Morgan Stanley: Why 2023 will be a good year for income investors

With 2023 about six weeks away (I know, where did all that time go?), the biggest research houses in Australia are starting to drip-feed their respective outlook papers. Given how volatile and historic 2022 has been for financial markets, these papers are a brave document to release as early as now. Nonetheless, the first cab has left the rank and it's Morgan Stanley's paper that gets the first review.

Morgan Stanley has been (by far) Wall Street's most accurate research house on equities. Chief US equity strategist Mike Wilson was famously bearish as early as June 2021 when he noted stateside markets were flashing "sell" signals across the board.

He was the lone (and loudest) bear for a while, but being the contrarian has paid off handsomely for Wilson and his team.

Here in Australia, lead equity strategist Chris Nicol is similarly cautious and argues next year will be a period for "peaking signals and stress". Nonetheless, he believes 2023 will be a year for marginal upside on the ASX - and a great year for income investors.

In this wire, we'll go through Nicol's thesis and the sectors his team is backing. You may notice a tilt towards certain kinds of value in this list.

Macro overview: Here come the hikes

While the Reserve Bank's slew of interest rate hikes began in May, they will only really feed through to the economy next year due to response lag. That means lower GDP growth is all but a certainty with a big slowdown in consumer spending likely to exacerbate the below-trend effort. Morgan Stanley also forecasts the inflation headache will linger. Their core inflation (headline minus energy and food) forecast does not show Australia returning to the target band until the end of 2024.

Nonetheless, the team believe the RBA's pause will come in April next year. On the easing debate, they predict that will come in 2024 - later than some other economists (eg AMP and the Commonwealth Bank) who are backing a late 2023 easing.

As a result of all these hikes, economist Chris Read also believes we'll see a big fall in house prices next year (compounding this year's steep falls). The team have a consensus view in this regard - a 20% fall peak-to-trough on national house prices before a recovery in 2024.

Global markets: It's still too damn high

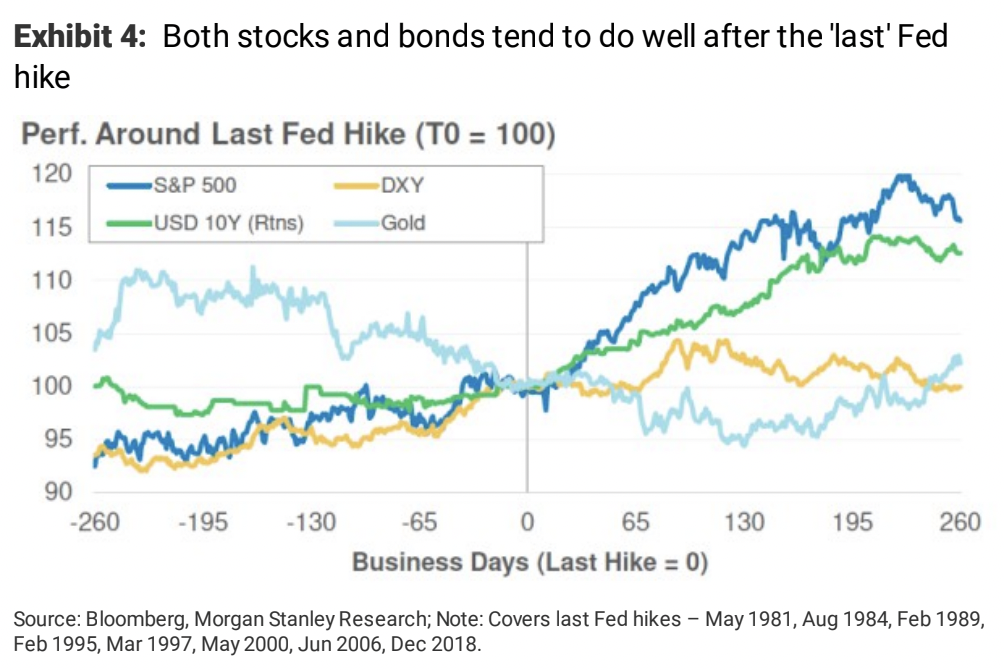

The good news? Stocks and bonds do well in the post-Fed hiking environment. The bad news? It won't be an easy ride until then - especially as the global team are now dangerously close to forecasting a recession.

First - the good news and for this, Morgan Stanley has created this chart which shows the returns on various asset classes after the last Federal Reserve rate hike in a cycle.

But before we see all this good news play out on markets, strategists say we have to answer the bigger debate: What do you pay more attention to - the hot economy or the cooling pace of rate hikes?

We won't tell you their answer to that specific question - but given the fact, they no longer prefer cash and would rather invest it in fixed income instead, that should give you a clue. In their view, fixed income will outperform equities in an income-centric play. If you have to stay in global equities, they like US "defensives" (healthcare, supermarkets) and the European value plays (banks and energy companies).

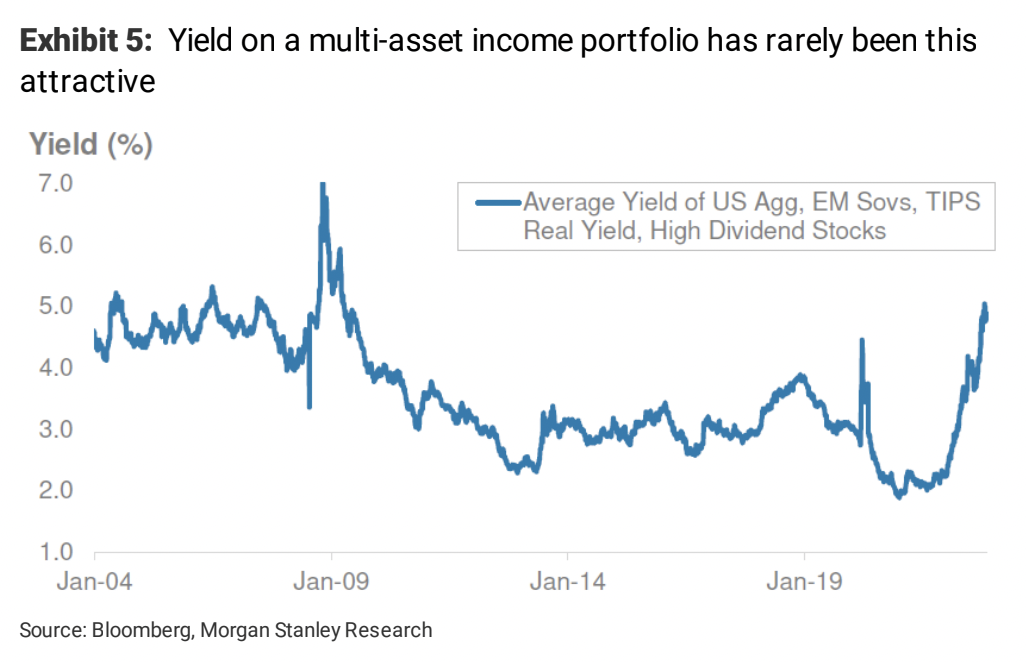

Whatever you choose, yield seems to be the way to go - as this chart demonstrates.

Australia outlook: Energy 2, Banks 0

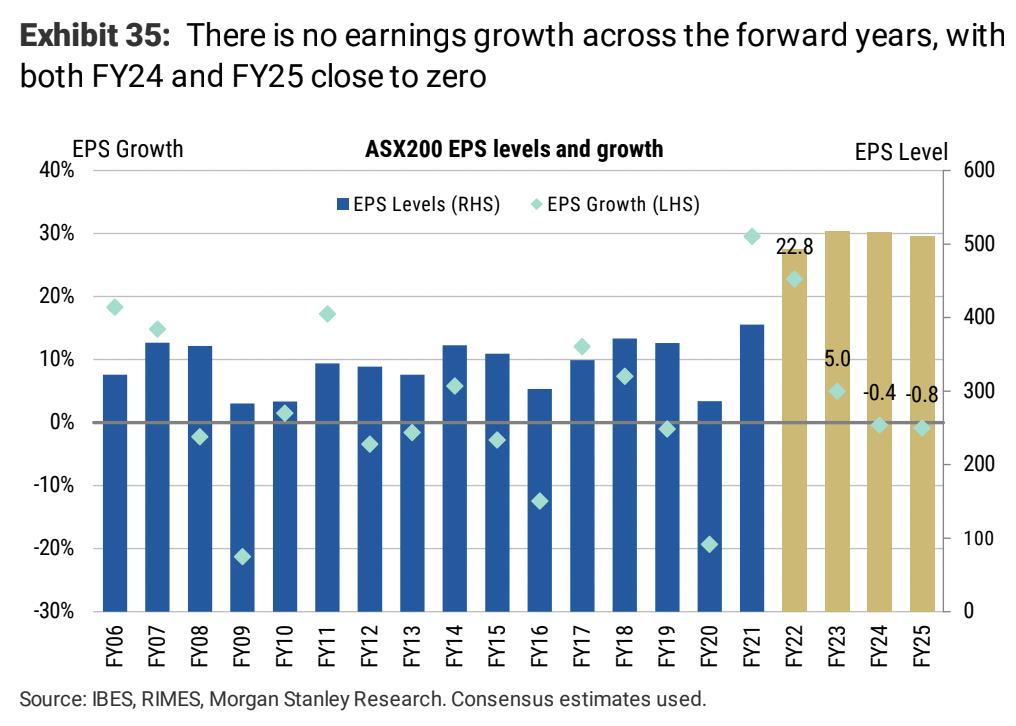

Rate rises should have been the best gift of all for the Big Four banks, but huge competition and falling house prices have been an even bigger weight. And in a year when inflation was at highs not seen since the early 1990s, infrastructure and industrials should have had a better year. It's in these two sectors (plus consumer stocks) that Morgan Stanley's Chris Nicol believes we'll see the largest risk of earnings downside.

Alarm bells are a good way to describe how the Morgan Stanley equities team feel about ASX earnings in general. As this chart shows, they are hoping for the best but not expecting a whole lot.

But there is one bit of good news - the valuation de-rating process has almost finished. That means market multiples are more in line with where they think valuations should be at an index level.

Here are some of their key changes:

- Overweight energy, healthcare, miners, and GARP (growth at a reasonable price) sectors. For GARP examples, try Aristocrat Leisure (ASX: ALL), property giants REA Group (ASX: REA) and Domain (ASX: DHG), job giant Seek (ASX: SEK), and automotive staple Carsales (ASX: CAR)

- ANZ (ASX: ANZ) is now an equal weight, but the underweight on the Big Banks deepens heading into next year

- REITs move to an equal weight rating, with Goodman Group (ASX: GMG), Scentre Group (ASX: SCG), Shopping Centres Australasia (ASX: SCP), and Arena (ASX: ARF) moving into the favourable column.

- Gold is finally turning good, and Northern Star (ASX: NST) is considered the place to be.

- Industrials move to underweight, with Woolworths (ASX: WOW) reduced to equal weight.

And finally... yields (real and otherwise)

We mentioned "GARP" and gold stocks in that last run of stocks. They also said income is the play for 2022 - especially in fixed income. But here is the catch to that call. A lot of the thesis is dependent on the continued performance of real yields (nominal rates plus inflation).

Real yields will likely determine the direction of these names - and in the case of gold, you also need to watch the inflows and outflows of the US Dollar. If real yields continue to rise, then growth-oriented names will do better and vice versa. But real yields are also linked to interest rate expectations, and expectations fluctuate based on the words and actions of central banks.

So you see - all roads eventually lead back to global economics.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

3 topics

12 stocks mentioned