Morgan Stanley's top stocks for earnings certainty

We are three weeks away from the all-important August earnings season, when Australia's listed companies will reveal the good, bad and ugly of their full-year results.

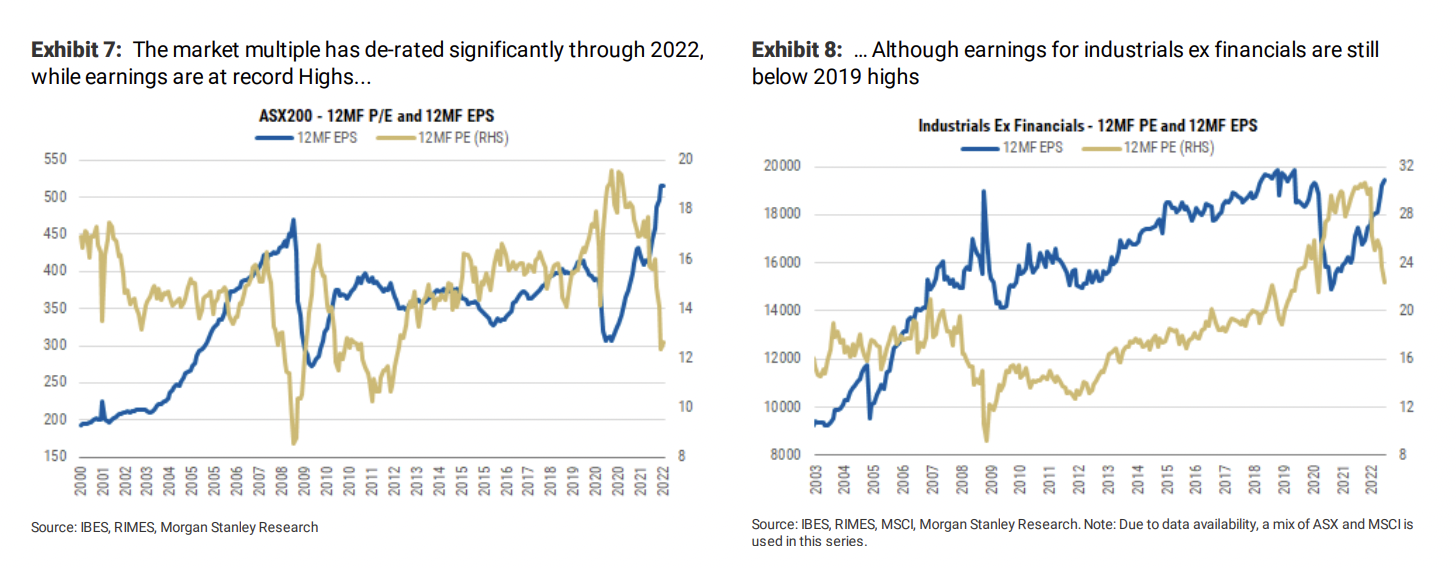

Given the uncertainty (read: numerous headwinds) that abounds at the moment - inflation, rising rates, continued supply chain blockages, worker shortages (need I list more) - it may surprise readers to learn that analyst earnings estimates still remain historically elevated.

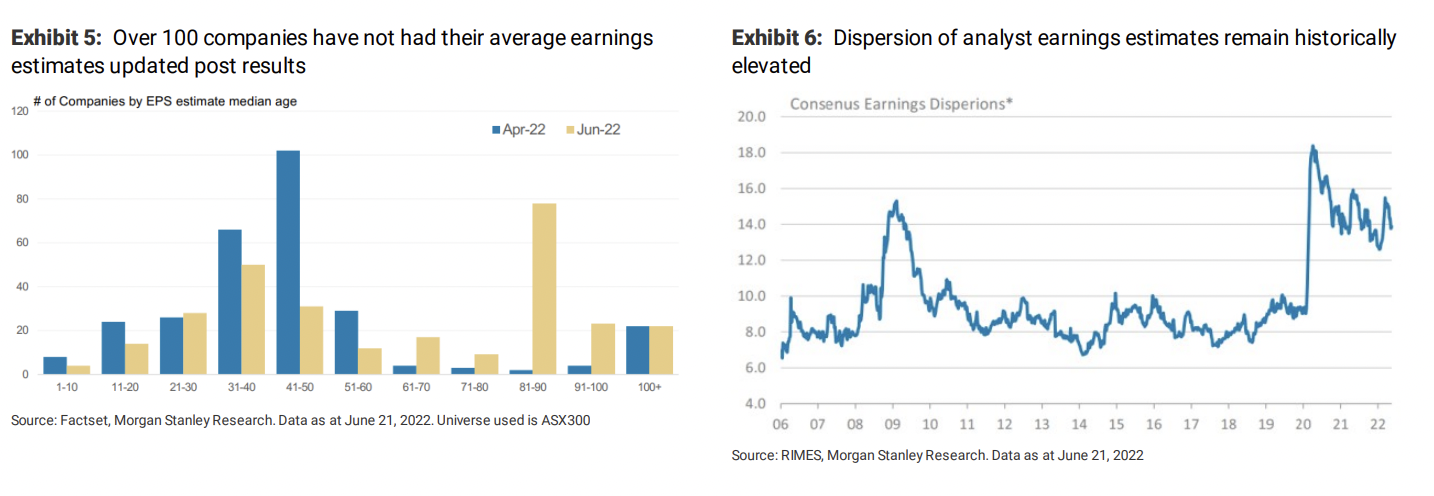

That's according to Morgan Stanley, which in its latest update said that "earnings estimates are currently both highly dispersed and relatively stale - with the sharp move in equity prices and valuations centring the attention on the accuracy of current earnings estimates."

In fact, the investment manager and broker found that more than 100 companies within the S&P/ASX 300 have not seen their earnings estimates updated post their results in February. Meanwhile, the benchmark has fallen nearly 13% into the red since the beginning of the year.

It comes as Talaria Asset Management's Chad Padowitz forewarns of an "earnings recession", predicting that corporate earnings could collapse anywhere from 20-40%.

With this in mind, Morgan Stanley believes that earnings certainty will be front of mind for the Aussie market as we head into the August reporting season, and has outlined 33 companies that have passed its filters thanks to their high earnings stability score.

These companies boast lower estimate dispersion, lower ROE volatility, and lower sales growth volatility, helping provide investors with some much-needed certainty when they need it most.

So without further ado, here are the top stocks that have passed Morgan Stanley's filters. The data below is as of 7 July 2022.

1. CSL (ASX: CSL)

- Market cap: $138 billion

- Share price: $287

- Morgan Stanley target price: $312

2. Westpac (ASX: WBC)

- Market cap: $70 billion

- Share price: $20

- Morgan Stanley target price: $22.30

3. Macquarie Group (ASX: MQG)

- Market cap: $65 billion

- Share price: $170.65

- Morgan Stanley target price: $234

4. Telstra (ASX: TLS)

- Market cap: $45 billion

- Share price: $3.89

- Morgan Stanley target price: $4.60

5. Goodman Group (ASX: GMG)

- Market cap: $36 billion

- Share price: $19.19

- Morgan Stanley target price: $23.70

6. Rio Tinto (ASX: RIO)

- Market cap: $36 billion

- Share price: $97.18

- Morgan Stanley target price: $199.50

7. Santos (ASX: STO)

- Market cap: $23 billion

- Share price: $6.90

- Morgan Stanley target price: $11

8. Newcrest Mining (ASX: NCM)

- Market cap: $18 billion

- Share price: $19.75

- Morgan Stanley target price: $28.60

9. South32 (ASX: S32)

- Market cap: $17 billion

- Share price: $3.70

- Morgan Stanley target price: $5.10

10. Sonic Healthcare (ASX: SHL)

- Market cap: $16 billion

- Share price: $33.23

- Morgan Stanley target price: $36.35

11. James Hardie (ASX: JHX)

- Market cap: $15 billion

- Share price: $34.03

- Morgan Stanley target price: $51

12. Computershare (ASX: CPU)

- Market cap: $15 billion

- Share price: $24.28

- Morgan Stanley target price: $29.50

13. Wisetech Global (ASX: WTC)

- Market cap: $14 billion

- Share price: $41.86

- Morgan Stanley target price: $50

14. Medibank Private (ASX: MPL)

- Market cap: $9 billion

- Share price: $3.32

- Morgan Stanley target price: $3.70

15. Treasury Wine Estates (ASX: TWE)

- Market cap: $8 billion

- Share price: $11.29

- Morgan Stanley target price: $13.80

16. Bluescope Steel (ASX: BSL)

- Market cap: $7 billion

- Share price: $15.40

- Morgan Stanley target price: $25

17. Worley (ASX: WOR)

- Market cap: $7 billion

- Share price: $13.57

- Morgan Stanley target price: $14

18. IDP Education (ASX: IEL)

- Market cap: $7 billion

- Share price: $25.21

- Morgan Stanley target price: $35

19. Carsales.com (ASX: CAR)

- Market cap: $7 billion

- Share price: $19.65

- Morgan Stanley target price: $24.30

20. Dominos Pizza (ASX: DMP)

- Market cap: $7 billion

- Share price: $75.12

- Morgan Stanley target price: $100

21. Orica (ASX: ORI)

- Market cap: $6 billion

- Share price: $15.34

- Morgan Stanley target price: $19.70

22. Cleanaway Waste Management (ASX: CWY)

- Market cap: $5 billion

- Share price: $2.59

- Morgan Stanley target price: $3.08

23. Whitehaven Coal (ASX: WHC)

- Market cap: $5 billion

- Share price: $4.73

- Morgan Stanley target price: $7.75

24. Bank of Queensland (ASX: BOQ)

- Market cap: $4 billion

- Share price: $6.93

- Morgan Stanley target price: $9.80

25. Altium (ASX: ALU)

- Market cap: $4 billion

- Share price: $29.23

- Morgan Stanley target price: $35

26. Downer (ASX: DOW)

- Market cap: $3 billion

- Share price: $5.13

- Morgan Stanley target price: $6.30

27. Ansell (ASX: ANN)

- Market cap: $3 billion

- Share price: $23.48

- Morgan Stanley target price: $28.93

28. Breville Group (ASX: BRG)

- Market cap: $3 billion

- Share price: $19.52

- Morgan Stanley target price: $25

29. ARB Corporation (ASX: ARB)

- Market cap: $2 billion

- Share price: $30.48

- Morgan Stanley target price: $33

30. Deterra Royalties (ASX: DRR)

- Market cap: $2 billion

- Share price: $4.08

- Morgan Stanley target price: $5.25

31. Domain Holdings (ASX: DHG)

- Market cap: $2 billion

- Share price: $3.30

- Morgan Stanley target price: $5.40

32. Perpetual (ASX: PPT)

- Market cap: $2 billion

- Share price: $28.69

- Morgan Stanley target price: $41.50

33. Centuria Capital Group (ASX: CNI)

- Market cap: $2 billion

- Share price: $1.94

- Morgan Stanley target price: $2.50

Never miss an update

Enjoy this wire? Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

1 topic

33 stocks mentioned

1 contributor mentioned