Meet Jim: The investor sailing through his retirement

Jim, like many of our readers, spends his days investing and thinking about markets. But unlike many, he does it aboard a boat.

Jim and his wife, Adriana, have been living their retirement dreams aboard their yacht, a Swanson 42, for about six years now. A few years ago, after selling their business, they decided to establish a self-managed super fund (SMSF) to help buoy their capital for a cruisy retirement.

Since then, Jim has thrown the anchor down and settled in for a crash course in investing. He's navigated one market crash, sailed through stormy markets, and now is fishing for opportunities in the smaller end of town.

His first objective was to manage risk and remains so. He describes himself as risk-averse and careful, and reveals he can spend up to 40 hours a week researching markets and individual companies themselves.

But that's not to say that Jim is ready to rest on his laurels. He notes that both equities and debt markets are currently in uncharted territory - after all, nearly 80% of all USD ever created was "printed" in the last 22 months. And still, "nothing fundamental makes sense," Jim says.

In this Meet the Investor profile, Jim shares how he is currently positioned with this in mind, as well as the biggest lesson he has learnt from his relatively short time in markets.

Livewire investor profile

- Name: Jim

- Age: 64

- Employment status: Retired (for now)

- Years investing: 4 years

- Investment goals: To build more capital for a comfortable retirement

- Products used: Shares and derivatives

- Biggest portfolio holding: Vital Metals (ASX: VML)

.jpg)

How old are you and how long have you been investing?

I am 64 and have been investing for four years. I started after I came into a considerable amount of money after selling my business in 2018. We could either purchase another business or invest in a passive asset like property. But at the time, I wanted the flexibility and we dreamed of travelling around Australia on the boat. We didn't necessarily want to retire, but we wanted a break.

I think back then, interest rates were considered pretty bad - they were around about 2% - so putting money in the bank wasn't going to get us very far. And I was hesitant to put the money in a traditional super fund, as from my research, I expected a correction at any time. In the beginning, we kept a lot of cash and kept to gold miners and other precious metals and we managed to do ok.

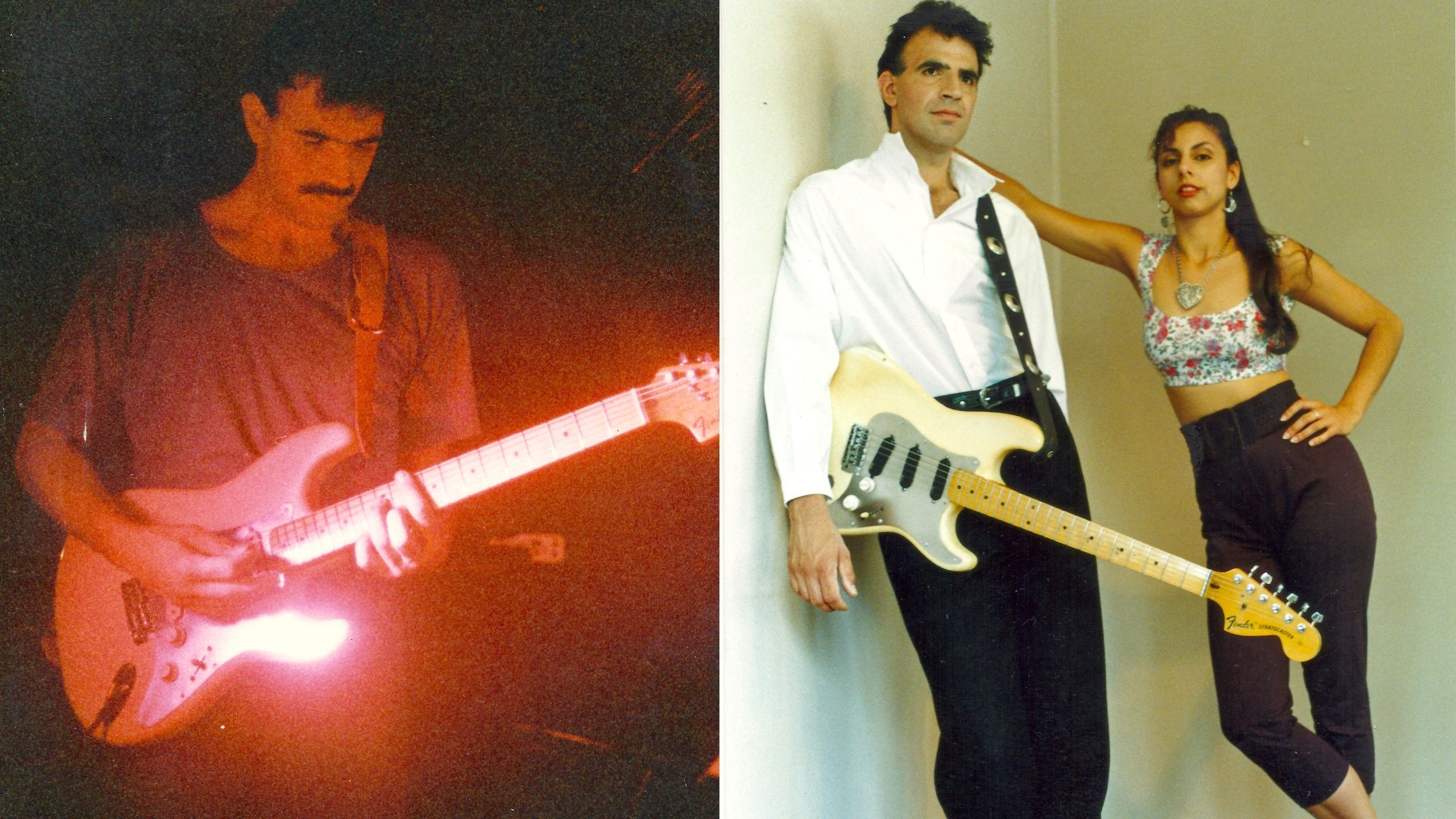

Long before this, I was a mechanical engineer and afterwards, I worked with my wife, Adriana, full-time in the music industry touring the East Coast of Australia. In 1985, I returned to the regular workforce after we had our first child, Jason. I completed an MBA at Macquarie Graduate School of Management (Macquarie University) whilst working in the corporate world at about age 50. So I have always been interested in businesses.

At the time, we had about $70,000 of studio equipment in our home studio (which was a lot of money back then) and so we sold most of it expecting to start another studio when Milly was a few years old, but we got into sailing instead and haven’t looked back.

.jpg)

What is your objective from investing? What is your appetite for risk? Are you still working?

I previously worked as part of the senior corporate management of a global business and was responsible for marketing in the Asia Pacific region. After that, I operated multiple retail businesses offering digital design and print solutions. In 2018, we sold the retail businesses to an Asia-based investment group looking to diversify from their core portfolio (which was oil and gas investments). My wife and I then decided to semi-retire with the intention of travelling on our yacht which we had owned since 2004.

Since I needed an income source that would allow me to work wherever we were, we decided to establish an SMSF to invest and manage the proceeds from the business sale. Prior to establishing the SMSF, I had opened a personal trading account to learn as much about trading using small position sizes.

My first objective was to manage risk. So that was really around position sizing and being very cautious about what type of investments we made.

The market is so crazy at the moment. It has been since COVID. Nothing makes sense. Nothing fundamental makes sense. The Fed has been printing sh*tloads of money and it's been flowing into equities, but at some point that has to collapse, because the economy just doesn't work like that.

So I would say I am risk averse. I do the research. I'm very careful. And if I buy something, it's because I believe in it. I probably spend 40 hours a week researching companies and markets, that is, when I am not renovating the boat.

What products do you use to execute your strategy?

Currently, I am invested about 80% in shares, 5% in derivatives and 15% cash, however, we have also invested in ETFs, and retail and commercial property trusts at times.

How would you describe your strategy?

When I started the SMSF, the S&P 500's P/E Ratio was already at its upper band and going vertical so the prospect of a large correction was already forefront on my mind. But of course, I had no idea what was coming. Luckily, we came through the first year (2020FY) and the COVID crash with a 20% return.

As time has progressed, our portfolio has diversified from primarily investing in the larger cap stocks, ETFs, and property trusts, to looking at opportunities in small caps, and even some micro-cap stocks - however, I am still very cautious with position size.

Currently, we’ve invested about 30% in precious metals, 25% in rare earths, 15% in cybersecurity, 10% in other battery/renewable energy industry metals such as lithium, copper, nickel, and graphite, and 5% in energy (but only gas).

I am trying to get an entry into potash. I did make an entry into Agrimin (ASX: AMN) but sold out after I found the charts within my trading platform did not agree with the other trade history data within the trading platform. I am quite risk averse, so a bit of a nervous Nellie when I start a position, and so ran for the hills, after which the stock shot up nearly 50% the following week!

I previously held a large position in BHP (ASX: BHP) and looking to rebuild another position as I like their future commodities strategies, particularly their potash strategy, as an exposure to agriculture.

What are your top holdings in percentage terms? Why do you hold each of these positions?

Northern Star Resources (ASX: NST) - 15% - I held investments in Saracen and NST when they merged. I had expected that in due course the synergy from the merger would reflect more in the single (NST) company’s valuation but the lesson learned was that stock prices are always mostly forward looking and so, any synergistic benefit was already priced in for both companies share prices before the merger. I believe NST is one of the better precious metals companies in Australia and consider it a cornerstone investment.

Regis Resources (ASX: RRL) - 15% - I have owned and traded RRL since the inception of the SMSF. The acquisition of Tropicana affected the share price, as have the delays in the McPhillamys Gold Project. The current gold price in USD is on par with the last time RRL’s share price was trading 45% higher (June 2021). Gold miners globally have been oversold and additionally, RRL has the burden of short interest on about 7.7% of the register. I am down about 35% on this investment but will continue to hold. Shaw & Partners' 12-month price target is $3.10. In the meantime, the dividend is expected to be circa 3.5% plus franking, to deliver around 5% total ROI at market value, or just under 3% ROI at my cost – so better than bank rates.

Vital Metals (ASX: VML) - 15% - Held since June 2020. I made an entry to a number of rare earth companies around the same time and took profits on the others but retained and added to VML. Finding a rare earth resource is one thing, but bringing it to production is another and VML’s management has the experience to do just that. So far, they have not put a foot wrong in my view. The MD, Geoff Atkins, was previously corporate planning manager for Lynas Rare Earths. Geoff’s background added to the quality of their resource, the jurisdiction, and VML’s relationship with REEtec (for downstream rare earth processing) places them in a somewhat unique position as one of the first non-China based suppliers of both light and heavy rare earths.

Ionic Rare Earths (ASX: IXR) - 10% - Held since May 2021. I wanted to invest in IXR but was a latecomer and couldn’t find an entry point until May 2021, when the price crashed due to a negative market reaction to a scoping study. I looked into the scoping study and felt the price drop was not justified, so made the decision to invest. I traded in and out for a few weeks until I established a holding I was happy with and the price started to recover. I regret not having kept the full holding at the time but sold 50% as part of my risk management.

Archtis (ASX: AR9) - 15% - Started a position in June 2020 on the day the government announced a massive increase in cybersecurity investment. They offer a suite of arguably the best security solutions for document collaboration, up to top secret level for government, defence, industry, etc. Their NC Protect and Kojensi solutions won eight Gold Product Awards in the 2022 Cybersecurity Excellence Awards in the categories of Access Control, Application Security, Data-Centric Security, Data Security Platform, Data Leakage Prevention (DLP), and Insider Threat Solution, and a Silver Industry Solution Award for Government. In my view, their strategy of building significant sales channel staff and partnerships globally, to deploy their solution with partners like Microsoft, SAP and Thales, will reap huge rewards.

Vital Metals. I invested in it early, and they keep hitting the runs on the board. They don't over-promise, they just keep delivering. As mentioned above, I invested in this position in June 2020 and continued to add to this position up until the end of that year. If there is another market correction that affects this stock, I may consider adding to my investment again.

Could you tell me about your worst investment?

In July 2019, Rural Funds Group (ASX: RFF) crashed 33% after a critical report by short selling firm, Bonitas Research. It was eventually refuted by an Ernst & Young Report and the stock recovered but I sold at the low - I should have stuck it out!

How do you go about dealing with losing positions?

I generally look for stocks to invest in for the longer term, and I’ll only qualify a stock to invest in if the chart shows a very good entry point, after which I will do quite a bit of research on the company, the macro environment, trends, etc. Once I’m in, I will continue to closely monitor the trading patterns, volume, etc., and manage the position going forward accordingly.

Since position sizing upon entry is usually small, if the share price goes lower I may make the decision to average down and then reduce size again on a swing. I will only do that after a lot of consideration and scenario analysis.

If my conviction is not strong enough I’ll exit the position. Once I start to get more confidence in the company and share price direction I may continue to add, at opportune times, to establish a larger position. I try not to overtrade but will normally reduce a position size immediately if I choose to average down, so as to manage risk related to position size.

How does Livewire help with your investing process and what tips can you share with other investors about using Livewire?

As a one-man band investor, the opinions and insights of the contributors can help make sense of the equity markets or a particular stock. As an example, I recently opened a position in Sandfire Resources (ASX: SFR). I thought I had a good entry but the price went ‘south’ on no news, before shooting back up nearly 12% a few days later on the 28th April, the day of their quarterly report.

The article by Barry Fitzgerald on the 29th covering Sandfire helped me to better understand Sandfire’s price action over that period.

The ‘The Decarbonisation 2022 Megatrends Series’ is great for identifying opportunities at an early stage. The Buy Hold Sell interviews, where experienced fund managers can often put forward differing views of a stock, provides different perspectives and insights from investing professionals. The ‘Trending on Livewire’ section is also a great filter for identifying what investors are interested in and thus what may be important for me.

What can Livewire do better or what do you dislike about Livewire?

I think given how Livewire is positioned within the advice market they do a pretty good job. As an investor, there is never enough time to keep up with the daily permutations of the overnight markets, in other words, how they will affect the local markets etc., so perhaps a morning highly condensed section that summarises the overnight action and the probable implications for the local markets/sectors would be advantageous.

Do you have a favourite contributor you recommend other investors follow?

I don't have any favourites off the top of my head, but I usually enjoy pieces by James Gerrish and Barry Fitzgerald.

Is there a lesson you’ve learned as an investor that could help others?

The more work you do, the more you read, the more you learn about trading and the macro and micro environment you’re dealing with - the probability of you making better decisions increases.

Secondly, make it a priority to avoid large losses, and for those longer-term investments, you’ll sleep better at night through those inevitable corrections if you really believe in the company.

Is there a topic that you want fund managers to write about?

The current equities and debt markets are in somewhat uncharted territory, given that nearly 80% of all USD ever created were ‘printed’ in the last 22 months. How does one navigate such an environment? My thoughts on this are reflected in the construction of our portfolio but would like to read more views on this subject.

Can you share a personal passion or ambition you have for your future?

My wife and I have had our cruising ambitions curtailed by the pandemic, however, we are re-grouping this year and hope to resume our travels next year. We'd like to sail around Australia first, and then see as much of the world as possible.

Looking ahead, to achieve that we will need to succeed in our strategy of building more capital through active investing and migrating the portfolio to lower beta holdings, more focused on dividend return.

.jpg)

Enjoying Livewire's Meet the Investor series?

If you enjoyed hearing about Jim's investing journey, please give this wire a 'like', and if you know someone who might enjoy the article, why not send them the link.

You can access more of our Meet the Investor interviews by clicking here.

We are looking forward to hearing from more of our readers in 2022. If you are interested in being profiled in our Meet the Investor series, contact us using the email address below:

content@livewiremarkets.com

2 topics

9 stocks mentioned

2 contributors mentioned