Most-tipped small caps take off in Q1

Dear readers: When the Livewire overlords first told me of your investment prowess and foresight I have to admit I took it with a grain of salt. This is after all a platform where seasoned fund managers and investment leaders share their insights every single day (as well as pit their own picks against their peers at the dawn of the new year). It takes a little chutzpah to put your picks up against the pros, right?

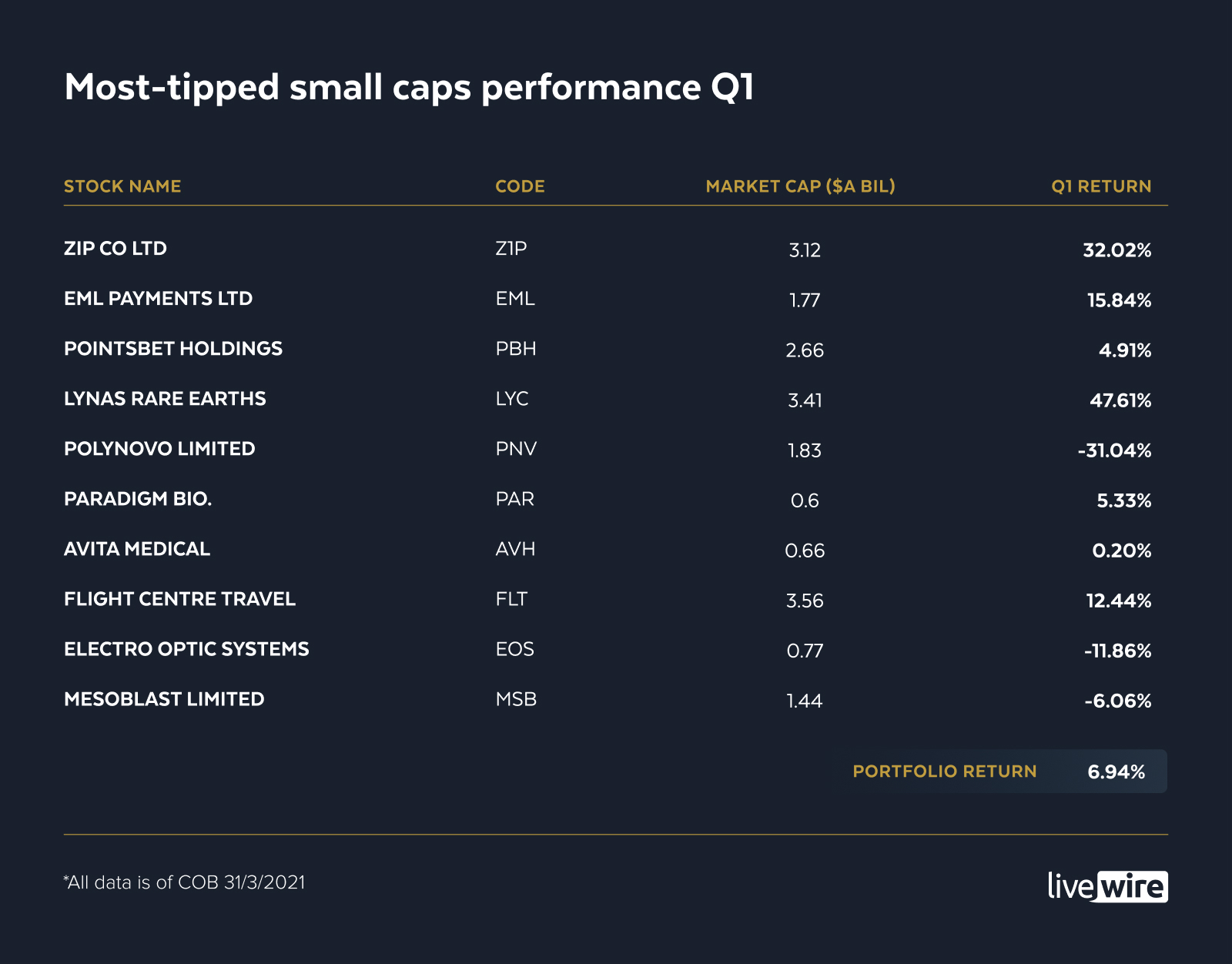

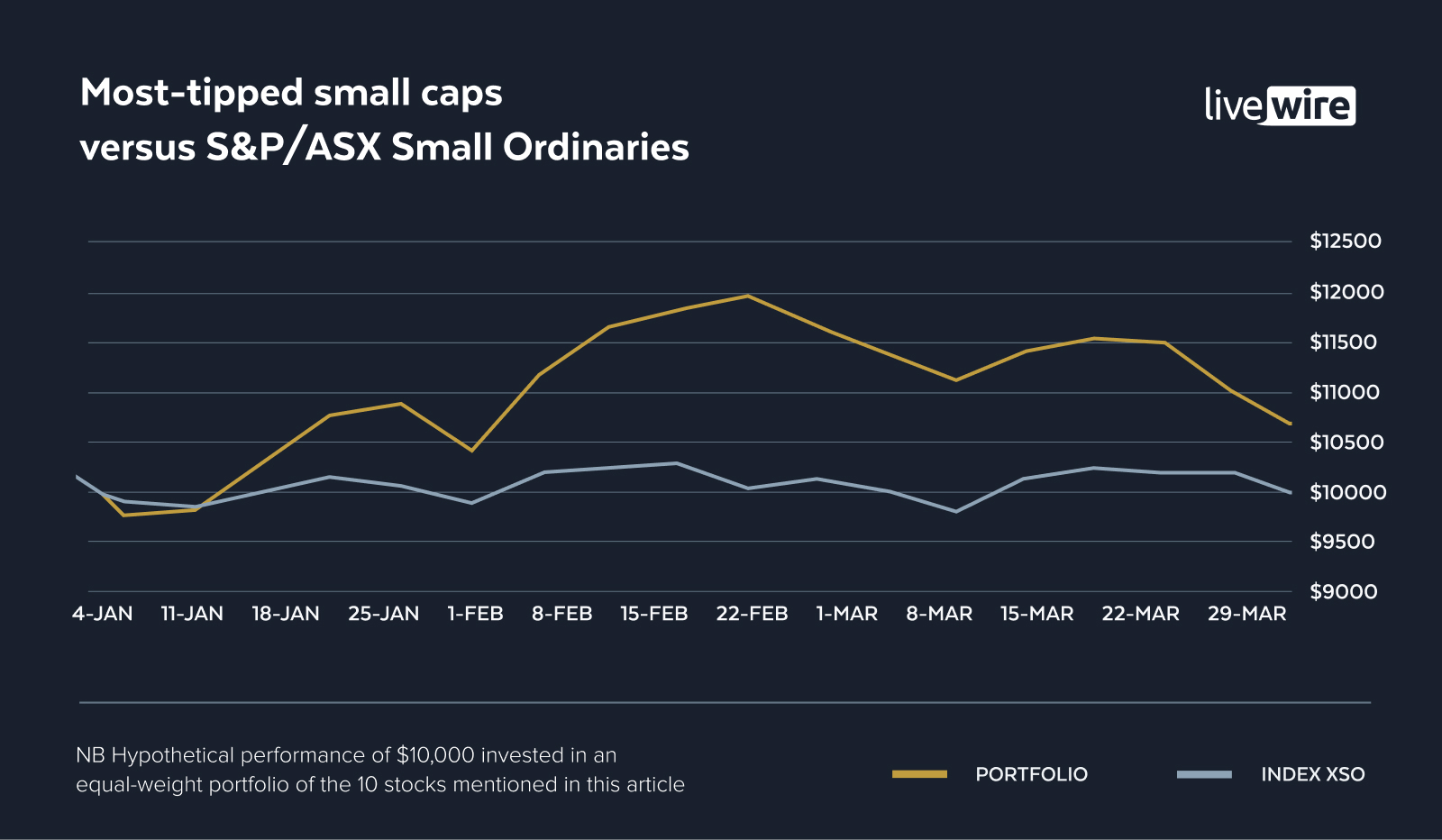

Well, my friends, please forgive me. Because you've done it again. Your picks (yes, even you in the back!) managed to beat the benchmark, returning a nice 6.94% over the S&P/ASX Small Ordinaries Index's 1.32% since the beginning of the year. That's an outperformance of 5.62%.

Among the top performers are a global gift-card creator, a rare earth excavator, and a growing flexible repayer, not to mention a travel retailer too. These Small Ords picks have done pretty well for themselves over the last three months, returning around 16%, 48%, 32% and 12.44%, respectively.

Seven out of your top 10 picks have posted positive returns in the first quarter, with only three picks dragging the total performance of the group down (albeit by nearly 49% combined - yikes).

So, without further ado, let's take a look at how your top-tipped smalls fared in the first quarter.

The #1 most-tipped small cap: Zip Co (ASX:Z1P)

- Percentage of votes in the top 10: 19.2%

- Market Cap: $4.26 billion

- YTD return: 32.02%

Zip Co soared to an all-time high of $14.53 during the quarter (on February 16), rising a whopping 160% since the beginning of the year. Since then, the buy-now-pay-later contender has given back a significant portion of those gains, settling in at a 32.02% return at the end of the three month period.

During February's reporting season, Zip Co results beat broker expectations, with the company offering positive guidance for the year ahead. Following its results, the stock dropped nearly 15% in two days, despite announcing its income had lifted 131% year on year.

Tribeca's Jun Bei Liu argued this share price drop could be attributed to the fact that the result was in line with or slightly better than expectations, and continued to back the sector going forward.

"In my view, you have to look at the last couple of months, in terms of performance. The BNPL sector has performed very, very well. If you look at Zip in the last month, it's done incredibly well," she said.

"So I don't see that sell-off as changing the trend, it's simply a bit of profit-taking after very strong performance."

However, Coppleson warns that any rally in share price from here on in will likely see a raft of retail investors sell down their holdings in tech and growth stocks like Z1P, slowing down potential rebounds.

The #2 most-tipped small cap: EML Payments (ASX:EML)

- Percentage of votes in the top 10: 11%

-

Market Cap: $1.77 billion

- YTD return: 15.84%

Gift and prepaid-card provider EML Payments has returned nearly 16% since the beginning of the year, after surviving an undeniably challenging COVID-19 period and emerging relatively unscathed.

The company was rewarded with a 22% one-day gain following the announcement of its results, with EML's diverse profit mix, a new acquisition and surprising resilience of the mall and incentives business keeping the company afloat.

While Shane Fitzgerald of Monash Investors doesn't believe there are any analyst upgrades in EML's future, he remains impressed by EML's resilience.

"If the mall business wasn't going to have a catastrophe in this macro-environment, I can't imagine what would ... EML has come out the other side mostly unscathed with a strong balance sheet and a very strong pipeline of new opportunities," he said.

The #3 most-tipped small cap: PointsBet Holdings (ASX:PBH)

- Percentage of votes in the top 10: 10.3%

- Market Cap: $2.66 billion

- YTD return: 4.91%

Having returned an impressive 158% last year, PointsBet Holdings continued on its upward trajectory until February 15, after which its share price fell around 30% - eek.

And while PBH reported a statutory loss of $85.6 million for the first half (up from a $32.3 million loss YOY), Ausbil Investment Management's Mason Willoughby-Thomas says the online bookmaker's catalysts for growth outweigh the risks.

Having broken into the highly competitive US market and with the potential to take Canada by storm later in the year, Willoughby-Thomas argues it's important for PBH to “strike while the iron is hot and to build on that momentum.”

“We see it as a unique opportunity in a big market. And as an early mover, we think the outlook is quite positive," he said.

And while Willoughby-Thomas anticipates the company will continue to bleed cash for a number of years, he argues that “the pot of gold at the end of the rainbow is pretty large”.

The #4 most-tipped small cap: Lynas Rare Earths (ASX:LYC)

- Percentage of votes in the top 10: 9.9%

- Market Cap: $5.55 billion

- YTD return: 47.61%

Well, hello hot stuff! This quarter's winning stock is Lynas Rare Earths, having returned an awe-inducing 47.61%. As the largest producer of rare earth oxides outside of China, we all knew LYC was a force to be reckoned with, particularly given the long-term shift towards a greener future.

While LYC beat broker expectations, UBS maintains a sell rating on the company, arguing optimism surrounding an acceleration in demand for electric vehicles is already priced into the stock.

However, Eiger Capital's Victor Gomes, who holds a position in the stock, believes there to be opportunities within companies exposed to the lower end of the EV supply chain, rather than the vehicle manufacturers themselves.

“We believe it is at this early point in the supply chain, particularly in lithium mining (for batteries) and rare earths mining/production (for magnets used in synchronous electric motors), where the likely price pinch points will emerge," he said.

LYC is a tier-one global producer, Gomes said, with a long mine life, and is also at the bottom end of its respective global cost curve.

Also the #4 most-tipped small cap: Polynovo (ASX:PNV)

- Percentage of votes in the top 10: 9.9%

- Market Cap: $1.83 billion

- YTD return: -31.04%

Polynovo has been the worst-performing stock on your most-tipped list, with the burn and wound treatment developer's share price cascading more than 31% since the beginning of the year.

It comes after a widely successful 2020, with Polynovo soaring to all-time highs. But it seems that the honeymoon is over for investors, with Market Matter's James Gerrish arguing it was time to sell.

"This is a really expensive stock that has missed in terms of their outlook," he said.

"If something is priced for perfection and it doesn't deliver it, I think it'll be under a fair amount of pressure going forward."

PNV's results in February were broadly in line with broker expectations, with Macquarie donning it a hold rating in light of the company's potential to sign up new companies in the US and move into alternative markets like breast reconstruction and hernias.

However, a word to the wise, Polynovo is one of the ASX's most shorted stocks, with a 5.62% short interest according to shortman.com.au.

The #6 most-tipped small cap: Paradigm Biopharmaceuticals (ASX:PAR)

- Percentage of votes in the top 10: 9.2%

- Market Cap: $602 million

- YTD return: 5.33%

Paradigm Biopharmaceuticals has seen its share price lift 5.33% since the beginning of the year, but it's been anything but a smooth ride for investors.

Its share price whipsawed up around 20% in the first week of February, before giving back these gains as the month wore on. Then in March, Paradigm's share price rose nearly 10%.

So, where to for the rest of the year? Well, the biopharmaceutical company has been spending a lot of cash on R&D and has made "significant progress" on its osteoarthrosis and mucopolysaccharidosis clinical programs. This resulted in an NPAT loss of $20.7 million in the first half (up from $5.1 million YOY).

Paradigm has also recently penned a deal with bene pharmChem to further develop its injectable Pentosan Polysulfate Sodium product, which helps treat pain associated with musculoskeletal disorders.

The #7 most-tipped small cap: Avita Medical (ASX:AVH)

- Percentage of votes in the top 10: 7.8%

- Market Cap: $662 million

- YTD return: 0.20%

While Avita Medical's year to date return doesn't look too impressive, the biopharmaceutical company had a cracker of a January, with its share price soaring just short of 46%. Since then, investors have taken profit, with its share price sitting flat by the end of the quarter.

AVH, which specialises in therapeutic skin restoration, was carrying an 8.4% short position in early February, with traders betting COVID-19 would continue to hinder the company's growth following a difficult 2020.

Back then, Market Matter's James Gerrish argued the company's revenue growth in the second quarter has put this view into question, recommending the risk/reward only looks attractive for traders with stops under $6.

Since then, the company has reported a net loss of $15.9 million, up 13% from the previous year. And while its sale of goods was up 60% to $10.2 million, other sources of income had dropped 60% to $1.1 million.

Also the #7 most-tipped small cap: Flight Centre (ASX:FLT)

- Percentage of votes in the top 10: 7.8%

- Market Cap: $3.56 billion

- YTD return: 12.44%

Hello Flight Centre and the possibility of an eventual holiday. This high-flying stock had been grounded for the good part of 2020 after its share price crashed 75% at the beginning of the crisis.

But now, with a travel bubble (between our Kiwi cousins) on the horizon, things are starting to look a lot sunnier for this travel retailer. Its share price has risen more than 12% this year, with fundies pinning Flight Centre as a reopening trade.

1851 Capital's Martin Hickson has recently re-established positions in Flight Centre and Corporate Travel Management, and is bullish on the sector going forward.

“The share market is always a lead indicator, and we believe that the travel sector will improve as that vaccine delivery rolls out,” he says.

Wilson Asset Management's Oscar Oberg also believes there to be plenty of upside for the travel booking company, as does Credit Suisse's Mike Jenneke.

“They have very good hibernation strategies that are very credible and which will see them through the downturn," Jenneke said.

“That said, investors should be prepared to ride out some volatility here.”

The #9 most-tipped small cap: Electro Optic Systems Holdings (ASX:EOS)

- Percentage of votes in the top 10: 7.4%

- Market Cap: $773 million

- YTD return: -11.86%

Electro Optic Systems Holdings has not had a great run in the first quarter of the year, nor did it during 2020 (the stock fell over 21% during the year).

However, Monash Investors' Simon Shields believes its share price could soon recover, as investors shift towards stocks beaten down during the crisis.

“EOS, which is a defence based stock for the most part... should have been immune from COVID," he explained.

"But it turned out that one of its largest customers in the Middle East shut down its military bases. You wouldn't have expected that, but that's what happened. Therefore, there was a cashflow lag and the stock got hammered."

The #10 most-tipped small cap: Mesoblast (ASX:MSB)

- Percentage of votes in the top 10: 7.2%

- Market Cap: $1.44 billion

- YTD return: -6.06%

And last but not least, we have Mesoblast, the regenerative medicine company, which has rewarded investors with nothing short of a volatile ride over the past 12 months.

This year, the biotech has sunk into the red, with its share price dropping -6.06% over the past three months.

But there are still nine months left of 2021, so could it all turn around? Well, company management sure thinks so, with Mesoblast recently reporting its strengthened balance sheet would help it to further develop and commercialise treatments for chronic heart failure, chronic lower back pain and respiratory diseases.

We hope you enjoyed this update on your top-tipped small caps' performance in Q1. If you did, why not give it a 'like'? Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Don't forget to follow my colleague Patrick Poke for an update on your Aussie large-cap picks, Glenn Freeman for your global stocks, and Mia Kwok for a final wrap of the fundies' favourites.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.