Mid-year – How will economic reality influence markets?

Jamieson Coote Bonds

Halfway through a year that will get recorded in the history books as epic and ironically it feels like we have come to a fork in the road as governments, central banks and companies take stock or pause and assess the human and economic damage that has been wrought so far and what more is needed going forward in these uncertain times.

Markets have responded exceptionally well to the unprecedented monetary and fiscal stimulus afforded to them, although going forward we are concerned that some of the sugar high might start to wear off. The money keeping the economies afloat from various governments globally is coming close to ending, in the US, businesses that received support from the original 8-week term to spend funds under the Paycheck Protection Program (PPP) will exhaust those funds, and the extra $600 per week in jobless benefits that Congress approved in March is set to expire at the end of July. The cash that the 30 million Americans receiving unemployment benefits will lose in August will detract from consumer spending and their ability to meet their credit card, car loans, rent and mortgage commitments.

This is not lost on the Central Bankers – whom have all acknowledged the uncertainties that lie ahead as the delicate balance of reopening economies and keeping the Covid curve flat persist. The recent flare up in the virus rates in the Southern States of both the US and Australia is testament to the difficulties provided by this health crisis. These behavioural changes in the economy will remain, even as the restrictions are tentatively eased – a recent study by the National Bureau of Economic Research entitled “Scarring Body and Mind: The Long-Term Belief-Scarring Effects of Covid-19” underscored that the greatest economic cost of the pandemic could arise from changes in behaviour even after the immediate health crisis is resolved.

Their conclusion was that “even if a vaccine cures everyone in a year, the Covid-19 crisis will leave its mark on the US economy for many years to come”.

The litany of programs from monetary and government authorities has also managed to stabilise the volatility of global markets which reached extreme levels through March – the common benchmark for equity volatility, the VIX has returned to more palatable levels. This has also been reflected in the tight ranges exhibited in currencies and bonds over the last two months.

We are cognisant that we are entering a seasonally challenging period for the direction of the financial markets and wary of complacency creeping into the mindset of investors.

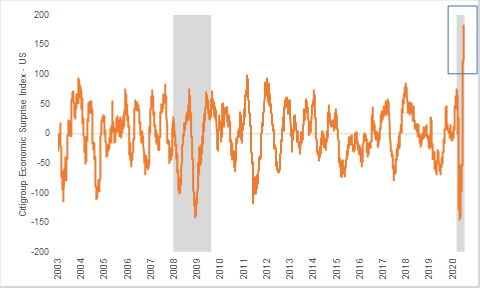

Expectations are high given the recent data surprises in the US that have surprised to the upside as the Citi US Economic Surprise Index chart below demonstrates – data releases have been much stronger relative to market expectations as this index hits record levels. This suggests the market could be ripe for economic disappointments as the financial assistance from governments winds down and the financial engineering of the Central Banks gets challenged as we remain at the lower bound.

Citi Economic Surprise Index – US

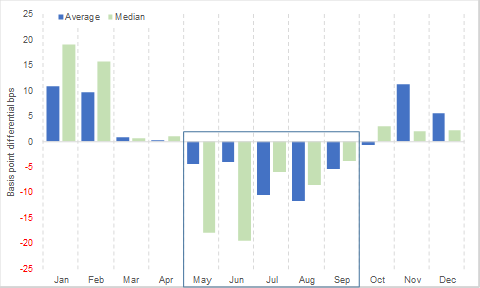

As we monitor the supply and the flows of the bond market religiously, as part of our disciplined process, and as we enter the peak of the Northern Hemisphere summer, this has historically been a positive period for bonds which can be shown in the below chart. The overseas holiday period curtails the issuance of bonds and is also a solid period for bond redemptions, and this year is forecast to be no different. Net supply of bonds in the Europe and the US is typically negative – this year is no different with expectations that US supply alone will fall from USD +87 billion in June to only USD +14 billion in July – the largest drop in the last decade.

The demand side of the equation also provides a bullish backdrop for high grade bonds, as the world’s largest buyer of US Treasuries goes shopping in July, as this is the month when Japanese investors historically buy the most fixed income. Combined with the consistent buy program from Central Banks, which was recently reiterated by Fed Chairman Powell at his recent testimony that the Fed is committed to using its full range of tools to support the economy and to help assure that the recovery from this difficult period is as robust as possible, and the potential for a pullback in fixed income is somewhat limited going forward.

US Treasury 10 Year yields: Monthly averages/medians vs the long-term average.

Source: JCB team analysis, based on daily data from Bloomberg from Jan 1962.

Past performance is not an indicator of current or future performance.

Bond investors would have also taken comfort from recent remarks from the RBA’s Dr Debelle which defrayed any concerns on inflation and supported our secular view of a low inflation environment. Dr Debelle informed the Economic Society of Australia that fears of inflation are misguided − "Indeed, the opposite seems to be the more likely challenge in the current economic climate. That is, that inflation will remain below the RBA's target."

The backdrop for bonds remains positive as we push through the half-way marker for what will be a gruelling and testing marathon year for investors.

4 topics

Chris oversees a range of investment strategies for institutional and retail clients. He is a bond investment specialist with over 20 years of experience gained at Merrill Lynch, Société Générale and The Royal Bank of Canada, here and abroad.

Expertise

Chris oversees a range of investment strategies for institutional and retail clients. He is a bond investment specialist with over 20 years of experience gained at Merrill Lynch, Société Générale and The Royal Bank of Canada, here and abroad.