Never send a suit to do a founder's job

Investing and management team access go together like gold and steak - a mouthwatering combination attained only by a select few. However, the premise of investing relies on using any facts available to inform your decisions, as there will always be information asymmetries in place. So what can be used to gauge the quality of the management team?

We've all heard of 'skin in the game' - whether management is willing to put their money where their mouth is and trust in the future of the company. But there are those where fortune is also linked to an intangible measure of value: Legacy.

That is where the idea of investing in founder-led companies originates - companies that are managed by those that were responsible for the inception of the business. This is often extended to family-owned businesses, where it has grown through multiple generations of ownership. Finding out whether a company fits this criterion is a matter of a simple Google search, though is this a viable screen? Credit Suisse research seems to think so, with its recent Family 1000 report showing a clear outperformance:

"Using our database of over 1,000 publicly listed family- or founder-owned companies, we calculate an annual average alpha of around 370 basis points since 2006" - Credit Suisse Family 1000 Report

In the first wire of this three-part collection into founder-led companies, I sought to understand what benefits being founder-led can provide and some interesting examples of such companies. I reached out to the following fund managers to hear their insights:

- Maroun Younes - Fidelity Global Future Leaders Fund

- Shaun Weick - Wilson Asset Management

- Emma Fisher - Airlie Funds Management

- Andrew McAuley - Credit Suisse

Discipline and innovation are the keys

Maroun Younes - Fidelity Global Future Leaders Fund

Founder-led businesses go a long way towards solving the “principal-agent problem” inherent in the corporate landscape. Misalignment of interests between management and shareholders can often plague companies, so aligning the two can ensure that the business is being run in a way that is focused on growing shareholder value.

Research by Rudiger Fahlenbrach of the Fisher College of Business found that “an equal-weighted investment strategy that had invested in founder-CEO firms from 1993 to 2002 would have earned a benchmark-adjusted return of 8.3% annually”.

What’s driving this outperformance? From a quantitative perspective, it is driven by strong financial metrics. According to Credit Suisse, founder-led businesses generated stronger revenue growth (11.3% vs 6.8%), higher EBITDA margins and higher returns, all while maintaining stronger and more conservative balance sheets than non-founder-led businesses. Founder-led businesses tend to adopt a longer-term mindset when making decisions and have invested more of their revenues back into research & development over the past decade.

A study by Lee, Kim and Bae found that founder-led businesses within the S&P 500 generated 31% more patents, as well as generated higher value patents, than the rest of their peers.

There are countless examples, both domestic and abroad of successful founder-led businesses. In Australia, we have companies such as Seek (SEK Andrew & Paul Bassat), WiseTech Global (WTC - Richard White), Goodman Group (GMG - Greg Goodman), TPG Telecom (TPG -David Teoh) and Xero (XRO - Rod Drury). All have produced very attractive long-term returns for shareholders.

Globally, the list is even longer, including Alphabet, Facebook, Walmart, Samsung, LVMH, Tesla, Oracle, Nike and for most of their corporate lives, Apple, Amazon and Microsoft.

A trifecta of qualities

Shaun Weick - Wilson Asset Management

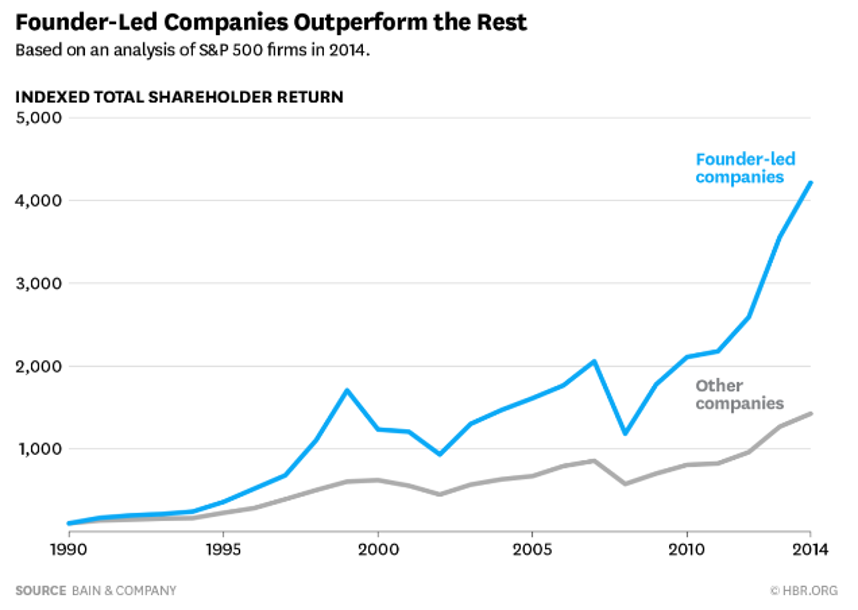

Numerous studies have demonstrated that founder-led companies tend to outperform hired managers, to the point that today there are exchange-traded funds (ETF) created to invest solely around this theme. A study undertaken by Bain & Company (2014) concluded that founder-led companies are 4-5 times more likely to be top quartile performers, while an index of S&P 500 companies in which the founder is still deeply involved performed 3.1 times better than the rest over the previous 15 years.

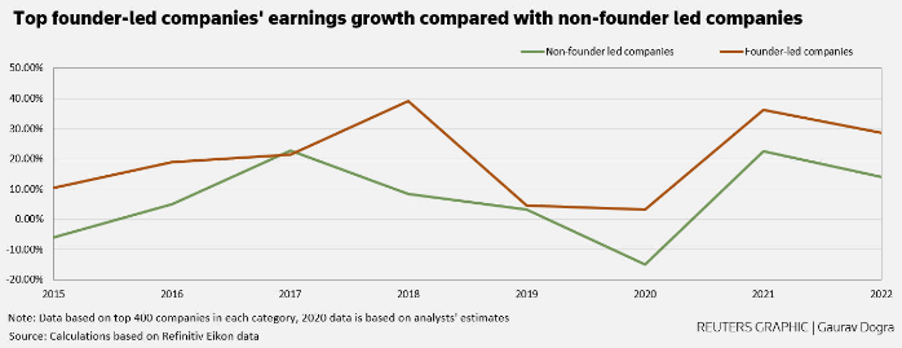

Recent analysis undertaken by Reuters demonstrated that founder-led companies’ earnings growth has materially outperformed non-founder led companies, with founder-led tech firms seeing growth of around 30% over the past five years versus 6.7% for companies led by other managers.

While it is difficult to pinpoint precisely why these companies have produced strong long-term results, several common qualities of corporate founders often exist:

- An entrepreneurial spirit: successful founders have created something that didn’t exist before, underpinning a willingness to continue to invest and innovate and overcome competitive pressures over time.

- An unrivalled understanding of the business and what makes it tick: Building “from the ground up” generally results in a much deeper knowledge of the business, whilst deeply engraining the company culture or “ethos”.

- Long term incentives and alignment with shareholders: Founders often own large equity stakes in their businesses, accounting for a significant proportion of their net worth. They tend to deploy capital as if it were their own, with a focus on delivering long term results.

The ASX has a rich history of founder-led companies delivering stand-out returns for investors. Global Buy Now Pay Later payments juggernaut Afterpay (ASX: APT) would be at the top of the list in terms of founder-led success stories in recent memory. We originally invested in the business attracted to the quality and vision of Management, led by co-founder and CEO Nick Molnar. Nick’s background was one of entrepreneurship, launching American online jeweller, Ice.com, into Australia which he successfully grew to become the largest online-only jewellery retailer.

Domino’s Pizza Enterprises (ASX: DMP) is another great example. CEO and Managing Director Don Meij started out as a part-time delivery driver during school when. A desire to pursue a more entrepreneurial path saw Don leave his teaching degree behind and climb the ranks from supervisor through to national operations manager, becoming and the company’s single largest franchisor in 2001. Don is widely known for driving the “high volume mentality” and “customer obsession” focus that has underpinned the success of the business. Today, DMP is the largest franchisee outside of the US, holding the master franchise rights to 10 markets with a network of more than 3k stores & appetite to continue expand into new markets.

The numbers don't lie: Family 1000 Report

Andrew McAuley - Credit Suisse

Credit Suisse has published regular research on founder-led and family-owned companies since 2006, when we identified 1000 companies that fitted this description and compared them to our proprietary database of more than 20,000 companies around the world.

Our latest research from 2020 confirmed that since 2006, our 1000 companies have outperformed non-family-owned companies by an annual average of 370 basis points.

Performance has been strongest for family-owned companies in Europe and Asia at 470 basis points and more than 500 basis points per annum, respectively.

The reasons for this outperformance is most likely that family-owned businesses pursue a longer time horizon in their investment strategy, delivering more stable and superior through-cycle profitability, and ultimately driving significant excess returns for all shareholders, minorities included. They also tend to have above-average defensive characteristics that allow them to perform well, particularly during periods of market stress. These include higher margins and cash flow returns and lower debt levels. We felt this allowed them to outperform broader markets, especially during so-called “risk-off” periods.

The best founders resemble proud parents

Emma Fisher - Airlie Funds Management

There are two parts to why founder-led companies make desirable investments. There’s the “why” and the “how”.

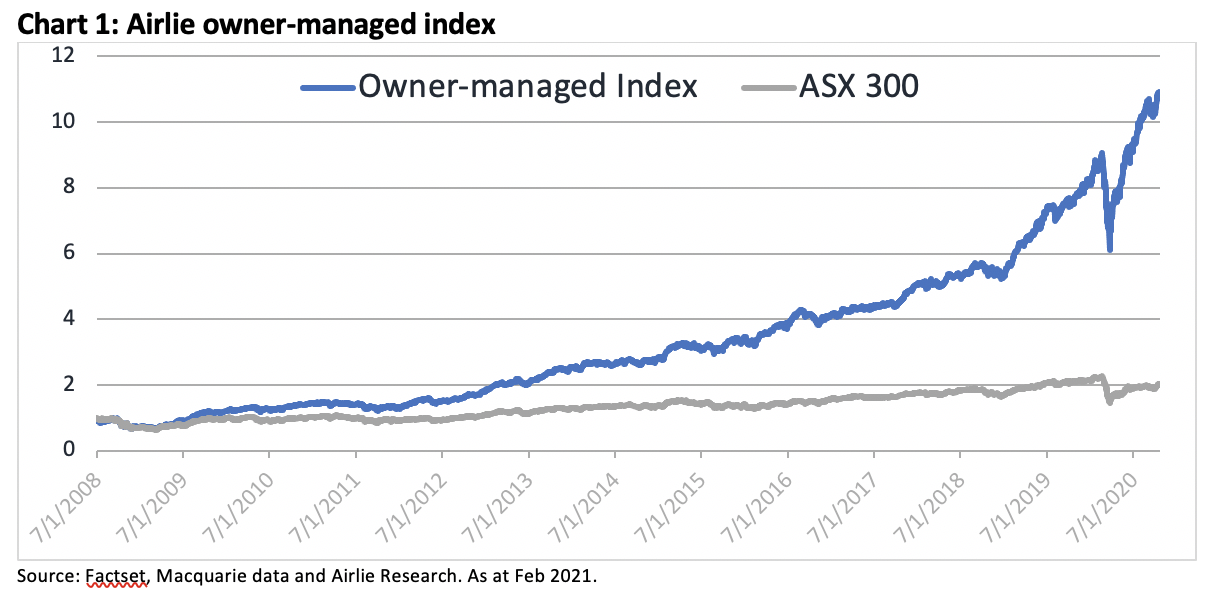

Why own founder-led businesses? The answer is simple: they tend to outperform, dramatically, over the long term. We tested this by creating an index of owner-managed businesses, screening the ASX for companies with at least 10 years listed history (so no recent IPOs) and still run by their original founders. The resulting index of 33 companies dramatically outperformed the actual ASX200 by a factor of 5.

The obvious next question is how do they deliver this dramatic outperformance? What makes them better investments? We believe the answer lies in 3 factors:

- Long-term thinking: Founder-led companies think on a longer time horizon than typical corporate management teams. It is not uncommon for us to hear about the “ten year” plan from founders, although memorable meetings include discussion of 30 and 50-year thinking horizons!

- Mandate and alignment: Founder-led companies have the mandate to act - large personal shareholdings and/or board control allow them to make decisions that may be unpopular in the short term, but are the right decision for the long term. They tend not to chase this year’s profit at the expense of next years’, nor are they motivated by hitting short term EPS targets. The bigger motivation is improving the value of their shareholdings.

- Passion: The best founders have an x-factor that stands out from most of the corporate management teams. They have an enthusiasm for the business that is given away in meetings by a casual mention of some minute aspect of the business that no ordinary CEO would know. For example, one founder excitedly showed us videos of a talent show put on by some of his elderly residents, another proudly told us about a nurse at one of his mining sites who had just been accepted into the Olympics hockey team- bragging like a proud father!

The best company-led business we have come across is Reece (ASX), Australia’s largest wholesale plumbing business. Reece has been run by the Wilson family since 1968, and the family own more than 60% of the shares on issue.

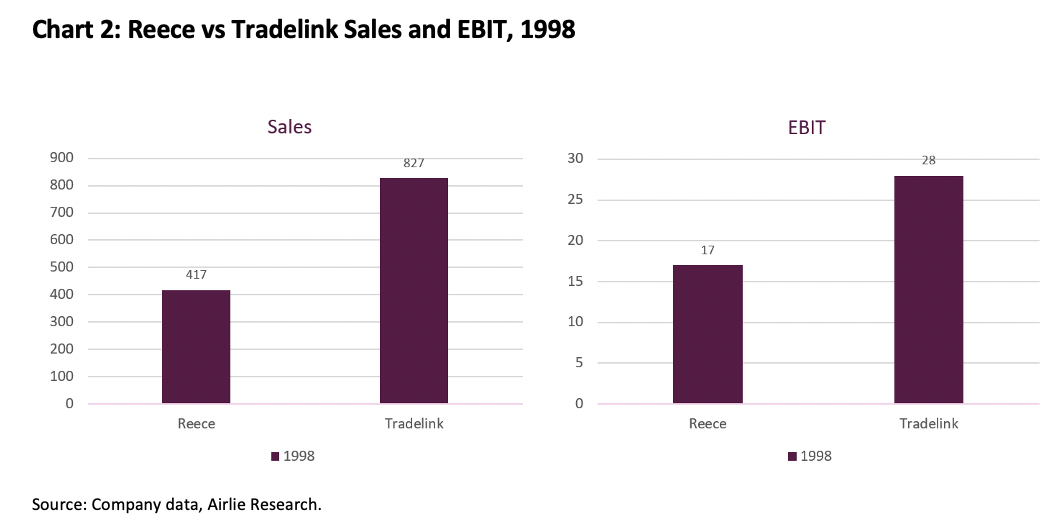

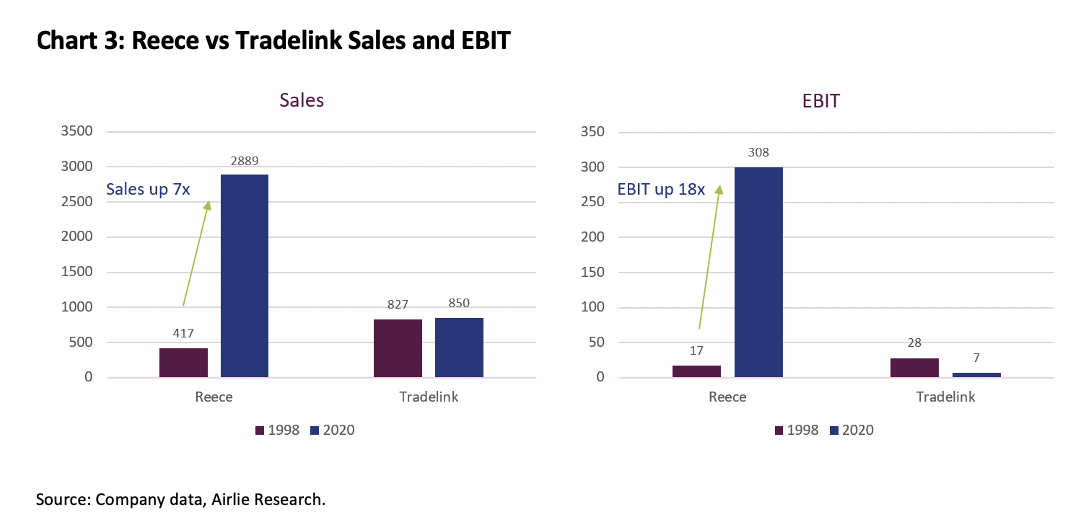

The value the family have created is obvious when examined over a long-time frame. In 1998, Reece was mostly a Victorian-based business, and was a minnow compared to the market-leading Tradelink business.

Over the next 20 years, Reece focused on: rolling out stores, investing in technology to improve service offerings, and working with manufacturers to stock exclusive ranges, all under the steady leadership of Alan Wilson (now Chairman), and then his son, Peter Wilson (now CEO). Meanwhile, Tradelink went through a range of corporate hands (Crane Group to Fletcher Building) and many different management teams. Roll forward to today and Reece’s sales are up 7x and EBIT 18x in Australia and its share price (including dividends) has been a 50-bagger, vs Tradelink which has, quite incredibly, delivered flat sales and declining profits since 1998.

Conclusion

Evidently, founder-led companies are managed by those that look to execute on a long term vision. While there may be some stubbornness in doing so, their relentless pursuit of success and entrepreneurial spirit aligns your needs as an investor with the direction of the company. This is information we can all access, and the research appears to suggest some value in doing so.

Join myself and our guests in future parts of this collection, where we will explore the prominent sectors founder-led companies rise and potential risks investors should be aware of, before discussing their tips for the next founder-led behemoths.

I will also be launching a Fund Manager Q&A with Lawrence Lam from Lumenary Investment Management, whose investment strategy revolves around the idea of finding companies that are founder-led.

Stay up to date with this series

Make sure you "FOLLOW" my profile to be notified of the upcoming entries in this series.

If you enjoyed this wire, please click like and comment below the founder-led companies you have on your watchlists. There are a range to choose from including Facebook, Tesla, Amazon (until recently), Airbnb, Airtasker, Dominos...

4 topics

15 stocks mentioned

6 contributors mentioned