Markets are priced to perfection - but does anyone really know what will happen next?

“Although expectations of the future are supposed to be the driving force in the capital markets, those expectations are almost totally dominated by memories of the past. Ideas, once accepted, die hard.” – Peter Bernstein

If the market does represent the future, US markets have priced in a lot of good news. Undoubtedly, the uncertain outcome of the US Presidential election impacted markets throughout 2024. But, after Trump swept to power, equity markets rallied as he was seen as the more pro-business candidate.

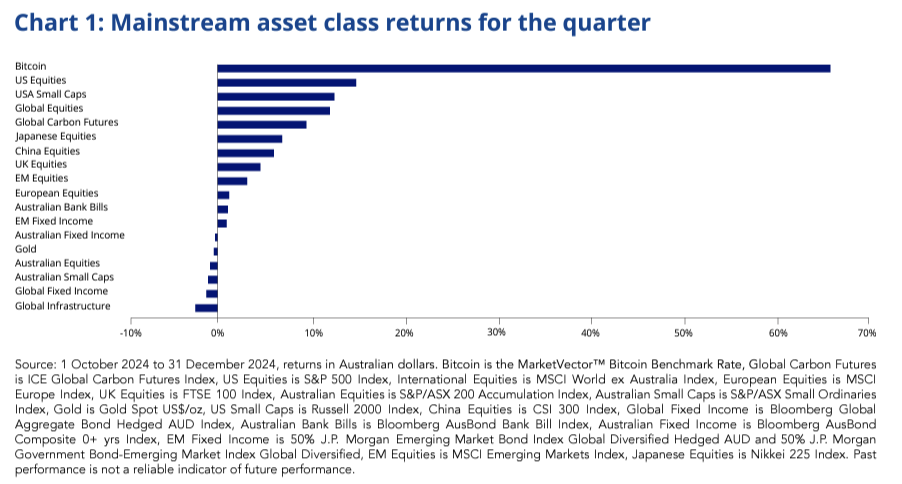

Overall, in 2024, international equity markets, driven by the US have had a strong year. Reflecting the new cycle, US large caps followed by smaller caps both had a strong December quarter, the latter have historically done well following rate cuts made in response to economic weakness.

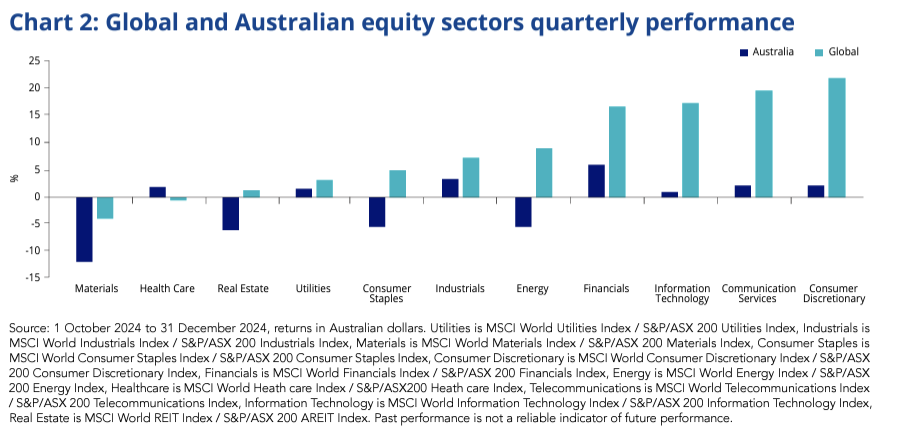

The consumer discretionary, communication services and IT sectors were among the best returning international sectors during the quarter. These sectors were seen as beneficiaries of Trump’s election victory with the rally petering out post the Federal Reserve meeting. Healthcare, on the other hand, seen as a policy target, was the worst-performing sector globally for the quarter.

Cryptocurrencies defied naysayers and affirmed the resilience of risk-on sentiment in an evolving global economic landscape. Bitcoin broke through the US$100,000 mark during the quarter, buoyed by Trump’s pro-digital-currency campaign pledges. But it has not just been risk-on assets that have done well.

Gold, typically associated as a safe haven asset, has also had a stellar year. The gold price had been around US$2,070 per ounce at the start of the year. Now it sits above US$2,600, breaking price records throughout the year.

Closer to home...

Our banks have driven share market returns with financials being the better returning sector last quarter with Australian equities posting a negative result.

While there was initial euphoria for China’s policy changes, it petered out, but Australia’s resources sector could potentially benefit from any kick-start for Chinese growth in the new year. Chinese authorities, rightly, might be waiting for the impact, the depth and the size of Trump’s expected tariffs before deciding how they will approach 2025.

But the reality is no one knows what 2025 has in store.

While the US appears fully priced, we think there are opportunities in equities at the sector, market capitalisation and stock levels. Being selective will be important. In terms of bonds, duration may be a way for investors to add value.

10-year yields have been volatile this year, but with the Fed well into its easing cycle and the market expecting the RBA to start easing in 2025, longer-duration assets may be the place to be, they also tend to be a buffer against shocks.

Emerging markets, both debt and equity complexes, offer a greater risk premia and past structural reforms have resulted in strong relative fundamentals coming to the fore now.

Gold still has many tailwinds, and we continue to think its miners are undervalued and could outperform the yellow metal through 2025.

Famed investor Warren Buffett turns 95 in 2025 and throughout those many years he has “never met a man who could forecast the market.” Neither have we. All we know is that 2025 will be unpredictable. This time last year, we wrote about the coming year saying, “A new wave of opportunities will present themselves and smart money anticipates this.” We enter 2025 with the same carriage.

This is an excerpt from VanEck's first quarterly outlook for 2025

To read the rest of the outlook, download the attached PDF or click through to the following link.