Michael Burry pays the price for shorting the S&P 500

Short investing is, at the best of times, a dangerous game. It can lead to humongous profits, as it did for Michael Burry in 2008 when he correctly predicted the American real estate bubble would crash. But it can also lead to huge losses, as it has done for Burry in the last few months.

Three months ago, his 13F filing showed that Burry had bought more than $1.5 billion in put options, betting the S&P 500 and NASDAQ would fall sharply. In the intervening period, he has closed that position - apparently at a 40% loss. While there is some nuance to this story (including the fact that the $1.5 billion figure is actually the notional value of the short and not the actual amount of money at stake), it still proves how risky shorting assets can be.

Not that this has deterred Burry. He's already found his next target - and it's no small fish either.

In this wire, the second in the latest 13F series, we'll look at Burry's latest short target - as well as some of his individual long positions.

Burry's top five buys

| Name | Stock Code | % of Portfolio |

| iShares Semiconductor ETF (short) | NASDAQ: SOXX | 47.86% |

| Booking Holdings | NASDAQ: BKNG | 7.79% |

| Stellantis NV | NASDAQ: STLA | 7.4% |

| Nexstar Media Group | NASDAQ: NXST | 6.9% |

| Star Bulk Carriers | NASDAQ: SBLK | 4.68% |

Burry's top five sells

| Name | Stock Code | % of Portfolio sold |

| SPDR S&P 500 ETF | ASX: SPY | -51.05% |

| Invesco QQQ Trust | NYSE: QQQ | -42.54% |

| Expedia Group | NASDAQ: EXPE | -0.63% |

| Charter Communications | NASDAQ: CHTR | -0.53% |

| Generac Holdings | NYSE: GNRC | -0.47% |

For the full list of stocks, go to 13F.info, where you can also find comparisons between each quarter. As always, 13F filings only mandate the declaration of long positions and the filings don’t require investors to reveal the price paid, strike price or expiration date of options purchased.

Insight #1: Burry's big losses

Although investors are only required to disclose their long positions, Burry is one of those who offers insight into his short positions as well. In the second quarter of 2023, Burry's Scion Asset Management bought four million put options in the SPDR S&P 500 ETF Trust and the Invesco QQQ Trust.

Put options are used by investors to sell an underlying asset by a set time for a set price. Puts can be used as a hedging strategy, but they can also be used as bets against a downturn.

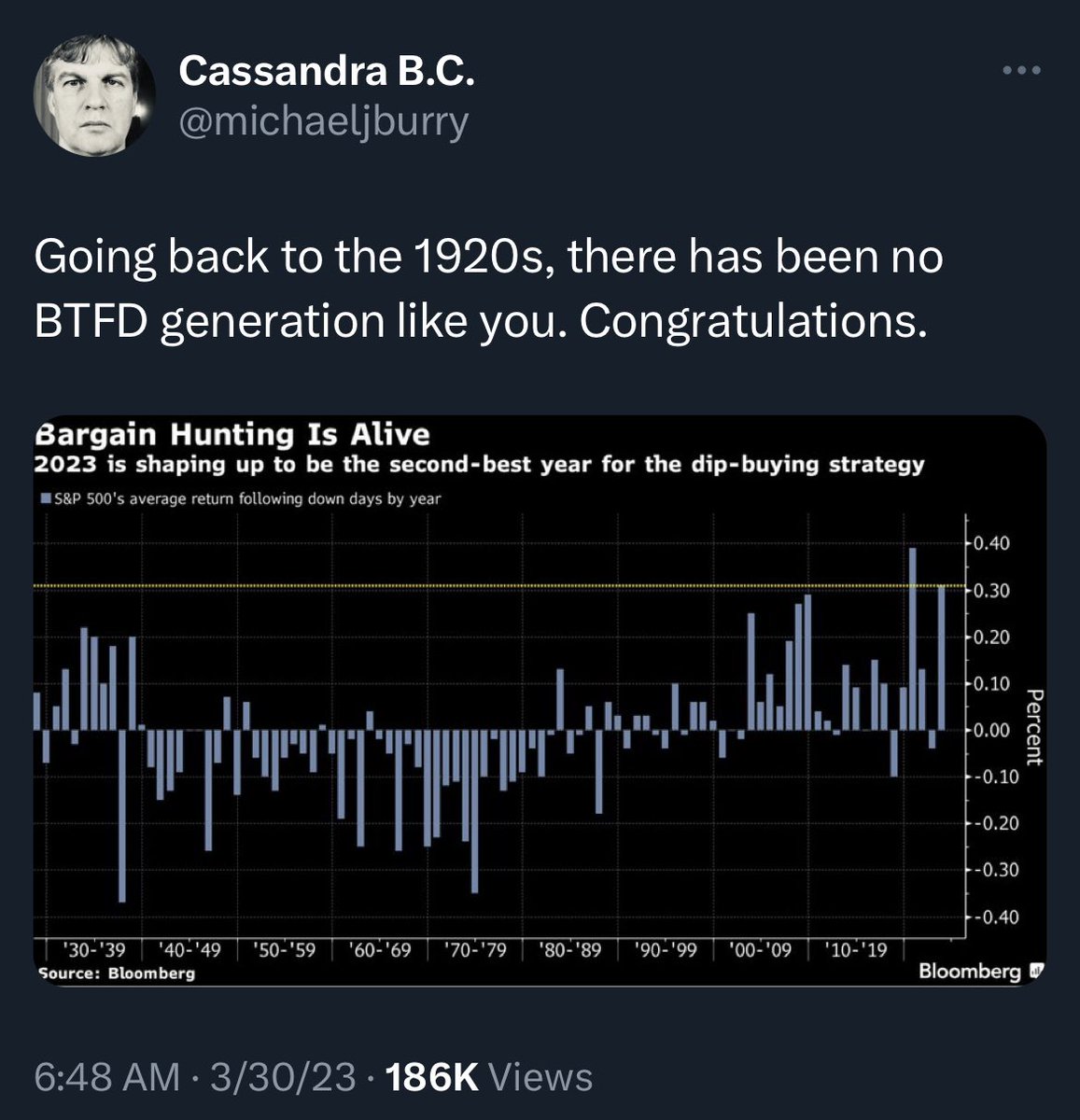

After US equities rallied at the start of the year, Burry argued the best move was to "sell". At the end of March, he admitted that he was wrong to say sell, adding this tweet:

Insight #2: Burry's losses haven't deterred him

The big story of 2023 has been the rise (and rise) of generative AI. Nowhere is this more apparent than in companies like Nvidia (NASDAQ: NVDA) and Advanced Micro Devices (NASDAQ: AMD), which are up more than 240% and 87% respectively. One such ETF that tracks these major players is the iShares Semiconductor ETF (NASDAQ: SOXX).

But Burry may think the rise of these names has gone too far, too fast. If his 13F filing is anything to go by, nearly half of his current portfolio is now a put option against this ETF - suggesting he thinks the bubble will burst.

The recent quarterly results from major chip players seem to agree with Burry's short thesis.

- Arm Holdings reported a 6% year-on-year drop in chip shipments for the period April to June 2023. The decline was due to weakening demand for smartphones and IoT.

- AMD's Q3 results beat earnings and revenue expectations but the guidance was weaker than expected. "In the fourth quarter, we expect to see strong growth in Data Centre and continued momentum in Client, partially offset by lower sales in the the gaming segment and additional softening demand in embedded markets," said CFO Jean Hu.

- Taiwan Semiconductor CEO said "due to the persistent weaker overall macroeconomic conditions and slow demand recovery in China, customers remain cautious in their inventory control. That's why we expect the inventory digestion to continue in the fourth quarter."

Insight #3: Burry is consolidating his long, single-stock holdings

While Burry is known to move his portfolio around more often than most, it appears he has used the last three months to cut many names. His 13F filing shows that there are 20 fewer holdings (net-net) than in the previous quarter.

Even more interesting, Burry used the last quarter to add to existing holdings. For instance, he boosted his stake in television station owner Nexstar Media Group, REIT Hudson Pacific Properties (NYSE: HPP), and crude oil shipping company Euronav (EBR: EURN).

The only new long single stock position he has entered is into Booking Holdings, seemingly at the expense of industry rival Expedia Group.

He also seems to have sold his stake in Warner Bros Discovery (NASDAQ: WBD). If that's the case, he will have sold it just in time. Its Q3 result missed analyst expectations and its stock was sold savagely as a result.

With assistance from Kerry Sun.

4 topics

13 stocks mentioned

1 fund mentioned

1 contributor mentioned