More Power!

Key Points:

• Global electricity demand is expected to continue to rise in the decades ahead, driven by emerging markets trending towards developed market status, the rise of electric vehicles and demand for cloud computing power in data centres.

• Given concerns around climate change, much of this additional demand will be satisfied by renewable energy.

• This will likely increase the cost of energy for households and businesses, despite some convergence in cost relative to fossil fuels.

• This transition is likely to be inflationary. As such, in this year’s Strategic Asset Allocation Review, all of our scenarios feature some degree of inflation persistence.

Energy markets are in a period of great transition. Most major economies are attempting (with varying degrees of effort) to lower net carbon emissions. The cost of renewable energy and energy storage have fallen substantially in recent decades as technology has improved, helping to facilitate this transition. However, energy usage will still rise from here, despite improvements in energy efficiency. Data centres will soon command an appreciable percentage of global energy production and demand from developing countries is still rising as they become richer. In this month’s Market Insight, we investigate the net of the above and what it means for the global economy and markets.

How Did We Get Here?

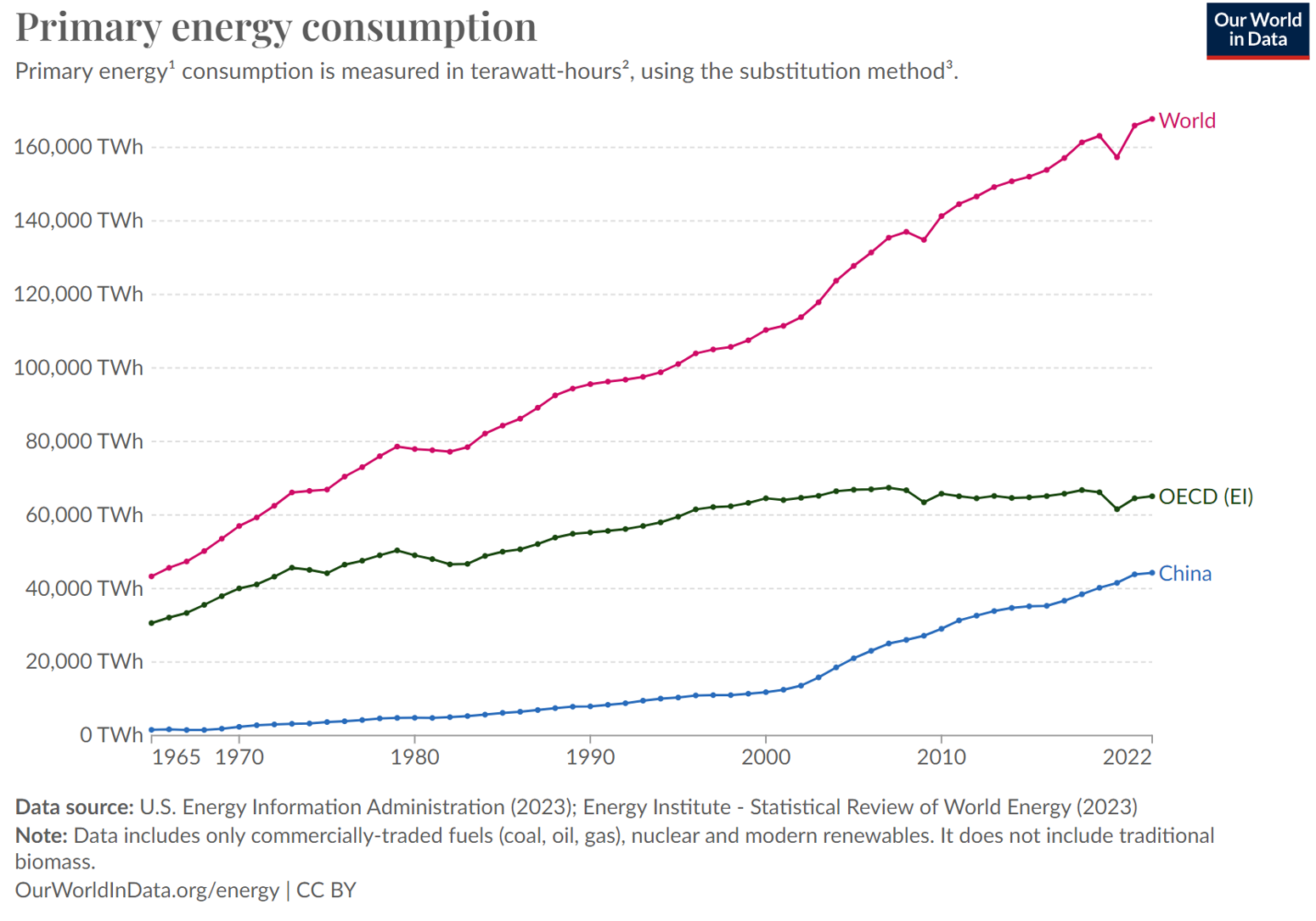

Global demand for energy has trended higher for as long as it has been measured, but consumption by rich countries has flatlined since the late 2000s. Increased energy efficiency across the board has allowed rich countries to continue to grow their economies without increasing their energy use. However, overall consumption has continued to rise globally because of increased energy usage in developing economies (see below). More efficient appliances and cars have not been sufficient to stem this tide. Rich households replacing a dishwasher with a five-star model doesn’t offset the impact of a household in a poorer country upgrading from no dishwasher at all.

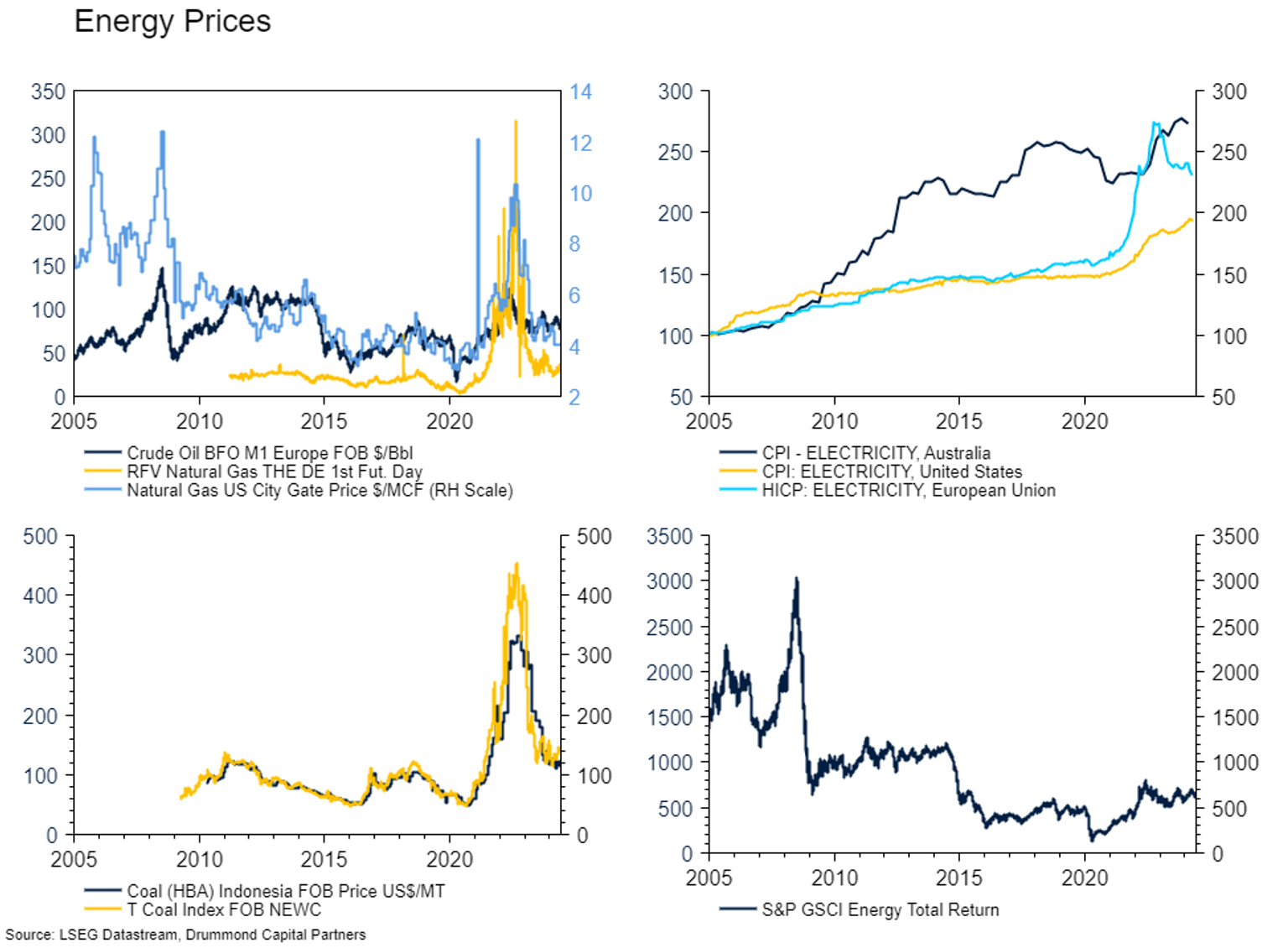

Despite this steady increase in demand the impact on the cost of energy, at least in rich countries, has been mixed. Oil prices are generally around where they have averaged over the past twenty years. Natural gas prices in the USA have been trending lower, likely due to growing domestic supply, and gas prices in Europe had been trending lower as well prior to Russia’s 2022 invasion of Ukraine, which disrupted supply on the continent. Thermal coal prices had also been trending lower pre-2022, but have not yet fully normalised. Despite this, retail electricity prices in Australia, the USA and Europe have all risen significantly faster than overall inflation since 2005.

There are a number of reasons for this. Focussing on Australia, higher electricity prices over the past twenty years reflect higher network costs (currently ~50% of total, a regulated rate of return compensating operators for investment in transmission lines etc), wholesale power costs (~30%, the cost to generate), environmental costs (~10%, government renewable schemes, feed in tariffs etc.) and retail cost and margins, which make up the small remainder. Aside from retail costs and margins, all of the other factors have been contributing to higher prices over this time. Environmental costs have steadily increased over the period as climate change has become a policy focus. Wholesale prices have risen as (previously) more expensive renewables entered the generation mix and input prices have risen (a little bit). In Australia, network costs have risen significantly as poor incentives (when you earn a regulated rate of return on investment, the hurdle to spend more isn’t much of a factor) mixed with high forecasts for peak demand and a desire for improved reliability. Average network utilisation in Australia has actually trended lower over time, though we do have fewer blackouts now than in the past as a result. Arguably, the reason for rising power prices hasn’t been increased demand, rather a structurally higher cost to supply, largely unrelated to raw material costs.

Power Demand

We think there is a good chance that electricity demand rises even in developed countries in the decade ahead, driven by electric vehicles and data centres in particular. The former is a substitution between oil and electricity, which requires a change in the overall energy mix while the latter represents true new demand.

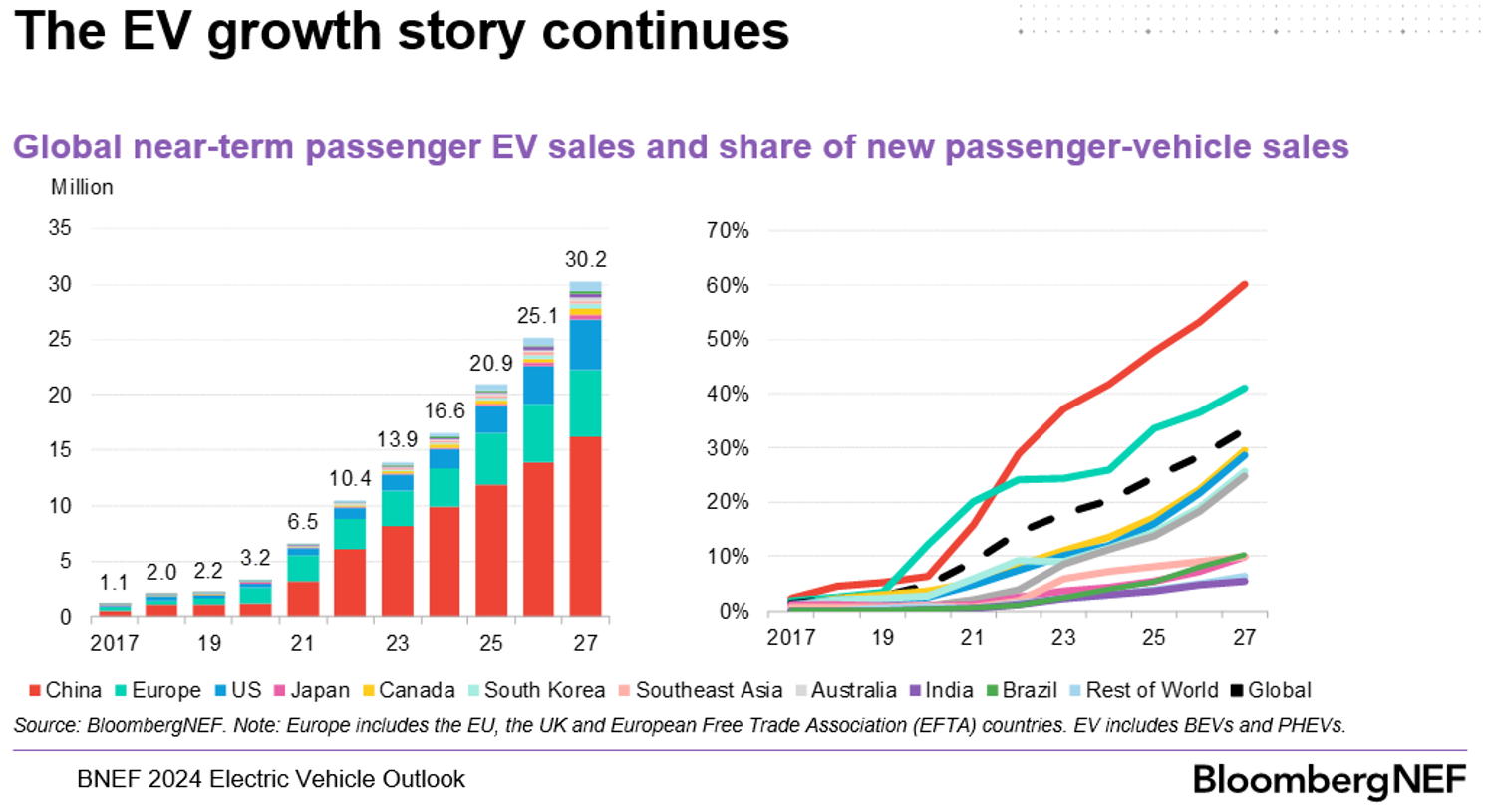

Electric vehicles (EVs) are becoming more common, thanks to technological innovation and policy support. Globally, EVs account for around 20% of the total sales of personal vehicles. It’s not unreasonable to assume they will end up the majority in the years ahead – particularly given policy announcements to ban internal combustion engines across many major economies. Supporting this will require investment in generation and transmission infrastructure, given the likely increase in household electricity demand.

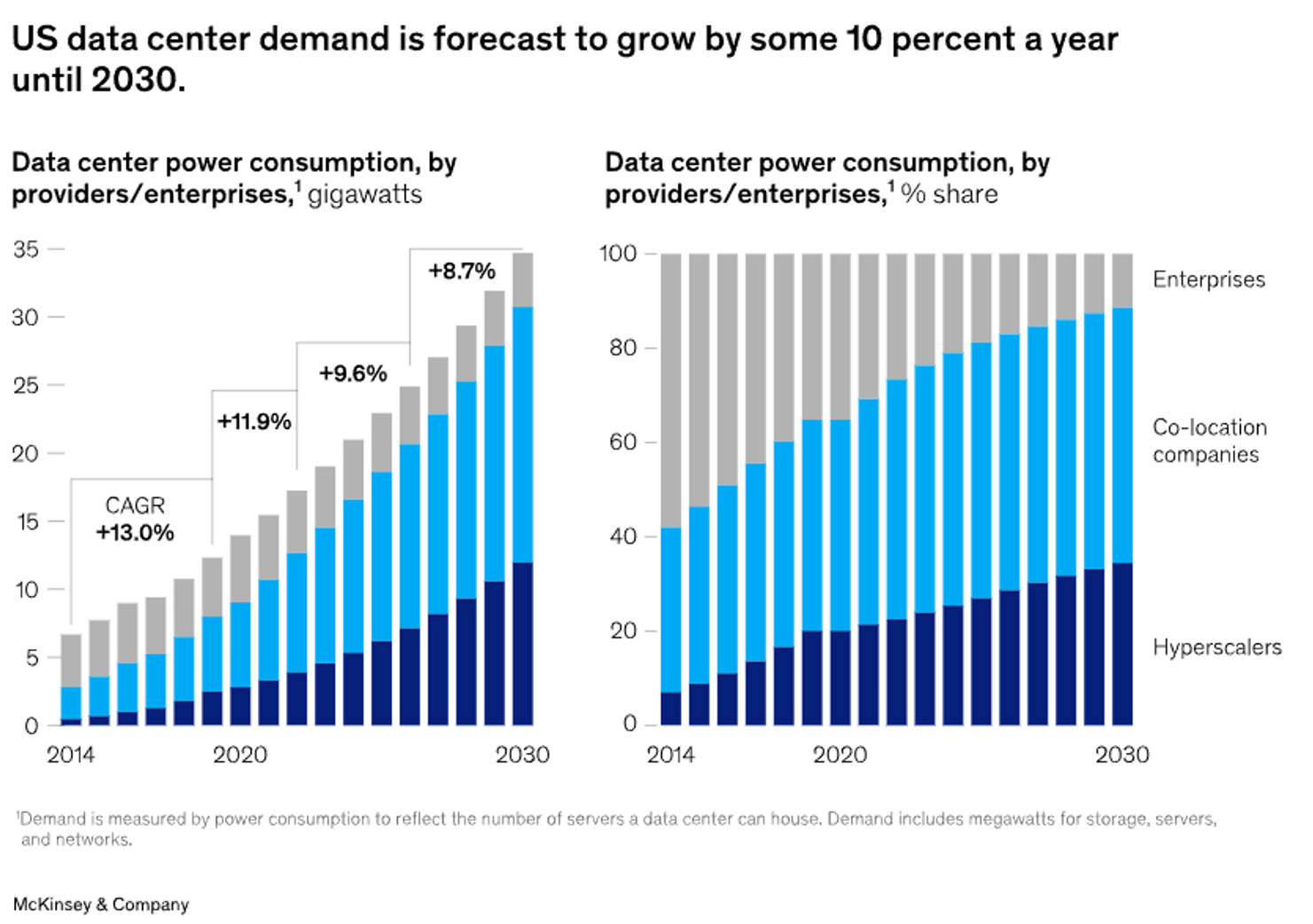

Another source of power demand growth will be the expansion of data centres, which are facilities that store and process large amounts of digital information, they require a lot of electricity to run their servers and cooling systems. As cloud AI capabilities are incorporated into everyday corporate life, demand for data centres should continue to rise strongly. McKinsey estimates total power draw from US data centres to reach around 8% of current total electricity production by 2030, from sub-2% today. This is net new demand, which will also require increased generation and transmission investment.

Government commitments to reduce carbon emissions will see the continued shutdown of fossil fuel power generation facilities and their replacement with renewable or lower carbon energy sources. So, even if the pace of improvement in energy efficiency accelerates and power demand stays sideways in developed countries despite higher demand from data centres and EVs, a lot of new power generation, transmission, and storage capacity will need to be built. Adding to this, emerging market countries will continue to increase energy demand as they get richer. The energy capex cycle associated with this transition will be substantial.

What Comes Next?

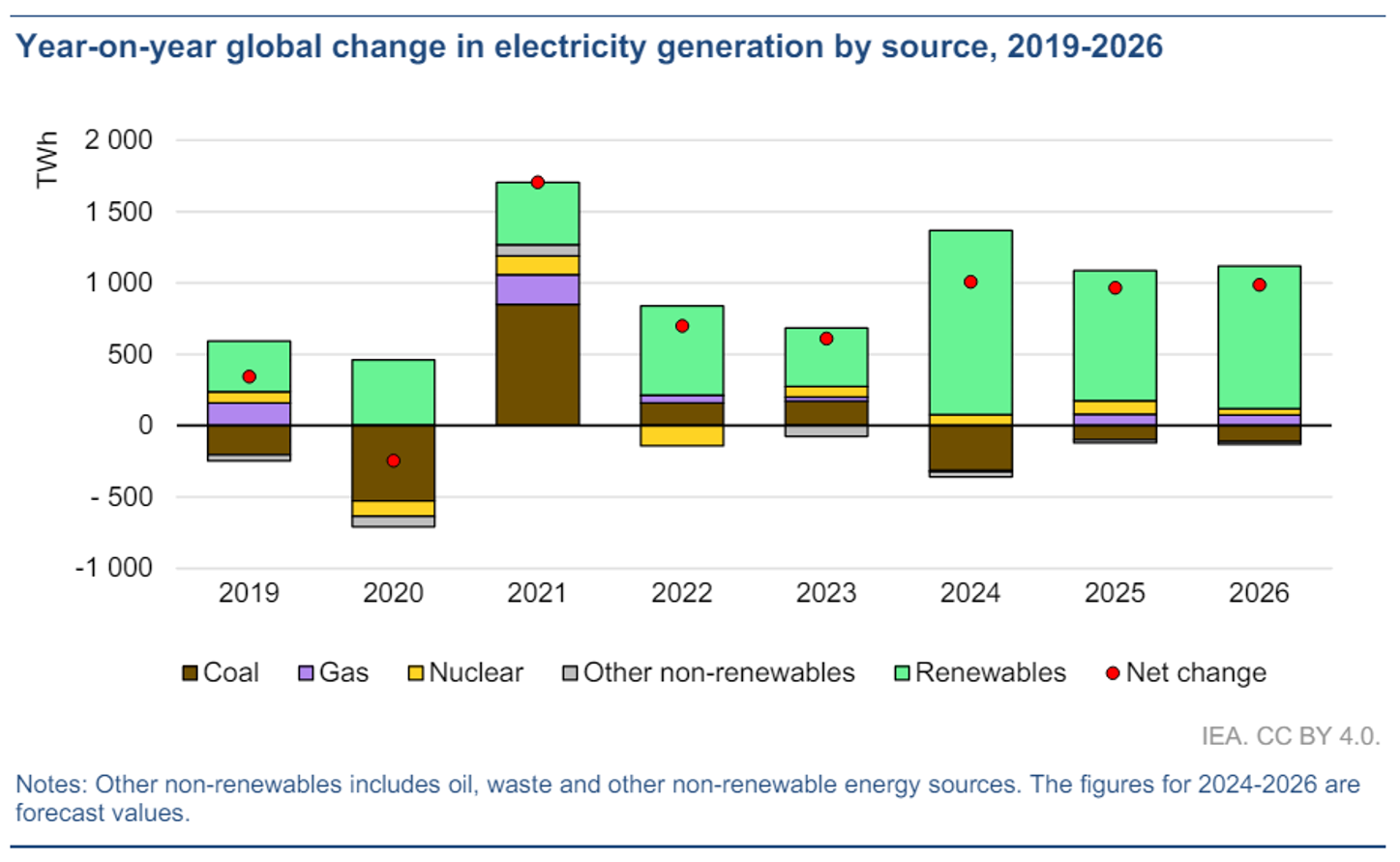

More power demand requires more generation. Probably mostly from low or zero carbon sources. Despite the hype, in the USA, renewable energy only makes up around 15% of the total energy mix. For the World as a whole, it is much smaller. However, renewable energy constitutes the bulk of net new power addition in rich economies (see below for the USA). That should continue to be the case for decades as coal plants in particular are phased out.

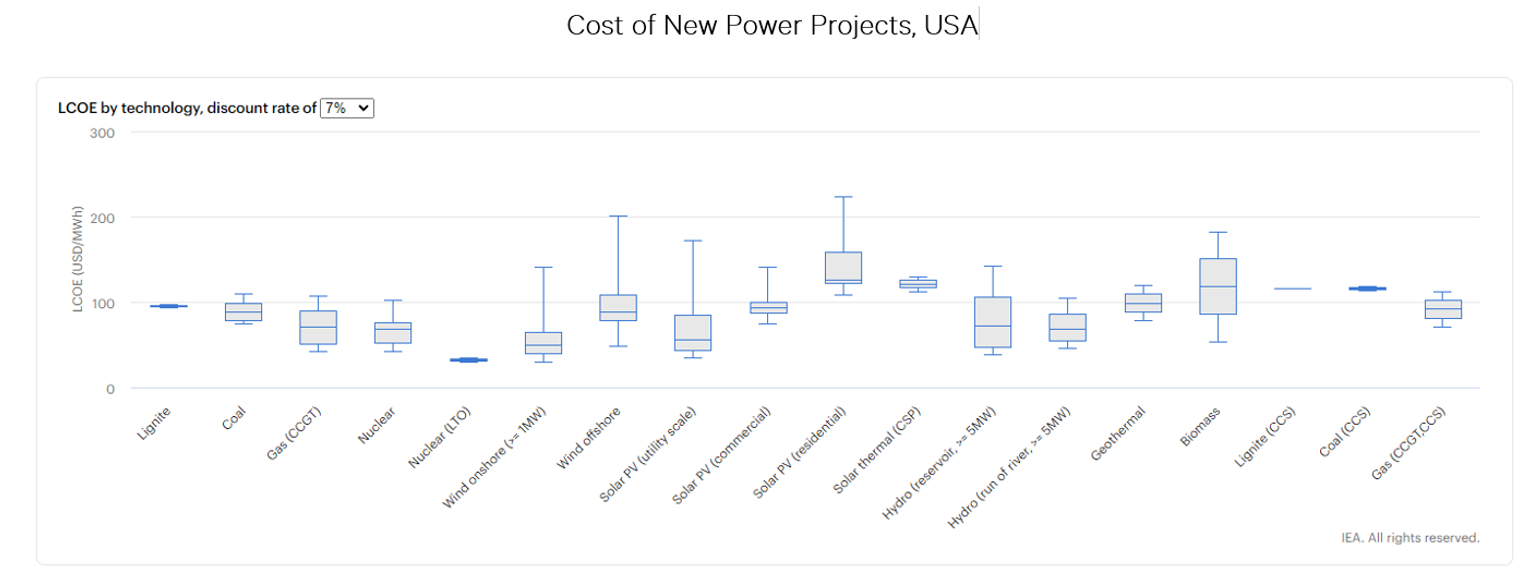

The consequences of this is probably higher, and more variable, energy costs. While the cost of new renewable projects is arguably now similar to fossil fuels and nuclear (depending on the political affiliation of the person creating the assumptions), the required storage and transmission investment from converting that into reliable baseload power adds another layer of cost which consumers will have to pay. Alternatively, overbuilding renewable capacity will improve system reliability without requiring storage, but again will clearly raise costs.

Political influence across the spectrum has increased the required discount rate for new power projects, also increasing costs. What is the appropriate discount rate for a nuclear power plant with a 75-year lifespan if a Greens Government is elected at any point in that horizon? What assumptions should be made for renewable subsidies in the United States with another Trump administration around the corner? A lack of political consensus on what the allowed power generation mix should look like in fifty years’ time is a significant problem which isn’t likely to be resolved quickly.

Cost escalation is another problem. Rich economies have become very bad at costing major projects appropriately and delivering them on time. A 2023 audit of 800 Australian infrastructure projects showed a cost increase of 41% in total and an expectation that more would be coming. The Vogtle nuclear reactor in the USA, the first new plant in decades, arrived seven years late at around twice the original budgeted cost.

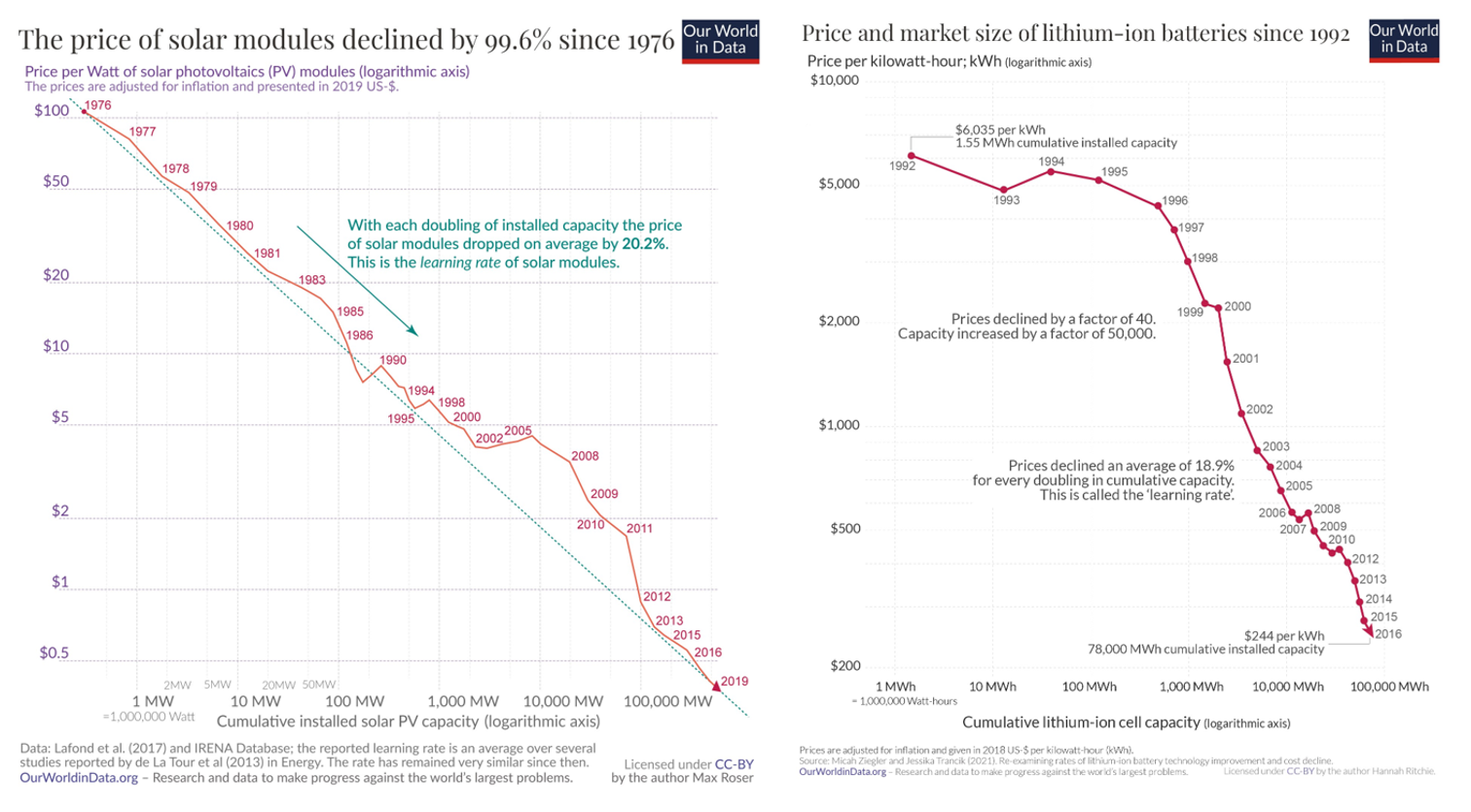

A positive in the renewables camp is that the cost of solar and wind generation has generally been falling over time. Batteries have also become much cheaper. The extent to which this will continue in the future is uncertain. When European farmers use solar panels from China as fencing, it’s hard to see them becoming much cheaper. That said, it’s unlikely that they will face the same level of cost escalation as major capital projects such as a new nuclear plant. Smaller projects are easier to control. Maybe the solution is smaller projects across the country, rather than a handful of major developments.

Regardless of the falling cost of installing renewable capacity, we think the likelihood of replacing much of the existing system with a more intermittent and dispersed generation method, and then either overbuilding capacity or building storage to enhance system stability, will lead to higher energy costs. Alternatively, building a handful of nuclear reactors will inevitably cost multiples of what is originally costed. Either way, power prices rise.

Portfolio Implications

Paying for energy is a net drag on the global economy, a pure supply side constraint. The main consequence of higher energy costs is higher inflation and lower economic growth. This theme is reflected in this year’s Strategic Asset Allocation Review, where all of our capital market assumption scenarios are modelled to incorporate varying degrees of inflation persistence. Importantly, this assumption doesn’t just reflect higher energy prices. Structurally higher government spending (defence and vote buying) and ageing populations are also factors.

Otherwise, it is important to recognise the potential for an upside scenario. If the renewables optimists are correct, and the price of producing renewable energy continues to fall, perhaps the energy transition we are undertaking will be a net positive for global economic growth. At this stage, this scenario isn’t likely enough to form part of our capital market modelling, but is worth considering as an upside risk.

From an investment perspective, the most impacted asset class from the energy transition will be infrastructure. Within the asset class, there will clearly be winners and losers. The losers will be the ones holding stranded assets which are rendered uneconomic by climate change legislation. The winners will be the ones who can covert the (potentially) trillions of dollars into a return on shareholder equity. Data centres within the real estate asset class also represent an in-demand area for those who can supply well located facilities, ideally with a low cost and reliable power supply.

2 topics