Magellan’s top 10 utility stocks

Toll roads and gas companies are the pick of infrastructure stocks into 2021, said Magellan head of infrastructure and portfolio manager Gerald Stack. He also revealed which of this defensive cohort – including an Australian utility – stuck to their guidance targets despite a pandemic-riven 2020, and which should outperform over the next half-decade.

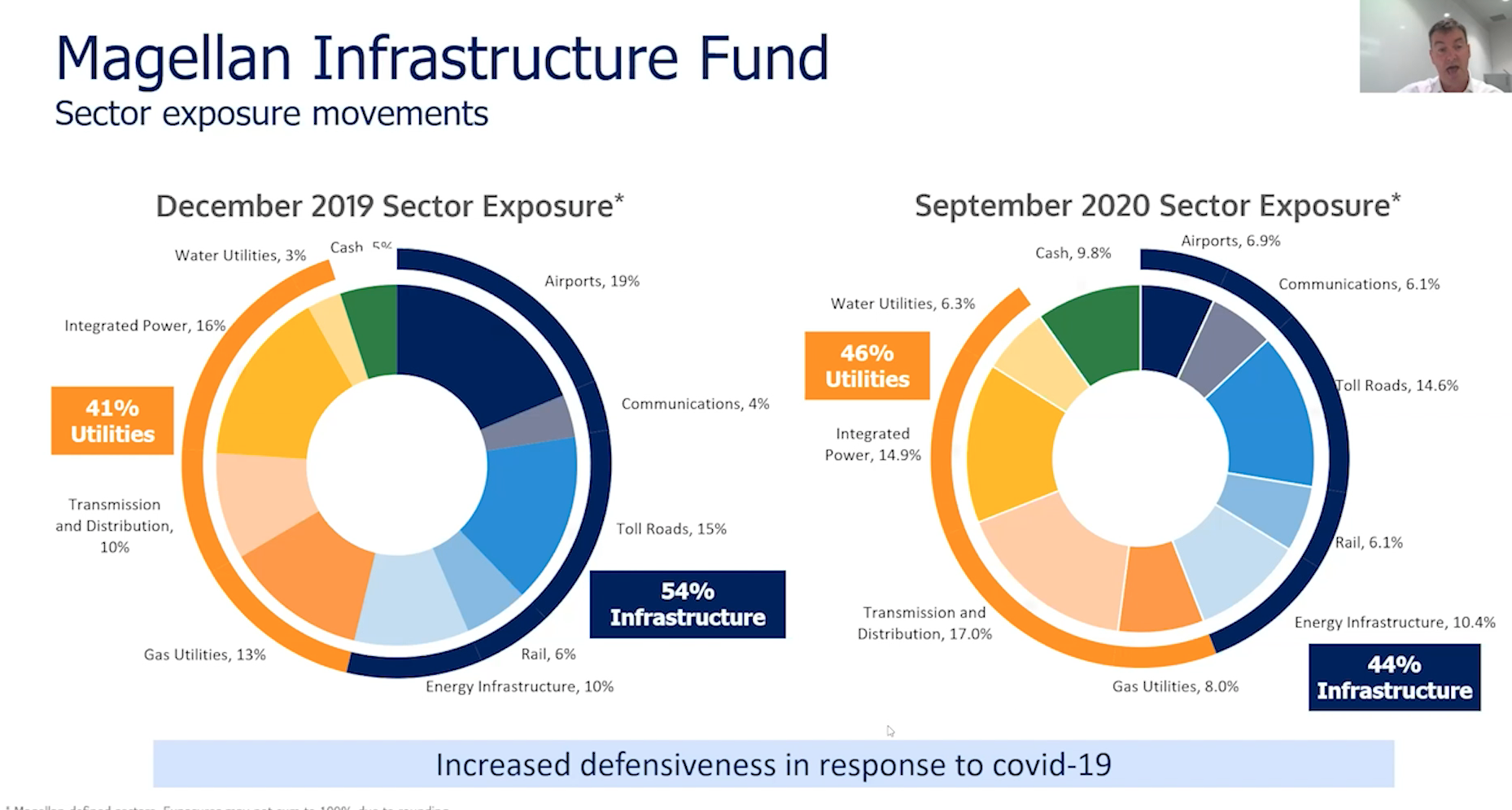

On a broad basis, Magellan’s global infrastructure strategy shifted to a more defensive stance during 2020, in response to COVID-19, boosting its allocation to infrastructure by 10%.

“Our tactics over the course of the year have been to look for those assets and companies who face relatively low levels of uncertainty but have some degree of upside, and we’re continuing to allocate cash levels back into the portfolio,” said Stack during a webinar in early December.

The fund has long favoured utilities, and this continued during 2020 – largely because of their ability to reduce costs and to work with the regulator to spread the impact of the pandemic shutdowns across a broader time period.

“The pandemic meant a reduction in volumes – whether you’re a water utility or in gas or electricity – the fact that people haven’t been at their place of work has meant a reduction in commercial and industrial volumes,” Stack said.

“That’s been offset somewhat by an increase in those services in residential homes, but net-net, there’s been a reduction in volumes.”

But Stack and his team identified a strong grouping of utility stocks that provided impressive profit guidance ahead of the pandemic, and which were reasonably assured of continuing to meet their projections. These are the top 10 utility positions of the Magellan’s infrastructure strategy. All are US electricity- or gas-focused utilities, with the exception of SNAM and Terna (Italian); National Grid (UK and US-based electricity and gas).

Spark Infrastructure (ASX: SKI) is the sole Australian company in the list. It operates a portfolio of assets, owning a 49 per cent stake in three electricity networks—CitiPower and Powercor in Victoria and South Australia's SA Power Networks. It also owns 15% of electricity transmission grid network TransGrid. The Victorian networks contribute around half of Spark's earnings before interest, depreciation and amortisation. SA Power provides 40 per cent of earnings, and TransGrid makes up the remainder.

- Atmos Energy

- Eversource Energy

- Sempra Energy

- Xcel Eenrgy

- SNAM

- American Water

- WECEnergy

- Terna

- Spark Infrastructure (ASX: SKI)

- National Grid

“The bulk of these are in line with where they expected to be. And in general, that was for earnings growth of 5%,” Stack said.

“The pandemic of course has been a significant issue, but they’ve been able to work with their regulators to make sure their earnings are unaffected during the course of the year.

“The outlook from here is actually pretty attractive …a place where we expect to get a fair return rather than a get-rich-quick effect.”

And he maintains this isn’t what utilities are about.

“But given our normal expectation is inflation-plus-5% – for a total return of 7% – given what’s gone on in the course of the year, we’re looking for 8% or 9%, so an additional 1% or 2% per annum over the next five years,” said Stack.

Air travellers still grounded indefinitely

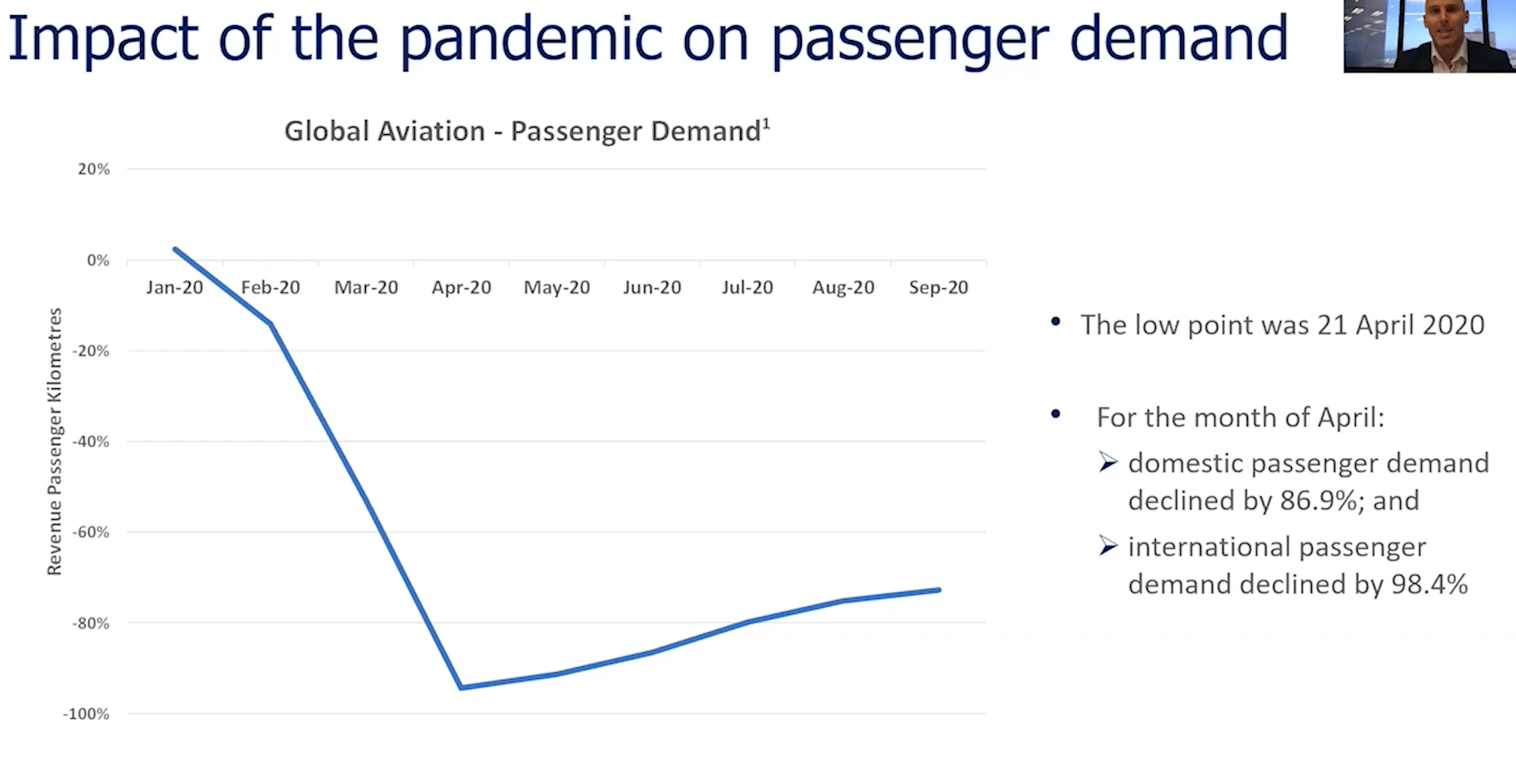

Airports make up another component of essential infrastructure that typically features in defensive portfolios. But the travel bans implemented early in the pandemic to control COVID spread hit the two key profit drivers of airports:

- Aeronautical revenue, comprising the multiplier of passenger counts and airline terminal space rentals, landing fees, and other usage fees.

- Passenger spend rates, or non-aeronautical revenue, from airport’s retail and carpark businesses.

But these revenues fell between 95% and 99% in the earlier stages of the pandemic amid lockdowns and movement restrictions – with international travel hit the hardest.

Listed airports have delivered investment returns of -34.8% for the 10 months ended 31 October 2020.

By September, domestic travel had started to recover in the US, retracing by around 30% and facing declines of 65%, from 95% in April.

Europe was down a similar amount, but hasn’t regained ground as quickly as the US in the face of second- and third-waves of coronavirus. In the Asia Pacific, passenger traffic was down 88.5%, but pared losses back to 63.5% in September versus the end of April.

China’s earlier position on the infection curve and enforced lockdown measures has seen its airports return to almost parity by the end of September, with passenger volumes down just 3% as of September versus 84% in February. Needless to say, airports aren’t a particularly bright spot for Magellan, which predicts that even when air travel recommences globally, the sector faces persistent headwinds.

“Structural shifts in the aviation sector this time means we’ll probably be back to a lower level rather than returning to the pre-pandemic trend line, said Ofer Karliner, portfolio manager, Magellan Infrastructure.

He points to estimates from Magellan’s own research that suggest traffic could be down 10% by 2024 versus pre-pandemic estimates. Karliner cited data from Fraport – which operates Frankfurt Airport – projecting a 25% reduction in domestic travel going forward.

“The big unknown is business travel. Certainly some of those marginal trips will disappear, such as trips from Sydney to Melbourne for a single meeting that may be done by Zoom in future, and the same thing for training sessions,” said Karliner.

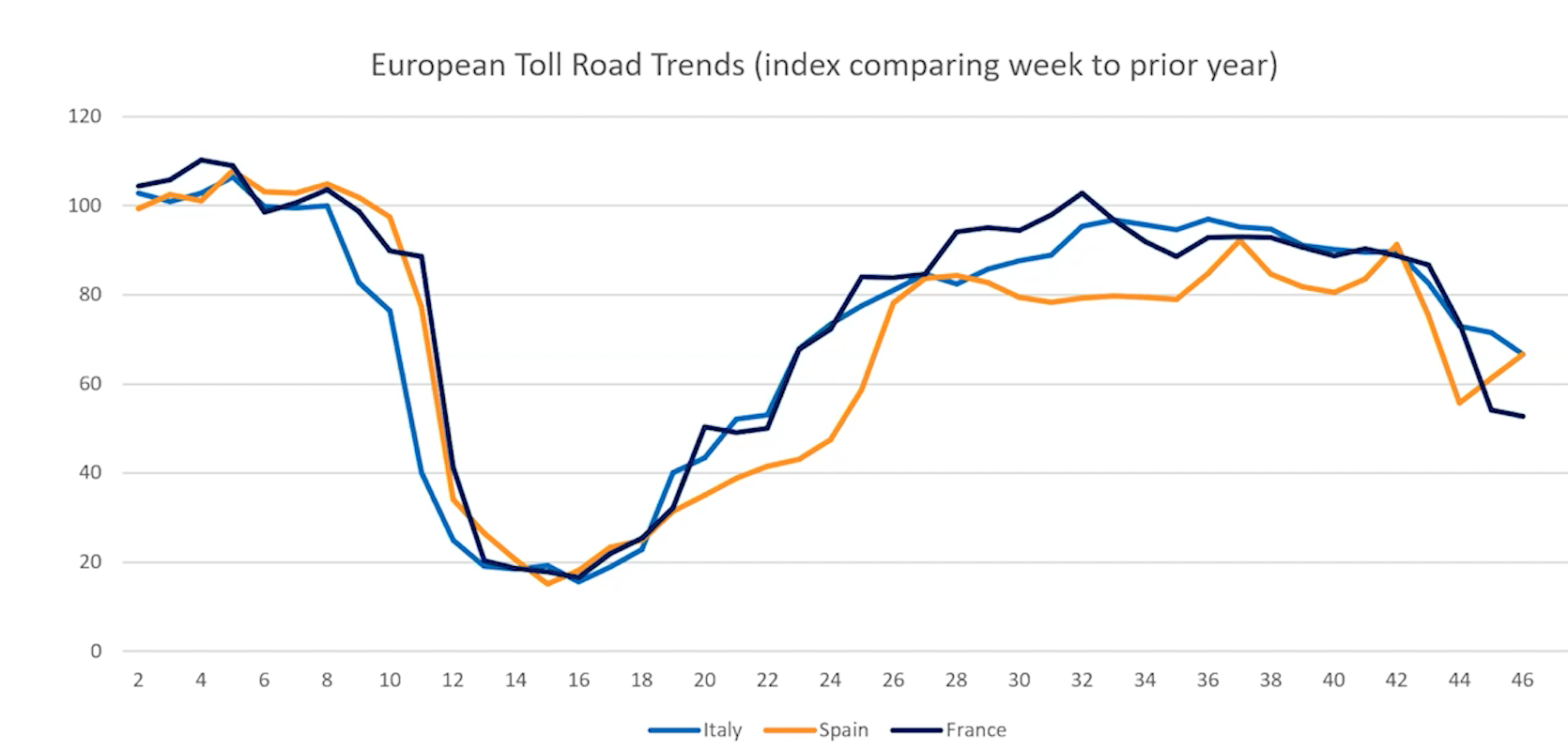

But Magellan is more bullish on toll roads for a couple of reasons, including their “contracted concession” characteristics, which mean long-term revenues that “give you a high degree of confidence about what to expect on the pricing side,” said Ben McVicar, Magellan Infrastructure portfolio manager.

“The piece you need to get confidence with on a toll-road is the long-term structural story…the advantage you’ve got is that while prices might be set, the benefits and risks of volumes fall to the operators.”

“You can get confidence around structural growth trajectory via economic and population growth of regions,” McVicar Said. He expects the segment will deliver a “nice return and a growth profile for investors.”

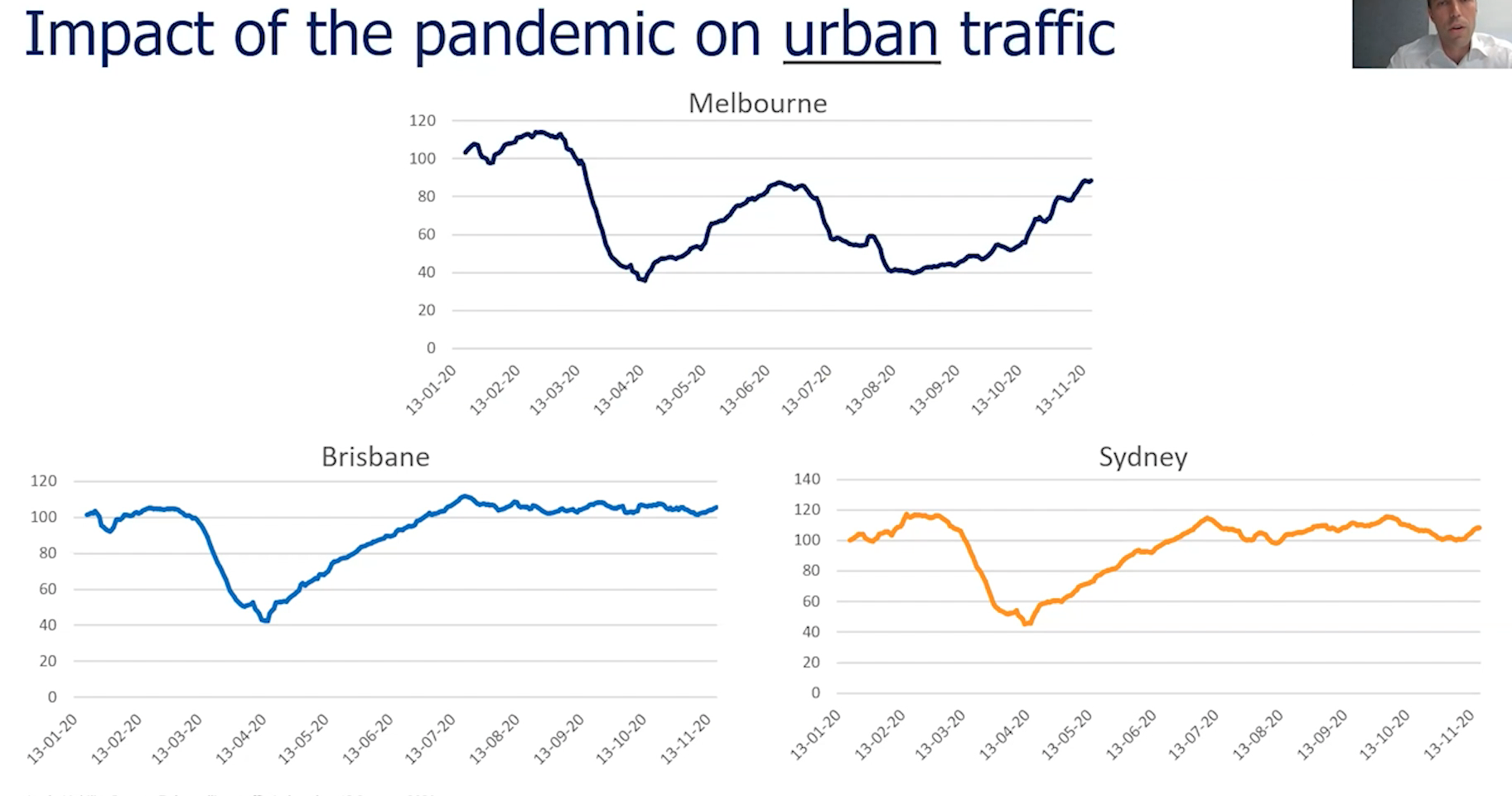

Urban motorway traffic is Magellan’s preferred part of this infrastructure category, because intra- and inter-urban travel is more essential as people return to their normal daily lives.

“We think of the recovery in waves, like ripples in a pond – assets that recover fastest are those more exposed to the shorter-haul trips – urban motorways are the fastest, followed by inter-urban roads.

“At this stage, we assume it takes a few years to get back to that level, without putting a precise number on it. But what we really take away from the data we’ve seen year-to-date is that resilience, that rebound,” said McVicar.

“To the end of October, the average tollroad was down 18%, but November was a very strong month in markets more broadly as vaccine announcements came back – this number went to -4% by mid-November.”

Not already a Livewire subscriber?

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a like.

5 topics

1 stock mentioned

3 contributors mentioned