Move over big tech: JP Morgan Asset Management’s five other equity market ideas

Who doesn’t love an up start to a trading year? Especially when January was the best first month since 2018 for US equities, and the 1990s for Australian equities. Bonds are being bid in voracious fashion too with the US 10-year yield down 47 basis points in January alone in one of that asset classes’ best starts to a year on record.

But several questions still need to be answered:

- When will the rate hikes stop from central banks?

- Will all those forecasts for earnings downgrades come to fruition?

- Is January a sign of bigger things to come?

The answers to the first two are still playing out but JP Morgan Asset Management already has an opinion on the answer to the third question:

“We’ve had a view of being relatively underweight equities, but we are definitely warming up to the equity market given where valuations were at the start of the year. But we’re still cautious because the markets have run very hard,” JP Morgan Asset Management Global Market Strategist Kerry Craig said.

In this wire, I’ll take you through JP Morgan Asset Management’s latest markets briefing entitled Bad for the Economy, Good for Markets. I’ll also share some comments from Craig and US equity specialist Christian Mariani on where they are paying most attention in the investment universe.

Why “soft landing” is the wrong term

Craig and Mariani said that the world is now entering a three-speed economy rather than a US-led “soft landing”.

The consensus has shifted in the last few months. First, it was that the US Federal Reserve was too late to start hiking interest rates. But after 400+ basis points worth of hikes in 2022, the conversation has pivoted from a deep recession to a mild one at worst. But both analysts agree now is the time to see things differently.

“You’ve definitely got slowing momentum in the US, acceleration in China, and stagnation in Europe,” Craig said. “And that creates a lot of opportunities for investors that didn’t exist in the first part of the year.”

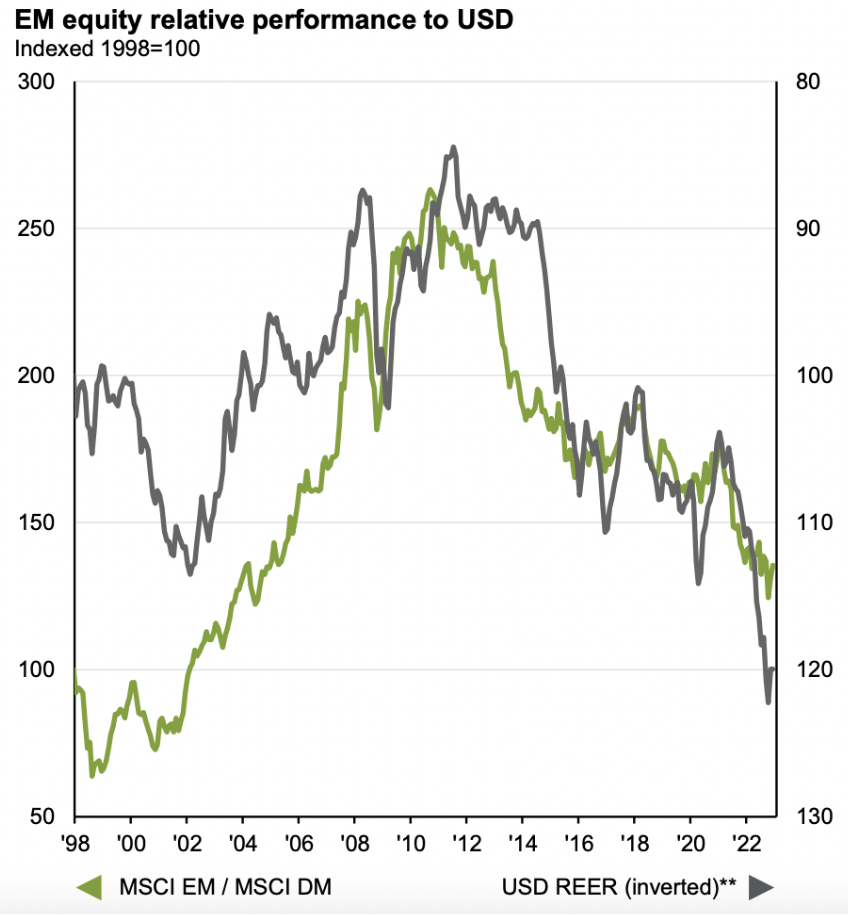

This, in part, has informed a greater allocation towards emerging markets such as China, Taiwan, and South Korea.

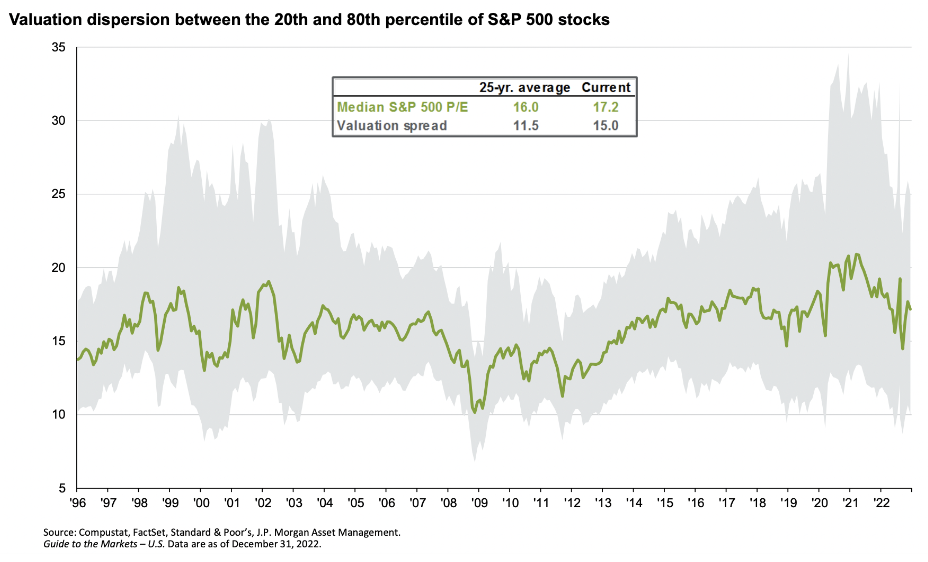

That allocation was taken away from US equities where the valuation spread is falling but not back at attractive levels yet.

In another counter-consensus opinion, Craig believes the market will be disappointed by central banks - again.

“We do think that the market is being overoptimistic in thinking about rate cuts this year,” he said.

He believes we’ll see two more hikes from the Federal Reserve while the Reserve Bank locally will be done by March.

Sector opportunities within the US

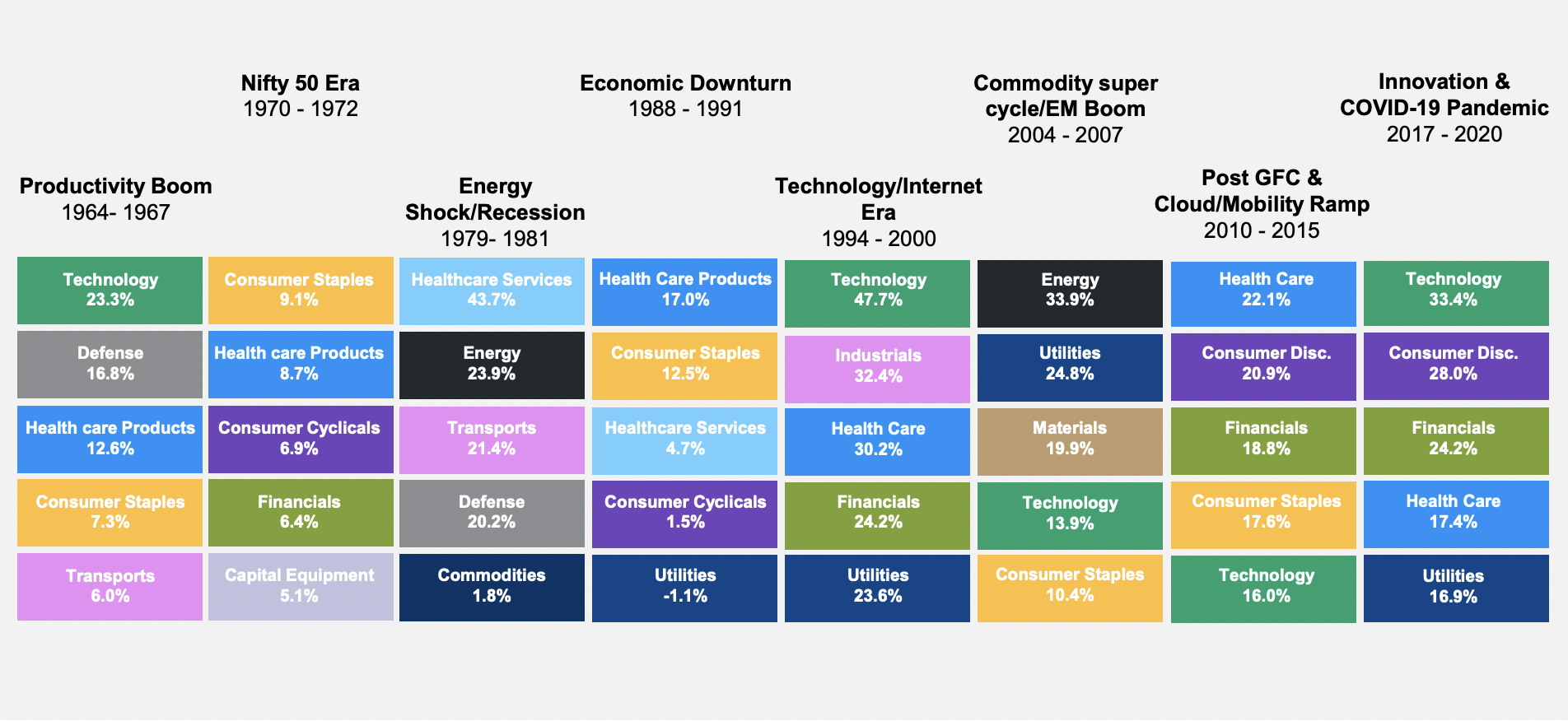

One of the big themes in Craig and Mariani’s presentation was that market leadership rarely remains consistent. Between 2017 and 2020, technology stocks were the darling of the market - up 33% in those years.

But opportunity doesn’t always knock twice and Mariani tells me that he does not expect technology to retake its top spot in the next few years.

“Higher interest rates have been sending those valuations down, and you’re seeing normalisation in growth rates from those high levels,” Mariani said. “It’s difficult to see that sector retaking leadership.”

So which sectors does Mariani like? Over the medium term, he thinks the time for sector picking has passed and believes it’s now down to individual stocks.

“I wouldn’t say there is one specific sector we would forecast to lead the market. I think it’s time to be more balanced,” he added though he did admit energy stocks could have another year of outperformance.

One theme for the near-term

Although Mariani said he doesn’t expect one sector to take multi-year leadership, he does have a favourite theme for the immediate term: US stocks with a bias towards cyclical themes.

Among his favourite sectors:

- Consumer staples and defensive-type names

- Financials (given those shares have already priced in a recession)

- Defence stocks

- Utilities

There was one notable omission from this list - airlines. That sector is Mariani’s one exception to the rule.

“Over the long term, the recovery will continue but how fast can you increase capacity in a profitable way? That’s difficult. That’s why generally speaking we’re not finding that many opportunities right now,” Mariani said.

What about bonds?

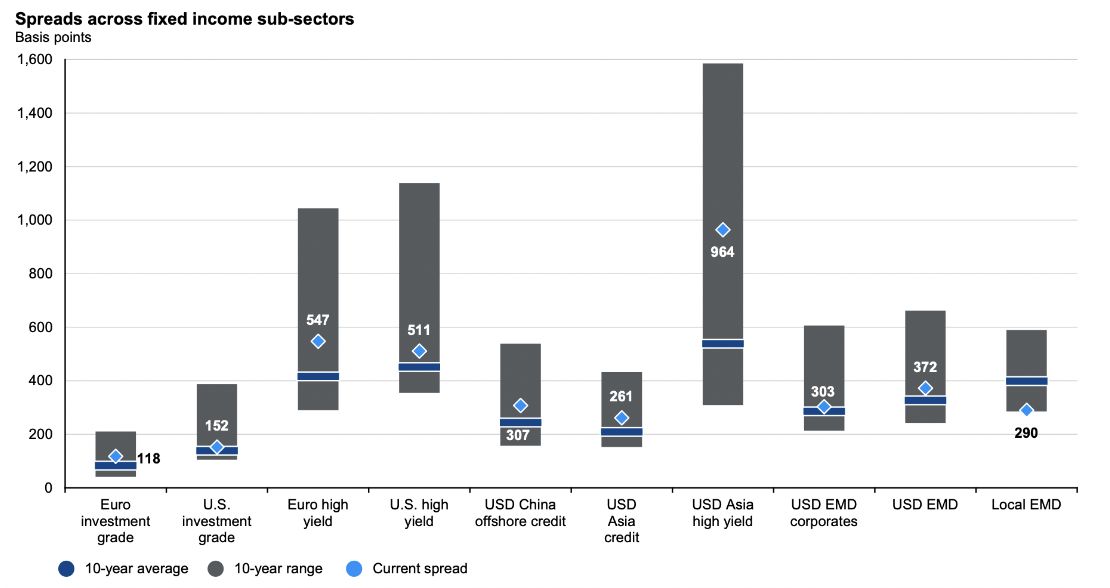

2022 was the worst year for bond returns in decades (and on some measures, in recorded history). So naturally 2023 was going to be a better year right? That’s certainly Craig’s view.

“In terms of the risk-reward ratio, I think it’s much more appealing in the fixed income space generally,” he said.

In the government bonds space (the safest of all possible options), he is noticing heavy client rotation back into the space as prices rise and yields fall. He expects yields will continue to fall rather than reversing imminently.

Craig said the team also likes the cut of investment grade bonds’ jib - indicated by a recent rally and this next chart. Examples of investment grade ideas are US corporate bonds, where balance sheets remain strong and yields are healthy.

2 topics