Netflix Earnings Preview: Unlocking Growth and Shaping the Future of Streaming

Netflix is set to report second-quarter earnings after US markets close on July 20 at 0800 AEST. The company is closely watched by investors and analysts as it provides a barometer for the overall health and performance of broader market conditions as it shines a light on consumer demand and preferences in the entertainment industry, subscription-based business models, and now the growing addressable TV advertising industry.

The article examines expectations around crucial operating metrics and long-term growth. Additionally, it briefly explores why Netflix has a valuation premium over streaming peers.

Subscriber Growth Expectations

- Consensus expectations for 2Q23: +1.8 million (m) net new subscribers, reaching 234m

- Consensus expectations for FY23: 245m subscribers

One of the key factors contributing to Netflix's positive performance is its regained momentum in subscriber growth. The company has undertaken a dual strategy to revive growth by introducing a new ad-supported tier and cracking down on password sharing. These initiatives are expected to drive user acquisition and retention, ultimately bolstering the company's subscriber base.

- Password sharing

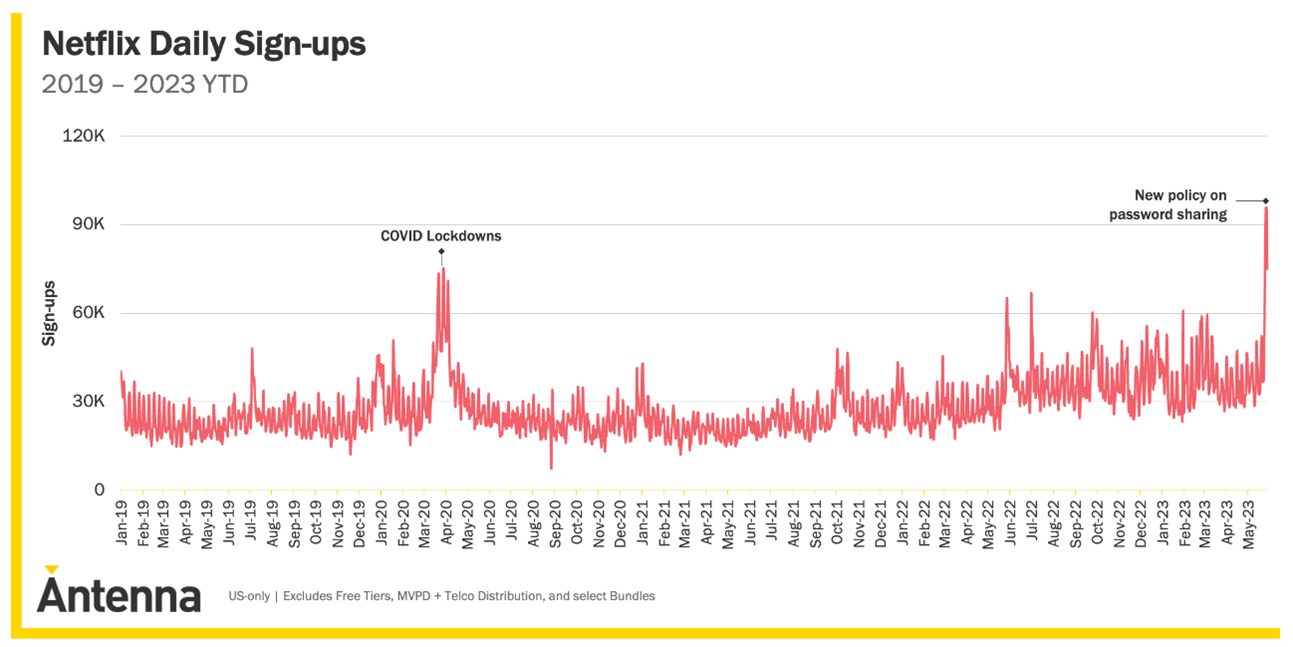

The crackdown on password sharing is expected to impact paid subscriptions as it reduces unauthorised access immediately.

Antenna, a trusted measurement provider for the subscription economy, released findings that corroborate the expectations. Netflix saw its four most significant days of user acquisition in the US following restrictions on password-sharing. Average daily sign-ups to Netflix reached 73k during that period, a +102% increase from the prior 60-day average, exceeding the spike in sign-ups observed during the initial US Covid-19 lockdowns in March and April 2020.

2. Ad-supported tier

The introduction of an ad-supported tier is projected to boost subscriber growth further. This new offering will likely attract a broader audience, including price-sensitive consumers who were previously hesitant to subscribe.

In May, Netflix disclosed during its 2023 Upfront presentation that its ad-supported tier had attracted almost 5 million global monthly active users. The company also noted that the number of ad tier subscribers has more than doubled since early this year, while 25% of new signups select the tier in countries where it is available. Engagement on the tier is also mirroring levels seen in non-ad plans.

Any signs that Netflix is seeing momentum and incremental growth from its initiatives will be well-received by the markets and could lead to further consensus upgrades.

Earnings Recovery Expectations

- Consensus expectations for EPS 2Q23: $2.9, -9% year-over-year

- Consensus expectations for EPS FY23: $11.3, +13% year-over-year

The market is optimistic that earnings will recover through 2023, driven by cost management, robust subscriber growth, improved margins from the curb in password-sharing and increased monetisation through the ad-supported tier.

Critical Considerations for the 2Q23 Earnings Call

1. User metrics

- Commentary around user acquisition, engagement, and retention.

- Data related to subscriber mix of shared accounts, ad-supported and non-ad tiers.

- Positive updates to new monetisation efforts can further boost investor sentiment.

2. Content development and spending amid writers’ strikes

- Content spending, content pipeline and backlog

- Commentary on Netflix’s ability to withstand the writer’s strike, which started in May and the more recent actor’s strike, which started in July.

Long-Term Revenue and Margins

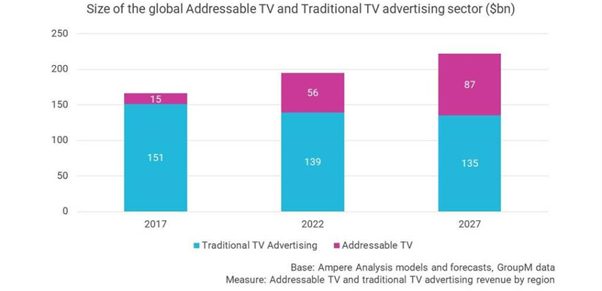

The introduction of the ad-supported tier is anticipated to have a more pronounced impact on Netflix's margins in the long run. By diversifying its revenue streams and attracting a more extensive customer base, Netflix benefits from higher advertising revenue and enhanced profitability.

At the 2023 Cannes Lions advertising festival, the company expressed a larger commitment to advertising. Netflix will introduce new advertising formats that allow advertisers to target consumers more directly in ways not possible on linear TV channels.

The global addressable TV sector is set to continue its rapid growth, with the $56 billion 2023 global spending set to rise by more than 50% to $87 billion by 2027, according to a new report on the addressable TV market published today by Ampere Analysis in partnership with GroupM Nexus’s addressable TV solution Finecast and Microsoft Advertising.

At the previous earnings call, Netflix noted that it captured 7% of viewing in the US. Since the US makes up more than 30% of the global TV advertising market, we believe Netflix could capture at least 7% of the global addressable TV market. This equates to roughly $4 billion in 2022 and $6 billion in 2027. Advertising represents significant incremental revenue and profit upside for Netflix.

Catalysts that can unlock advertising demand include launching new advertising formats, tools, measurement partnerships and a new first-party advertising platform after the partnership with Microsoft ends next year.

We look forward to management providing more data points on the advertising tier regarding engagement trends, average revenue per user trends and advertiser traction.

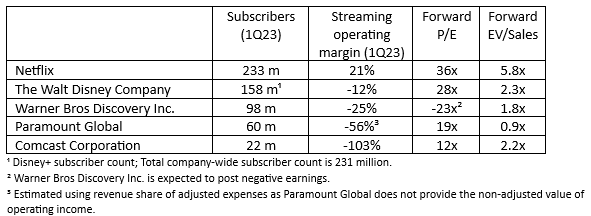

Premium Valuation Reflecting Profitability and Scale

Netflix's valuation multiples are at a significant premium compared to its rivals. However, this premium valuation is considered justified by market participants due to Netflix's ability to generate consistent profits as the only pure-play streaming player.

Netflix should also benefit from continued execution and scale economies as competitors cut back on investments amid accelerated cord-cutting, ad market weakness and subscription services cash drain.

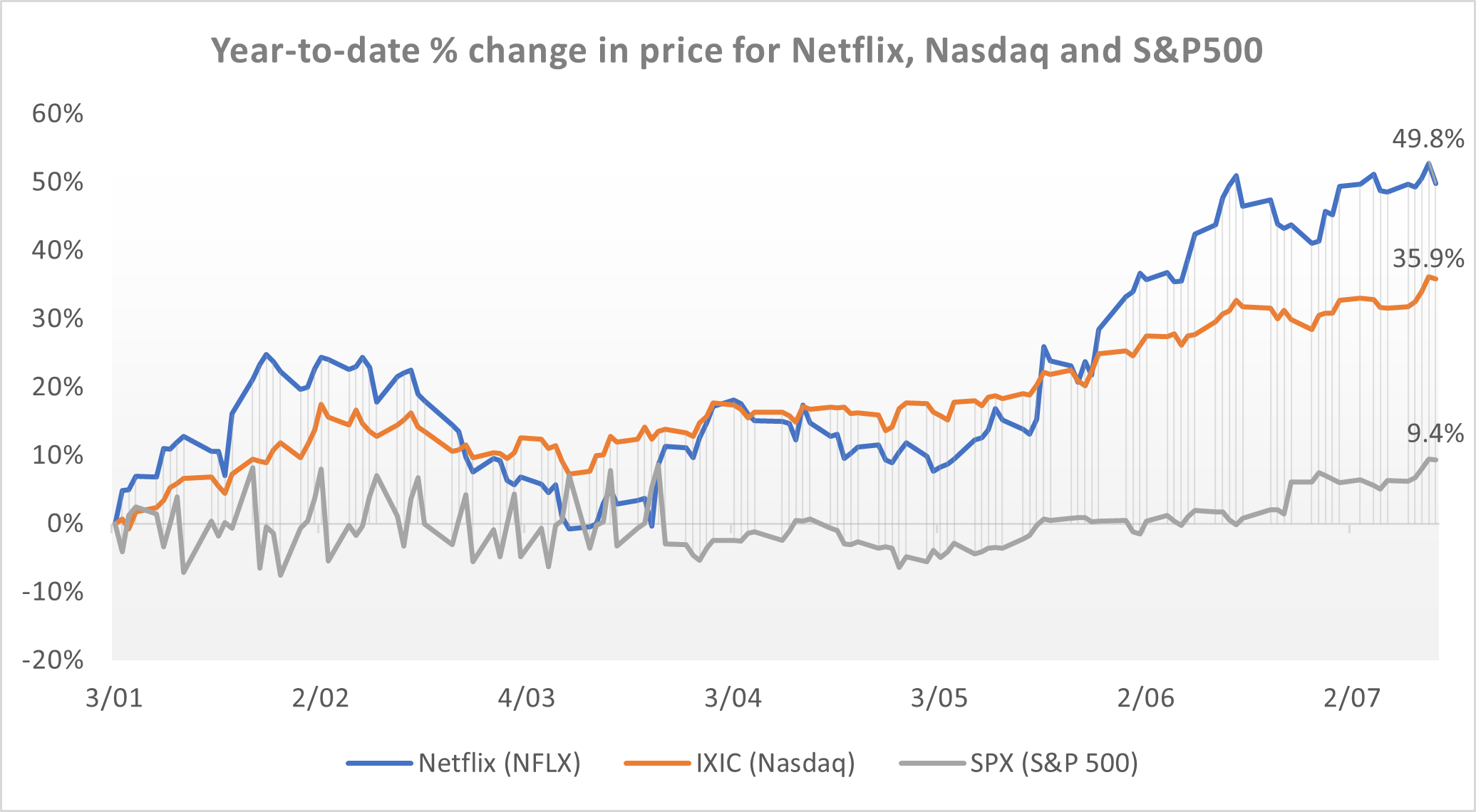

Supportive Outlook for Netflix Stock

The optimistic market expectations surrounding Netflix's future performance will likely support the company's stock value. As long as Netflix meets or exceeds these expectations, investor sentiment should remain positive. However, it is important to keep in mind that expectations are high, limiting the opportunity for upside surprises. It is essential for the company to consistently demonstrate its ability to deliver on its promises and maintain its competitive edge in the streaming industry.

5 topics

1 stock mentioned