Morgan Stanley says this key factor pushing gold to record highs is now the single biggest risk

Gold's record-thumping bull run could be about to reverse if US President Trump forces Ukraine and Russia into a peace deal that heals geopolitical divisions and caps surging demand for the precious metal from major central banks.

That's the view of Morgan Stanley's strategists in a February 14 research note that said an end to the Ukraine war is the number one downside risk to gold, which could send it 17 per cent lower to $US2400 an ounce in a bear case scenario.

"It was really the start of the [Ukraine] conflict in 2022, and the sanctioning of Russia’s assets, that catalysed the step up in central bank buying among emerging markets more generally," Morgan Stanley said. "If a potential peace deal somehow then also lessened the pace of central bank buying, we’d see this as bringing some risk to prices."

Gold is up more than 50 per cent since the Ukraine war escalated in 2022, but lost 1.5 per cent on February 14 to $US2880 an ounce on news reports Presidents Trump and Putin spoke late last week about the conflict.

Gold price forecasts

Morgan Stanley said fast-changing geopolitics make it "difficult to explain the magnitude of gold price moves using traditional approaches." However, its base case forecast is that gold hovers around $US2850 an ounce in the July quarter, with potential for US trade wars to push it over $US3000 an ounce in the short term.

The bank's bear case of $US2400 an ounce revolves around the thesis that major central banks (across the emerging world in particular) will slow their purchases of the precious metal if they believe the risk of sustained conflict between the US alliance and Russia eases.

Morgan Stanley pointed to a World Gold Council report that shows central banks' gold purchases averaged above 1000 tonnes a year between 2022 and 2024, which is double the average before the start of the Russia-Ukraine conflict.

In the final quarter of 2024 central bank purchases jumped 54 per cent on the corresponding quarter in 2023, as other worries around US fiscal deficits, money printing and debt encourage nations such as China, India, Poland, Brazil and Turkey to seek alternatives to US dollar exposure.

"Given its role in decoupling gold from its usual drivers since 2022, the pace of central bank gold buying remains critical to the outlook," Morgan Stanley said. "We remain watchful of any slowing in central bank demand that may arise in the event of a potential Russia/Ukraine peace deal."

Gold versus real risk-free yields

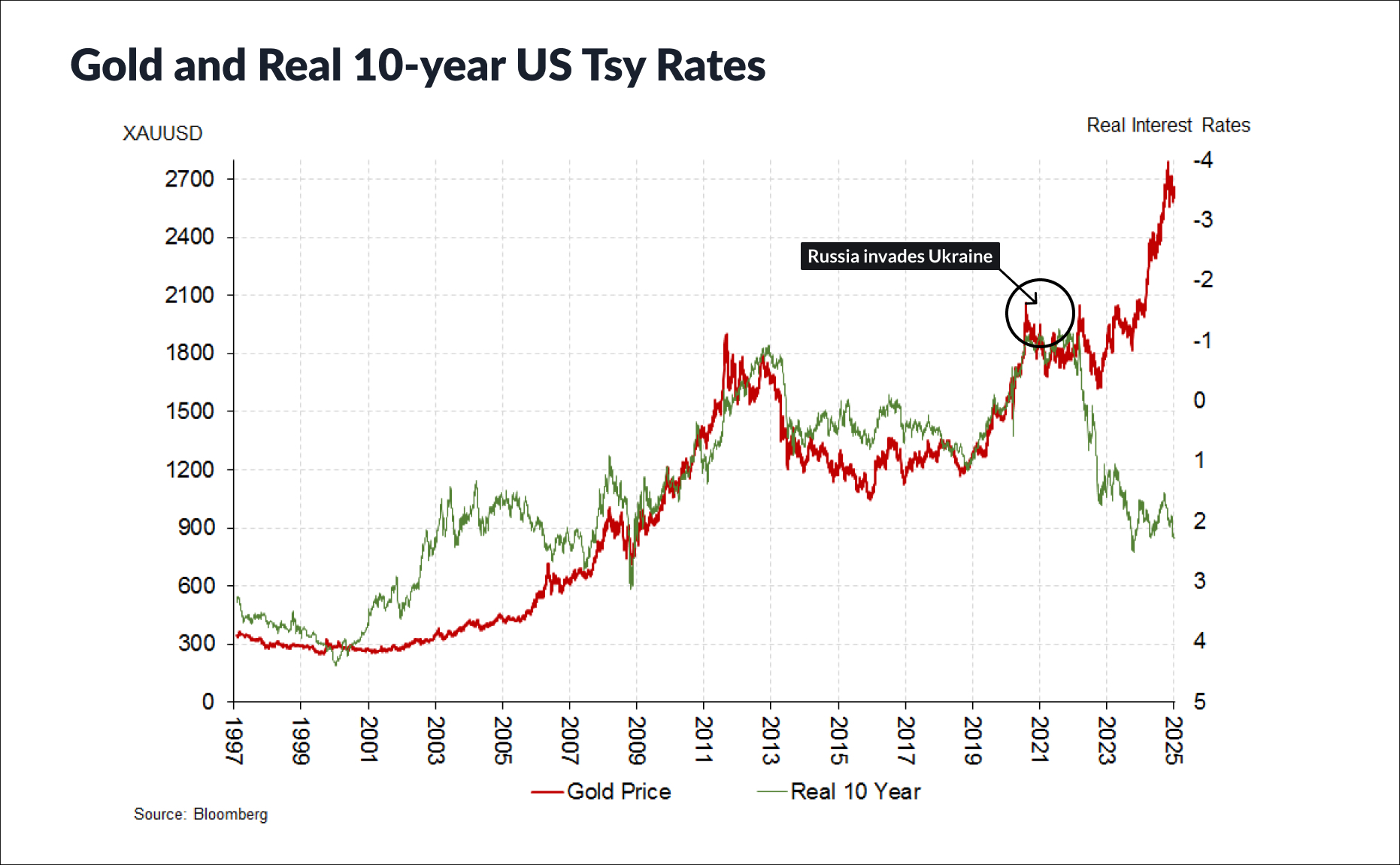

The strategists also said that real US yields - measured as the yield on 10-year treasuries minus inflation rates - had eased since January in a move that should support gold prices.

Real yields are positive when interest rates are higher than the rate of inflation and gold has traditionally moved inversely to real yields as it becomes less attractive to investors when they can earn higher real yields and vice versa when real yields fall.

The below chart [from Bloomberg] shows how Russia's Ukraine invasion broke the correlation, as gold rose in tandem with real yields likely due to record central bank demand, among other factors.

"This relationship [between gold and real yields] has been somewhat asymmetric since 2022, with gold generally performing when US yields rise and fall, which has worked to gold's benefit," the strategists said. "Indeed prices have held up even as US yields have moved higher again in recent days on higher inflation expectations. On top, US tariffs are keeping inflation concerns alive, and fiscal deficits are in focus."

Morgan Stanley's base case is for gold to retreat to $US2700 an ounce by the final quarter of 2025. Its bull case is $US3400 an ounce, although it reiterated the warning that slowing central bank demand for the metal could burst its price.

Gold ETFs

On the Australian Stock Exchange, many exchange traded funds (ETFs) that track the spot gold price have surged over the past 12 months and hit record highs in 2025.

Some of the largest by paper exposure include Global X's Physical Gold ETF which has $4 billion in assets under management. It has surged 48 per cent over the past 12 months and the fund is unhedged to mean it will benefit if the Australian dollar falls further against the US dollar.

While other popular gold ETFs include the VanEck Gold Miners ETF under the ticker GDX, iShares Physical Gold ETF under the ticker GLDN and BetaShares Gold Bullion ETF under the ticker QAU. The latter is unhedged to mean it gets a valuation tailwind as the Australian dollar falls versus the US dollar, this is because gold is priced in US dollars.

4 topics