Morgan Stanley: Challenging healthcare outlook results in 2 surprise rating changes

If one thing was evident in the August reporting season, it was that there is margin pressure and earnings are increasingly challenged. This was even true of the healthcare sector, traditionally a defensive sector in tougher climes.

Leading into August, a range of companies released downgraded earnings expectations setting the tone for a muted reporting season. It was the first time that CSL (ASX: CSL) had downgraded its expectations – and then its annual reporting was in line with this. Ramsay Health Care (ASX: RHC) disappointed with its results, while Resmed (ASX: RMD) actually reported an 18% rise in full-year revenues but still found analysts, including Morgan Stanley, reducing their price targets.

Like companies in other sectors, a tight labour market and rising interest rates meaning a higher cost of debt, will see healthcare companies tighten their belts and continue to adjust expectations in FY24.

The four key issues that Morgan Stanley sees

Morgan Stanley cited one stock-specific concern along with three broader issues.

- Immonoglobulin yields were larger but longer than Morgan Stanley had thought. This is a concern for CSL going forward, though Morgan Stanley retain an Overweight rating on it.

- Private health surgeries and claims have moved higher, though they are still below pre-pandemic levels.

- Labour costs are likely to remain elevated for healthcare services.

- Debt costs have become much higher as a result of the rapid increase in the cash rate over the last year.

Of the back of this, Morgan Stanley revised price targets downwards for Resmed, Fisher & Paykel Healthcare (ASX: FPH), and Sonic Healthcare (ASX: SHL) with cost pressures from labour and debt a common thread.

Two surprise rating changes

Readers may be interested to find out that the company to disappoint was the company to be upgraded, while the company to offer better than expected annual results was a downgrade.

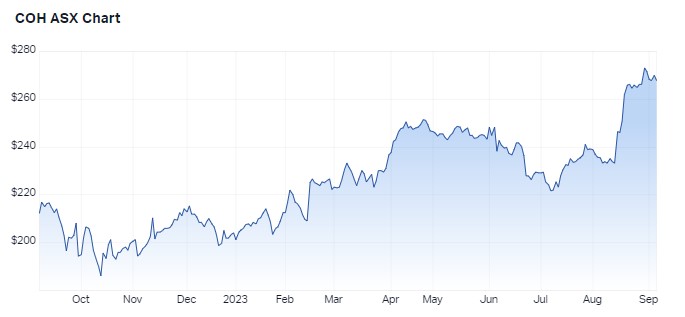

MarcusToday’s Henry Jennings recently described Cochlear’s (ASX: COH) results as one of the few in the sector to do better than expected.

“That one seems like a shining light, but I think the healthcare sector generally is not quite as defensive as some investors though and, as a result, I think we’re seeing a lot of people shunning the sector at the moment,” said Jennings.

Morgan Stanley downgraded its ratings for Cochlear to underweight from equal weight, though retained its price targets. The rationale for the downgrade was due to a rally in stock prices post reporting above Morgan Stanley’s price targets and historical forward PE average despite guidance suggesting slower unit growth in the coming year.

“We think there is limited surprise to the upside while valuation also looks full,” said equity analyst Sean Laaman.

On the other side, Ramsay Healthcare offered disappointing results. Morgan Stanley even downgraded EPS expectations off the back of higher guided opex, slower operating margin recovery and higher net interest.

Despite this, Morgan Stanley upgraded its rating for Ramsay Healthcare to Equal-weight.

“We think expectations are now reasonable, and further near-term EPS downside look less likely,” said Laaman.

Livewire’s Hans Lee recently interviewed Ramsay Health Care CEO Craig McNally. You can watch the interview here.

High conviction picks

Morgan Stanley holds Overweight ratings on 4 stocks - only one of these is a small cap.

The large-cap picks include CSL, Ebos Group (ASX: EBO) and Sonic Healthcare Limited (ASX: SHL). Market darling is ranked a Strong Buy by Market Index's broker consensus tool, while Ebos Group and Sonic Healthcare are both Buys.

The sole small cap on the list is Monash IVF Group (ASX: MVF), also a Strong Buy on Market Index's broker consensus tool. Interesting, this company was referenced by Centennial Asset Management's Michael Carmody as one that had been challenged by wage cost base inflation.

1 topic

8 stocks mentioned

2 contributors mentioned