Nearmap: Climbing through turbulence

We have seen growth stocks pull back in recent weeks on the back of sky-high valuations and subdued market sentiment. Whilst some growth stocks may have flown too close to the sun, we believe others have demonstrated a sustainable trajectory into FY19. A good example is Nearmap (ASX:NEA).

We've been happy to participate in Nearmap's story and performance for some time now and look forward to the next potential step-change in their growth profile: North America and beyond.

What is Nearmap?

Nearmap is a Software-as-a-Service (SaaS) company that provides high-resolution aerial imagery across Australia, New Zealand and USA (and soon to enter Canada). The global market for aerial imaging in 2018 was estimated at US$7.4 billion and projected to reach US$10.1 billion by 2020.

Since 2012 Nearmap has utilised and continually improved its proprietary camera technology to become a leading provider in Australia. As at FY18 it had captured 88% of the Australian population, 72% of New Zealand and already 70% of USA. It adds 400km2 of images daily and has 10 years’ backlog of high-resolution images.

Customers can access over 10 petabytes of images through a subscription model. Nearmap’s subscription platform is stratified to capture not just large institutions, government entities and large companies, but also a long-tail of small and medium enterprises (SMEs) and single-users.

5 reasons why we like Nearmap

1: A significant market opportunity

Nearmap estimates its addressable markets to be A$350 million in Australia & New Zealand and US$1-2 billion in North America as at 2018. With such a considerable addressable market and its current penetration, Nearmap is optimally placed to benefit from a step change in growth in the near future. As at FY18, the company had penetrated approximately 15% of the Australian market and less than 0.5% of the US market.

The subscription business model allows Nearmap to pursue a previously untapped market of SMEs and sole traders. Additional growth has been attained by upselling new product lines (e.g. 3D and oblique imaging allowing for building measurements within 15cm accuracy) and use-cases to existing clients in Australia. Additionally, it recently launched a new mobile-enabled MapBrowser app to drive customer engagement. Given Nearmap is a big data play, it is likely Nearmap will look to overlay value-add analytics to customers through organic or inorganic investments in FY19-FY20. This opens yet another growth corridor for Nearmap into the spatial analytics global market, currently estimated at US$18.4 billion.

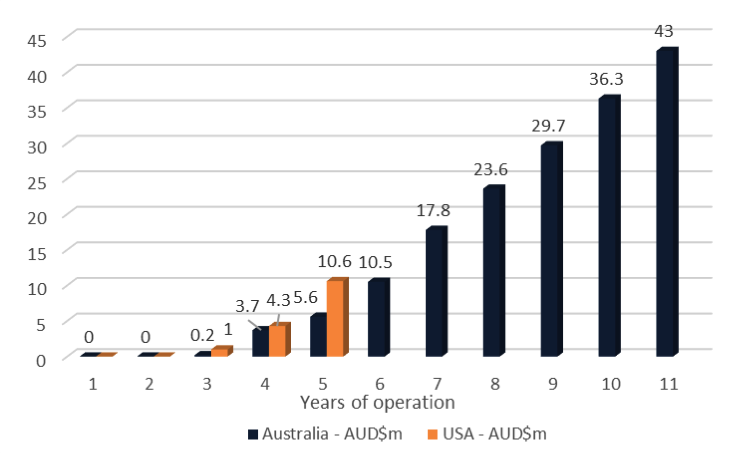

Exhibit 1: AU v US ramp up - subscription revenues rebased to first year of operations

2: Favourable unit economics and cost base scalability

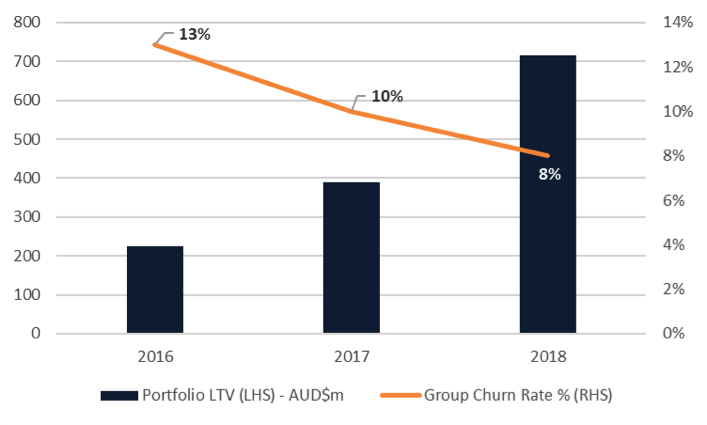

A good barometer of sustainable growth in SaaS companies is the customer lifetime value to cost-of-customer-acquisition ratio (LTV/CAC). A rule-of-thumb LTV/CAC for healthy SaaS business is above 3x. A company above 5x is generally considered to be leaving growth on the table. As at 1Q19, Nearmap sported a compelling LTV/CAC ratio of over 10x in Australia and 5x for the Group.

Management provided a market up date in November 2018, reiterating its focus on attaining at least 100% incremental annualised contract value (ACV) to direct sales cost. If this is greater than 100%, then the payback period is less than 12 months. Incremental ACV to direct sales costs is currently ~117%, meaning for every $1 spent on sales and marketing, Nearmap makes $1.17 in annualised contract value (or $15 in future revenue at its current churn rate). This indicates improving marketing productivity.

Exhibit 2: Effect of churn reductions on portfolio lifetime value

3: Nearmap is an established player with a robust competitive position

A quick review of recent corporate history would suggest that it is usually the incumbent that is most vulnerable to disruption and competitive threats. Competition from other aerial imagery providers and potential technology developments (e.g. drone imagery) remains a risk that we watch closely.

There has been some concern on Eagleview's acquisition of one of Nearmap’s local competitor Spookfish (ASX: SFI). However, we note Eagleview focused on providing bespoke “pay-per-report” imagery services and is late to the SaaS platform. Transitioning to a SaaS model may cost Eagleview operational headwinds and customer churn. In addition, Nearmap CEO Rob Newman Ph.D. recently acknowledged it’ll take Spookfish 12-18 months to catch up to Nearmap’s camera technology. We believe this provides Nearmap a healthy head-start and will look to Nearmap to maintain this lead through innovative product add-ons, reduced churn rates, new use-cases and effective penetration of the North American market. Promisingly, churn continues to decrease from 17% in 4Q18 to 12% 1Q19 (Australia) and Nearmap has been reporting greater upsell through customer engagement and new products such as the obliques product line (commenced in late 2017).

4: Healthy balance sheet and proven management

At FY18 Nearmap’s balance sheet held a net cash balance (c.A$17.5m) and benefitted from an impromptu capital raising in September 2018 of ~$70m. Despite this raise, Management continues to assert Nearmap will achieve cash flow break-even from existing businesses (i.e. excluding capital raised) by FY19.

So why raise cash when they do not need to? One reason could be invest organically and inorganically faster than anticipated. For example, accelerate its North American expansion given their highly attractive LTV/CAC achieved in Australia. The increased sales and marketing expenditure would be well spent with a marketing contribution ratio of 117% (up from 89.5% in FY17). Another reason could be to bolster the balance sheet to fend off any increased competitive activity from Eagleview and Spookfish. Either way, we approve of the optionality provided by a robust balance sheet.

5: Growth

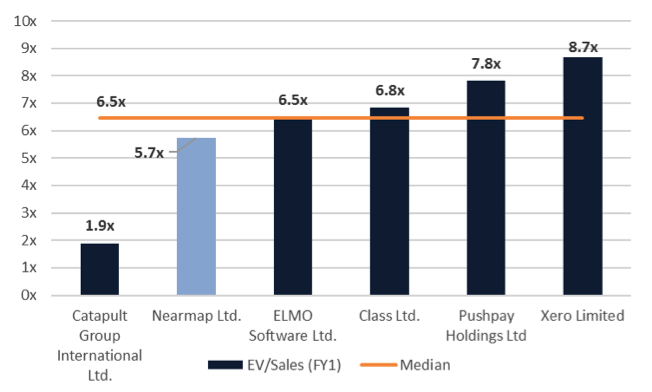

Growth is good, but we’d argue the market has weakened its tolerance of stratospheric valuations. Sustainable growth is back in vogue and Nearmap continues to deliver. It beat FY18 expectations by achieving 41% organic growth in Group ACV through customer additions in the US, reducing customer churn and achieving a 14% net increase in upsells. 1Q19 incremental ACV growth is up 54% compared to 1Q18 and group ACV now exceeds A$70 million. Nearmap currently trades on a forward enterprise to sales ratio of 5.7x. Again, this is favourable to peers as shown below.

Concluding thoughts

We’ll be keeping a close watch on Nearmap’s cash and cost base management as FY19 approaches. We expect the US expansion may require an increase in sales and marketing expenditure to adequately penetrate that significant market. That said, Nearmap’s market is massive and with a proven organic growth track record, research and investment into new market-leading products, strong balance sheet and attractive LTV/CAC it seems well positioned to climb through turbulent times.

More about Monash

Monash Investors Limited aims to achieve their objectives by investing in a small number of compelling stocks that offer considerable upside, and by shorting expensive stocks that are at risk of falling. Find out more here.

1 stock mentioned

1 contributor mentioned