Macquarie's list for avoiding earnings "distress" in your portfolio

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

MARKETS WRAP

- S&P 500 - 4,155 (+1.56%)

- NASDAQ - 12,668 (+2.59%)

- CBOE VIX - 21.95

- FTSE 100 - 7,446 (+0.49%)

- STOXX 600 - 438.19 (+0.49%)

- US 10YR - 2.706%

- USD INDEX - 106.38

- GOLD - US$1765/oz

- CRUDE OIL - US$90.81/bbl

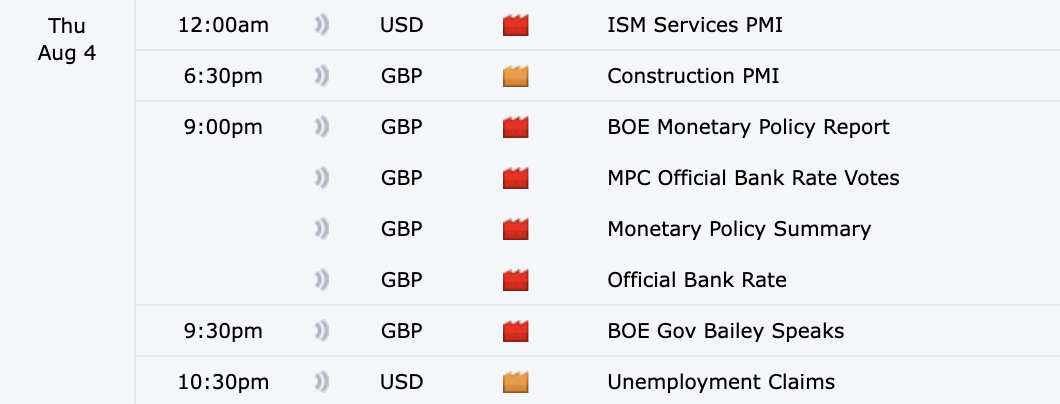

THE CALENDAR

The big highlight for this afternoon is the Bank of England meeting. The Bank has not hiked rates by 50 basis points for a long, long time (27 years, to be exact). Having said this, it's never stared down the barrel of a 10% headline inflation rate in these circumstances.

If it comes to fruition, the move will be anticipated by most analysts and investors. Governor Andrew Bailey has suggested the hike won’t be the last, saying policymakers are prepared to act “forcefully,” if necessary, to rein in inflation.

Let's see what they do tonight as a result.

Also of interest, after some months away from the spotlight, US unemployment claims. A labour market trending towards more firing than hiring may be what is needed for the world's largest economy to sort out its recession woes.

THE CHARTS

Speaking of labour markets, I thought I'd take a look today at the investment implications of a tight labour market. In particular, what happens when the unemployment rate is finally going up when you're investing in a recessionary environment.

Caveat: These are US-centric charts. I haven't seen an Australian-centric chart featuring this comparison yet.

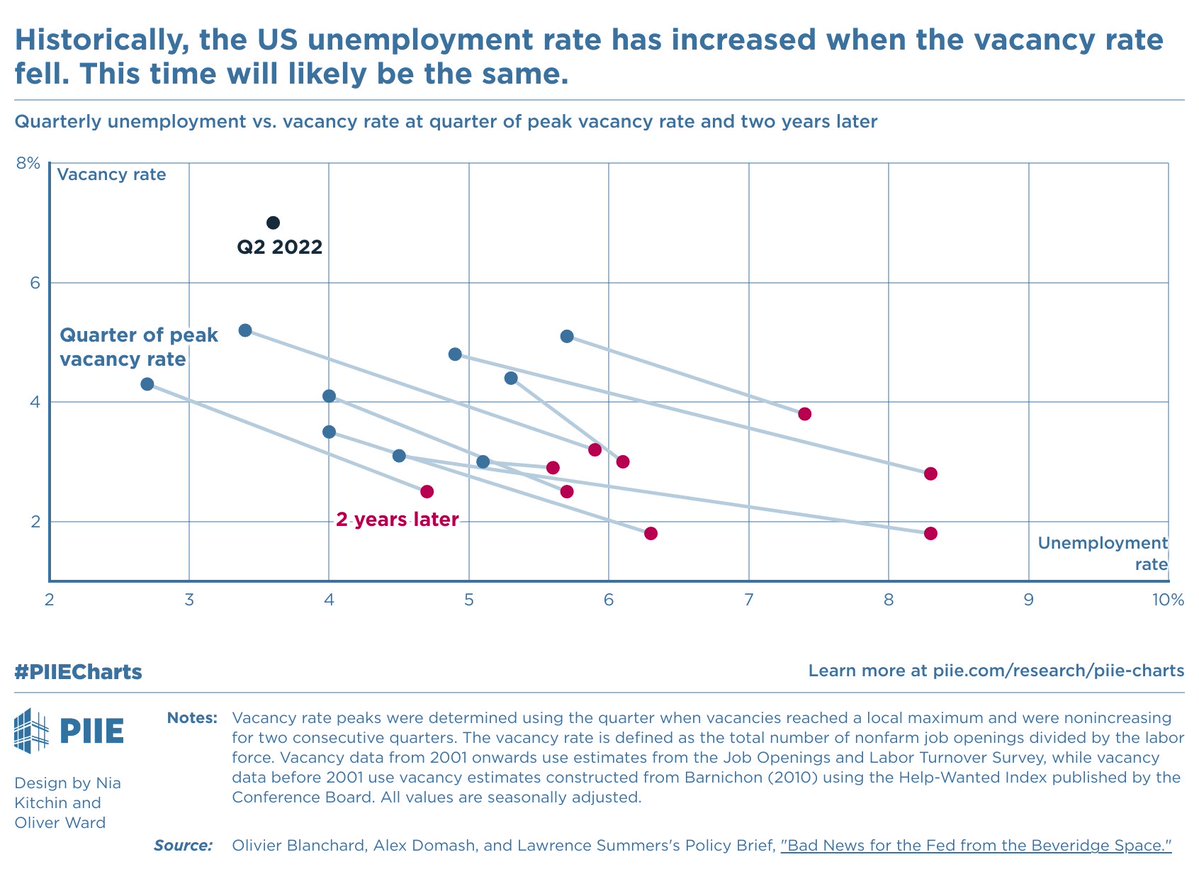

The US labour market is tight as unemployment remains low (just above the half-century low, in fact) and because job vacancies are also high. It is still the case that there are two jobs (roughly) for every unemployed American. In its battle to engineer a soft landing, the Federal Reserve intends to slow activity by decreasing vacancies without a rise in unemployment. The only problem? This is a rare feat to pull off.

This chart is the correlation showcasing this general inverse pattern. It also shows what unprecedented times we live in. This is a recession but not in the regular sense given unemployment is not very high and struggling to come down. In fact, the labour market still has all the signs of a booming economy. For now.

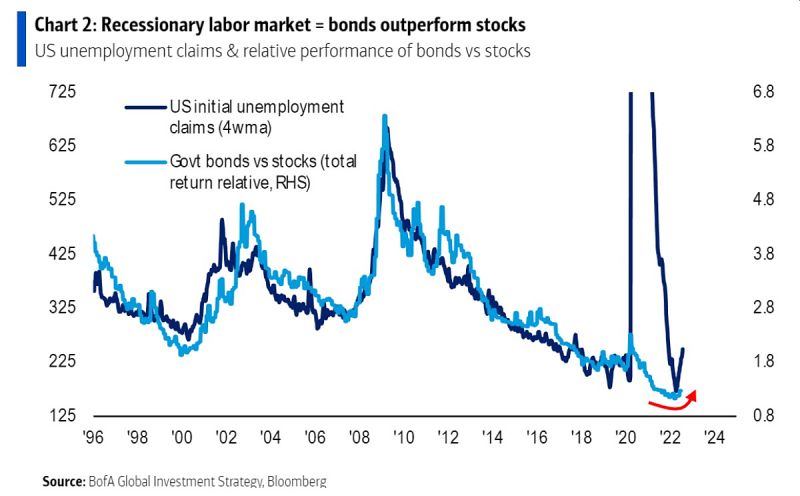

So what's a better investment when times are tough but most people have a stable job? The answer, seen in the next chart, might surprise you.

The clever team at Bank of America have produced an interesting correlation between the bond vs stock returns ratio and weekly jobless claims (the data point out tonight, see The Calendar). What they found is that the two go pretty hand-in-hand with bonds outpacing stocks in difficult times. Is there any reason this time will be different? Not if that rampant pricing on the US 10-year note has something to say!

THE TWEET

STOCKS TO WATCH

In today's segment, I thought I'd take a look at "distressed" stocks - but not my definition of distressed. Rather, Macquarie has put together a list of companies whose earnings could be under stress this August for a range of reasons. Of course, with interest rates rising, inflation running hot, and GDP growth slowing, there is a heightened risk of financial distress in the market. But will any of those hit publicly listed balance sheets?

Through a few cheeky formulae plus the use of some market metrics, they've put together a list of companies that could be in trouble.

One thing that should be noted is that this is a global list encompassing a lot of the Asia-Pacific, including Chinese equities. Our list will only feature Australian names - and surprise surprise - all of these names are rated underperform or neutral.

The stocks in "distress" are:

- Evolution Mining (ASX: EVN)

- Dominos Pizza (ASX: DMP)

- Xero (ASX: XRO)

- Seek (ASX: SEK)

- Reece (ASX: REH)

TODAY'S TOP READ

Is lipstick the surprise recession-proof investment? (Livewire/Sara Allen): Despite the title, this is not an article about how different shades of lipstick reflect how people feel about the world. This piece by my colleague Sara is absolutely brilliant in explaining what stocks and sectors might do well in a recession based on changing consumer habits.

This piece from Bloomberg also tackles a similar subject - but does it in a (let's just say) more colourful way: Is the US Economy in Recession? Here Are Eight Offbeat Indicators to Watch

Today's report was written by Hans Lee.

GET THE WRAP

If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

4 topics

5 stocks mentioned

2 contributors mentioned