Medtech Companies Gained 45.6% in FY15, And A Strong FY16 Expected

Stockbroker

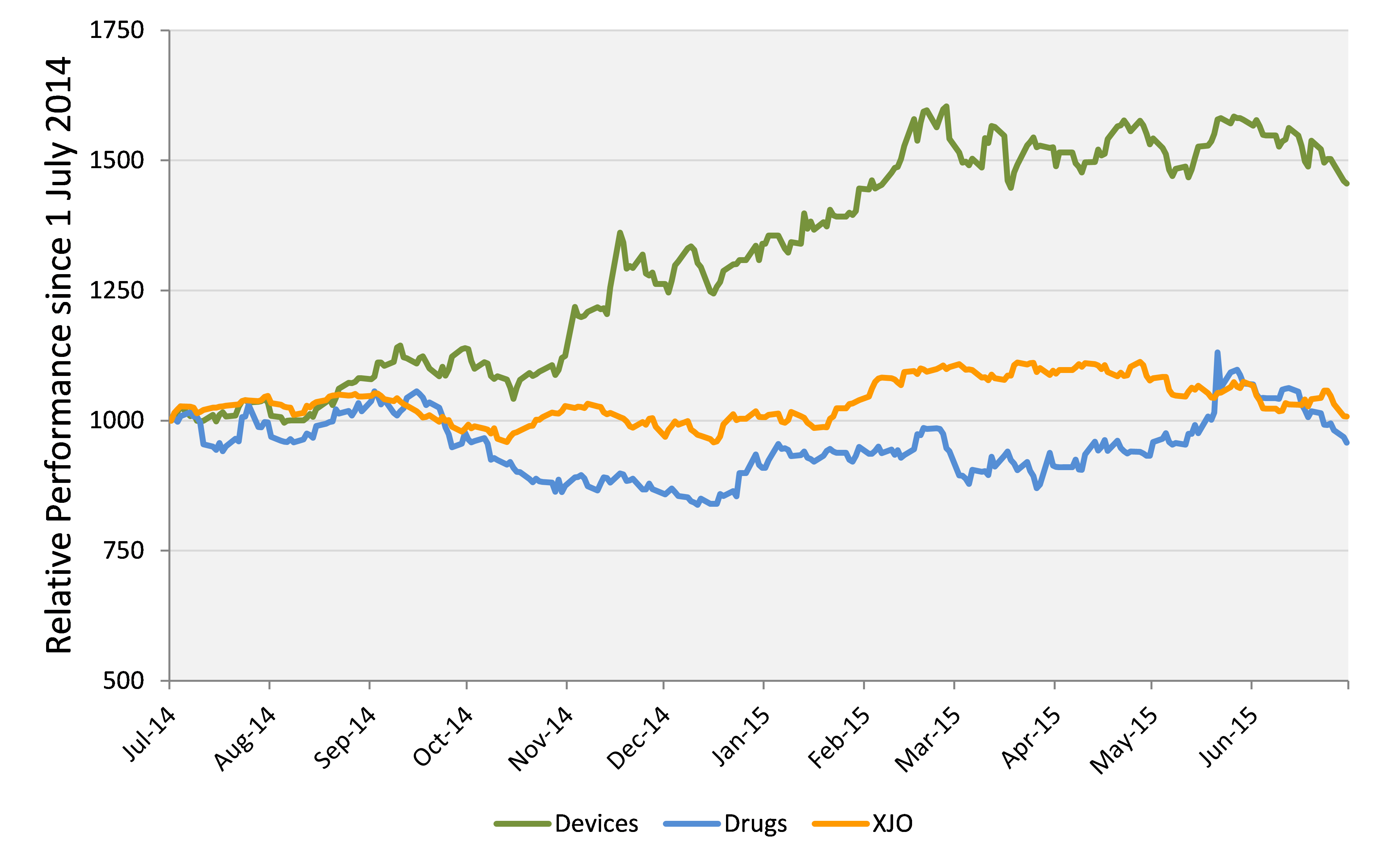

MEDTECH 'SECTOR' (GREEN) VERSUS XJO (ORANGE) AND DRUG COMPANIES (BLUE)

It is worth highlighting the divergent performance of medtech and drug companies. While medtech gained 45.6%, an equally weighted index of 25 ASX-listed drug-development companies was down by 4.3%.

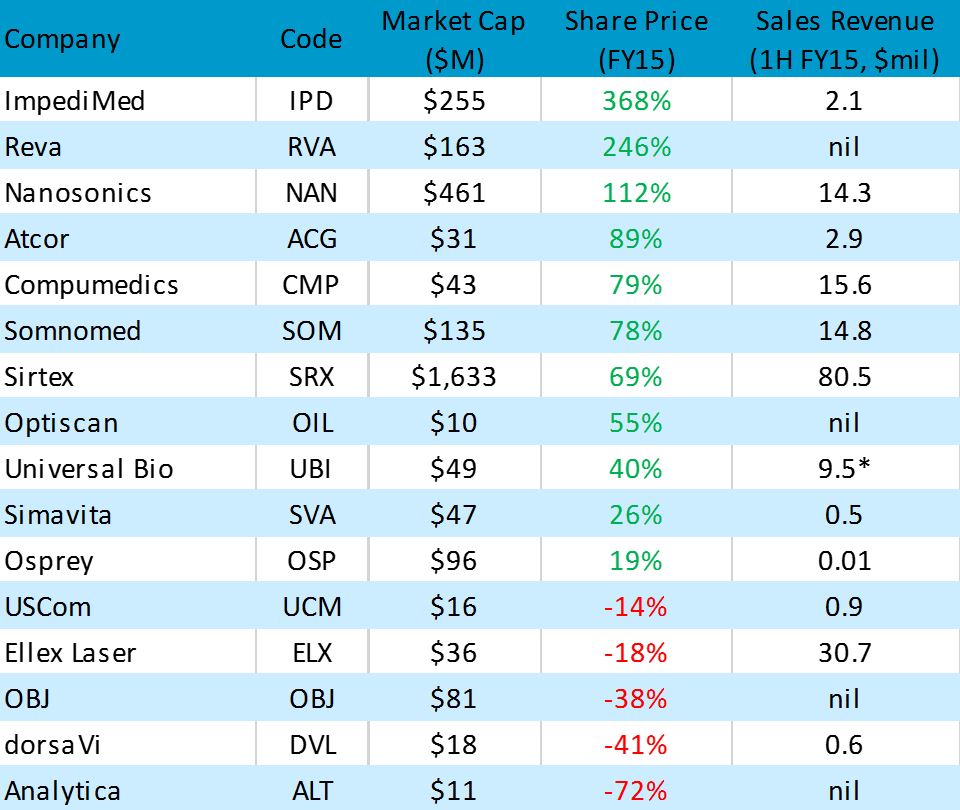

As demonstrated in the table below, eleven of the sixteen ASX-listed medtech device companies saw share price gains during FY15, with three posting gains excess of 100%. Notably, the companies with better performances were generally those in the early or mature stages of revenue growth.

FY15 PERFORMANCE OF MEDICAL DEVICE COMPANIES

Structural drivers continue to support the thematic

We believe the structural drivers that have supported this strong performance are still in play. These include:

- Commercial demand for products that reduce healthcare costs

- Gross margins that are typically in excess of 80%

- Relatively low regulatory risk

- Policy changes focused on improving hospital performance or establishing a standard of care

- Underlying technology platforms underpin the next generation of products, and new products

- Medtech products often generate revenue within three years of listing (unlike biotech)

- Broader investor engagement achievable because the function of products is easier to articulate

- Ongoing demographic shift, and related increase in medical costs.

Products that reduce healthcare costs

Some of the more successful ASX-listed medtech companies are leveraging structural changes emerging in the healthcare landscape. A key driver in Canaccord’s stock selection has been to harness the commercial demand for products that reduce healthcare costs. While healthcare economics have always played an important part in the adoption of new technologies, there is an increasing focus on reducing healthcare costs through prevention.

With the Accountable Healthcare Programs in the US, hospitals are required to cover the cost of treating any new conditions that develop as a during the course of a patient’s treatment, such as hospital-acquired infections. Hospitals now receive penalties for patients that are readmitted within 30 days of discharge. Any product that lowers the incidence of hospital-acquired complications are likely to see strong adoption. Hospital performance is closely monitored on these metrics, and we expect there will be strong demand for products that assist with outperformance relative to peers.

Three of the Medtech companies that Canaccord covers, Nanosonics (NAN), Impedimed (IPD), and Osprey (OSP), produce devices that will help hospitals improved patient management, as well as meet the goal of improving hospital performance.

Three ASX-listed Medtech stocks best positioned to leverage the thematic

NANOSONICS LIMITED (ASX-NAN | MARKETCAP: A$473M | PRICE: A$1.70 | RATING: BUY | TP: A$2.20)

Nanosonics has a propriety system that allows high-end medical equipment to be rapidly and effectively disinfected at a relatively low temperature of 60°C. This makes it suitable for sensitive equipment that can’t be used by conventional autoclaves. NAN’s first product is trophon, which disinfects ultrasound probes. Trophon and the associated consumables generated sales of $14.3M, and a net profit of $1.2M in H1 HY15. We expect significant sales growth in the next 12-18 months as the company starts selling directly in the US, alongside distribution partner GE, as well as expanding in other geographic markets. The issue of reprocessing of medical equipment has come to the fore in the US after hundreds of patients were infected, and several deaths occurred, from a superbug transmitted by ineffectively disinfected duodenoscopes. Furthermore, a recent study has shown that trophon is the only system shown to kill the Human Papilloma Virus (HPV), the leading cause of cervical cancer. We believe this could drive sales in the gynaecological clinic market, which Nanosonics does not yet service. You can access Canaccord’s full reseach here (VIEW LINK)

IMPEDIMED LIMITED (ASX-IPD | MARKETCAP: A$254M | PRICE: A$0.83 | RATING: BUY | TP: A$1.82)

Impedimed uses a proprietary technology called Bioimpedance Spectroscopy (BIS) which can rapidly and non-invasively establish a person’s tissue composition, i.e.: the proportion of fluid, muscle, fat and bone. IPD’s first product is the L-Dex, which is able to detect potential onset of lymphoedema. This is an irreversible build-up of fluid in the limbs which occurs in 20%-30% of cancer patients. L-Dex is fully approved in the US, EU and ANZ. Last year it secured a dedicated Category-1 CPT code that provides Medicare reimbursement of US$112 per test. In the US, approximately 700,000 – 900,000 new patients are treated for cancers that carry a risk of lymphoedema, and based on current clinical protocols, these patients are likely to be monitored for lymphedema 12-17 times in the 5 years following their cancer treatment. A recent study reported that providing intervention following the detection of sub-clinical lymphoedema using L-Dex, could drastically reduce the proportion of patients progressing to clinical stage disease from 36.4%, to 2.8%. Some studies have reported that patients with clinical stage disease can have additional annual treatment costs of $8,000 - $16,000 per annum. More recently, the National Comprehensive Cancer Network (NCCN) has included a requirement for cancer survivors to be monitored for lymphoedema and treated. The NCCN guidelines are seen as the gold standard for cancer care, and are followed by the majority of leading cancer centres. As the existing methods (tape measure and water displacement) take a long time and are not sensitive enough, we see the NCCN guidelines as a major driver for adoption of IPD’s L-Dex. You can access Canaccord’s full reseach here (VIEW LINK)

OSPREY MEDICAL INC (ASX-OSP | MARKETCAP: A$101M | PRICE: A$0.60 | RATING: BUY | TP: A$1.50)

Osprey has developed an elegant way of reducing the amount of contrast (the dye used to visualise blood vessels in X-rays) used during cardiovascular procedures. With a simple pressure modulation system, the ‘AVERT’ system is able to reduce the amount of dye used by up to 40% without affecting the quality of the image. This is important because contrast dye is toxic to the kidneys and can cause further, permanent kidney damage in the 25% of patients having a cardiovascular procedure that have pre-existing kidney disease. This can result in a poorer long-term prognosis for the patient, and additional treatment costs of up to $15,000 that are borne by the hospital. Given the established correlation between dye-dose and risk of kidney damage, reducing the amount of dye given to patients by 40% should lead to a significant reduction in both the incidence and severity of kidney disease. A recent, independent study reported that hospital-acquired acute kidney damage was associated with higher rates of readmission to hospitals within 30 days of discharge. Exposure to contrast dye is the third most common cause of hospital-acquired infection. As hospital readmissions are estimated to cost the US healthcare system US$26B, of which US$17M is believed to be preventable, for the last 3yrs Medicare have been monitoring readmission rates and penalising hospitals with rate that are too high. This year, 2,610 hospitals (75% of those monitored) were penalised with cuts to their Medicare funding of up to 3%. To avoid these revenue penalties, hospitals will focus on lowering their 30-day readmission rates, and one way to achieve this will be by minimising contrast dye given to patients. You can access Canaccord’s full research on Osprey here (VIEW LINK)

Canaccord Genuity (Australia) Limited:

|

Sydney: |

Level 26, 9 Castlereagh Street, Sydney 2000 |

Ph: +61 2 9263 2700 |

|

Melbourne: |

Level 4, 60 Collins Street, Melbourne 3000 |

Ph: +61 3 8688 9100 |

For important current disclosures in relation to financial products mentioned in this note, please visit our Online Disclosure Database at (VIEW LINK). For more information, please contact disclosures@canaccordgenuity.com

DISCLAIMER: SALES COMMENTARY ONLY, NOT FORMAL RESEARCH.

DISCLOSURE: The author and his associates may have a material interest in some of the securities mentioned in the paper.

Canaccord Genuity (Australia) Limited and its related entities (“Canaccord”), its Directors and/or employees may earn brokerage, fees, commissions and other benefits as a result of a transaction arising from any advice mentioned in this report. Canaccord as principal, its Directors and/or employees and their associates may hold securities in the companies the subject of this report, as at the date of publication. These interests did not influence Canaccord in giving the advice contained in this report. Details of any interests may be obtained from Canaccord. Canaccord has not been in receipt of any fees for the preparation or publication of this report. Canaccord seeks to do business with the companies outlined in this report and as such cannot be considered independent.

Disclaimer: All information, terms and pricing set out in this document is indicative, based on, among other things, market conditions at the time of this writing and is subject to change without notice. This document is for informational purposes only and is neither an offer to sell securities, or other financial products nor a solicitation of an offer to buy securities, or other financial products. Canaccord and each of their respective directors, officers and agents (together the Disclosers) have prepared the information contained in these materials in good faith. However, no warranty (express or implied) is made as to the accuracy, completeness or reliability of any statements, estimates or opinions or other information contained in these materials (any of which may change without notice) and to the maximum extent permitted by law, the Disclosers disclaim all liability and responsibility (including, without limitation, any liability arising from fault or negligence on the part of any or all of the Disclosers) for any direct or indirect loss or damage which may be suffered by any recipient through relying on anything contained in or omitted from these materials. Any reader is strongly advised to make their own enquiries and seek independent professional advice regarding information contained in these materials. In no way shall Canaccord be deemed to be holding itself out as a fiduciary of the recipient hereof. The recipient must independently evaluate any investment which include the tax, legal, accounting and credit aspects of any transaction.

Financial products and trading strategies of the type described herein may involve a high degree of risk, and the value of such financial products may be highly volatile and may be adversely affected by the absence of a market to provide liquidity. To the extent that this document includes any financial product advice, the advice is of a general nature only and does not take into account any individual’s objectives, financial situation or particular needs. Before making an investment decision an individual should assess whether it meets their own needs and consult a financial advisor, the product disclosure statement, prospectus and/or available research in respect of the financial product. Canaccord does not make markets in the financial securities referred to in this document. Canaccord and its directors and employees may hold such financial securities and may, as principal or agent, buy or sell such financial securities.

Copyright 2014 © Canaccord Genuity (Australia) Limited. All rights reserved. This material is proprietary to Canaccord and may not be disclosed to third parties. Any unauthorised use, duplication or disclosure of this document is prohibited. Canaccord Genuity Wealth Management is a division of Canaccord Genuity (Australia) Limited. The content has been approved for distribution by Canaccord Genuity (Australia) Limited ABN 19 075 071 466 holder of AFS Licence No 234666.

6 topics

Canaccord Genuity Group is a leading independent, full-service financial services firm. Canaccord Genuity has been driven by an unwavering commitment to building lasting client relationships. We achieve this by generating value for our individual,...

Expertise

No areas of expertise

Canaccord Genuity Group is a leading independent, full-service financial services firm. Canaccord Genuity has been driven by an unwavering commitment to building lasting client relationships. We achieve this by generating value for our individual,...

Expertise

No areas of expertise