More please! Dr Don Hamson’s cure for the 'disappearing dividends' on the ASX

Fully franked dividends are a prized asset of the Australian market. While the lack of growth is often lamented, plenty of self-funded retirees are content to dine on the distributions of Australia's big miners and banks.

And who can blame them - high commodity prices, particularly in iron ore and lithium, resulted in record dividends from the top end of town. However, after peaking in 2021 and 2022, dividends from mining companies are steadily declining.

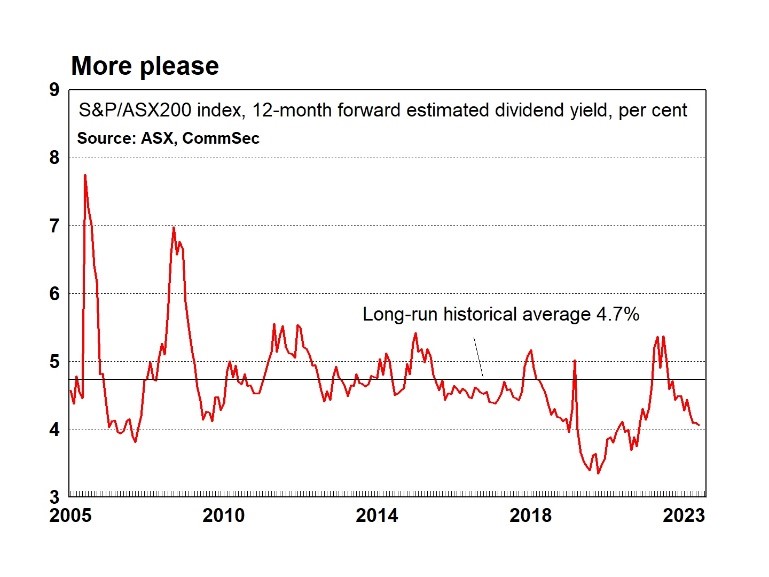

Research from Commsec published late in 2023 showed that the 12-month forward dividend yield for the ASX200 has been below the long-run average of 4.7%, and dividend per share estimates have been cut by 14 per cent.

The good news is that Australian banks have been increasing their dividends whilst also enjoying surging share prices. There is also a long list of consistent dividend paying stocks that often fly under the radar.

In this episode of the Rules of Investing, Livewire's James Marlay speaks with Plato Investment Management's Dr Don Hamson to get his diagnosis on the case of the 'disappearing dividends'.

Hamson insists that diversification remains a free lunch for investors, especially for those seeking stable and consistent returns. He also emphasises that fully franked dividends continue to stack up as the backbone of an income-generating portfolio.

Other ways to listen and follow

Timecodes

- 0:00 - Introduction

- 1:43 - The outlook for dividends

- 8:27 - Dividends versus Fixed Income

- 10:25 - Dwindling dividends

- 13:08 - The dividend outlook for mining shares

- 17:00 - Tactics to combat declining dividends

- 20:07 - Australian banks - stable but expensive

- 22:10 - The case for diversification

- 25:15 - Winning by avoiding the losers

- 28:09 - What returns are realistic for Plato?

- 31:26 - A lesson from Medibank Private

- 34:10 - Don’t focus on the US election

- 36:23 - The stock most likely to be a 5-year resident in the Plato Australian Shares Income Fund

1 contributor mentioned