Net profits "substantially down" at the Millionaires' Factory

Australia's highest-paid banking executive, Nicholas O'Kane, has announced he is departing the Millionaires' Factory at the end of the month, after taking home $57.6 million in 2023. For context, Macquarie's CEO Shemara Wikramanayake reportedly earned $30.4 million last year (and she was the highest-paid CEO on the ASX).

On Tuesday, Macquarie Group (ASX: MQG) announced the Group Head of its Commodities and Global Markets (CGM) division would be leaving the bank for "opportunities outside" the business, with the firm's current Global Head of CGM's Financial Markets division, Simon Wright, set to take his place.

It comes as the bank reveals that CGM and Macquarie Capital's combined net profit contribution for the third quarter of FY24 was "substantially down" year on year, due to "exceptionally strong results" in the Commodities business in the prior corresponding period.

This wasn't the only area of the business where net profits were "substantially down"...

Macquarie also announced that year-to-date FY24 net profit contribution in its annuity-style businesses (Macquarie Asset Management and Banking and Financial Services) had also been impacted - mostly due to lower "asset realisations in green investments", continued investment in green energy portfolio companies, margin compression, as well as "run off in the car loan portfolio".

So should investors still hold their Macquarie shares from here? To find out, Livewire spoke with Medallion Financial's Michael Wayne, who broke down the bank's latest operational update and provided his outlook for Macquarie from here.

Key financial figures

- Markets facing businesses: Commodities and Global Markets (CGM) and Macquarie Capital combined 3Q24 net profit contribution was "substantially down" y/y due to "exceptionally strong results" in the prior corresponding period (pcp) from the Commodities business and lower fee and commission income.

- Annuity-style businesses: Macquarie Asset Management (MAM) and Banking and Financial Services (BFS) combined 3Q24 net profit was "down" y/y due to "lower asset realisations in green investments in MAM" and margin compression.

- Group capital surplus of $9.7 billion

- As of 31 December 2023, $235.8 million of ordinary shares have been acquired on-market at an average price of $168.74/share

- Group financial position: Bank CET1 ratio 13.4% (Harmonised: 18.2%), leverage ratio 5.0% (Harmonised: 5.7%), LCR 217% and NSFR 113%.

- Management update: Nicholas O'Kane steps down as Group Head of CGM, effective from 27 February 2024, to "pursue opportunities outside Macquarie". Simon Wright, current Global Head of CGM's Financial Markets division, to take his place.

- For more financial data on Macquarie Group, head to Market Index.

1. In one sentence, what was the key takeaway from this result?

The key takeaway would be that this is the third downgrade out of four of the previous updates, which is an unusual sequence of events from Macquarie management and also for investors in Macquarie.

2. Were there any major surprises in this result that you think investors should be aware of?

Yes, there were definitely a couple of surprises considering the most recent update was only in early November. Management indicated that the Macquarie Asset Management unit would now have revenue or operating income significantly down compared to the same time last year. They had indicated in November that it was expected to be broadly in line. So that's a definite downgrade for that particular division of Macquarie.

The second key takeaway was the Macquarie Capital division also appeared to have a downgrade. They're expecting their numbers to be slightly down on FY23, when previously in November they had guided the market for that particular part of the business to have operating income broadly in line with the previous year.

So two out of the four divisions have been downgraded. Banking and Financial Services and the Commodities and Global Markets business, from what it appears in the update, remain unchanged in terms of outlook guidance.

3. Would you buy, hold or sell this stock on the back of this result?

Rating: SELL

Off the back of the result today, if you haven't already sold, we would be tempted to sell. We held Macquarie Group in our managed fund and exited in September of last year. So, on that basis, I'd have to go a sell, given we don't hold it.

It's not that we think Macquarie is a terrible business or anything along those lines. It's just a matter of opportunity cost. We just think there are other areas of the market that you can look at right now.

With Macquarie, we would wait for an opportunity to take a position after a large sell-off or maybe an improvement in the outlook. History suggests that you'll get a pullback with Macquarie at some point. It's just a matter of when and how large that will be.

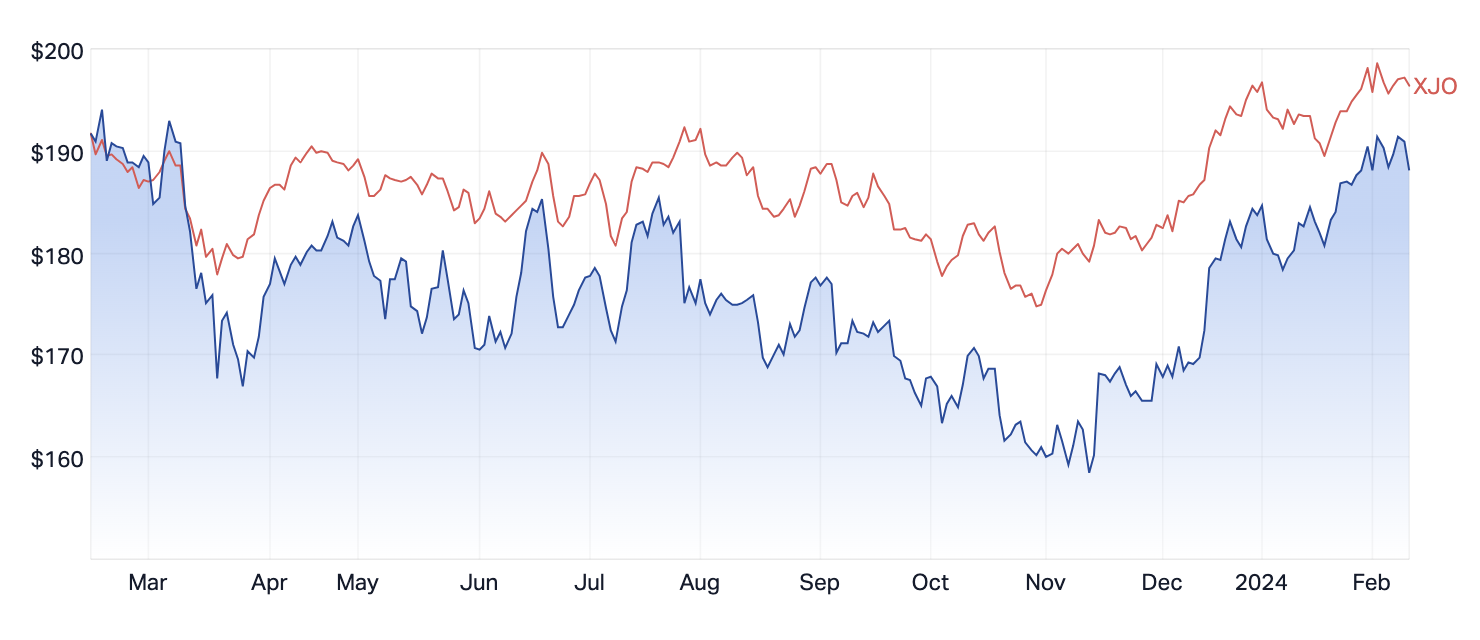

That said, we think the stock has been incredibly resilient throughout the last six months or so, but we would have a sell on Macquarie.

4. What’s your outlook on this stock and the sector over the year ahead?

It's difficult because at the moment there are so many different outcomes that could play out. However, we are cautious on asset management, funds management and the banking sector overall.

We still have geopolitical issues that are flaring up in different parts of the world. And there is potential for contagion to play out on the geographical sphere. Obviously, everyone's been talking about the inflation and interest rate narrative over the last 18 months. The markets become pretty comfortable with the idea that there is going to be "immaculate disinflation" and interest rates will eventually come down. However, we're less optimistic and still somewhat concerned about core inflation numbers coming out of the US on a three and six-month rolling basis. We're concerned about higher services inflation and also, persistently high wage growth figures that we've been seeing.

So, our outlook for inflation is less certain than what the market's pricing in and therefore our outlook for interest rates is also less certain. We're just a little bit worried that after a good couple of months, financial markets could go through a jittery period which would adversely impact a company like Macquarie.

5. Are there any risks to this company and its sector that investors should be aware of?

I think the main risk to reinforce is that financial markets have become very optimistic - they are priced to perfection in many ways. We're also concerned about the impacts higher interest rates and higher inflation are going to have on the real economy. There's still the potential for vast slowdowns in the US and in Europe - and potentially, even a recessionary environment rearing its head, as the lagged effects of interest rates start to bite. And the geopolitical situation as well - if that were to broaden into other areas and include other nations, then that would be a considerable risk.

6. From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing in the market right now? Are you excited or are you cautious about the market in general?

Rating: 3

We would call the market a three out of five in terms of the value proposition at the moment. The reality is the dividend yield of the market has come down a long way in the last 12 months. The P/E ratio is quite elevated for the ASX - compared to its 20-year history. And expectations are for an earnings decline in FY2024.

So when you consider that multiples are fairly high relative to the recent history, excluding the COVID period and, given that earnings expectations are negative, it's hard to be overly optimistic.

In saying that, below the surface and considering the market on a segment-by-segment basis, we still think there are opportunities. The market has been pushed higher because the banks have had a fairly good run and that's created this level of expensiveness. However, when looking at the earnings outlook for sectors like health care and technology and also the value on offer in the mid-cap and small-cap part of the market (ex-ASX 100 to ASX 300) we can see certain pockets of value there.

4 topics

1 stock mentioned

1 contributor mentioned