Neoliberalism is greatly misunderstood

The last decade has seen the concept of Neoliberalism go out of fashion. Today it is typically used as a slur against people holding small government and free market beliefs, with plenty of articles promoting its death, failure or both. Whilst neoliberalism has lost the marketing battle, the evidence points to its key tenets producing the best outcome for both rich and poor members of society. The key headwind for neoliberalism is the increasing belief amongst politicians, economists and the general public in a free lunch from government spending and intervention.

Defining neoliberalism

Neoliberalism can mean different things to different people, but at its core is the belief that the best way to promote economic growth is to have low levels of government spending and limited intervention in free markets. It can be summed up as “small government”.

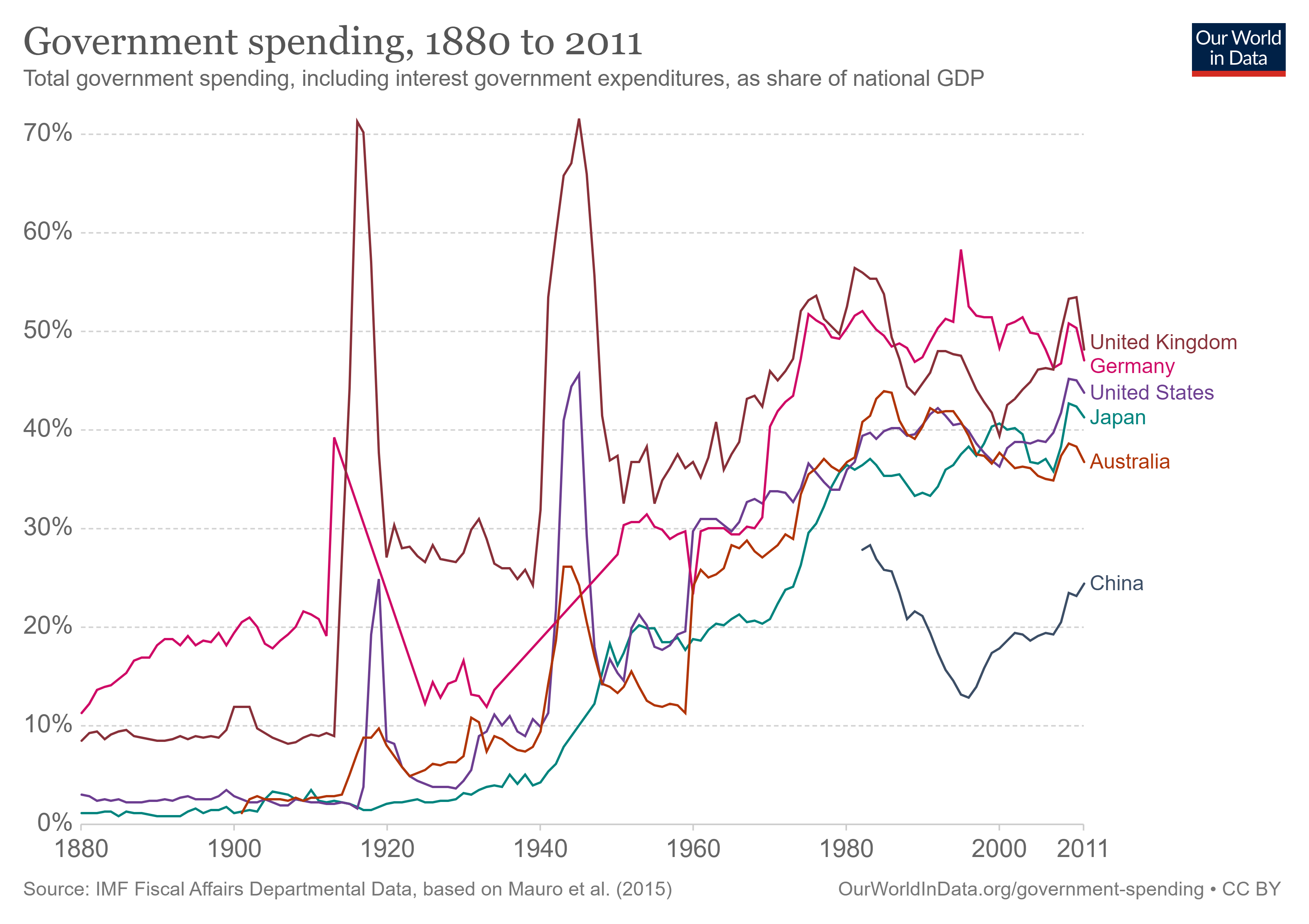

The modern use of the word came about when governments led by Margaret Thatcher and Ronald Reagan pursued small government policies. However, while many like to think neoliberalism was an idea that took off in the 1980s, the graph below from Our World in Data shows that governments were a small fraction of their current size before the First World War and had been on an upward trajectory until the 1980s. Neoliberalism should be seen as a halt to the takeover of the economy by the government, rather than a reversal of the trend. Given where developed economies have come from pre-World War One, what is often referred to as small government today would have been considered mammoth government 100 years ago.

Criticisms of neoliberalism

One of the things that kicked off my inspiration to write on this topic was a recent commentary in a government report by the Australian Greens. I’ve copied the first paragraph below as it summarises the essence of many criticisms I’ve read recently.

Many of the shortcomings in the Australian Government’s (government) response to COVID-19 can be traced back to neoliberalism, which has been the dominant ideology in Australian politics for the last forty years. The purported aim has been to free up the potential for markets to generate growth and distribute the benefits. In reality, it has been a cover story for the rise of crony capitalism and the hollowing of the state in favour of corporate interests. Neoliberalism is a great, big con that has been used to justify privatisation and deregulation, the winding back of the social security, and the concentration of wealth in the hands of fewer and fewer people.

There are enough points raised here to write a book about, but I’ll make some short comments on crony capitalism, hollowing of the state/welfare, and concentration of wealth/trickle-down economics. There’s some agreement here but mostly disagreements.

Crony capitalism

One thing almost everyone can agree on is that crony capitalism is both morally wrong and economically destructive. The arguments come when determining who are the cronies, with wealthy individuals, large corporations, unions and special interest groups the most common targets. Left of centre politicians typically disdain wealthy individuals and corporates for their excessive influence. Right of centre politicians are more likely to scorn unions, environmental groups and advocates for various “disadvantaged” blocks of citizens. Examples of crony capitalism include big businesses arguing for more regulation (thus hamstringing smaller businesses), farmers wanting bailouts/subsidies, and unions arguing for “safety” initiatives or lower student/teacher or patient/nurse ratios. At its heart, crony capitalism is about using access to government to tilt the playing field in your favour.

In this way, crony capitalism isn’t a feature of neoliberalism, it is a clear sign that a government has abandoned neoliberalism. Less regulation, the elimination of subsidies and lower taxes for all results in higher employment and higher wages across the economy. Crony capitalism enriches special interests at the expense of the general population.

Hollowing of the state/welfare

The graph earlier shows that government spending as a percentage of the economy has been roughly steady since around 1980. Claims that neoliberalism has resulted in a hollowing out of the state are patently false, government spending has continued to grow at roughly the same pace as developed economies. That leaves good arguments to be had about where governments spend taxpayer’s money and the value gained from it. (e.g. less defence spending but more on healthcare, welfare versus investment, eliminating fraud/corruption)

The welfare aspect is far harder to analyse as it often gets caught in definitional disputes about poverty and inequality. What is clear is that wealthy countries have far more expansive and generous welfare systems than poor countries, which can include monetary payments, as well as free (to the consumer) or heavily subsidised schooling, healthcare, food, accommodation, and transport. Whilst the poverty rate typically remains steady, the poorest households are able to consume more goods and services that are paid for by others.

Concentration of wealth/trickle-down economics

Given the above point about the increasing consumption of goods and services by those classified as being in poverty, those seeking to argue that there is increasing inequality in developed countries must look at either wealth or earned income measures. These measures have obvious drawbacks.

Wealth inequality falls down as some people have below-average incomes but are good savers, whilst others have high incomes but spend it all. Assuming that an individual’s lack of savings is only caused by a lack of income is obviously naïve. Similarly, entrepreneurs can come up with great ideas to improve the quality or reduce the cost of goods and services, and in doing so become very wealthy. There are good arguments to have about reducing monopoly power and crony capitalism, but we shouldn’t have a problem with wealth created by making the lives of others better.

Income equality falls down as there is a decreasing willingness to work in many developed nations. Migrant workers are often needed to do “dirty jobs” that locals can’t be bothered to do. This raises the issue of whether welfare systems have become too generous or at least too poorly targeted, given there are both unemployed people and employers struggling to find workers for low skill jobs.

The phrase trickle-down economics highlights the definitional debate. Those who look only at wealth will say that the poor still have no savings, therefore the wealth isn’t trickling down. Those looking at the consumption of goods and services argue that the benefits of a growing economy have flooded down. Compared to 100 years ago, the poorest citizens are living in larger and better-furnished residences, have significant educational opportunities (to increase their income and wealth), far better access to healthcare and are more likely to be obese than malnourished.

Neoliberalism and the broken window fallacy

Proponents of big government policies have the advantage of being able to point to obvious “wins”, where the long term costs are hidden. Neoliberalism’s negatives are more obvious in the short term, with the long term prosperity it creates overlooked by most. Jobs lost when businesses switch to sourcing from overseas are obvious, but the lower cost of goods that benefits millions of consumers is ignored.

To argue against big government requires an understanding of the broken window fallacy, a simple economics concept that a dwindling number of economists seem to understand. When applied to government actions it is a reminder that when one group is “given” government assistance, another group must pay for it. Whenever one group is taxed they have less to spend, offsetting the “gain” of those who receive the assistance.

This simple counterbalance is often missed in the arguments today about government stimulus for individuals and businesses. It is commonly argued that giving benefits to low-income citizens is good for the economy as they tend to spend all they receive. It is true they will spend quickly, but this is an incomplete response. The counterbalance is that wealthier individuals tend to save and invest, creating businesses that employ others, that improve the quality of goods and services available as well as reducing their cost. While the government stimulus provides a sugar hit, private investment provides sustainable long term benefits.

Another common fallacy is that citizens bearing increasing tax burdens will simply cop it. This is extremely naïve and ignores a long history of citizens moving their wealth, businesses and residence to lower tax jurisdictions. Those with the greatest wealth and income levels are the most mobile, with many national governments having visa and citizenship schemes particularly targeted at these individuals. There’s a common economic saying that summarises this reality, “if you want less of something, tax it”. Big government proponents are willing to accept that this applies with taxes on cigarettes and alcohol but believe it doesn’t apply to taxes on income and wealth.

A live experiment in big versus small government

The current tax and regulatory settings at the US state government level are providing a live experiment in how people respond to the choice they have in living in a big government or small government state. New York, California and Illinois have pursued higher regulation, higher government spending and higher taxation agendas. States such as Florida and Texas have chosen to pursue lower regulation, government spending and taxation.

The results are further proof of one of the oldest economic concepts; that people respond to incentives. The big government states are seeing residents leave, typically heading to the small government states. The flow is skewed with the wealthiest and highest income residents leaving, the very ones who have shouldered the highest tax burdens.

Those who stay are more likely to include government employees with generous salary/retirement benefits and welfare recipients. Both groups would likely see their income drop if they switched states. A vicious circle occurs, where tax revenues drop as higher tax-paying residents leave, resulting in tax levels being raised on remaining residents, further incentivising the remaining high taxpayers to leave. Whilst the impact of higher taxes is obvious, less obvious impacts include regulation that makes it difficult for entrepreneurs to start businesses or that makes homeownership more expensive. Examples of these reasons for departures include technology businesses leaving Silicon Valley and finance businesses leaving New York.

International comparisons of big versus small government

A common argument is that America would be better off if it became more European, that is, having higher levels of government spending and regulation. Dan Mitchell has dismantled this argument repeatedly on his blog, including posts comparing Europe generally and France specifically. One of his most compelling points is “the OECD data that shows that people in the bottom 10% in the United States are better off than the average middle class person in France”.

The challenge that has long been unanswered by proponents of big government is to show a country that has become wealthy through higher regulation and government spending. History points to the opposite being true, the standard pathway to prosperity involves a country pursuing greater economic freedoms. Poor countries that have the highest levels of government intervention remain mired in a self-imposed poverty trap. Wealthy countries that pursue big government agendas tend to stagnate.

The death of Neoliberalism?

Those arguing that neoliberalism is dead are mostly right. It isn’t that it hasn’t worked (the evidence shows that it has worked very well compared to the alternative), it is that governments are generally no longer willing to tell people unpleasant truths. Many mainstream economists are now willing to assisting politicians by telling comforting lies. The well-known cartoon below captures this reality.

One common comforting lie is that high levels of government spending and debt are affordable as interest rates are currently low. This ignores that low-interest rates reduce long term growth rates as they discourage saving for investment activities and encourage inefficient spending and investment to occur. If interest rates were normalised, many governments would be quickly facing bankruptcy or would have to embark on currency destroying levels of money printing.

Another common comforting lie is that the only way out is via growth, which needs short term stimulus to occur. The example of the Great Depression is put forward, with the lack of government stimulus cited as the reason for the sustained downturn. This simplistic analysis ignores that government actions worsened the Great Depression, as well as misunderstanding the level of cleansing needed after the debt-fuelled excesses of the 1920’s. The counter-example of the 1920-21 depression in the US is almost always ignored when government spending and taxation were cut and the economy took off.

Increasingly, politicians are promoting magic pudding economics. The trend of never-ending government deficits that largely began with the Financial Crisis has accelerated with the onset of the Covid-19. Substantial “one-off” handouts to businesses and individuals and the push to implement universal basic income generate a growing belief amongst citizens that governments have a bottomless pit of money to draw upon to fund whatever is deemed necessary at the time. The costs of this profligacy that will last for generations are rarely discussed. Neoliberalism has been discarded with the old cartoon below summing up the current situation well. Hayek’s classic tome, The Road to Serfdom, is a much deeper exploration of this phenomenon.

Where to from here?

Two months ago I wrote about the endgame for government and central bank stimulus. A muddle through outcome like Japan has had for the last 30 years could be optimistic for many developed economies, with the loyalty of Japanese citizens and businesses to Japanese government debt unlikely to be repeated elsewhere. At some point, governments must switch from popular short term stimulus to less popular measures such as productivity reform, tax reform and unwinding excessive government involvement in the economy that provide long lasting economic stimulus. For many nations, these measures will be resisted until their economies break. Should we be fortunate enough to get a modern-day Thatcher or Reagan, they’ll be starting from a worse position than those two began with.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics