Maiden profit sees 19% surge for this tech turnaround

The tech turnaround expects FY24 EBITDA will be in the range of $51-$57 million, an increase of 152-182% from FY23's numbers. It also confirmed that it expects to be net cash flow positive for the full financial year.

It comes as a victory for new CEO Michael Reid, who attributed the turnaround to the "continued improvement in operating and financial performance" and "a strong validation of our business model... [demonstrating] our excellent operating leverage as the business continues to grow revenue."

But after rallying 20% today (and 60% over the past 12 months), is the good news already in the price? (see below)

In this wire, Wilson Asset Management's Sam Koch provides his analysis of Megaport's latest result and shares whether he would be buying the stock today or taking profit.

Note: I hold shares in Megaport in my personal portfolio. Wilson Asset Management also has a position in Megaport.

FY23 Key Results

- Revenues up 40%, to $153.1 million

- Gross profits up 52%, to $103.9 million

- Normalised EBITDA up $30.4 million to $20.2 million (it's highest on record, FY22 was -$10.22 million)

- Net cash flow of -$34.5 million, up 31% (however, it was net cash flow positive in 4QFY34 of $2.3 million)

- Net cash position: $33.3 million (cash in bank of $48.5 million less amounts owing under the vendor financial facility of $15.2 million)

FY24 Guidance

- Normalised EBITDA between $51-57 million, above analyst expectations of approximately $48 million (13 estimates on FactSet between $42.1-$52.7 million)

- Revenue between $190-195 million, around analyst estimates of approximately $192.8 million (13 estimates on FactSet between $183.4-$199.9 million)

- Net cash flow positive for the full year FY24

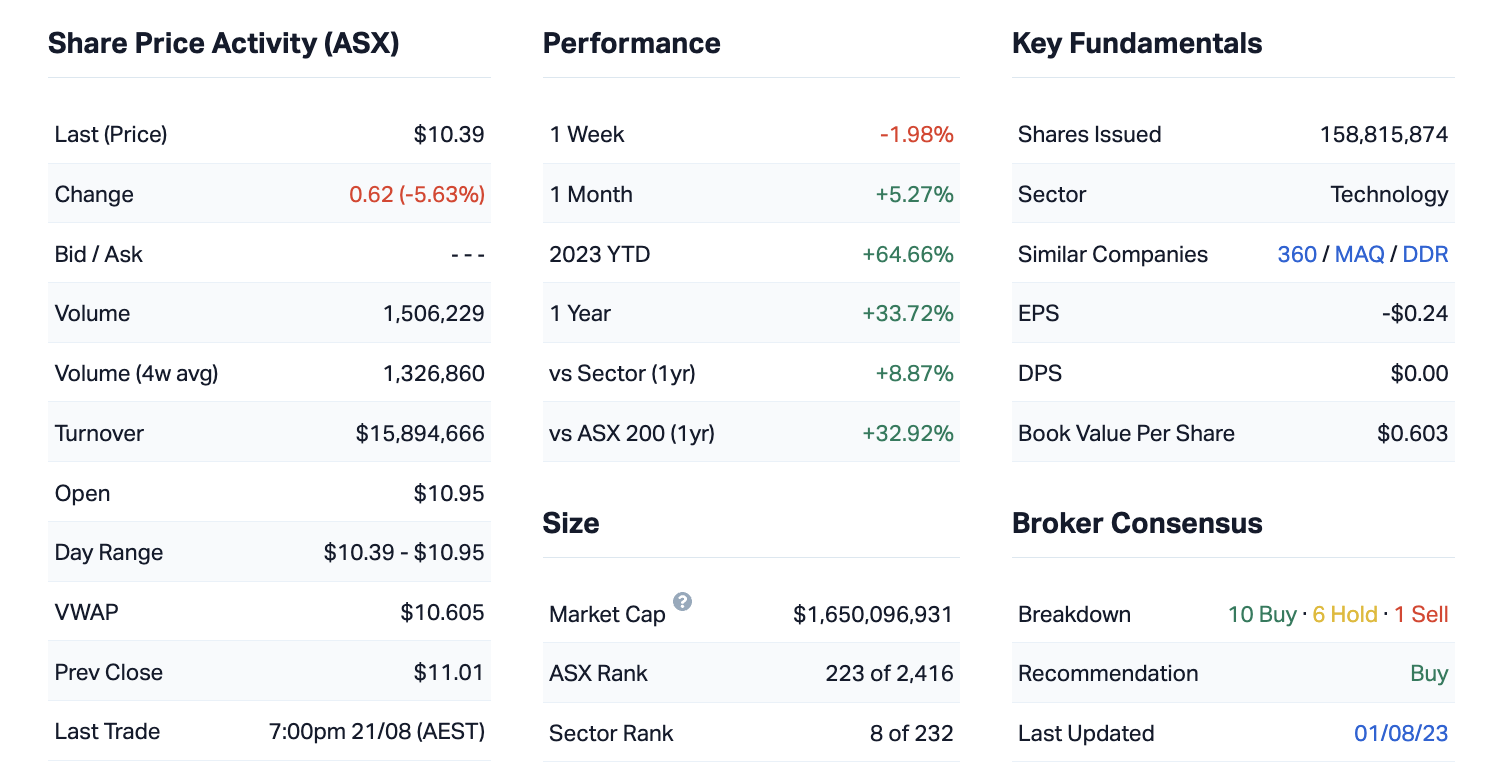

Key company data for Megaport (ASX: MP1)

In one sentence, what was the key takeaway from this result?

The key takeaway for us was the incremental profitability for every dollar of revenue that Megaport will earn in FY24 (guidance implies over 85% EBITDA margins for every incremental dollar of revenue).

What was the market’s reaction to this result? In your view, was it an overreaction, an under-reaction or appropriate?

The market reaction was obviously positive but we believe it was appropriate. This is a business hitting an inflection point in terms of its earnings and profitability.

As they accelerate revenue growth, they should be able to see a much larger impact on the bottom line, especially as revenue growth re-accelerates into FY25 and FY26. So we think it's an appropriate reaction.

Were there any major surprises in this result that you think investors should be aware of?

Megaport already announced previously that it was going to increase its FY24 guidance, so I think the biggest surprise was that they are still able to get that impressive earnings growth even though they're adding 20 additional sales heads. I think that's the key; they can do both. They can add headcount to accelerate revenue at the same time as increasing profitability across the group.

Would you buy, hold or sell Megaport on the back of these results?

Rating: Hold

After today's share price run, we would hold Megaport. We wouldn't be taking our profits here, we like to let our winners run.

What’s your outlook on Megaport and its sector over the year ahead? Are there any risks to this company and its sector that investors should be aware of?

The outlook for Megaport and the sector for the year ahead is positive, in our view. The risks that we see are obviously related to the rapid rise in the stock's share price. There is a risk that the company can't deliver to the increasing expectations of the market.

However, our view around the acceleration of revenue into FY25 and FY26 leads us to believe that there is a lot more positive news and positive catalysts for the market to look forward to. So, we see any weakness or pullback as a buying opportunity.

That said, the sector's future is very much dependent on the trajectory of inflation and interest rate. We want to continue to see inflation ease from record levels - which implies that we don't need to increase interest rates at the rate we did through the calendar year 2022.

From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing on the ASX right now? Are you excited or are you cautious about the market in general?

Rating: 3

I don't want to sit on the fence, but we're seeing a lot more value within the small-cap industrial market which is our bread and butter versus the All Ords benchmark as a whole. We're quite positive on the small-cap industrial market, and expect it to outperform the broader equity market over the next 12 months.

You're seeing signs of that now, with the tech sector rally and some companies exposed to the economy, like Nick Scali (ASX: NCK), Harvey Norman (ASX: HVN) and Premier Investments (ASX: PMV).

The 10 most recent director transactions in Megaport

Catch all of our August 2023 Reporting Season coverage

The Livewire Team is working with our contributors to provide coverage of a selection of stocks this reporting season. You can access all of our reporting season content by clicking here.

4 topics

4 stocks mentioned

1 contributor mentioned