Massive ASX mining stocks review: Aluminium, Copper, Manganese & Nickel

This is Part 2 of a series of articles investigating two massive research reports from major brokers Macquarie and Morgan Stanley detailing changes in their outlooks for several major commodities, and the ASX stocks that produce them.

You can read Part 1 on Iron Ore and ASX Iron Ore Stocks here.

You can read Part 3 on Coal, Gold, Lithium and Uranium and the stocks that produce them here.

Today we’re going to review the brokers’ updates for base metals, so this means aluminium, copper, manganese, and nickel. We’ll also look at each broker’s updated views on key ASX base metals stocks such as Alumina (ASX: AWC), South32 (ASX: S32), Sandfire Resources (ASX: SFR), and Nickel Industries (ASX: NIC) among many more.

Aluminium outlook

Macquarie

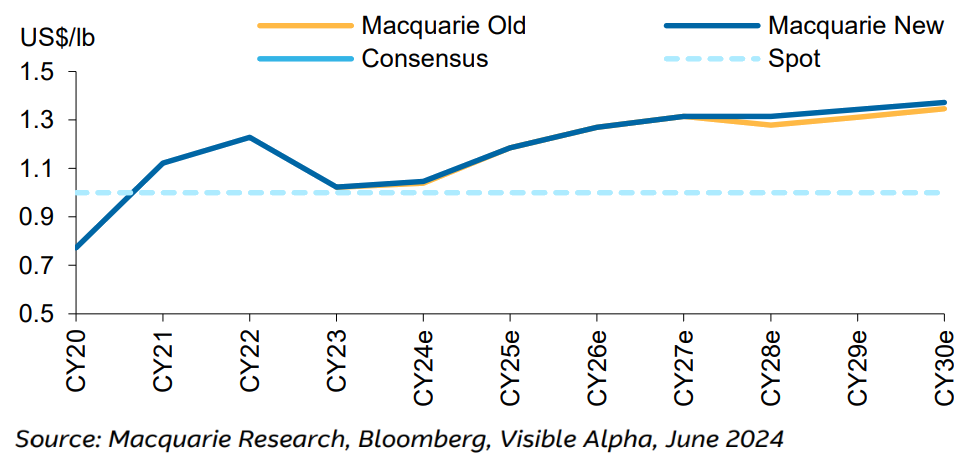

Alumina prices targets have been increased by 13% in 2024, 15% in 2025, and by 18% in the long term. Aluminium increases are more modest, 6% in 2024, 2% in CY25, and 4% in the long term.

Macquarie describes its overall view on aluminium as “overweight”. They note they’re more bullish than consensus estimates by around 3-4% out to 2026, by around 5-6% in 2027-28, and by 11% in the longer term (target US$2600/t by 2030).

For alumina, price target increases are steeper due to price induced supply cuts and unplanned disruptions to refining and bauxite mining. These factors have “tightened the near-term balance”.

Morgan Stanley

Morgan Stanley describes the outlook for aluminium as “compelling”. Cost curves are rising for the first time since 2022, they note, and this “making it harder for European smelters to restart”. This could curtail supply.

On the demand-side, Morgan Stanley points out that Chinese imports of both primary and scrap material remain robust, and that China has been a net importer of aluminium products since September last year. This is “providing scope for upside risk”, the broker says.

Copper outlook

Macquarie

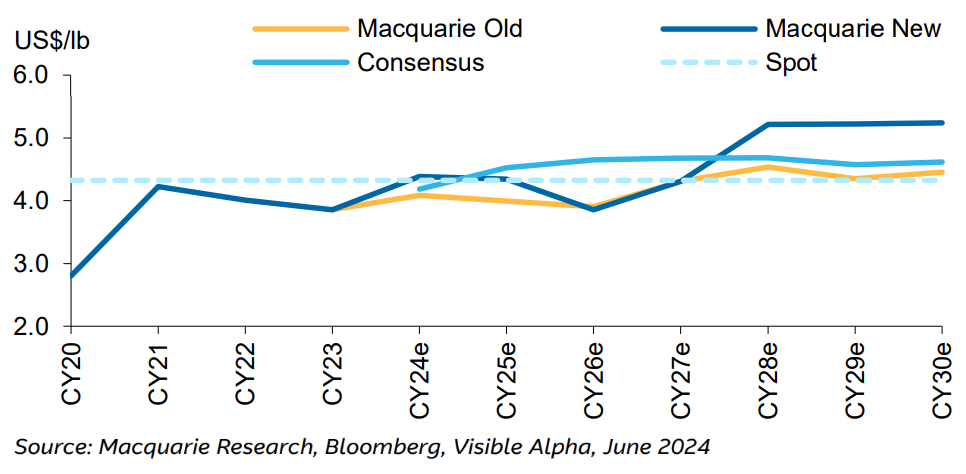

Macquarie describes its overall view on copper as “medium term underweight” and “long term overweight”. They have increased their price targets by 7% in 2024 and by 9% in 2025, citing “supply shortages against a relatively robust demand backdrop”.

Looking further out, to 2026 and 2027, Macquarie is forecasting a supply side response that has led to flat forecasts for prices in those years. The broker notes it is “under the street in the short term” with respect to its forecasts, but above in the longer term.

Macquarie’s 2024 target price stands at US$4.38/lb (versus US$4.43/lb current), and US$9,000/t or US$4.08/lb in 2023 real terms 2030. The broker notes their long term target is 14% above consensus.

Morgan Stanley

Copper supply “continues to be tight” says Morgan Stanley, “driven by demand which continues to accelerate on grid spend”. The broker believes the recent pull-back in the copper price, from around US$5.20/lb to US$4.43/lb, presents consumers with a buying opportunity.

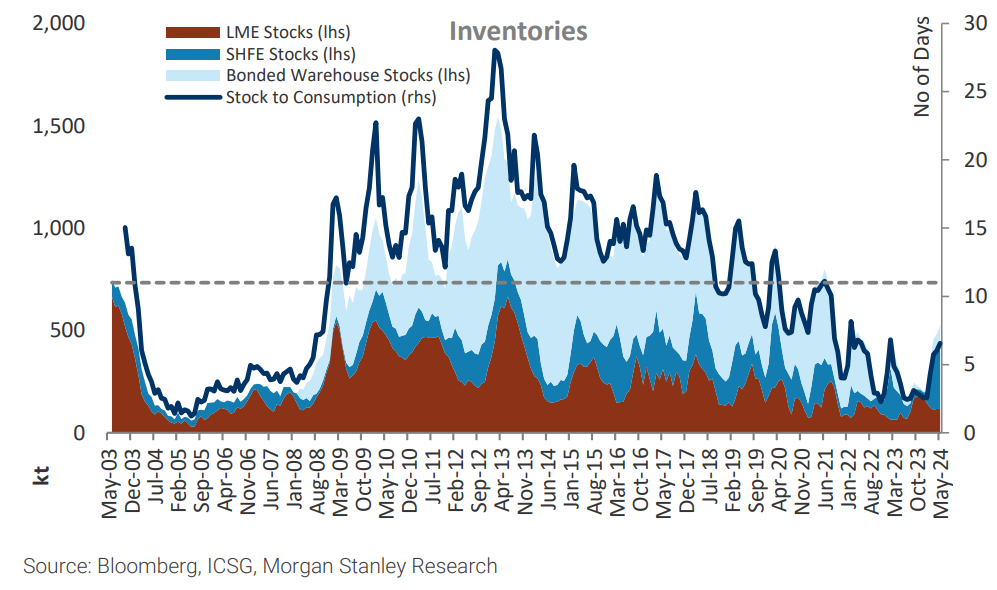

This is due to robust demand fundamentals including higher spending on power grid expansion from China, amidst an environment of “continued supply tightness”. Morgan Stanley notes copper inventories are currently at around 7 days’ supply and this is well below the 20-year average of around 11 days’ supply.

Morgan Stanley’s price targets for copper are as follows: US$4.48/lb in 2024, US$4.65/lb in 2025, US$4.31/lb in 2026-27, US$4.11/lb in 2028-29, and US$4.02/lb in the long term.

Manganese outlook

Macquarie

Macquarie notes that manganese prices have risen due to production issues at major supplier South 32’s GEMCO operation. The broker suggests “tailwinds” should continue for the commodity “over the remainder of 2024”.

Macquarie is forecasting the manganese price will rise from the current US$5.12dmtu to US$7.13dmtu in FY25 before settling back to US$5.50dmtu in FY26, and US$5.00dmtu from FY26.

Morgan Stanley

Morgan Stanley did not provide specific commentary on manganese but did provide the following price targets: US$8.79dmtu in 2024 (+103% vs previous), US$8.75dmtu in 2025 (+75% vs previous), US$5.25dmtu in 2026, US$5.50dmtu in 2027-29 (-3% vs previous in 2029), and US$5.39dmtu in the long term (-1% vs previous)

Nickel outlook

Macquarie

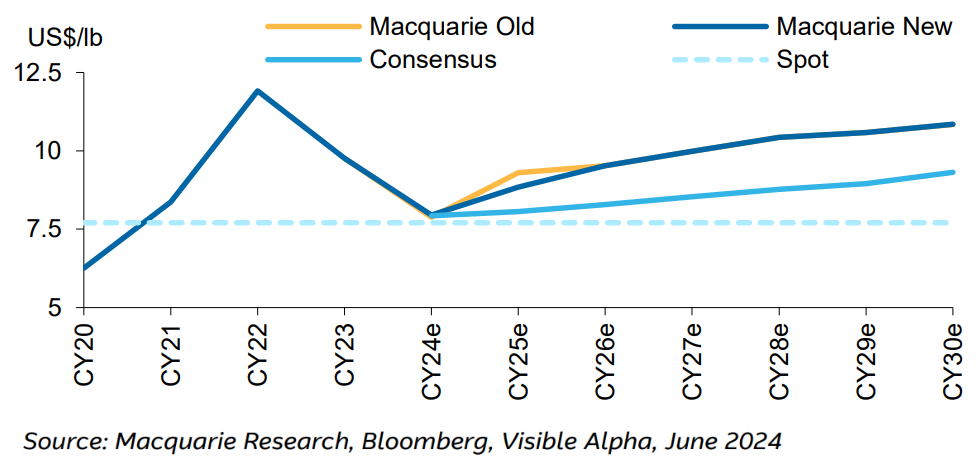

Macquarie describes its overall view on copper as “overweight”. They have increased their 2024 nickel price forecast by 3% to be in-line with consensus. In 2025, their forecast has dipped by 5% to US$19500/t which is 10% above consensus, in 2026-28 their forecast is unchanged at US$21,000-23,000/t which is 15-19% above consensus, and Macquarie’s long term nickel forecast is unchanged at US$20,000/t in 2023 real terms which is around 16% above consensus.

Morgan Stanley

Morgan Stanley did not provide specific commentary on nickel but did provide the following price targets: US$8.79dmtu in 2024 (+103% vs previous), US$8.75dmtu in 2025 (+75% vs previous), US$5.25dmtu in 2026, US$5.50dmtu in 2027-29 (-3% vs previous in 2029), and US$5.39dmtu in the long term (-1% vs previous)

ASX base metals stock ratings and price target changes

29Metals Limited (ASX: 29M)

Macquarie: NEUTRAL | Price Target: $0.47⬇️ vs $0.50

Broker notes price target change is “due to rolling forward our EV/EBITDA to 3QCY25-2QCY26, and altering our assumed equity funding assumptions.”

The broker cites the restart of Capricorn after the severe flooding event as a “key risk to both the upside and downside”

Morgan Stanley: OVERWEIGHT | Price target: $0.55

“We update our model for higher CY24/25/26 copper and CY24/25 zinc prices. In all, CY24-26 EPS estimates increase.”

“We adjust our risk weighting for Capricorn Copper from 100% to 50% and see room for upside driven by derisking of the site as 29M proceeds with measures to re-start the mine”

Aeris Resources (ASX: AIS)

Macquarie: NEUTRAL | Price Target: $0.26⬇️ vs $0.30

Broker has applied a 1-10% EPS uplift in FY24-28 “largely driven by stronger gold outlook”

Broker notes price target change is “due to rolling forward our EV/Ebitda to 3QCY25-2QCY26 in line with the rest of our coverage”

Broker points out that the balance sheet is a “key risk” with the “potential for additional debt or equity if base metals prices don't improve in CY24”

Aurelia Metals (ASX: AMI)

Macquarie: OUTPERFORM | Price Target: $0.27⬆️ vs $0.25

Broker has applied a 5-17% EPS uplift in FY24-28

Broker notes price target change is “mainly driven by earnings upgrades from high gold price assumptions”

Alumina Limited (ASX: AWC)

Macquarie: NEUTRAL | Price Target: $1.40

Morgan Stanley: EQUAL-WEIGHT | Price target: $1.60⬆️ vs $1.30

“Higher alumina, aluminium and bauxite prices in CY24/25/26 drive the increase in EPS,

which in turn pushes up our base case.“

“We are EW as we expect the transaction with Alcoa to be completed in the 2H24”

BHP Group (ASX: BHP)

Refer to broker comments in Part 1.

Carnaby Resources (ASX: CNB)

Macquarie: OUTPERFORM | Price Target: $1.00⬇️ vs $1.13

Broker notes price target change is “due to altering our assumed equity funding assumptions (increased dilution), offset by stronger gold price assumptions”

Broker notes exploration drilling results have the potential to provide “upside risk” to CNB’s base case assumptions

Centaurus Metals (ASX: CTM)

Macquarie: OUTPERFORM | Price Target: $0.70

Broker notes that adverse movements in the nickel price presents the greatest risk to CTM’s earnings and valuation

Broker notes exploration drilling results have the potential to provide “upside risk” to CTM’s base case assumptions

Capstone Copper Corp. (ASX: CSC)

Macquarie: OUTPERFORM | Price Target: $12.80⬆️ vs $12.60

“Our pure-play copper preference is CSC”

“It is a copper producer with a lot to like including organic brownfields/greenfields growth (164kt in CY23 to ~380kt by CY29e, 130% growth), portfolio optimisation potential (Santo Domingo minority selldown & potential divestment of Cozamin), future index inclusion, and strong relative value versus SFR”

Broker’s preference for CSC is due to the company showing an “EV/EBITDA multiple of 4.1x in CY25E (Macquarie forecasts) and 3.7x in FY25e (Spot)”

“CSC has a CY25 FCF yield of 16% which improves to 18% in a spot price scenario”

Broker notes price target change is “driven by a decrease in our WACC”

Iluka Resources (ASX: ILU)

Macquarie: NEUTRAL | Price Target: $7.00⬇️ vs $7.40

“There is minimal EPS changes for ILU, as we have not changed our mineral sand price outlook”

Broker notes price target change is “due to the downgrade to DRR and as we roll our model forward”

“Updates on studies and the Eneabba refinery are key catalysts for ILU”

Morgan Stanley: EQUAL-WEIGHT | Price target: $6.70⬇️ vs $7.00

Broker notes mineral sands forecasts are unchanged, but EPS changes are “driven by updates to AUDUSD. Our base case falls due to model date roll forward”

Jupiter Mines (ASX: JMS)

Macquarie: OUTPERFORM | Price Target: $0.40⬆️ vs $0.35

Broker notes price target change is due to the “strong rally and continue tailwinds in manganese prices”

Lynas Rare Earths (ASX: LYC)

Macquarie: OUTPERFORM | Price Target: $7.00

Morgan Stanley: UNDERWEIGHT | Price target: $4.85⬇️ vs $5.35

“LYC's plan to get to 12ktpa NdPr is well understood, but we think costs could be higher (with consensus underestimating the combined impact of operating in higher cost jurisdictions and with higher mining costs), while further production expansion is likely not a current focus capping potential upside”

“LYC's balance sheet is in a good position even if low NdPr prices remain (net cash 1HFY24 A$514mn), but a capital management surprise is unlikely, in our view, with LYC likely to maintain a protective cash buffer, especially given debt covenants in place”

Nickel Industries (ASX: NIC)

Macquarie: OUTPERFORM | Price Target: $1.10⬇️ vs $1.20

Broker notes price target change is “driven by weaker nickel price outlook in CY25 and rolling forward our EV/Ebitda to 3QCY25-2QCY26”

Morgan Stanley: OVERWEIGHT | Price target: $0.95

“Lower nickel price forecasts for CY24-25e decrease our CY24-25e EPS forecasts”

“We see potential for positive revisions to forecasts on decreasing Ni market surpluses and Ni prices trading above both Morgan Stanley and consensus estimates”

“We see payabilities having the potential to revert to historical averages of the past 5 years; this could be significantly positive”

Rio Tinto (ASX: RIO)

Refer to broker comments in Part 1.

Rex Minerals (ASX: RXM)

Macquarie: OUTPERFORM | Price Target: $0.40

South32 (ASX: S32)

Macquarie: OUTPERFORM | Price Target: $4.50⬆️ vs $4.25

“We prefer S32 over iron ore majors”

“S32 sees 21%/49% upgrades to EPS across FY24/25 with base alumina/aluminium price changes benefiting the base metals focussed name”

“S32 is trading at a suppressed multiple (under our forecast prices)”

“Since our S32 upgrade, we note its share price performance has benefited from the commodity basket, but there are still catalysts to play out”

Morgan Stanley: EQUAL-WEIGHT⬇️ vs OVERWEIGHT | Price target: $3.80⬆️vs $3.35

Rating is downgraded on “valuation” grounds, given recent share price movements to within 4% of broker’s price target

“S32 is mainly affected by changes to aluminium, alumina and manganese. Our increase in FY24-26 for the aforementioned commodities drives an increase in our FY24-26e EPS estimates”

“The majority of S32 assets are well positioned in the the global cost curve and will likely benefit from rising base metal prices however, we see the opportunities as being largely priced-in”

Sandfire Resources (ASX: SFR)

Macquarie: OUTPERFORM | Price Target: $11.20⬆️ vs $10.80

Broker notes price target change is “driven by earnings upgrades from higher silver, zinc, and lead prices”

Broke upgrades SFR’s EPS forecasts by 2-6% in FY24-FY28, “buoyed by 5-11% upgrades in our silver price outlook during CY24-CY28 and a 9% lift in our LT real silver price outlook of US$22.50/oz”

Morgan Stanley: EQUAL-WEIGHT | Price target: $8.25⬇️ vs $8.40

Broker notes that increases in its FY24-26e copper price forecasts drive increases to SFR’s FY24-26e EPS forecasts

“Whilst we forecast an improving balance sheet on lower gearing levels, higher FCF's by FY25e and potential for improvement at MATSA operation we see the stock fairly pricing this in”

“Catalysts include any improvement in energy prices (and costs at MATSA) thanks to softening gas prices, successful build and ramp-up at Motheo, and operational stability”

This article first appeared on Market Index on Tuesday 25 June 2024.

5 topics

15 stocks mentioned