New CBA hybrid launched paying 2.84% pa, about 0.15% pa more than market

CBA has launched a new investment-grade hybrid (ASX: CBAPK) to replace the maturing $1.64 billion CBAPF security, the latter of which will be repaid on 31 March 2021. CBAPK proposes to pay a fully franked distribution of 2.75% pa (or 275 basis points) above the quarterly bank bill swap rate (BBSW), which equates to a total running yield of about ~2.84% pa. This is about 5bps more than ANZ paid on an almost identical hybrid a couple of weeks ago, which is a nice concession for CBA to market in recognition of the elevated financial market volatility.

As the RBA cash rate climbs over time, the bank bill swap rate or BBSW rises in lock-step, which would translate into a a superior running yield. For example, if the RBA increases its cash rate from 0.1% to 1.0% over the next year or two---and assuming BBSW trades at about 0.1% above the cash rate---CBAPK holders would expect a total quarterly distribution annualising at about 3.85% pa (ie, 275bps above the new 110bps BBSW rate).

CBA will likely issue about ~$1.5-$1.7bn to replace the $1.64 billion CBAPF security, with at least $800 million of this coming from existing holders of CBAPF, who are allowed to roll, or switch, into the new deal.

Given the impressive success of ANZ's recent hybrid (ASX: ANZPJ), which attracted more than $2.3 billion in investor demand, including large switches/rolls from the existing ANZPE hybrid that it replaced, it is reasonable to assume that the more attractive 2.75% pa margin CBA is offering on CBAK will secure similarly strong---if not even greater---demand.

CBAPK has an expected call, or repayment, date of 7.2 years from the date of its listing on the ASX on 1 April. As noted above, although this is only 0.25 years longer than ANZ's new hybrid, ANZPJ, CBA has generously offered-up an extra 5bps (or 0.05% pa) in income distribution.

I've said this before, and it bears repeating: CBA is probably the smartest bond issuer we come across globally, and its treasury team is exceptionally well-led by the likes of Terry Winder, and offsiders such as Fergus Blackstock and Todd Henniker.

But the real question for investors is whether this new CBA hybrid is still cheap given recent market moves...

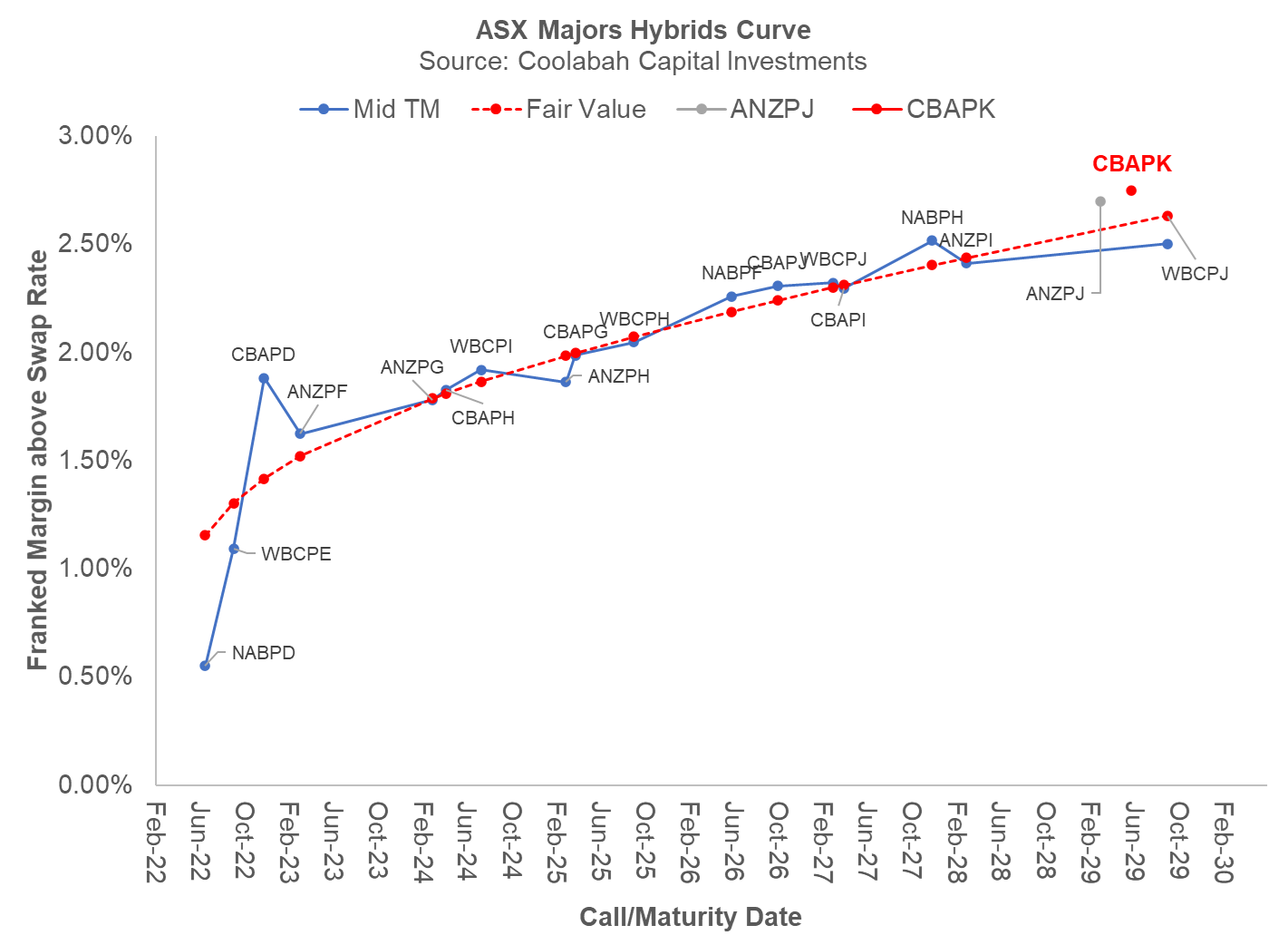

Our models had fair-value for a 7.2 year major bank hybrid at around a 2.60% (or 260bps) margin above BBSW, so the proposed 2.75% pa margin represents a 15bps uplift over this benchmark (see chart below). In our view, CBA has the lowest credit risk of the four majors, which are among the best capitalised banks globally. S&P technically rates major bank hybrids at the "investment-grade", BBB- threshold, and we have been forecasting for a while that they will be upgraded one notch higher to BBB flat.

Proximate hybrids on the curve likewise imply that CBAPK appears comparatively cheap. Specifically:

- The ANZPI hybrid is 1.2yrs shorter than CBAPK and is currently trading on a 240bps margin above the swap rate. Since the start of the year it has traded between 235-250bps.

- WBCPK is the longest hybrid (3 months longer than CBAPK) and the most recent issue prior to ANZPJ. It is currently trading at a mid of 250bps and has has been trading between 242-256bps this year.

- Significantly, both ANZPI and WBCPK trade tight on the ASX hybrid curve. NABPH (1.5 years shorter than CBAPK) is the widest major bank line at 250bps. This has historically traded wide of the curve, exchanging hands at between 240-262bps this year.

Having said all of that, current 5-year major bank hybrid spreads are somewhat tight of historical post-GFC trading ranges, although they are within the normal range when evaluated as a multiple of 5-year senior bond spreads.

Note that ANZ only printed $1.28 billion via its new ANZPJ hybrid, which is actually less than the $1.61 billion size of the ANZPE security it refinanced. And given the ANZ captured about $800 million in switches from ANZPE to ANZPJ, we will see ANZ repay investors roughly $800 million in net cash on 24 March 2021 when ANZPE matures. And that cash will want to find a home, a fair bit of which should bleed back into the ASX hybrid market.

There are a few other interesting developments with the CBAPK deal. As a result of the implementation of ASIC's new Design & Distribution Obligation laws, this 2.84% pa hybrid is only available to:

- wholesale/sophisticated investors, or

- retail investors who have received personal advice from their financial planner.

There will also be no general offer to CBA securityholders.

We are also forecasting that the major banks will shift some of their future supply to the institutional unlisted over-the-counter market, as NAB has repeatedly done.

If non-advised retail investors want to buy CBAPK, they will either have to wait until it lists on the ASX, or allocate indirectly via an exchange-traded fund that can buy the deal in primary.

In the bank capital structure, hybrids rank ahead of ordinary shares but below Tier 2 bonds. In March 2020, the Solactive major bank hybrid index fell about 4.7%. While this was more than government bonds, it was substantially less than so-called high-yield bonds, which fell 13.5%, and bank equities, which declined 25%-35%.

Hybrids have many risks, including the risk of being automatically converted into CBA's ordinary shares or written-off, and you should read the PDS and consult an adviser to better understand these issues.

1 topic