The Hub24 of Hedge Funds?

Perennial Value Management

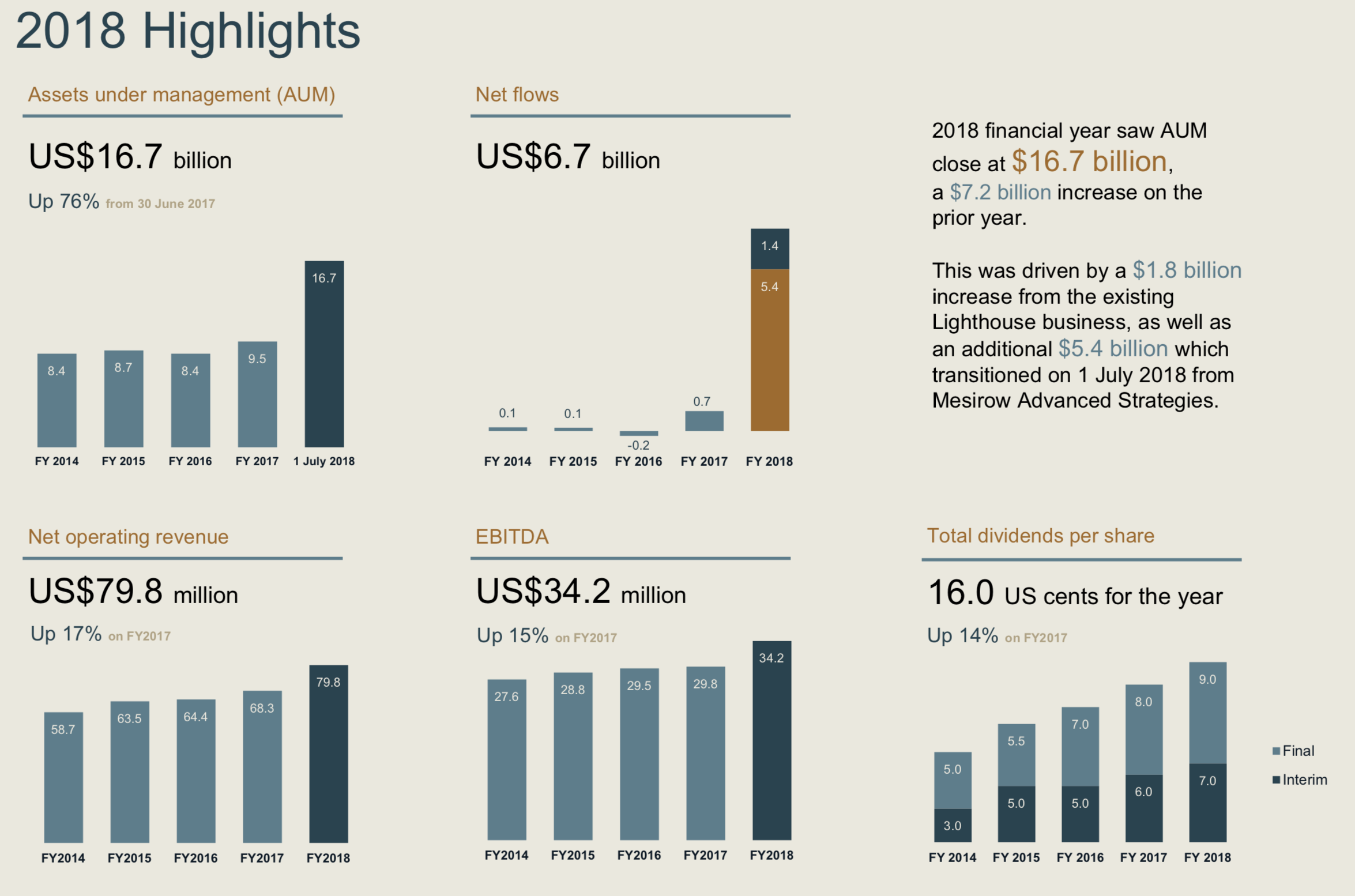

Navigator Global Investments delivered a quality FY18 result with EBITDA +15% and dividends +14% both in US$. This capped off a successful year, which saw the share price almost double.

Source: NGI FY18 Result Presentation

After such a strong run, investors could be forgiven for thinking all the good news is now in the price. However, the recent investor roadshow revealed a management team as excited as ever about the two growth options ahead of them – both of which we believe are underestimated by the market.

First, it is worth exploring the recent Mesirow acquisition, which lifted assets under management by US$5.39bn and contributes to earnings from 1 July 2018. The deal has been structured in such a way that NGI shareholders look set to enjoy a strong uplift in earnings while payment for the acquisition stretches over seven years and is funded out of the earnings of Mesirow itself. This low risk, but high return deal, is typical of the conservative approach of founder and CEO Sean McGould who still owns 12% of the company. While the market has increased earnings expectations to reflect some of the benefit from buying Mesirow, we see further upside if management can deliver on their goal of lifting margins towards those of their existing Lighthouse business.

Secondly, it was management’s discussion of a new “platform only” solution for investors that grabbed our attention and made us ponder – could this become the Hub24 of the hedge fund world?

NGI has spent a considerable amount on their IT systems since the GFC to allow their clients to hold the underlying assets in NGI’s hedge funds directly, as opposed to holding these assets through a traditional fund structure – much like Hub24 allows investors to directly hold the underlying assets in managed share portfolios.

From FY19, NGI will begin offering their technology platform to those investors using 3rd party hedge fund managers. We believe this offer will be compelling for medium size endowment funds, pension schemes and insurance companies who can take advantage of the increased transparency, improved reporting and lower funding costs of placing their investments on the NGI platform.

The addressable market for NGI is significant with capacity to house 3rd party managers well in excess of the $16.7bn NGI currently have on their platform for their own funds. NGI has recently hired an experienced executive to build out this new and potentially substantial business opportunity.

While it is too early to factor any earnings in from this initiative, it is clear that any new ‘platform only’ funds are likely to attract a high multiple from the stock market.

As an example, consensus estimates currently see NGI trading on a PE ratio of 16.8x in FY19, falling to 14.5x in FY20 – by comparison, their pure platform peers HUB24 and Netwealth trade on 35.3x and 45.4x respectively in FY20, according to FACTSET.

If progress with these two growth options can be demonstrated to the market, we see considerable upside on offer for NGI over the next two years.

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Perennial. This promotional statement does not take into account your investment objectives, particular needs or financial situation.

1 topic

1 stock mentioned

Andrew commenced with Perennial Value in July 2008. Prior to joining Perennial Value, Andrew was Head of Research at Linwar Securities, a boutique broker specialising in smaller company research. Andrew joined Linwar in 2003 and during this...

Expertise

Andrew commenced with Perennial Value in July 2008. Prior to joining Perennial Value, Andrew was Head of Research at Linwar Securities, a boutique broker specialising in smaller company research. Andrew joined Linwar in 2003 and during this...