen as a way to counter Australia's near-monopoly on their demand for iron ore.

If this time is different, it may very well be because of changes to China's policy.

Does that make resources a no-go?

In short - mostly yes. With Macquarie's sectors and research preferences to go by, the team has put together an ASX portfolio that can outlast and outperform through downturns. The list is:

- Consumer Staples: Coles Group (ASX:COL), Endeavour Group (ASX:EDV), Metcash (ASX:MTS)

- Infrastructure: Transurban (ASX:TCL), Origin Energy (ASX:ORG), Amcor (ASX:AMC), Orora (ASX:ORA)

- Healthcare: CSL (ASX:CSL), Ramsay Health Care (ASX:RHC), Resmed (ASX:RMD)

- Gold: Newcrest Mining (ASX:NCM), Northern Star (ASX:NST)

- Food: Graincorp (ASX:GNC), United Malt Group (ASX:UMG), Elders (ASX:ELD), and Costa Group (ASX:CGC)

One final chart

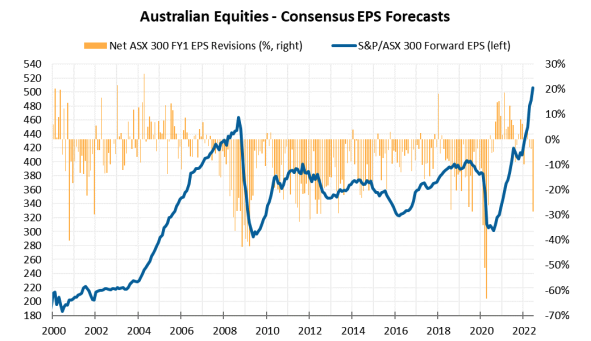

Before we go, one last chart to note - and it's a key one ahead of August reporting season.

Australia’s net earnings-per-share revisions were minus 29% in June 2022. This is the highest level of EPS downgrades since the initial COVID shutdowns in 2020.

At this stage, the team expects to see more balance sheet downgrades in the next two results seasons.

Earnings revisions are

not yet negative enough, in their view, to constitute a market low.

But there is also no doubt that when corporates start to break, so does investor confidence. That will make July confession season all the more fascinating.

.jpg)

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

I'll be in charge of asking the questions to Australia's best macro strategists, economists and fixed income fund managers. If you have questions of your own or guests we should chat to, flick us an email: content@livewiremarkets.com.

3 topics

16 stocks mentioned